Cali Sober

Cannabis: Hot. Alcohol: Not.

Daily Recap

The American Buzz is on the move. As cannabis dispensaries multiply and warnings about alcohol continue to manifest, more consumers—especially younger ones—are actively reevaluating what it means to relax, socialize, and celebrate.

The battle for mindshare and market share between weed and booze is more than a matter of taste—it’s a shift in values, wellness priorities, and state-by-state policy.

Gen Z is helping to drive the replacement theory. A recent survey found that 69% of consumers 18-24 prefer cannabis to booze, and drinking use among 18-34-year-old Americans fell from 72% to 62% over the last 20 years.

Along with its growth in popularity, cannabis is also becoming legal across the United States, with 40 of 50 states approved for medical cannabis and 79% of Americans now living in a county with at least one dispensary.

With the liquor industry generating US$250 billion, even a small dip into the overall market could account for a skyrocketing opportunity for investors—per FlowHub, the cannabis industry is expected to reach US$45 billion 2025.

This trend hasn’t gone unnoticed. Diageo, who makes Guinness, Johnny Walker, Don Julio and Smirnoff, saw its stock fall nearly 50% since the end of 2021.

Constellation Brands, owner of Corona and Mondavi, collapsed 33.5% last year.

Brown-Forman, the 155-year-old company that makes Jack Daniel’s, is coping with a decline in sales and gross margins, as well as a 58% plunge the last three years.

The threat to the alcohol industry is even more acute given the rise in popularity of THC-infused drinks. Fortune Business Insights projects the THC beverage market will grow from US$3B in 2024 to US$117B by 2032.

Nine of Ten (!!)

