Man walks into a bar and says to the keeper, “I just returned from a three-month mindfulness retreat and haven’t looked at a screen since I left. Can you do me a solid and lemme know how cannabis fared given the first quarter is about to close?”

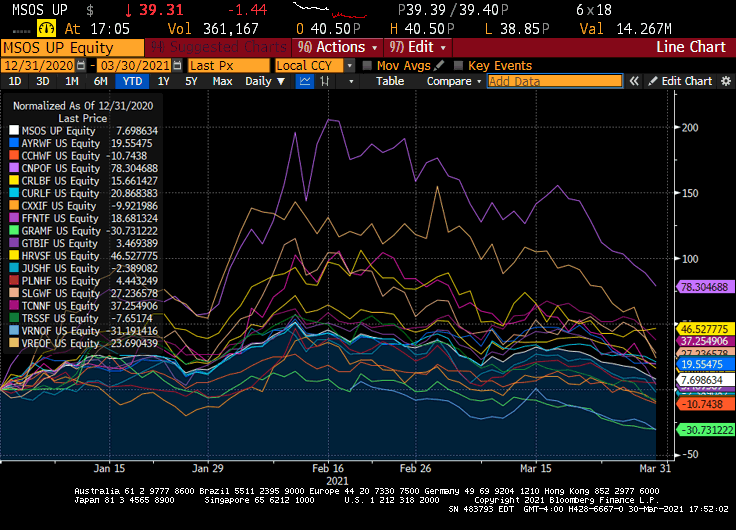

Barkeep pulls out his phone, scrolls a bit, “The BI Global Cannabis Competitive Peers Index is up 27% YTD,” he paused, as if to double-check the numbers, “U.S cannabis ETF $MSOS is +7% YTD, compared to 5% for the S&P and a flat NASDAQ.”

That man, if he existed, should have been pleased. 108% annualized return—and let’s be honest, even 28% if we wanna low-brow it—is better than a sharp stick in the eye. But for those living day-by-day and tick-by-tick, 2021 has been a bear of a ride.

The quarterly snapshot masks the vicious vol we’ve witnessed since the Feb 10 highs; US cannabis ETF $MSOS is off 30% in that span, while select leaders fared far worse.

In fact, most US canna stocks are back at levels last seen before the senate flipped blue and SAFE was moving in both chambers, much less… New York.

Why have the sellers been harshing our mellow so? A few reasons, many of which were touched on last week in Bulls, Bears & Wall Street F*ckery.

There’s conventional wisdom that the massive rally in global cannabis off the cyclical bottom last March has already discounted much of the good news. I mean, BI Global Canna is still a triple YoY (after everyone ran from Pershing <- memory stick).

And there’s the f*ckery scenario as several Wall Street banks implement and enforce custody and clearing guidelines around cannabis-related securities; curious-ass timing considering the legislation that is currently underway to alleviate such conflicts.

[note: volume trends have indeed dried up the last month but it’s impossible to know how much of that is due to custody-related issues, or the perception thereof]

Either way, after a cluster of good news, solid earnings, state adoptions and federal progress, pretty much smack-dab on the one-year anniversary of when this bull run began, the rally ran out of steam and buyer’s went on strike.

When the last gasp higher into earnings didn’t materialize — which traders were no doubt looking to sell—we got a decent pullback that set up some false flags. These things happen, which is why we eyeballed that right shoulder as it began to flank.

