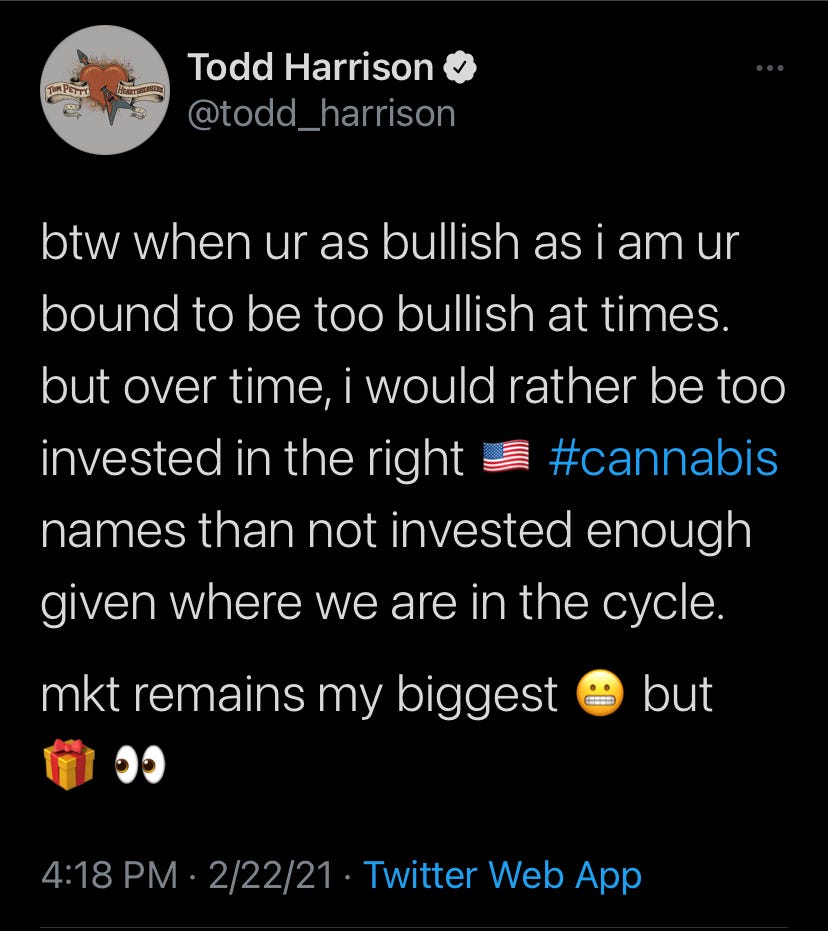

First, some ownership: I opined a few wks ago that US canna had entered a sweet spot into earnings and doubled down last wk. That was, well…

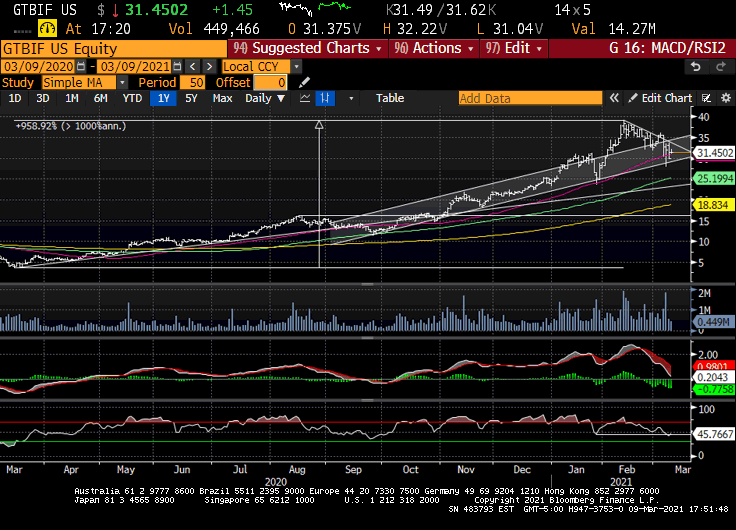

And it wasn’t like they weren’t due for a rest. $GTBIF was + 959% vs. 3/20.