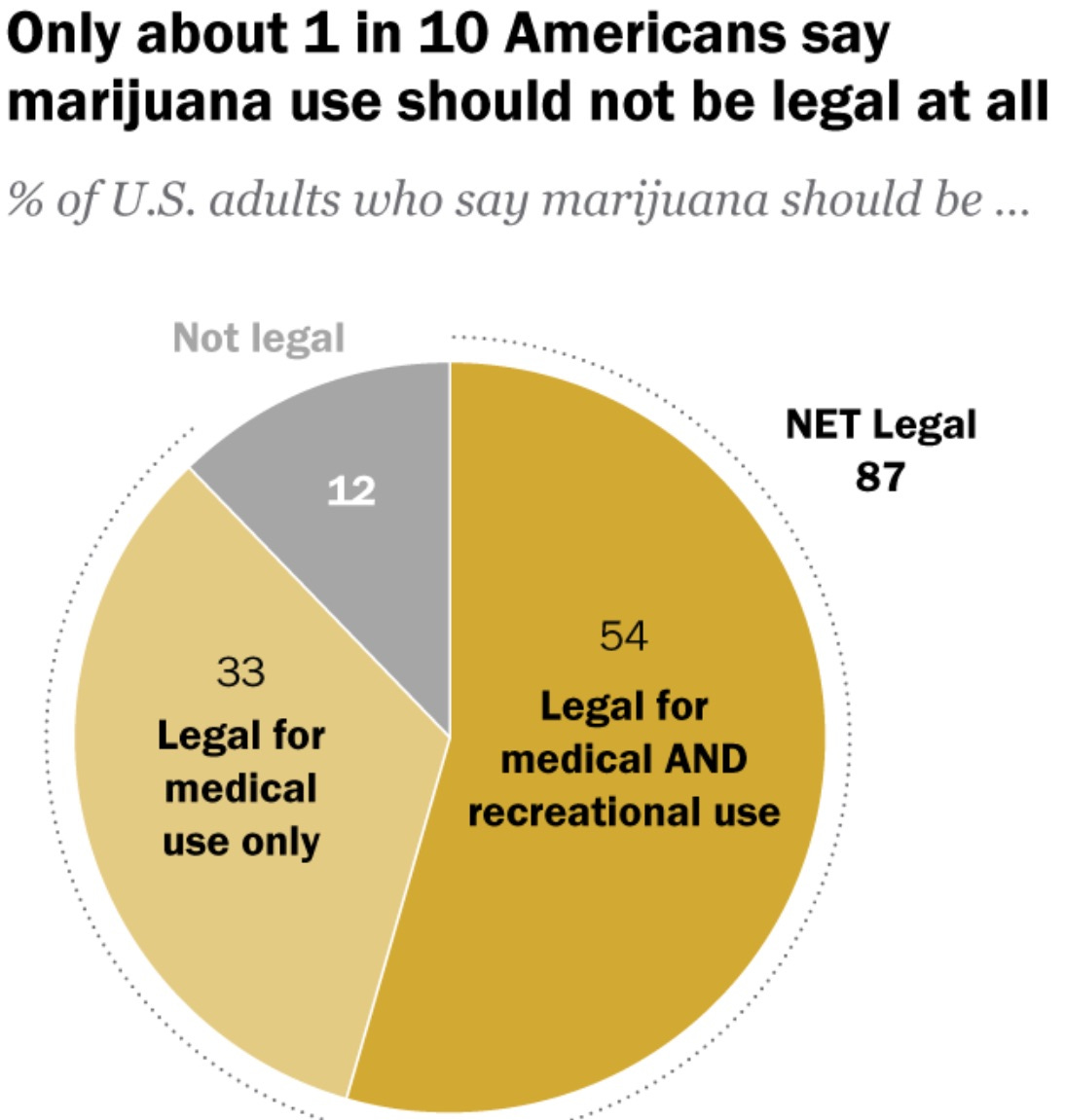

An overwhelming majority of Americans support legalizing cannabis in some form, according to newly released polling data from the Pew Research Center.

87% of respondents said they agreed with enacting reform, 54% said canna should be legal for both medical and adult-use purposes, while 33% said it should be exclusively legal for medical use.

Only 12% of U.S. adults think cannabis should remain prohibited across the board and most of them will probably “age out” soon.

Moscow Mitch

The glitchy senator who championed the federal legalization of hemp is now seeking to reverse much of the reform by pushing legislation at a committee hearing to ban consumable products with quantifiable amounts of THC.

Several sources told Marijuana Moment that Sen. Mitch McConnell (R-KY), the former majority leader in the Senate who led the push for hemp legalization as part of the 2018 Farm Bill, is behind forthcoming language in agriculture spending legislation that would effectively wipe out the consumable hemp product market.

The bill text has not been released at this point and there are efforts by some to get it amended before it goes to a vote in the Senate Appropriations Committee Thursday.

Naked Gun

A district judge in Pennsylvania dismissed a lawsuit challenging the federal govt’s ban on gun ownership by state-legal MMJ patients, ruling that prohibition is constitutional and patients can avoid legal jeopardy “by simply choosing an alternative treatment.”

“Plaintiffs have no constitutional right to use marijuana, medical or otherwise, and there are no allegations that medical marijuana is the only available treatment for their medical conditions.” U.S. District Judge Cathy Bissoon, an Obama appointee.

Stocks & Stuff

It was a mixed day on Wall Street as the tariff tango continued, and equities digested the recent run to all-time highs—and in what can only be described as a broken clock session, cannabis equities enjoyed a decent day on (relatively) better volume.

U.S. cannabis ETF MSOS finished the session +9% as continued efforts—including an attempt to ban intoxicating hemp at the federal level, coupled with unlikely allies that are working together behind the scenes—made its way into the trading ether.

Below, we’ll top-line the latest happenings, eye the slow motion political sea change, complete with newfound MAGA influencers, dig into two different names—Cannara Biotech and Curaleaf—and explore what it’ll take for this sector to become aroused.

All that and more, just scroll down.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ ETF Notional: $24M

Top Stories

Is America Going California Sober?

Alcohol Stocks Tumble as Health and Cannabis Trends Surge

Judge: Arizona can continue to crack down on hemp-based THC products

City of Dallas pauses enforcement of voter-approved marijuana law

Inside the European Takeover of America’s Cannabis Seed Market

Israeli ombudsman upholds rejection of tariffs on Canadian cannabis

Industry Headlines

Organigram Launches US E-Commerce Platform for THC Beverages

Curaleaf Announces Buyout of Minority Partner in Curaleaf International

Pregame (written in real-time at 9:00 AM ET)

Welcome back to the dog days of summer, which is more apropos for a canna sector 20% off all-time lows than a broader tape dancing near all-time highs.

The carnage has been absolute—I haven’t checked but I’m pretty sure it has been the worst-performing ETF in the market the last five years, which I was reminded of last weekend when someone who bought $62K of Bitcoin in 2011 sold it for $8.6 billion.

That was around the time I was weighing two possible career pivots: I was intrigued by the utility of the blockchain and spent some time digging into Bitcoin, but if I’m being honest, concerns about the durability of cryptography and the ability to analyze assets through one (technical) metric concerned me; I didn’t know what I didn’t know.

I was familiar with cannabis recreationally and became fascinated after it helped me solve for my post-9/11 PTSD, and then I met my current partner who had the same experience with his seizure disorders. That motivated us to build a cannabis wellness research repository, which continues to this day, and led us down a path to right now.

