1-800-GET-ME-OUT!

A cadre of cannabis investors capitulate

I had a buddy once; gruff fella who was sharp as a tack. A bond whiz, he was among the first to identify the level III assets that triggered the 2008 financial crisis; superb fam, too. I miss my friend, may he rest in peace, who once introduced me to a saying:

1-800-GET-ME-OUT!

I thought of him often the past few weeks as the U.S cannabis sector unraveled with indiscriminate selling and forced liquidation. Rumors ran rampant that analyst A got fired and management puked all their MSOs; trader Y got the tap on the shoulder and the CIO is ‘shuffling the deck.’ This person, that person, every person, all at once…

…but really, it doesn’t matter who’s selling, it only matters why and more importantly when they finish, both of which are unknowable; so we rely on things like models and multiples and maybe a little wine to see us through such sullen stretches.

We know some of the why, right? There’s the continued custodian conundrum as just last week Vanguard disallowed purchases of U.S plant-touching operators, joining JP Morgan in a lengthy list of banks that have contributed to this longstanding F*ckery.

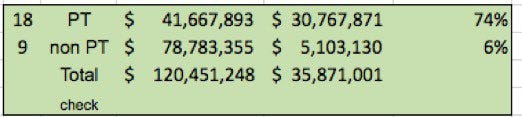

The resulting illiquidity maybe best reflected by the percentage of daily volume driven by the algos: 74% of US plant-touching volume was ETF-related on a random session last week compared to 6% for non-plant touching companies listed on US exchanges. This has increasingly become the norm.

[we know that why, too; institutions can’t touch these names until the AML/ FinCEN guidance updates, which will happen when SAFE finally passes but hold that thought]

