Note: Scott Grossman is Vice-President, Alternative Sales & Strategy at Turning Point Brands, a NYSE-listed company that manufactures, markets and distributes branded consumer products, many of which within the cannabis industry.

It’s been over three months since my last note so I thought I would share what’s on my mind. This one will be touch on themes that I obsess over while attempting to cut through the noise as we enter the final stretch heading into elections.

Business, culture, life, tips and a few new “Easter eggs” for those paying attention.

As always, these are my own humble opinions as an operator and investor, who puts pen to paper to hopefully provide value and pay it forward.

So roll up a doink, and enjoy the trip. This one will burn a while.

And thanks for 1K+ followers, we’re building on X; please share if you find valuable.

GOT EARNINGS?

In cannabis, a quarter feels like a year…earnings, more deals, more political movement and posturing, more stagnation with spots of brilliance.

Q2 earnings put my high conviction themes on display even if they are in the rear-view that I’ve previously commented on.

So far in ‘24 we’ve seen the “strong get stronger,” a critical tenet where the potential winners bifurcate, kinetic energy builds, and delevering balance sheets become a strategic weapon as capex sunsets and tax spigots shut off (even if temporary) as the green wave washes across the country.

We tend to talk most about public MSOs on @X, but these themes are prevalent throughout the value chain that I consistently see across the country.

GOT FLORIDA?

First, context: In August I said investors had what I considered to be the 2nd best opportunity in as many years (1st was 10/23). I felt strongly the Street was really offsides post-stellar Q2 prints for high-quality names where: 1) the mkt was gifting a valuable “free look” into a seemingly mispriced FL catalyst and 2) the outcome would be known in advance of Q3/Q4 prints in an increasingly murky cannabis and macro environment. Said differently, in a sea of unknowns we had an isolated event with a defined duration.

At worst, the market would begin to price-in the possibility of rec Florida; and at best, it would actually “pull to par” as the vote comes to fruition days before Q3 prints.

GOT TORQUE?

Florida is the same event for those involved, but all with different “torque”. And even if no new money enters (my view, pre SchIII/uplisiting), my bet was that the portfolio mix of marquee ETFs ($MSOS) would get reshuffled.

Since 8/31, $TCNNF is +47%, $MSOS is +13% nd $TCNNF % of $MSOS increased ~500 bps over that same period.

Yes, this market “sucks and the plumbing is broken” but the market continues to give you gifts if you forget about the past, stop agonizing about the future and focus on executing in the now. Not easy, but that’s what we’re paid to do.

GOT TRUMP?

Part of my thesis of course was contingent on a Red Sea tsunami which we got in spades since Aug. Ohio was the tell for those paying close attention of what would likely come next that was strongly felt on the ground.

Trump hinting on Aug. 31 and confirming “yes on 3” on Sept. 9 was the shot in the arm Florida needed.

Those who know me well have heard me relentlessly say for 10+ years that cannabis will be the only top 15 political issue that will overwhelmingly cross political aisles. I also expected—and one key reason I entered this space—that eventually the issue would be stolen by Republicans.

If that ain’t clear to you today, you ain’t paying attention.

I VOTE GREEN

Those who know me well know I loathe talking politics—politicians all suck period.

The incentives create a “bizarro world” that at times attracts real talent (increasingly rare) that sees sharp tools quickly blunted, made worse by a bunch of grifters that grind the gears of rational and common-sense productivity.

But for this industry it greatly and unfortunately matters. As we enter the late innings of this election cycle, we’ve already seen more signposts that Republicans have way more to gain than lose from supporting state-led regulated cannabis markets.

Ohio’s fast start and continued favorable polling in Florida are two real data points that the GOP sees every day.

GOT PTSD?

The market is missing how cannabis is a symbol of both parties today.

Freedom for the right. Freedom for the left. Tax dollars, jobs, criminal justice reform, company and industry creation, health/wellness, and a splash of vindication for the rest of us.