US Cannabis ETF $MSOS was +173% since September.

And rookie me, I got loud into the teeth of a 25% sector-wide drawdown; I’m sorry.

WHY did canna puke lower, other than gravity? There were several dynamics, a mosaic if you will. And I will, bc hindsight is so much easier than foresight.

High-multiple tech and other “growth” crashed lower on the specter of higher interest rates and active funds “de-grossed.” I get it, I do; except US canna multiples are reasonable vs. 2022 / the existing state footprint (much less a few yrs out + the other 2/3 of the nation) and hold on: higher rates? How about rates at all; debt financing at all! That’s not a thing for most US canna yet, nor are bank accounts, credit cards, access to capital markets, or NASDAQ / NYSE listings.

Settle down Francis; this is the cautious part of the note.

2. Perception of federal gridlock; again, I get it. Politicians largely suck and it took a weekend marathon to pass CV relief + infrastructure’s on tap and wait- West Virginia? It’s important to remember that the longer legislation takes, the better it is for the incumbents, the oligopoly of US MSO’s that will build MOAT / enterprise value from here to there. But we still think SAFE happens sooner vs. later, and if not please accept our apologies again and this time with sound.

3. NY state drama. Self-explanatory? Yeah but the big apple has to turn green bc if they can’t make it there, they’re gonna make it (bum bum) anywhere else in the tri-state area so follow the money / jobs and let’s hope / help social justice keep pace. It will. It has too. It will.

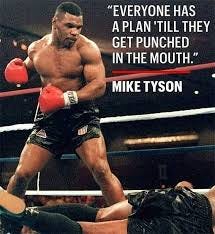

4. Retail holders. Mike Tyson was right: everyone has a plan until a 25% 3-week correction punches them in the mouth. And it’s not even US retail freaking out bc most of them can’t access US canna yet—and I’m talking to you Robinhood. But they’re coming, as are the Fido’s, Putnam’s, Vanguard’s, Blackrock’s and State Streets of the world, and the big boys don’t panic sell; they average in. They’re the original diamond hands; the big-mitten crowd. You’ll see.

5. US Earnings are gonna be buff but they’re not sneaking up on anyone, not after the recent rerating from “growth @ value” to “growth @ reasonable.” We recently shared a matrix of valuations of US vs. Canada so if you missed it, give it a click.

Anyway, we got a glimpse of that last night when Curaleaf painted the tape:

4Q MANAGED REV. $233.3M, EST. $242.2M

$53.8M ADJ EBITDA vs EST. $51.2M

4Q LOSS/SHR (.05), EST. (.02)

While pooh bear may say CURA was a slight miss vs. expectations I would say:

A) It’s a pandemic. Seriously. 25% unemployment in some places and canna ain’t cheap + Stimmy now, which will help the Q1 tail / Q2 gust and… 4/20 anyone?

B) if US canna was tippy-toes into these numbers, maybe it sells off but after a 25% haircut, it’s a different field position / set-up. I mean, this is a good looking chart:

C) if ever in the history of man there was a mulligan quarter, it was Q420 for US canna; think about what’s changed since then: A five-state sweep, blue senate, Pepe F Lepew!

D) BoJo just lifted his leg and marked his EU territory; in his backyard, no less, a strategic advantage given he knows his way around Europe better than most. Da.

*CURALEAF TO BUY EMMAC LIFE SCIENCES FOR AROUND $285M

*CURALEAF'S JORDAN SEES MAKING MORE ACQUISITIONS IN EUROPE

Attack of the Killer CPG

"Alcohol and tobacco are absolutely for legalization. Tobacco and Alcohol companies are already talking to cannabis companies. They think it's a huge market, they want in. They are working w/ lobbies in Washington." Boris Jordan, $CURLF (this echoes what we’ve been hearing; CPG is coming from every direction).

