Daily Recap

A federal judge scheduled oral arguments in a case filed by U.S. cannabis companies seeking to shield in-state cannabis activity from federal enforcement. The businesses said in their lawsuit that the prohibition of marijuana has “no rational basis,” pointing to officials’ hands-off approach to state-level legalization.

Litigator David Boies, whose prior clients include the Justice Department, former Vice President Al Gore and plaintiffs in the case that led to the invalidation of California’s ban on same-sex marriage, is leading the suit and in-court arguments begin on May 22.

Days of our Lives

The Biden reelection campaign says the Trump administration “took marijuana reform backwards” by rescinding Justice Department guidance that promoted discretion in federal cannabis prosecutions.

The Biden email omitted the fact that cannabis guidance has not been reissued under the current administration despite Attorney General Merrick Garland saying 680 days ago that the DOJ would address the issue “in the days ahead.”

Flight Delay

Congressional lawmakers have abandoned plans to attach a cannabis banking bill to unrelated must-pass aviation legislation, determining that it’s “insufficiently germane,” according to a top industry association that cited sources familiar with the decision.

That might come as a crotch-kick for canna advocates but there are other legislative paths for SAFER Banking this session, including the continued—if not telegraphed—possibility of advancing it as a standalone measure.

“It’s disappointing to be sure, but there will be ample opportunities to pass SAFER in this Congress. Leadership will now reassess and consider whether to advance the bill as a standalone or through one of the lame duck legislative vehicles.” -David Culver

Bhang for the Buck-eye

Ohioans will likely be able to buy recreational marijuana as soon as mid-June, earlier than the timeline outlined by the initiated statute they voted to pass last fall, and the existing medical dispensaries are actively preparing for the state’s green light.

“I've been assured they’ll be reviewed very quickly once they’re filed out and returned, and they will be fairly straightforward applications. That being the case, we could have recreational sales as early as the second week of June.”

Stocks & Stuff

It was an odd day in Cannaland as the space braced for a five-finger Sally that never quite arrived. U.S. cannabis ETF MSOS finished the session +4% to eek out a small gain for the week while the Canucks enjoyed some seasonally green screens, as well.

Below, we’ll chew through today’s price action, preview U.S. canna’s Q124 earnings, dig into the latest SAFER Banking plot twist, check on our levels and otherwise ready for a well-deserved respite, some killer college lacrosse and a Verilife site visit. 🙌

All that and more, just scroll down.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ PT Notional: $113M/$65M

Top Stories

Ohio medical marijuana dispensaries prep for adult-use green light

Mass. Sen. Warren, Dems, want DEA to bump cannabis from most dangerous drugs list

New York Tries to Prune Its Illegal Marijuana Crop

Kentucky will hold October lottery to award first marijuana business licenses

Wisconsin is missing out on legal marijuana tax revenue

Minnesota marijuana dispensaries could be stalled until 2025

Judge Schedules Oral Arguments In Marijuana Companies’ Lawsuit Challenging Federal Prohibition 👇

Fried Day (written 7:45 AM)

When we unplugged last night there were a lot of questions floating around about why MSOS traded so funky despite a steady diet of breadcrumbs that are seemingly leading us directly toward the DEA Main Event.

Last night, after unplugging on the bell for a dinner meeting + a Strong Island sunset, and after ruminating on yesterday’s nut-punch, I came home and tweeted:

returned home to find X angry and I get it; it's exhausting; so many rumors/ so much noise; price action felt NDAA-ish today; idk if that’s recency bias but either way Boies news welcome and timely.

We awoke this morning to a screenshot of an image from the USCC, which said:

"our sources indicate the SAFER Banking Act will not be included in the must-pass FAA reauthorization bill. We understand the provision, along with [stablecoin], were deemed insufficiently germane to the aviation-centric package."

While we didn’t know if that was confirmed, it felt true given the (lack of) reaction to the persistent rumors of momentum on both the package and vehicle—and if we got Schumered again, it might take SAFER off the table, at least until after the election.

Losing SAFE, if we have, may not be a shocker given the history but it would still be a dissapointment given the bipartisian support and leadership’s lip service. Yes, we still have SIII to look forward to, or so we think, but this remains an attainable companion.

All eyes will be on the primary trendline today/ into the weekend as nerves are frayed, patience is nonexistent and venom levels are high. I slept in an extra half hour this AM (fatigue) and thought about taking the day but then I remembered that showing up is half the battle, so let's go.

Early Due Dilly (written 9:00 AM)

Digging on the USCC post; if/once confirmed, we'll see it on MM or Politico but what we’re told—which doesn't make it so, at least not yet—is McConnell doesn't wanna give Dems a win prior to the election but would allow passage in the lame duck.