Financially, the decision speaks for itself—crypto has exploded into something other-worldly, which I got a firsthand glimpse of when I was in Nashville supporting port-co. Tempter’s as they sponsored the Karate Kombat Championships at the same time and venue as the national crypto conference.

That’s not regret you’re reading—life is the sum of the decisions that we make—which isn’t to say I wouldn’t do things a bit differently if I had the script prior. But I didn’t—nobody did—and I embarked on this mission to reverse the curse that has surrounded the cannabis plant for 88 years and continues to manifest despite an abundance of new evidence.

There was much I didn’t foresee: people (Biden, Schumer), places (FL NY MN) and things (hemp, pricing) all contributed to the price action but the late Biden Heisman, followed by the Florida fail and red sweep in November, really punctuated the pain as the small handful of institutional holders jettisoned exposure into a dearth of demand.

^ the ETF reflects these elements—but it isn’t the cause.

Sounds scary? It is. As shared before the break…

‘I can’t tell you the last time I awoke without a 3AM text/ DM from one of the leading MSO CEO’s complaining about the ETF, or disgruntled investors lamenting over the state of play, or pals navigating depression and anxiety as they look for a fresh start.’

…but as my friend Marc Cohodes likes to say, stocks have no memory. He often tells me that it doesn’t matter where these stocks have been/ how long they’ve been there, what matters is where they are now and even more importantly, where they’re going.

I’ve known Marc since I picked up the Rocker Partners light on the Morgan Stanley equity derivatives desk in 1991. We connected over our love for the (then) Oakland Raiders and bonded shortly thereafter when we went to playoff games in the late 90’s with his fabulous son, Raider Max.

We’ve kept in touch through the years, and I’ve watched him repeatedly do his thing. He sinks his teeth into a situation, does more diligence than any human I’ve known, and is relentless in his pursuit of the truth. There are numerous examples of his wins and suffice to say that I, for one, am glad he’s on the home team.

He and I have spoken more of late, often multiple times a day, as he levels his sights on the decision-makers across the U.S. government, from Treasury to DHS to DEA. I was excited to witness his connection to Derek Maltz Sr., another man I’ve known a long time and have immense respect for, as neither of those guys fuck around.

I spent most of last week doing what I do the other weeks of the year: connecting peeps who share qualities, skills, motivations and quite hopefully, synergies.

There are numerous individuals working tirelessly behind the scenes to effect positive change and federal reform this year. Some you know (Weldon Angelos, Kim Rivers, Jason Wild, Charlie Bachtell, Village) and some you don’t but we all know two things:

1) there are no guarantees, which is why we must keep our pedal to the metal, and

2) any and all federal reform will be decided by one man: Donald J. Trump, and he’s already told us where his comfort zone is.

MAGA influencers have come out in support of reform, which is Yuge.

ATB on Curaleaf

Curaleaf announced today (here) that it acquired the minority equity stake in Curaleaf International, bringing its ownership to 100%.

The minority investor had a put option and elected to get paid in shares. Curaleaf didn’t disclose how many shares were issued, but in its Q1/25 notes to the financial statements, the value of that put option was estimated to be less than $10mm.

What’s more significant is that Curaleaf has another put option related to the minority stake in Four20, with a value estimated at $80mm-$100mm, payable in cash and stock. This put option is to be exercised by no later than the end of this year.

The stock is trading close to its 52-week lows, with a market cap of approximately US$620mm. As such, the Four20 put option could represent 13% to 16% of the current market cap.

Research Capital on Cannara Bio: Low-Cost, High Quality- What's Not to LOVE?

We are initiating coverage of Cannara Biotech Inc. with a BUY rating and a target price of $3.00: As the Canadian cannabis sector continues to consolidate, a select group of financially disciplined LPs with focused execution has emerged as consistent outperformers.

Cannara stands out within this cohort by leveraging its low-cost Quebec operating base, in-house processing capabilities, and high-margin, consumer-focused product portfolio to drive both top-line growth and margin resilience.

In FY2024, the company generated $6.4 million in net income and $15.1 million in adjusted EBITDA, representing an 18% margin. That momentum accelerated into FY2025, with $13 million in adjusted EBITDA (25% margin) and $5.6 million in net income already reported in the first half.

These results reflect not only disciplined cost control but also strong execution in high-margin categories such as premium dried flower, vapes, pre-rolls, infused pre-rolls, and a variety of concentrate products.

Stems & Seeds

Marijuana Use Tied To ‘Significantly Higher Sexual Desire and Arousal.’

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.