Flower Power

Rubicon Organics is leading by example.

We’ve worked with—and been huge fans of—Rubicon Organics for a few years now. Purveyers of some of the finest craft cannabis in Canada, this female-laden executive management team has been making moves and taking names.

After our visit to British Columbia last Fall, we had a sense of their lofty aspirations but we were less clear on how they would achieve them. They took a strong stride in that regard a few weeks ago, and presented today at Ventum with an investor update.

Call Notes

ROMJ recently launched first ever vape product.

^ received key certifications required for international exports.

Acquired new cultivation facility.

ROMJ offers a compelling valuation upside, regardless of industry.

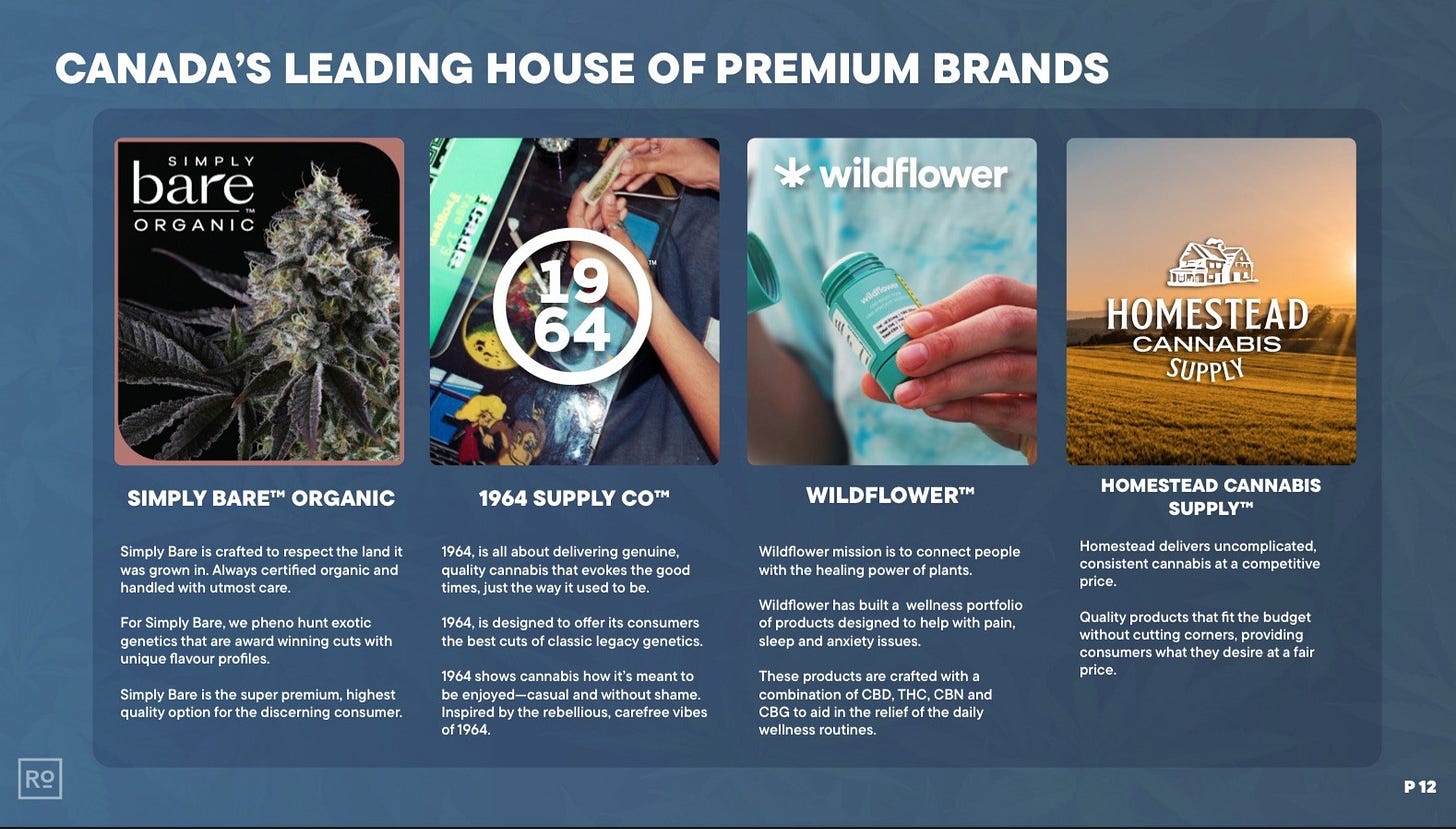

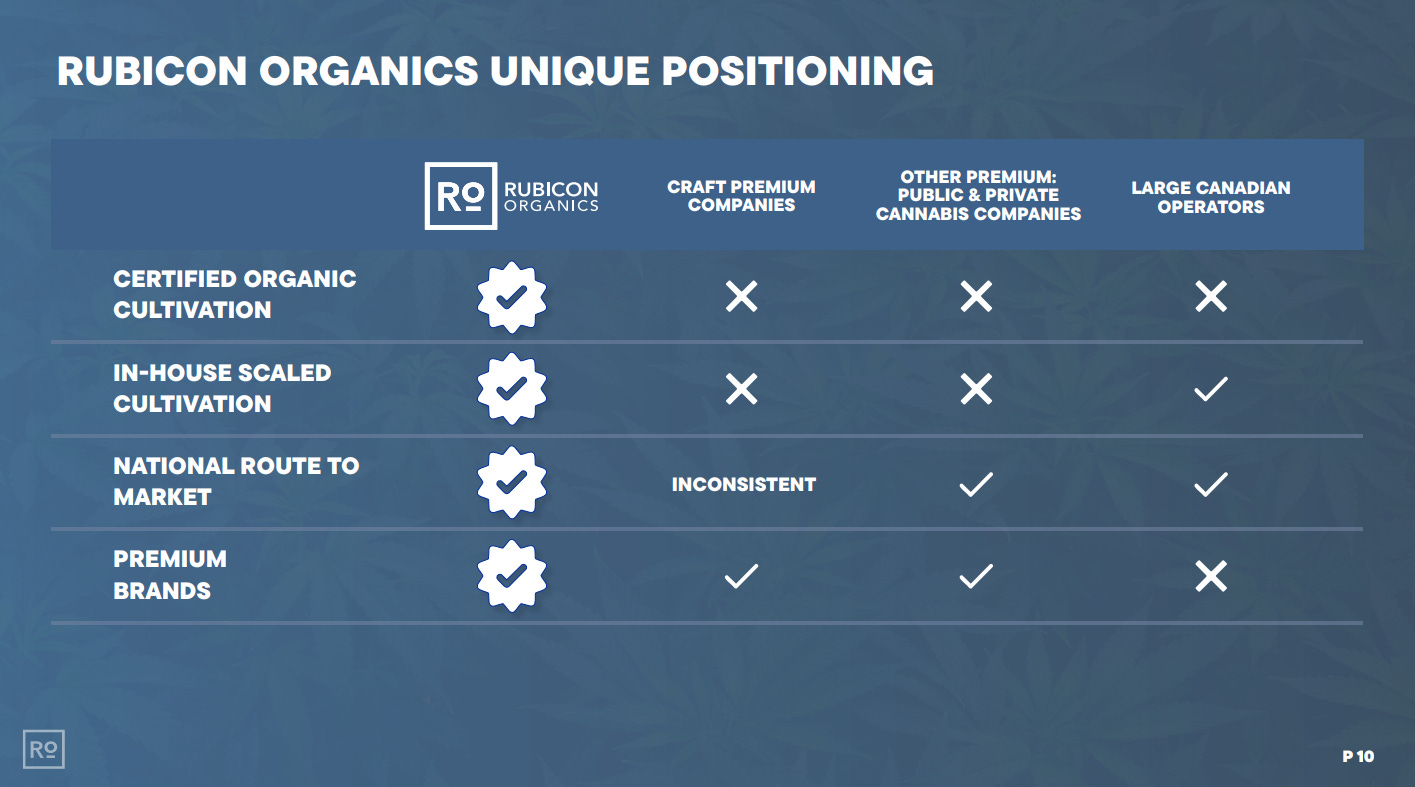

Today the largest scaled organic cannabis company in the world.