FLORIDA: MY VIEW

We’re now 15 days from the election and the pivotal vote in Florida on rec.

Here are the facts as of now:

Florida is poll over 60%, and Trump is ~6 points ahead of Harris in the state.

Florida-exposed MSOs continue to trade better than non-exposed.

Equity and fixed income markets are now trading as if Trump is pulling away–crypto, industrials, banks, “anti-tariff” names are simply outperforming.

First, I don’t have conviction on the general election and am not tilting my portfolio in any way other than moving away from duration and the long-bond. That should work regardless of who wins, unless we face a serious recession which will be a temporary blip on the thesis that America simply isn’t AA+ anymore.

Second, Florida Vote 3: The recent hurricanes certainly threw a curve ball into the mix (on the theory that more liberal “snowbirds” packed it up for the season). That said, if Trump’s lead is solidifying…AND if he’s voting yes…by default it seems logical that additional Trump momentum is likely more supportive of Vote 3 given independents who lean favorable on weed (mostly). I think it passes, but not a slamdunk.

FLORIDA: WHAT’S THE MARKET SAYING?

Quite simply, the market's view of Vote 3 is bonkers still. Thought I’d lay out what the market is saying based on consensus for say…Trulieve $TCNNF. I have a variant perspective on Florida post rec, for simplicity let’s take what the Street is saying for now. We can argue offline if they are right.

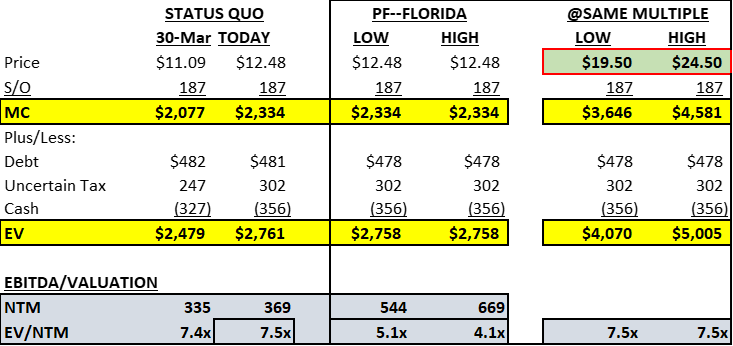

Trulieve was trading at ~7.5x NTM EBITDA into Q1 prints, and similar today due to higher NTM estimates (ex-Florida), offset by lower net debt. If we simply take consensus views on PF Trulieve post Vote 3 (~2026), Trulieve is trading at 4-5x. If we simply apply current multiple to revised estimate, it suggests $19-25/share, or 55-95% upside.

On the downside, this is where it’ll get messy–unlikely the “bifurcated” theme unwinds but a ton of hot money in this name will assuredly pressure Florida-exposed names. It’s reasonable to assume Trulieve loses at least a turn on lower estimates, which implies 15-25% downside.

It’s not lost on me with Schedule III next on deck, Cole 2.0 memo, uplisting etc all on the come that a Top 3 MSO trades 30-50% lower than Big Tobacco and 50-70% lower than Big CPG. Makes zero sense. Good setup still even after this 50% move.

Quick math (my math using St #s):

OK NOW YOU GOT ME STARTED:

While we’re on topic of politics and regulations: If it’s your job to write the rules, then do your damn job.

If it’s your job to enforce the rules, then do your damn job. If you’re gonna give licenses, well then protect the license holder.

If you’re gonna allow hemp, then figure out where and how.

If you’re going to ban legal cannabis (looking at you Texas), don’t create a hemp nightmare where it’s impossible to monitor and control the sale and distribution of global (yes global) cannabis.

All agriculture is inspected right? All inbound liquor is documented yes?

Wake up America.

PRO TIP:

The best investment advice I’ve ever received:

"Scared money don’t make money. And if you’re “batting a 1000” you’re simply not taking enough risk."