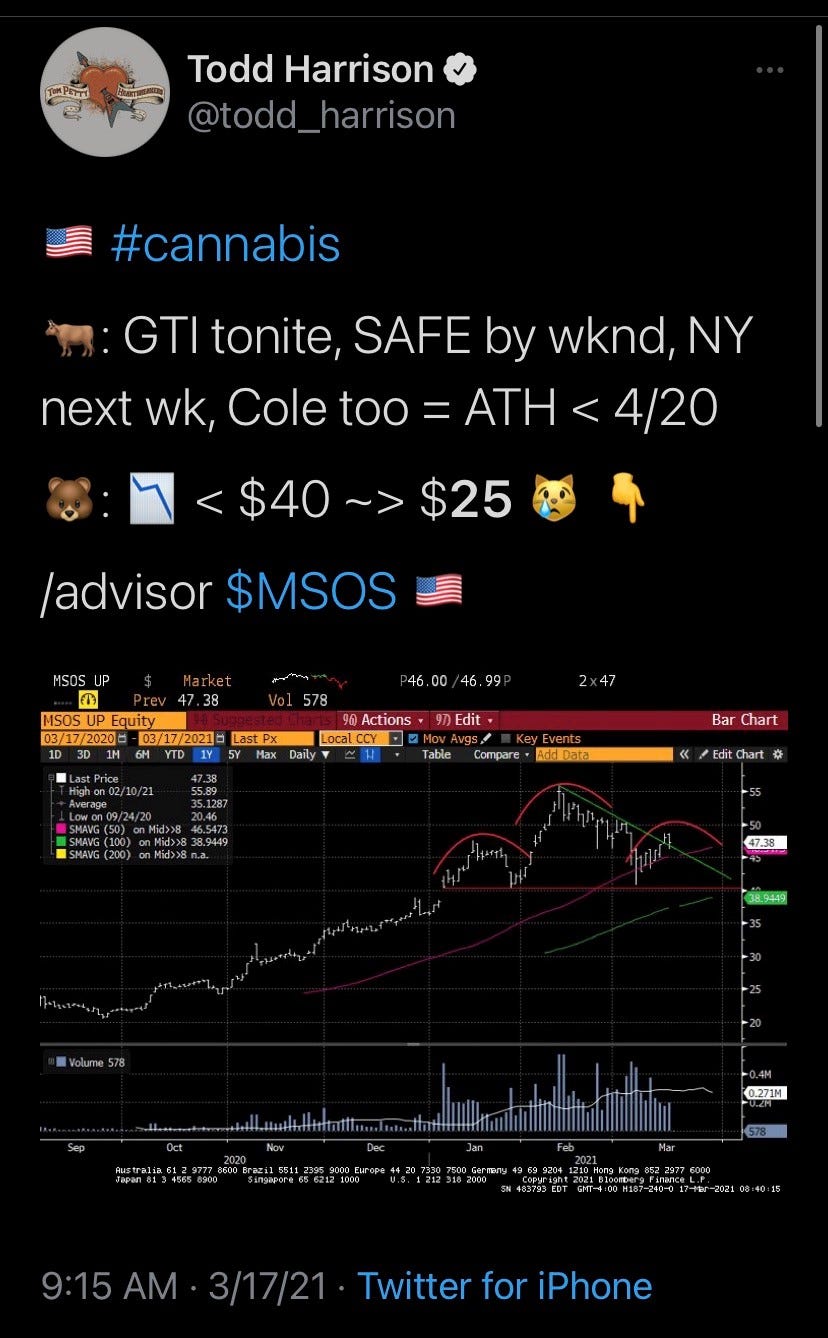

Hell, we even said the quiet part out loud…

But Wait, There’s More

As US canna bulls, we’ve tried to maintain loose grips on the handlebars throughout this extremely bumpy ride. It has everything to do with the forward opportunity and understanding we could have sold numerous overbought conditions the past year and each time would have been a mistake.

And really, we just wanna follow the fundies; as long as our companies continue to execute, as they’ve done throughout the most difficult conditions despite onerous regulatory and tax burdens, we plan to stick with them as institutions onboard the sector and US cannabis migrates into a mainstream asset class.

Some perspective: Three short months ago, most people were operating under the assumption that Mitch McConnell would still be turtling as we ready to flip the first quarter. In fact, when mapping election scenarios, our best-case was SAFE banking + States rights; that is now the base-case.

Plus, U.S Canna leaders are flush, having raised billions of dollars in January on top of generating free cash flow and (in the process of) achieving operating leverage at scale.

This isn’t the second coming of Canada, which topped almost to the day it became legal. This is a different ballgame; it’s almost a different sport.

But plumbing remains an issue and until these names list on NYSE or NASDAQ, which is on the other side of the SAFE Banking - FinCEN guidance - Cole Memo triple lindy, these stocks will continue to be pushed around by competing agendas.

Given the thin volume, it wasn’t hard to notice the hedge fund sellers that recently littered the landscape. And leadership—particularly Green Thumb, which many will argue is the best name in the space—couldn’t get off the mat on Monday. I remember scrunching my nose as I made my way to the dinner table; something def felt off.