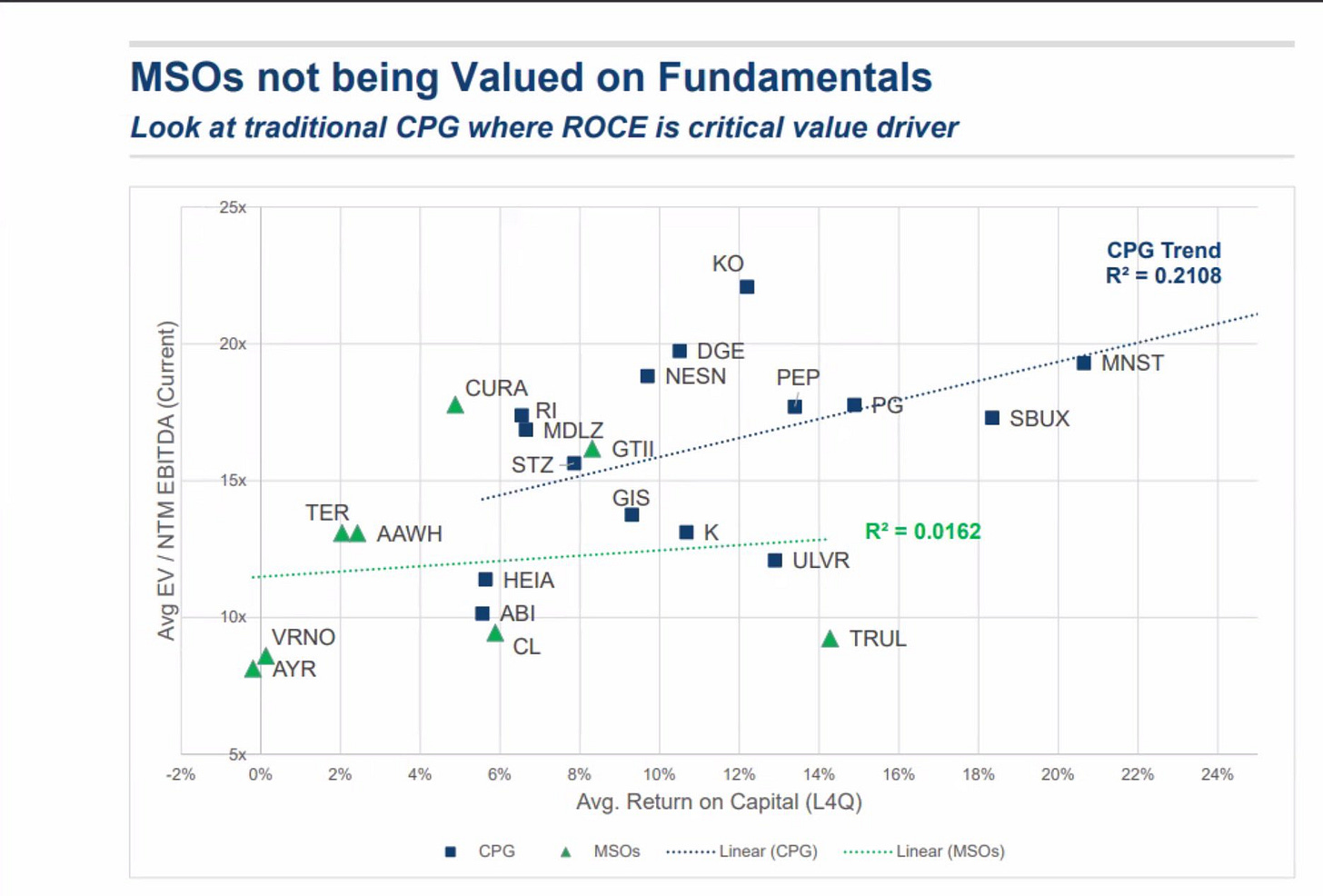

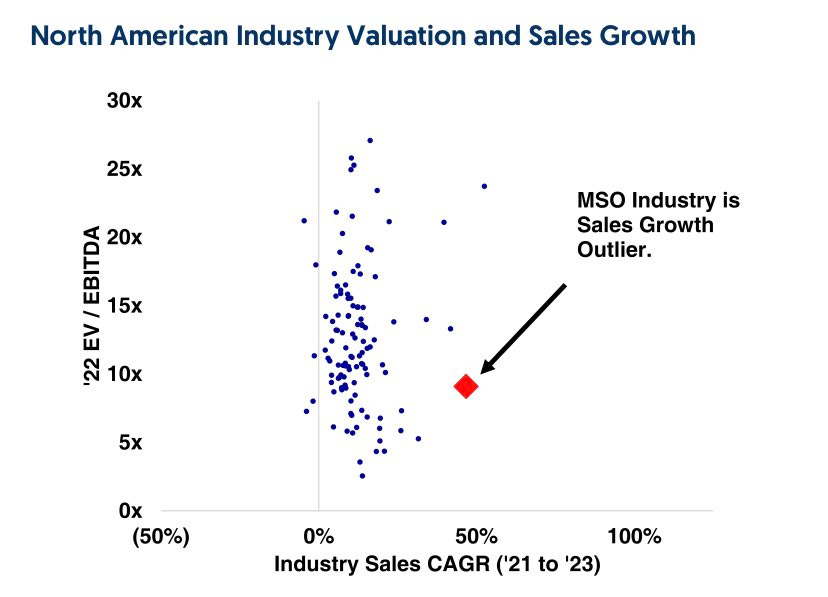

Algos designed to arb these illiquid stocks against the ETF have become increasingly egregious / pernicious; and algos don’t know math, only levels. The resulting chasm bw fundamentals and stocks is difficult to put into words so perhaps a picture…

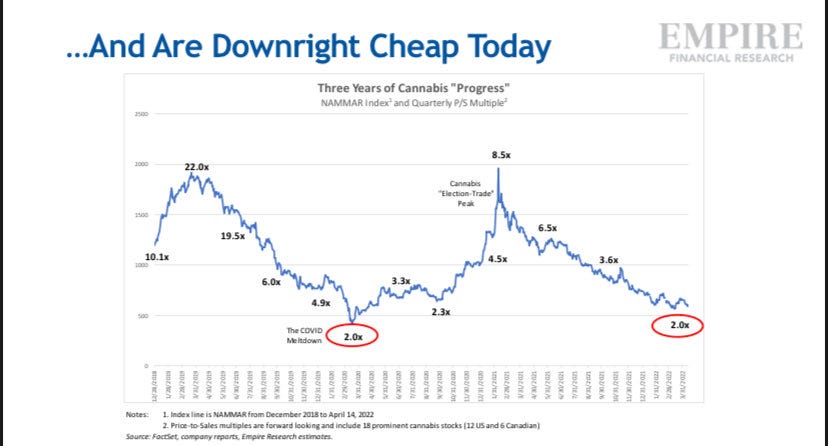

…will better illuminate what we’re trying to share: U.S cannabis stocks are as cheap as they’ve ever been and since they were last this cheap, the thesis has been de-risked w tristate adoption and the transformation of the eastern seaboard, a secular shift that’ll usher in an exploding TAM / organic growth regardless of what happens / when in DC.

But it’s bigger than cannabis! They’re slaughtering growth stocks w reckless abandon while hitting non-durables because in case you haven’t heard the consumer is DEAD…

…and there’s nowhere to run or hide, especially when 96% of your cap table are retail investors, many of whom were torched in meme stocks / fad-funds over the last year.