Leader in premium/super-premium.

Proven growth, track record shows know how to grow/scale business.

Significant expansion increases capacity by over 40% for ROMJ at-capacity brands.

Built strong brands / customer relationships.

Over 6% m/share in premium segment.

Focused on quality.

Essential when competing in premium/super-premium categories.

Team w/ a long history on legacy + competitive CPG industries.

Focused on competing where can win/outcompete.

^ instead of trying to be everything to everyone.

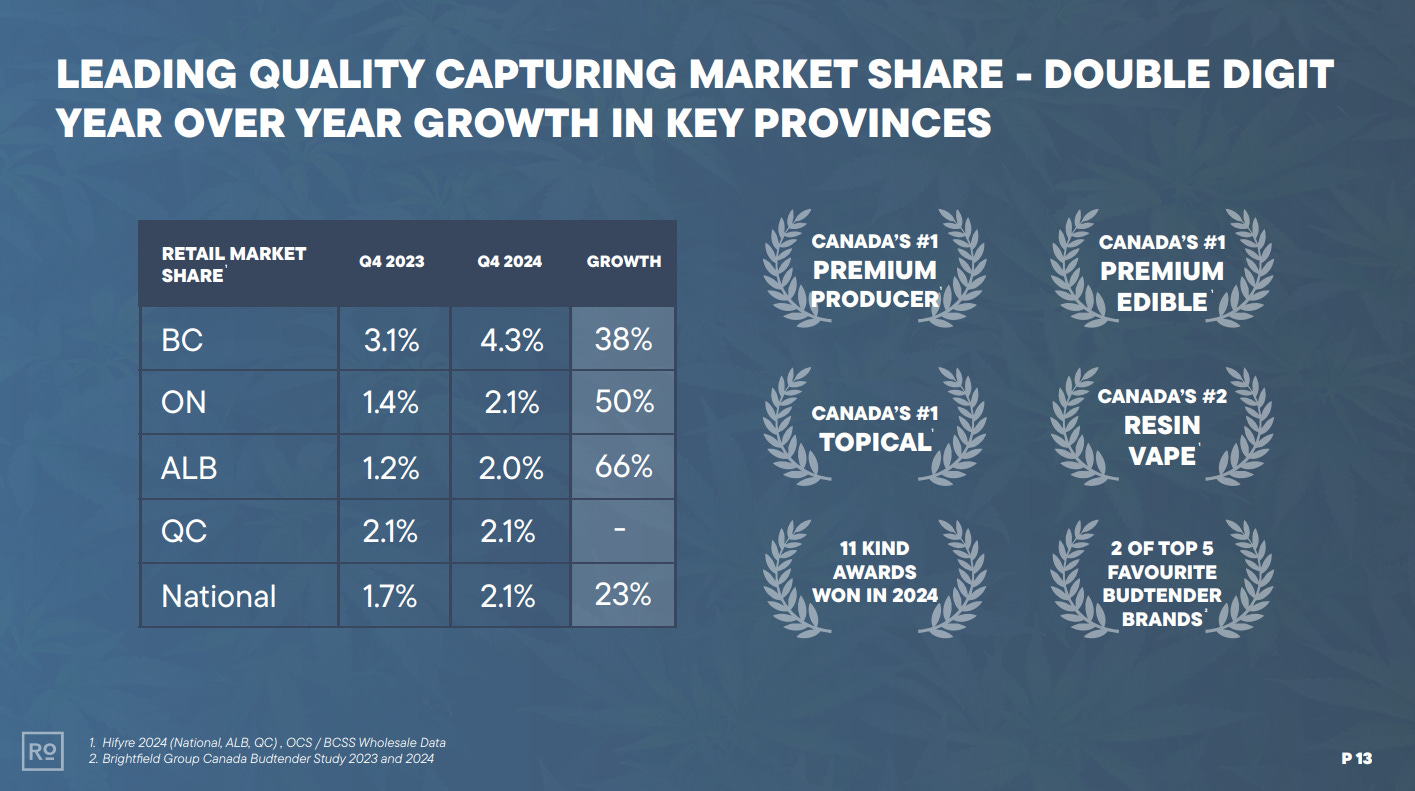

Cleaned house at KIND Awards (CDN Oscars for cannabis).

^ won brand of the year, vape of the year, flower of the year.

^ 11 total awards (!!)

Launched first ever live rosin edibles in CDN edibles market.

^ quickly capturing 30% share of premium edibles market.

Launched vapes in May to over 55% distribution, very quick expansion / roll-out.

Driven by leading brand strength.

Canada is 16-17% vape share, near 30% in US.

^ growth to come in this segment.

Quebec to come online in ’25.

Believe Vape can contribute in ’25 over 20% growth vs. ’23 revenues.

Consumers cant see whats inside the package, losing trust in brands.

ROMJ consistency / quality, evident in recent product launches.

Not winning first try opportunity, but winning repeat purchases.

Premium vape is only as good as flower inputs.

Vapes use ROMJ best-selling strains.

Canada’s #1 wellness brand w/ approx.

30% share in Wildflower brand.

Less SKUs than competitors and higher priced.

Higher quality topical products allowing strong ability to compete.

Building foundational strength over the last few years.

Canadian market already anticipating the long anticipated shake out.

Competitors moving internationally where profit/success is easier to achieve.

Initially Canada was marked by inconsistency, lower quality products.

Many consumers left the market for legacy market.

Now seeing trends emerge in product quality.

^ still a large gap in premium segment

^ a lot of inconsistency w/ products for consumer.

Provincial regulators making it harder to get on shelf.

Now switching to consistent, high-volume brands.

Now is the time where brands on shelf over the next 30 years are being built.

Canada went through hype curve.

Now witnessing a resurgence of winners as market matures.

Believe cannabis curve will be steeper/more sustainable.

Already seeing wholesale prices increase, driven by a tight supply market.

Some operators even increasing price on products.

Expect large-scale international demand growth.

Canada’s market still in early stages.

Still 30-40% of buyers are purchasing from legacy market.

New consumers entering the market will probably purchase legal cannabis.

Quebec allowing vape products will also help legal market.

Seeing international demand, significant supply shortage.

^ will take time for other countries to get online.

Well positioned to take advantage of this in ROMJ premium focus / competency.

Canada adding to GDP, not impacted by trade wars impacting other industries.

