When I last picked up the proverbial pen after a self-imposed sabbatical seven short days ago, the spirit among cannabis investors was tenuous at best. U.S Cannabis ETF $MSOS had just closed sub-$20 for the first time ever, a stunning fall from grace after trading at $55 a year ago this week. Twitter had become unbearably toxic as the blame game and I-told-you-so’s echoed through the rafters. Even some time-tested alliances showed signs of strife as the cannabis bear approached it’s one year anniversary.

There was only one thing left to do, really… road trip!

So I headed west 'cause I felt that a change would do me good—see some old friends, good for the soul. While I had been in Cali for the Ojai event in October, I never saw the sights, so to speak. And given how negative the narrative had become about any / all things California cannabis-related, I figured some due dilly was definitely in order.

The purpose of the trip was two-fold: visit Glass House Farms and see the new 4Front manufacturing facility. As I would only be in Cali for all of 40 hours, I suggested that we all have dinner together on Wednesday night to swap stories and compare notes / observations about the current operating environment.

The California cannabis challenges have been well-documented. The supply glut, the still-thriving illicit market, persistent pricing pressures, high taxes / regulatory costs and a litany of other concerns—not to mention the massive melt by U.S canna stocks—combined to create the perception that Cali canna belongs on the pay-no-mind list.

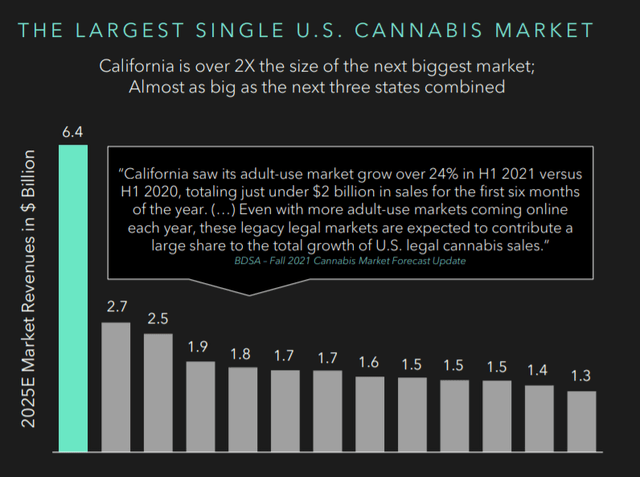

That would be a mistake. California is by far the world’s largest cannabis market (it collects more in canna tax revenue than other large markets sell in total) and it’s the incubation lab for cannabis brands, as evidenced by the fact that states that are legal are smuggling in Cali brands via the illicit market.

If someone could produce low-cost, high-end products while driving efficiencies at scale—and perhaps roll-up some distressed assets along the way—that smells like a recipe for success once we emerge from this cycle, with or w/o interstate commerce.

That’s largely what we discussed as we settled in for good food / better conversation…

…how the greatest opportunities are born from the most profound obstacles and how the winners that emerge from Cali will have the battle scars, war wounds and true grit to compete anywhere in the world. It was time well spent but after dinner and dessert…

…we called it a night. My jet-lag was kicking in and we had a packed schedule on tap.

Our first stop on Thursday morning was 4Front’s 185,000 SF manufacturing facility…

…which, in the words of CEO Leo Gontmakher, “will enable 4Front to emerge as one of the top high-quality cannabis producers and price leaders in the largest and most competitive marketplace in the world.”

Of course, this isn’t 4Front’s first rodeo. They’ve honed their skills / abilities in the equally-as-difficult Washington market, where they’re the #1 edibles manufacturer, the #2 flower producer and #2 in overall market share (they also have operations in Massachusetts, Illinois and Michigan that continue to scale).