Upon returning to my desk, I saw the headline from The Chicago Tribune: Chicago-based marijuana giant part of federal pay-to-play investigation. What in the actual f*ck? I opened it and read every word, waiting for the shoe to drop, the smoking gun, the Canntrust moment, the…

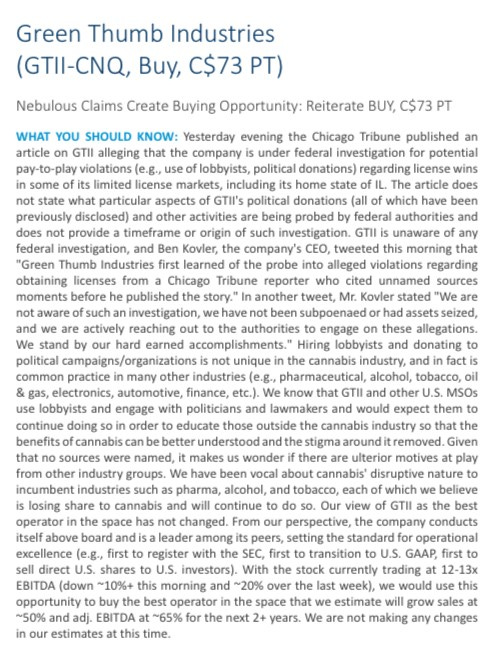

But there was nothing there. Anonymous sources, a dearth of facts and a company that seemed genuinely surprised to learn of an investigation. It’s impossible for me to sit here and tell you what did or didn’t happen in a room somewhere sometime but I can tell you that GTI has a sterling and hard-earned reputation for doing things right.

If you’re vibing some third-level voodoo shit, you’re not alone. Dropping a story like that as multiple banking institutions restrict purchases of cannabis-related securities and negative technical patterns self-fulfill would be a stroke of genius if it weren’t so evil. But that’s tin-foil stuff, right? Second shooter territory? Let’s ask Stifel…

"We note publishing timing of the article for maximum effect in a pessimistic tape which is in-line with a new CS policy no longer allowing trading of US cannabis stocks (likely came into force yesterday)”. Wow, that’s heavy. What say you, BTIG?

“Given no sources were named, it makes us wonder if there are ulterior motives at play from other industry groups. We have been vocal about cannabis’ disruptive nature to incumbent industries such as pharma, alcohol and tobacco, each of which is losing share to cannabis and will continue to do so.”

Jeezums Crow, now they’re saying the quiet part out loud too, confirming what many of us already know: that a trillion-dollar industry is taking shape and if we really want to know why things happen as they do, all we gotta do is follow the money.

Bringing it Home

I don’t know how the near-term shakes out—for our space, the market, any of it—but I do know that as I was writing this, the following headlines passed by:

*NEW YORK SENATE VOTES TO LEGALIZE RECREATIONAL MARIJUANA

*NY STATE ASSEMBLY VOTE EXPECTED TUESDAY ON MARIJUANA BILL

Followed soon thereafter by

*NEW YORK ASSEMBLY CLEARS BILL TO LEGALIZE RECREATIONAL POT

*NY MARIJUANA BILL HEADS TO GOVERNOR CUOMO FOR SIGNATURE

That is singularly ginormous, of course, as it will bookend our nation with cannabis-friendly meccas and all but ensure that the rest of the east coast follows suit.

I planned on spending more time writing about this historic day for my hometown, but for obvious reasons this column took a different turn.

Shit happened, and it needed to be addressed.

I will say this: NY State had an old version of the bill on their website until a few days ago, which sowed some confusion about what exactly was in the bill. And while it will take time and CAPEX ($) to build infrastructure, the incumbents are positioned to do quite well, particularly as it relates to distribution / wholesale / branded products.