Don't fear being wrong, fear always being right.

STAGES STACK

This years Benzinga Cannabis event put my themes on clear display.

On one hand, you had a CEO for tribal land who was giddy.

Or the “arms sealers” to the hemp drinks industry who was like the NVDA CEO (thankfully not autographing chests).

And the biggest company in the industry not even showing up. And a whole lot of angst and despair for those in between.

Thesis, confirmed.

But if I was being honest, I’m bored with my bifurcation theme…and I firmly believe we are entering a new phase which I teased in last note.

Remember folks, stages stack especially in cannabis.

If you think we are in now the phase of disillusionment—with respect, you’re late. The potential winners are not disillusioned—they are well beyond that.

The theme of 2025 will be more about Phase 3 and offers the most exciting opportunity sets since 2014/2015.

HAT TIP

I had the sincere privilege to be apart of Mission Green's Executive Dinner hosted by CB1 Capital, Todd Harrison and Weldon Angelos.

Personal story: I’ve followed Todd and his writing for decades, and first met him when we both were raising capital for respective HFs in 2018. When I heard his pitch, I was simply floored–and frankly envious–that Todd and his talented team were taking on this massive opportunity head-on, something I candidly didn’t have the “stones” to do then (although I had made investments in the space personally).

Seven years later, and backs filled with deep battle scars, it’s truly amazing how much we take for granted what Todd and his talented team do day in and day out. I deeply admire those like Todd that get in the arena every day in front of millions expecting to win because the mission is too important to leave to others. Being kind, generous and humble is just the cherry.

I tip my hat to you, and you should do too. This shit ain’t easy. Todd and CB1, keep going. I'm rooting for you.

SCALE?

“Scale” always gets thrown out as that “MSO holy grail” but often from those who understand scale in principle, but not in practice.

In cannabis there are too many “scaled” players that aren’t scaling, and many “boutique” players that are proving their SOPs can greatly scale as they expand into new states. Whether it’s a vertical operator, or asset-heavy brand moving east via licensing. We all know who they are by now.

Scale isn’t about necessarily about size, it’s about flexibility and quick, flawless execution that can be replicated with marginally decreasing resources.

Diversified markets, scalable expertise, fluid and nimble balance sheets, long vs short term capital allocation, the ability to live another day, and quality products that consumers want regardless of price point.

You’re starting to see fruits of that labor and the necessary trade-offs being made.

GOT DRINKS?

When I toyed with entering the space full-time—and had to convince those outside my close circle of friends/family—I got a lot of chuckles and skeptical looks.

My favorite was when I told a Big Alcohol executive in 2017 (!) that I was convinced a) cannabis beverages would become the biggest form factor (even though there was only a handful of California and Canadian early-adopters) and b) the market wasn’t only growing because illicit buyers were converting to legal, but that consumers will come from substitution particularly from calorie-laden, hangover-inducing beer and wine.

Today it seems obvious. Then, pretty out there especially with flower share actually growing as states turn on.

And yes that was my first “end-state” conclusion on what the market could/ should look like. That was 4 years ago. Candidly, WAY ahead of schedule.

GOT CRAFT?

Look, I absolutely love the cannabis drink mojo…the number of new consumers coming up to me after all these years guzzling bevies is now literally astounding. It’s just not my bag, rarely touch them. And from an investment standpoint–again disclaimer: my personal view: I have so many battle scars from earlier-stage and legacy beverage companies that I think the market is massively underestimating the cost of building and scaling a beverage brand.

If there's bifurcation in cannabis especially on the shelf (my bet), by extension there will bifurcation in competing substitutes. If you're watching carefully, low alc bevs are getting killed while aged and/or premium seems to be holding in better.

I’m closely watching Big Alcohol names–that sector is way too cheap in spots, and way too expensive in others, which is a stock-picker’s dream.

