Cannara Biotech Earnings + Call Notes

Canadian leader continues to flex.

Record FY25 Financial Performance:

$107.3M Net revenues

$28.1M AEBITDA

$13.1M NI

$20M OCF

FCF $13.7M

Stronger Balance Sheet and Earnings Quality:

^ first year of positive retained earnings.

^ supported by continued FCF generation and lower leverage.

Continued Market Share Expansion:

^ national market share rose to 3.81% in Fiscal 2025.

^ +32% YoY, and climbed further to 4.1% in October 2025

AGM scheduled for January 29, 2026

Management Commentary:

“Fiscal 2025 represents the strongest annual performance in Cannara Biotech’s history and reflects our ability to execute on the significant growth opportunity in front of us. During the year, we set new annual records for revenue, aEBITDA, net income, OCF and FCF, delivering substantial year over year growth across almost all key financial metrics.

We also delivered strong share gains across our markets, increasing our national market share by almost 32% year over year to 3.81%. In our home province of Quebec, we continued to capture and maintain consumer loyalty, increasing our provincial market share by over 53% year over year to 12.72%.

In the near term, our focus is on a successful execution of the Nov. vape category launch in Quebec,where Cannara has secured 20% of all accepted SKUs by the SQDC. We look ahead to our Fiscal 2026 post processing initiative at Valleyfield, which will position Cannara for its next phase of cultivation expansion. Over time, we plan to operationalize the remaining 12 grow rooms at our flagship Valleyfield grow, which will increase total cultivation capacity by ~100% over the next four years.”

“We would also like to note the passing of Jack M. Kay, and acknowledge his strong leadership, experience and support as a Board member since 2019. Jack made a lasting impact on Cannara and all those who had the privilege of working with him. On behalf of the entire Company, we extend our deepest condolences to his family and loved ones.” Zohar Krivorot, President and Executive Officer of Cannara.

“FY25 was another milestone year for Cannara, further validating our CPG strategy and the efficiency of our operating platform. Record financial results continue to demonstrate the strength of our brands, our focus on innovation and high return opportunities within our portfolio. Looking ahead, Cannara remains committed to disciplined, profitable growth, continued operational efficiency gains and a strong financial foundation that supports sustainable long term value creation.”

Nicholas Sosiak, Chief Financial Officer of Cannara

Call Notes

Cannara not built from an office, built from facility floor.

Pushing quality higher every year.

Strength in custom platform built for business.

Zohar’s IT background allowed creating own software.

^ for innovation, packaging, quality.

^ now also utilizing AI.

Industry anything but stable.

New financial record in almost every single quarter.

Continue to prove strength, scalability, profitability of platform.

Completed FY’25 expansion strategy.

^ increasing capacity by 18%.

^ unlocking a significant yield gain.

^^contributed an additional 25% capacity improvement

Capacity over FY24 up almost 50% to date.

Reached FY26 expansion target a full year ahead of schedule.

Closed year w/ strong doubt digit YoY improvement in market share nationwide.

Strongest year in Cannara’s history.

New records across every single financial metric.

^ as scaled into capacity and captured demand for products.

All time high revenues,

^ GP, OPINCOME, Adj EBITDA, OPCF, FCF, net income.

$149m gross revenue.

$107m net revenue.

^ +31% YoY

^ after paying $42m in excise tax

Federal tax reform would be welcomed.

^ excise tax representing over 30% of cannabis revenues

No meaningful reform on horizon.

Ability to profit during this environment puts Cannara in a strong position.

$44.5m GP before FV adjustments.

^ 41% margin, up from 34% last year.

$28m adj EBITDA, 26% margin vs. 18% last year.

$18m net income vs. $6.5m in YoY period, up 105%.

$20m OPCF vs. $11m last year.

$14m FCF vs. $3.2m last year.

Scaling into facilities and unlocking operating leverage.

^ w/o need to increase operating costs.

$28.3m record revenue in Q4, up 21% YoY.

Growth driven by deeper penetration into existing markets.

^ new product launches, expanded distribution.

Captured less than 3% of doors outside of QC.

Still meaningful expansion opportunity.

Sequential dip in profits driven by product mix.

GM before FV was 42% in Q4.

^ slightly below 44% in Q3 but well above 30% in last years Q4.

Delivering above 40% GM target.

Expect annual margins to continue growing into FY’26.

Maintained strong cost control.

^ $6.9m OPEX, 24% margin, up $800k QoQ.