Between the Balls Bells

As we readied for the opening bell, the mood in Cannaland was decidedly one-sided:

So I did what instinctively came natural, which was to pull up a chart and circle some potential support levels that might matter on the downside:

MSOS levels

$9.03 50day

$8.60 April low

$8.43 100day

$8.42 👈

$8.05-$7.75 GAP

$8.08 200EMA

$7.47 200day

$7.30 Feb lows

When the market opened, MSOS traded a quick percent lower before snapping higher (+2%) because chicken salad on Rye, I guess. It almost felt like folks got short ahead of news and there was some covering going on. The Canucks were notably perky withCGC 0.00%↑ ACB 0.00%↑ and VFF 0.00%↑ sporting double-digit % gains by 10AM.

At this point, my eyes began darting bw the news ticker, as I waited for Tom or Nat to drop the hammer on SAFER, and the MSOS chart as it backtested $8.60, which was the April low and our first real clue as to whether the rally would be real, or just Memorex.

I spoke to A. Friend into the 11:00 AM hour:

Just spoke with a PM who has decent exposure in the space; he told me they had zero expectations on SAFER but the news/ rumor made yesterday's reaction to what they thought was a constructive update from the DEA make a bit more sense.

At the time, MSOS was making a second effort to mount $8.60 and it was repelled, as the bears continued to control the narrative and the price action, They knew that until the ETF could recapture that level, it would remain mired in a textbook churn.

After several hours of suspended reality, MSOS pushed through $8.60 and got as high as $8.80 when, right at 3PM—YIKES!—Tom Angell published the USCC news/ source from this morning.

The kneejerk lower (-1.5%) was to be expected but the late day bullish bravado was a nice, if not notable surprise that just goes to show that no matter what goes on inside our minds, things rarely turn out as badly as we fear.

A few thoughts before we break for some wellness: 1) the breadcrumbs suggest we’ll solve for SIII and this orchestration is more Kabuki Theater than genuine dissaray and 2) the Boise oral arguments in a few weeks will ensure the intended goal of the lawsuit—to turn the screws on the U.S. government—will indeed acheive it’s desired effect.

Viridian Chart of the Week:

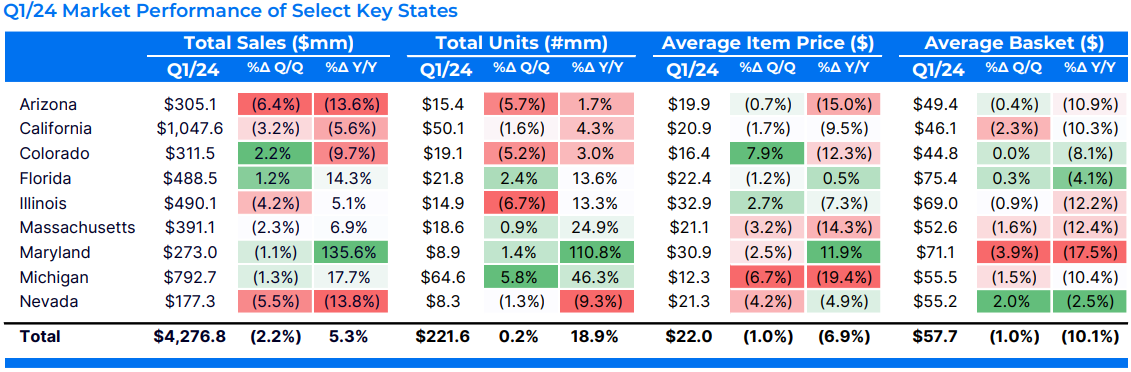

ATB previews U.S. cannabis Q124 earnings:

Expect a soft Q1/24 for most MSOs due to seasonality. Companies have guided to sequential revenue declines (Trulieve and Ayr are exceptions, guiding to flat to small increases), which is baked into consensus. We think Florida expansion plans and an update on tax returns will also be key themes for the quarter.

Arizona, Nevada, Illinois, and New Jersey with notable sequential revenue declines. In particular, New Jersey is seeing a rapid increase in number of stores, with increased competition at the retail level.

Pennsylvania appears to be improving, with sequential revenue increase and an increase in sales per stores.

Florida benefits from the winter bird effect, with a slight sequential revenue increase. Trulieve has regained share recently, and outside the top five, Cresco is a name to highlight with strong share gains.

New York is the fastest growing market as new AU stores open in the state.

Stems & Seeds

Scotland worst in world for boys smoking cannabis

Mike Tyson On Becoming A Heavy Hitter In Weed

Patients Report Improvements, Few Side-effects After Use Of High-THC Flower

Enjoy your weekend, stay safe and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.

Nice headline. (Beat 2J's comment)