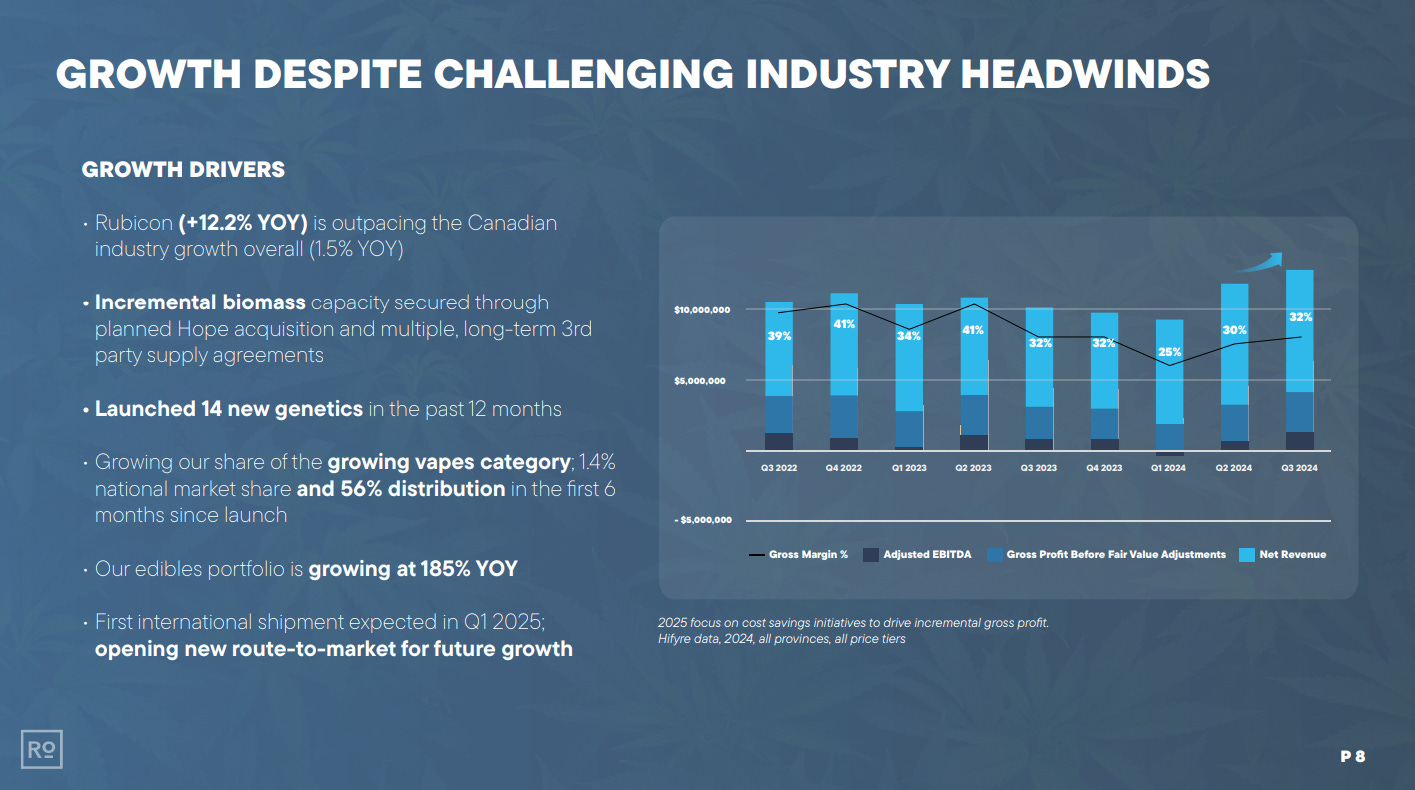

Outpacing industry growth (12.2% YoY vs. 1.5% for Canada).

Increasing biomass by over 40% w/ recent acquisition.

Launched 14 new genetics in the past 12 months.

Growing share in vapes.

^ 1.4% national m/share and 56% distribution within first 6mo of launch.

Edibles portfolio grew 185% YoY.

First international shipment expected in Q125.

Many strong product launches, several leading flower SKUs are recent launches.

125,000 sq ft in Delta BC.

Already producing some of Canada’s best premium cannabis.

Only scaled organic cultivator in the country.

Announced acquisition in Hope BC to bring addtl 41% capacity for only $4.5m price.

Incredible/strategic purchase, would cost significantly more to build that today.

Will own all real estate, allows considerable optionality to grow / strengthen B/S.

Post acquisition at 15,500kg (up from 11,000kg).

First harvests in ’25.

Former owners noted capacity of Hope facility at 6,900kg.

ROMJ is quoting 4,500kg.

^ under promise and over deliver.

New acquisition allows further optionality within Canada + international markets.

ROMJ is satisfied/committed to domestic business.

Not going to suffer there to focus on intl market.

Many companies in Canada failing to maintain shelf space / pivoting into intl markets.

Taking products off CDN shelves.

Going forward only strong, consistent brands will remain on CDN shelves.