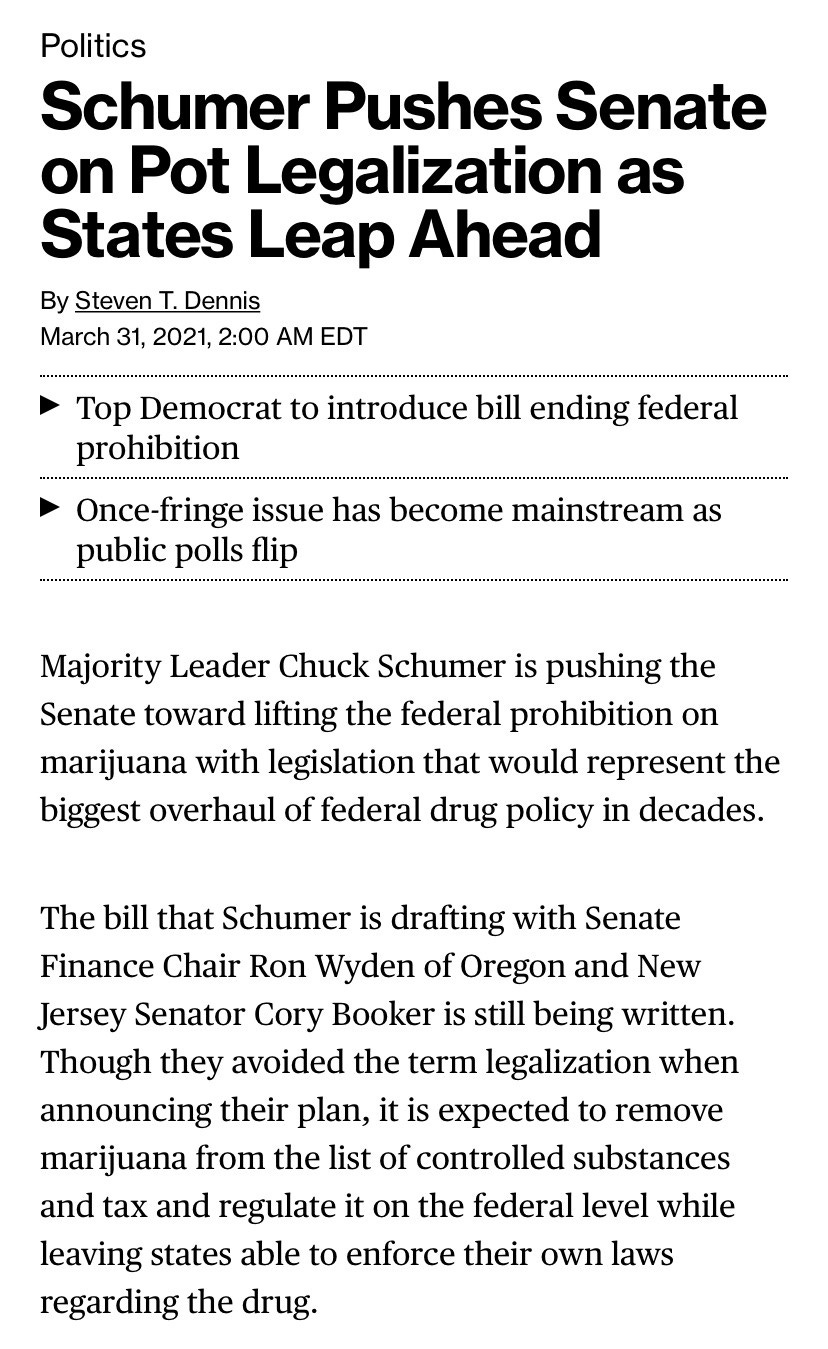

And that’s sorta the point, right? This thing—not just New York, but the whole thing—is gonna take time to prove through. Case in point, the Bloomberg Article that posted this morning as I was finishing up this column:

Whether or not that happens remains to be seen, of course, but we’re reminded that everything we could have hoped for as it pertains to the repeal of Prohibition 2.0 is on the table, whether it’s the base-case of States Rights / SAFE banking / continued state adoption or the whole magilicutty that’ll put this 90-odd year War on Drugs in the ground where it belongs.

Along the way, there will be competing interests; fiefdoms—entire industries—that will try to snatch our bag. People, hypothetically, that will plant stories about dirty Chicago politics to affect an outcome. Acts of desperation, deceit and duplicity.

The gloves are coming off, and you know what that means.

It means we’re getting close.

/positions in stocks mentioned /advisor $MSOS