Follow the Money

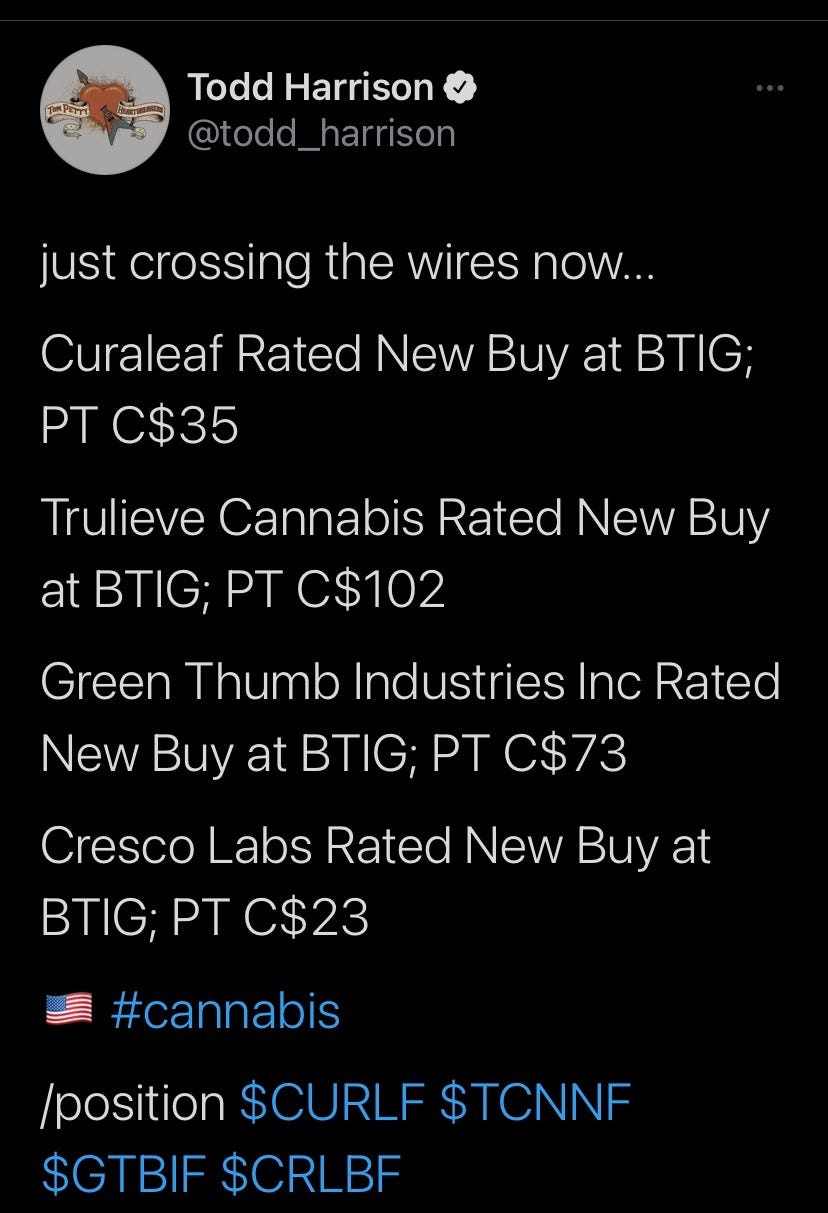

Remember ten years ago when I wrote about how one day Wall Street would initiate coverage of US cannabis and that would be a massive forward catalyst? No? I don’t blame you, I barely remember it and I wrote it.

Well, move over Steve Starker bc BTIG just planted a flag:

Those four picks, btw, are the same four horses we flagged last summer.

There’s more, much more: Mexico, Maryland, Hawaii, Alabama, New Mexico, Texas, Wisconsin, Rhode Island, Pennsylvania, Connecticut, expungments, research, science, set-ups, situations and yes, lots and lots of stock market risk (<- requisite disclaimer) but don’t think too hard bc before you know it, they will figure it out.

And this whole thing could trade ahead before you know it.

So good luck out there, and remember to stay humble or the market will do it for you.

/positions in stocks mentioned /advisor to $MSOS US Cannabis ETF