BEVS ARE HARD

I’ve been investing in bevs since 2002…a dozen or so privates, a shit-ton of publics both debt and equity, activism, Board representation, literally thousands of pitches and C-suite meetings cross the alcohol, CSD, and health/wellness space.

For every High Noon, there are 10-20K that generate <$1MM/year.

This…shit…ain’t easy. But some will figure it out. And thousands will try, because this category ain’t going away.

The question will be who can stand out. The biggest question is who has the staying power in a crowded regional shelf with no real consolidator yet. Makes you wonder if that future buyer is Big Alcohol or Big Weed or Big CPG or Big Pharma or Big Tobacco or Big Retail or Big Everything.

As always, if you’re running one of these businesses in real-time, assume the future buyer is nobody.

TIDE WENT OUT

In hindsight, it kind of makes you wonder why so many well-run, well-capitalized cannabis companies missed those enormous hemp tailwinds brewing and eventually colliding to build the perfect storm. Surely some nibbled through JV’s and licenses, and some are now entering like Curaleaf, but it still feels like a toe-dip.

I’m surprised no one took the bait yet–maybe Tilray–and my gut tells me this is a just a sign of the times in public cannabis land where capital is simply too scarce.

The bev co’s I’m meeting with are all sprinting—not enough people, not enough inventory, not enough capital. Good problems if you’re a growth investor.

One one side: If MSO’s truly believe they have a valuable brand that cuts across form factors, why didn’t they exploit that opportunity? Why not leverage their brands even if it’s a license opportunity? Have the “risk-takers” become risk-averse?

One the other side: What’s at risk if they support hemp? Can they actually win?

I have my theories of course, for another time.

I ❤️NY

As we start Q4, we’re going to start hearing some real positive movement in NY…it’s become a sleeper market that not many are paying attention to. Being my home market, you can literally see and feel the city turning. Even micro-license brands that operate/d in the gray market are finding their ways to the shelf.

What’s clear is that NYC always was and will be an important epicenter for the canna industry and I think we’re about to see a slew of household names and fan faves over the next 3-5 years

I’m long NY. Just hard to express and/or isolate. Other than supporting Ben Gilbert and the NY Grower's Cup. If you’re local and you love the craft of cannabis and real competition, you’d be silly to miss it.

If there’s a city where quality will win, you’re looking at it.

ECOMMERCE LOVES THCA

Part of job is keeping my finger on the pulse throughout US, and by everything you know what I’m talking about if you’ve ever been to a Champs show. Last week was my 4th and my team’s 6th of 2024. If you want to know where the innovation is happening, it’s happening there, especially on the consumer side.

The biggest shocker in FY’24 is the obliteration of everything D8/D10 with prolific D9 and increasingly, THCA flower. Literally happened <6 months—basically 1-2 inventory cycles.

(That’s the bar on innovation, if this feels too fast you’re simply too slow).

Now, this is where it gets confusing. And when I wake up with night sweats I think of this. Let me say the quiet part out loud. Weed is weed. If there’s a process or strain or curing procedure that ensures the bud stays in acid form, but is grown like canna… is it hemp?

What if it’s the opposite, and the hemp turns hot. Is it cannabis? You confused yet?

But what I’m now seeing at shows is indoor THCA and in droves. Even brands you know and love inthe legal rec mkt are doing this. At times, straight to the consumer. Other times, straight to the shelf.

Put this on the risk pile. Not new risk, but risk nevertheless. Very confusing risk.

IMO: Take a three-year view. Tell your investors your plan with signposts that would required you to pivot. But stay the course, whichever course that is.

LET’S TALK WEED

My favorite strains so far in '24 all involve a new-candy with old-school gas, all in R&D about 1-2 years ago that finally latched onto shelves this year. My favorite strains this year lean on older Sherbinksi/ Cookies lineage (gelato, sherb) with newer-school candy like TerpHogz/Zkittles, Runtz, and DeepEast(RS-11) lineage.