$7.5m Q4 adj EBITDA.

^ - 1% QoQ and +100% YoY.

26% adj EBITDA

Q4 Net income of $3.3m.

^ $0.03/share.

OPCF of $2.8m in Q4.

$1.4m FCF in Q4.

$1.5m CAPEX during the quarter.

Full year capex to $6.4m

^ largely to bring on 2 rooms.

^ 50k sq ft, bringing grow to 300k sq ft or 50,000kg annual.

^^ 50% of potential target.

18th consecutive quarter of Aebitda, 6th straight quarter of net income+

N/I positive since ’21, OPCF+ since ’22, FCF+ since ‘23

94.9m shares vs. 90m shares in YoY period and 87.7m shares in ’23 FY.

Over 50% insider ownership.

Top 10 shareholders hold over 70% of float.

As of Nov 19th, $160m M/Cap.

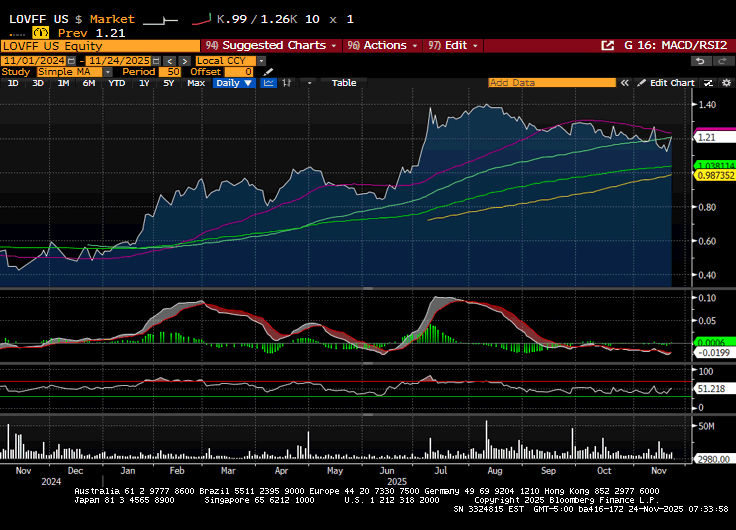

156% improvement in this years stock price.

$14.4m cash, flat QoQ.

$48m working capital.

2.4x current asset ratio.

Recorded positive retained earnings for the company for first time.

^ a rarity in Canadian cannabis

Converted $6.2m in convertible debt into equity at $1.80/share.

Closed sale of unutilized building/land for $5.5m.

^ applied to reducing term loan balance.

Completed amendment to credit agreement w/ BMO.

^ upsizing capex facility by $10m to fund post-processing expansion at Valleyfield.

One of the cleanest balance sheets in Canadian cannabis.

Ample CFs to service growth.

No near term maturities until Dec ‘27.

M/share continues to grow faster than peers.

^ driven by low cost structure / efficiencies unlocked w/ scale.

31% share growth nationally YoY.

53% share growth in home province of QC.

13.5% m/share of QC today.

#1 infused pre-roll in QC.

^ own 70% of QC infused pre-roll m/share.

#1 nationwide share of mass premium flower.

#1 nationwide share of premium live resin vape.

#1 nationwide share of CBD flower.

#1 nationwide share of hash rosin.

Leadership of premium vape category strong indicator when QC launches Vapes.

Approved for 5 of 25 SKUs of QC vape launch.

^ significant opportunity to expand leadership in home province.

Stand out against peers.

Ahieved highest ever national sales figure of $20.8m in August ‘25.

41% gain in YoY sales.

^ delivering more than 5x national industry growth.

Achieved monthly sales in Oct of $21.3m, breaking monthly sales record

Beginning post-processing expansion at Cannara.

Will turn online remaining rooms in FY’27 through FY’30.

^ increasing capacity by 50% to 100,000kg/year.

Remaining rooms at Valleyfield fully built out.

^ require only minor capex like lighting/tables.

Each room costs $1m to bring online.

^ will generate over $11m in annual revenue.

^ one of the most significant ROI opps of any canna company.

FY’25 another record breaking year.

Another proof point of investment thesis.

Delivered YoY growth across almost every metric.

^ despite constrained capacity

Cannara winning by choice,

Others in Canada losing share.

^ failing to build brands, failing to profit.

Expecting same pressures to continue internationally as domestic markets establish.

Designed for sustained, profitable growth.

This weeks launch of vape category in QC another chance to build leadership.