CDN regulators moving to more consistent, KPI-based purchasing strategies.

Simply Bare / 1964 have ranked in top 5 brands by budtenders consistently.

Margin hit in ’24 from implementing 1-time ERP program + associated costs.

Constantly innovating to be best-to-market.

First-to-market w/ Live Rosin edibles.

Hold 2.1% national market share in Canada (up 1.7% YoY).

Hold 4.3% share of BC (up 3.1% YoY).

Hold 2.1% share of ON (up 1.4% YoY).

Hold 2% share of AB (up 1.2% YoY).

Canada’s #1 premium producer.

Canada’s #1 premium edible.

Canada’s #1 topical.

Canada’s #2 resin vape.

11 KIND awards won in ’24. 2 of top 5 favorite budtender brands.

Secured $10m highly competitive debt facility at 6.75% coupon.

Hope acquisition a strong indicator of ROMJ strength.

Looked at many assets before landing on that one.

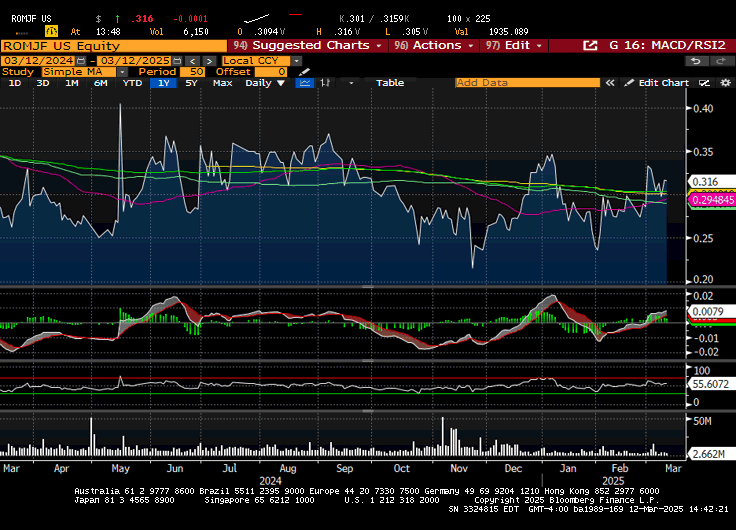

Valuation is extremely low relative to business + trajectory.

Believe were very undervalued before acquisition.

Now believe there is an even larger valuation gap.

Brands are being built today.

Owning supply is key to supplying domestic + international demand.

Plan to improve GMs as scale/ efforts around efficiency reach the bottom line.

International expansion plan will be similar crawl-walk-win strategy

^ ROMJ already executed in flower, then edibles, then vapes.

Believe ROMJ premium brands will be able to achieve strong valuation multiples.

^ similar to leading premium brands in other industries.

Unmet demand for 1964 + Simply Bare in Canada.

Will be looking to send some supply into international markets.

^ will speak more to that within 6 months.

Want to win at home in Canada, a protected market.

International markets not protected for CDN operators.

Have shown that there is a market for premium / super-premium in Canada.

Will drive internationally with 1 team.

^ TBD, don’t want to make assumptions.

People thinking internationally that 1 large nug = premium, which is not the case.

Room for sophistication around genetics, THC%, terpene%, experience / flavor.

Want to have more capacity in a market that is showing a shortage of supply.

Strategy to announce when locked / loaded and ready to deliver.

Underpromise, overdeliver.

Followed this strategy with edibles + vape.

^ hint it first, but only executing / delivering on strategies when confident ROMJ is going to succeed.

Genetics is one of the largest, more important, underviewed narratives in the market.

ROMJ a leading genetic strategy, many strains in process Margaret is excited about.

“Premium doesn’t just mean beautiful weed. Premium takes care of their own, premium doesn’t take shots at competitors, premium doesn’t complain or make excuses and premium pays taxes.”

Rubicon Organics CEO Margaret Brodie

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has a position in/ advises Rubicon Organics and nothing contained herein should be considered advice.