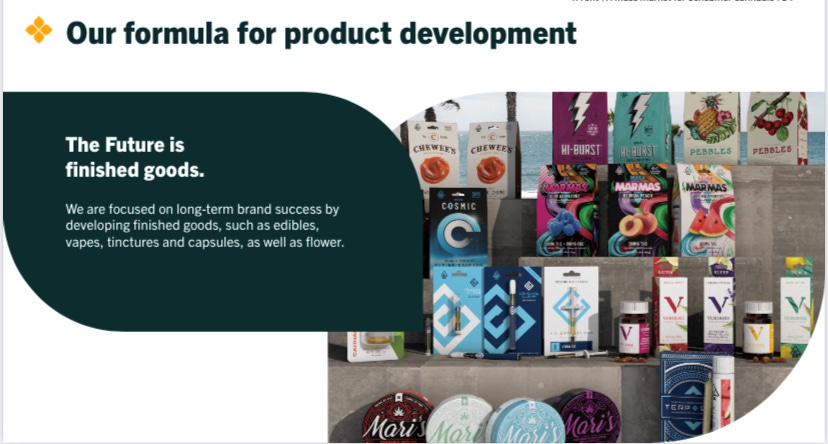

We’ve discussed how in canna 2.0 (U.S-led CPG), cannabis would be an ingredient in an array of different form factors. Gummies, hard candies, caramels, cookies, drinks, fruit chews, mints, gel caps, tinctures, infused pre-rolls, vapes… and this concept has not been lost on 4Front. In fact, they’ve built their entire franchise around it.

Now I don’t impress easily so when I tell you that this facility is a unicorn, you’ll have to take me at my word. 170,000 SF of manufacturing space includes 80,000 SF for distribution warehousing, 25,000+ SF for finished goods storage and 4,000 SF for dry flower., plus another 15,000 SF of office space. That’s more than three football fields of low-cost / high quality finished goods. (click video)

After several hours of walking the facility and allowing for a quick pitstop at IN-N-OUT Burger, we drove an hour to Camarillo, where Glass House Brands, the #1 cannabis company in the #1 market in the world…

….recently unveiled their unicorn, this one the size of more than 95 football fields.

I know “funded capacity” is a four-letter word after cannabis 1.0, when Canadian LP’s taught investors the risks involved in building it before they come. But California isn’t Canada and with the market cap of the entire company trading below the replacement value of it’s assets, the set-up and runway are diametrically different.

The planned conversion of this 160-acre property with 5.5M SF across six greenhouses began several months ago. At full capacity, this facility will yield total biomass of ~1.7 million dry pounds per year…

…which will drive a cost structure that will be difficult to replicate anywhere else.

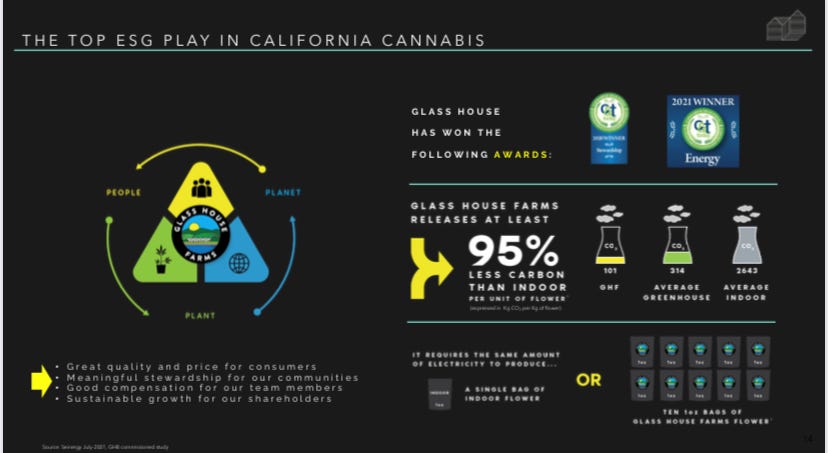

And it’s not just size that matters; it’s how they’re building this with a focus on ESG. That is good for the environment but it’s also good for the stock as it’ll open the door to an entirely new class of investors who have such mandates.

This sounds simple in principle but is more challenging to practice at scale, which is what will make the payoff that much more profound. (click video below)

At the end of the tour, Graham (GHB President) asked if anyone was afraid of heights. I said “no,” largely bc Andrew Thut (FFNT CIO) and others were nearby and I am, after all, a Raiders fan (and Raiders fans DGAF). Little did I know that meant I’d be climbing a single ladder to the top of a million gallon water tank (click video below).

I certainly didn’t enjoy the arduous process of that steep climb but once I got to the top and soaked in the rewards, I immediately knew that it was well worth the effort.

I would venture to guess that 4Front and Glass House will soon say the same about the unicorns they’ve built in the great state of California.

position / advisor $FFNTF $GLASF $MSOS