41-42% GM this quarter, well within target of above 40%.

Will continue to see margin efficiencies from increased yields from new genetics.

^ as well as new rooms

Some margin improvements from post-processing facility being built at Valleyfield.

^ moving post-processing there.

Harvested already from 1 of the 2 new rooms.

^ next room is harvesting soon.

^ ll 12 zones are active.

Quality, consistency, and price are driving forces in cannabis.

^ domestic or internationally.

Still focused on Canada.

Looking at international markets for foothold opportunities.

Main focus for Canada over next 3-4 years is Canada.

Valleyfield facility is underappreciated.

1m sq ft, purpose built, best in class worldwide.

^ all under one roof.

^ not many operators have that scalability and quality.

Over $250m spent in Cannara facility.

^ carried on balance sheet at $27m (purchase cost). 👀

Would be over $350m probably to replicate the build today. 👀

In order to open more rooms, sales need to be there.

^ uld be part of a retail chain, or more opps to expand share organically.

Confident w/ organic growth in QC + Canada.

^ could achieve fully open, all 24 rooms at Valleyfield fully operational.

13% market share in QC overall,

70% share of QC infused pre-roll category from 3-4 outperforming SKUs.

^ see bw10-70% share opportunity for Cannara in QC vape launch.

QC consumers are loyal, like the same brands/products.

^ like to change, but more often sticking w/ the same products.

Will know in first 3 months how successful the QC vape launch is.

Focused on selling out inventory within targeted 6 month period.

Looking at AI to facilitate progress.

^ if certain genetics yield, the data informs room, building mgmt, climate control, etc. ^ put it in a big AI layer to query it / improve yield / be more efficient.

Hired a team to build the AI stack.

^ looked at open source models already out there.

^ building a model for agriculture.

Cannara only represents 3% of points of distribution.

^ If take all SKUs across all stores/SKUs available,

Had 2 sales people in Canada over the last year.

^ starting last year investing more in sales/marketing team.

^ 1 individual in BC, 2 in AB, 3-4 in ON.

Orchid CBD brand represents 2-3% of revenue.

Investment strategies is the $10m capex at valleyfield post-processing facility.

^ then the opening of next 12 rooms over next 3-4 years.

^ then paying off debt.

Large debtor converting at $1.80/share.

^ when Cannara was trading around $1.70.

^ strong vote of confidence.

M&A opportunities.

^ strategies able to implement.

^ looking for the right one.

^ making sure have cash reserve to deploy for those moments.

Share buybacks and dividends also a forward opportunity.

Focused on innovation, phenohunting, R&D.

Invested years and millions of dollars into phenohunting for genetics.

Get many calls for acquisitions / bail outs.

^ not looking for anything right now.

^ still have 12 rooms to open / room to grow.

^ unless it is a very very attractive deal with high ROI.

Focused on building the business internally.

Most deals across desk over the last 12 months didn’t excite management

No current plans for further dilution.

^ only have $10m Valleyfield post-processing spend.

^ then the remaining 9 rooms left to turn online at Valleyfield..

^ 3 rooms activation at Valleyfield is part of the $10m post-processing spend.

Need post-processing expansion to turn online the remaining 12 rooms.

Rooms will begin generating revenue in FY’27.

^ can generate $10-11m+ from each room on only $1m approx. capex ea.

Edible 10mg limit is an issue.

^ edibles in illicit market are well above 10mg.

^ when rules change, will be an opportunity.

Aversion to INTL strategy hasn’t changed.

Were approached by a few brokers who do business in Germany.

^ to bring some Cannara brands to Germany.

Until Zohar gets real PO w/ real numbers that make sense, the answer is no.

Not looking ourselves at getting a foothold in international markets.

^ a lot of potential remaining in Canada

Goal in international is to understand the direction.

^ not going to invest into expanding into Germany.

^ will only represent a small % of revenue going forward.

^ could test the market to understand beyond 3-4 years.

^^ after Canada expansion is fully complete

International needs to make financial sense.

Cannara a great supplier.

^ 100% scorecard for SQDC and other provincial boards.

Don’t want to branch int’l bc taking focus away from provincial clients could impact.

^ want to maintain scorecards.

Phenohunt program 250-300 genetics per quarter.

^ hoping to pull 1-2 genetics from each search.

^ checklist for new strains are harder and harder

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has a position in / advises Cannara Biotech and nothing contained herein should be considered advice.