Examples from both coasts, with some growers that made them shine:

Biscotti x Sherb (KGB, NY)

Birria (Life Is Not Grape, CA; OZKxZxSherbanger)

Black Petronus (RS-11 x Falcon 9): (@Notillkings, CA)

Candy Fumez (ZxSherbanger): 516 Hort, NY

MSO LEVELING UP QUALITY

On the MSO side, Insa Cannabis is still doing a remarkable job in Mass, Fine Fettle making CT hip, and shout out to The Flowery and Sunburn Cannabis in Florida…arguably both growing some of the best legal weed in the country.

And don’t sleep on Alien Labs/ Connected in AZ and FL with Trulieve as they typically hold top share in those markets...and for good reason.

Also want to give a shout out to Cannabist—their mass market Old Pal and Revelry products have been exceeding my expectations. Can't beat the value proposition (again, you don't drink top-shelf every time right?)

Lastly, RYTHM. I’ve had their jars now in 5 states over past 12 mo.: MA, IL, FL, NJ, CT. Remarkably consistent. Shouldn’t surprise anyone.

(Plug alert, follow me and the team at stashtips if you really want to learn more)

HASH ME

As a brand in the space, I really tip my hat to puffco. The speed of innovation and product cycles seems to be increasing, and the marketing is something we should all aspire to (but in your authentic voice). They really don’t feel like a cannabis brand to me anymore, but on the path to becoming a great CPG company.

Speaking of hash, I think we’re going to wake up and hear about a hash fridge auctioned off at a ridiculous price in 5 years. We’re in the renaissance of hash making, and some jars are going to be enormously valuable in time.

It preserves and ages; it’s the cleanest, arguably healthiest and most flavorful form factor; it’s perfected by world-class flower and talented hash-makers; it’s a unique and differentiated “medicinal” quality buzz; and offers plenty of opportunity for self-titration.

Reminds me a lot of scotch/bourbon or wine, but without the hangover. Long hash.

BREAKING THE LAW

Let’s address the elephant in the room—most of those moving the needle in this industry have been “breaking the law” for a minute.

If you’re willing to break a law, you have to be of the mindset that said law is irrational based on your behavior that does no net harm to society, and you’re willing to face the consequences which you risk-assess vs return.

For me, consuming cannabis safely (and mostly alone) met that bar very early starting 30 years ago. Especially vs the alternatives as a battle-scared D1 athlete w a mountain of work that simply needed to get done.

Drive over the speed limit? You can do it if, a) no cars or peds are on the road, and b) you think the law based on the “85% rule” means 15% can and do drive over. And you’re willing to burden the cost of a ticket and higher insurance. Hence, most do.

Cannabis is the same way. Risks are extremely different today than yesterday, and it sadly was way riskier depending on the color of your skin, but my thesis is that as risks decline, rules will continue to be broken. Be prepared for that.

GOT BETTER-FOR-YOU?

Hope you all took note of Pepsi acquisition of Siete Foods–we cannabis operators and investors always need to watch the periphery within consumer as those actions often leave breadcrumbs for us to learn from and apply in our business.

So many themes in this deal are highly applicable to us.

TIME TO BE VULNERABLE

I don’t care where you sit in the supply or investing chain, we’ve all dealt with an incredible amount of stress, uncertainty and volatility at a relentless pace.

Across the spectrum—legal cannabis states, legal hemp adoption, breeders, growers, brands, accessories, equipment providers, distribution partners, retail outlets, agents, principals, entrepreneurs, investors, media, lawyers, PR, HR… it’s been a grind.

Highs and lows. Wins and losses. Hope and dread.

Make sure you’re taking care of yourself.

It ain’t worth it.

And Biggie was wrong, It’s ok to get high on your own supply—it’s there for a reason—but remember that it’s a tool, not a crutch.

FIN

There you have it folks, my latest sesh. I hope this provides value and if so, I’d greatly appreciate a follow, and you sharing to the community.

/end

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.