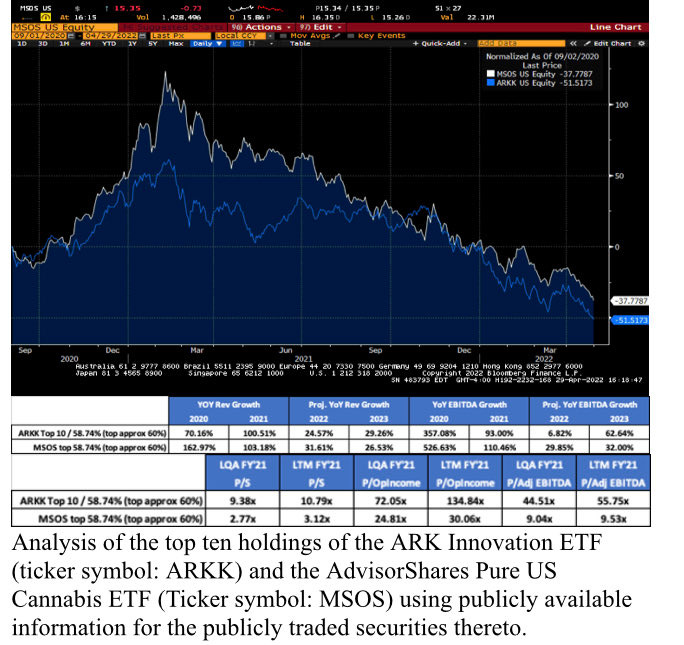

One of the more curious correlations we’ve come across is when comparing $ARKK to $MSOS. The charts are almost identical since $MSOS launched but check the math if you like numbers and stuff. It tastes great and it’s less filling.

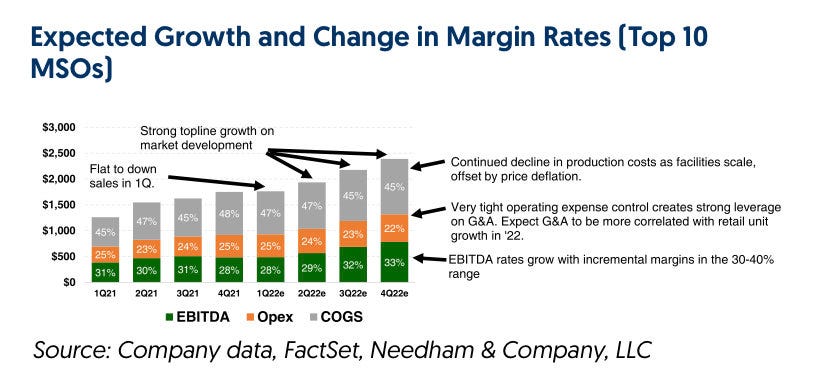

We also know Q122 numbers could harsh our mellow just like Q421 numbers did; post-COVID normalization + tristate delays = tough comps for an industry trying to put it’s best foot forward, all while being mocked by the right and villainized by the left…

…but one could argue that with NJ launched, CT on deck, NY tracking year-end (even if Q123) and Croptober back in the barn until the autumn wind that’s a Raider arrives, there’s a pretty solid shot that Q122 was the through through a fundamental lens.

And it’s not like we don’t know that the space is re-rating in wait…

So the question, I suppose, is: why for the love of God would anyone put money in a space as speculative as the emerging U.S cannabis industry if at best the broader tape is gonna give back it’s stimulus-driven gains and at worst…

…it gets thornier through a socioeconomic lens. We reckon however that if we go there— a further devolution of social mood and the unwinding of globalization—there will be a renewed focus on industries with a domestic supply chain.

[while U.S cannabis isn’t fully insulated (lighting, packaging, vape components come from overseas), nor is it immune from inflationary shocks (fertilizer), it’s homegrown economic growth / employment engine should benefit in that new world order]

Taking a step back, the BI Global Cannabis Index, which lost 92% from January 2018 through March 2020, has endured another 80% drawdown. Per Meb Faber, the average three-year nominal return when buying a sector down 80% is 172% (at 90%, it is 240%).

[Apple investors had to stomach two 82% drawdowns, one from 1991-1997 and another 2000-2003; Amazon had a 94% drawdown, Microsoft 70%; Google 65%. My intent isn’t to cherry pick, just demonstrate great investments require resolve and belief in thesis]

Given how venomous the sentiment is, historically oversold conditions, several fresh technical signals (DeMark, Fibo, bullish engulfing on volume) and oh yeah, this math…

…there is indeed a light at the end of the tunnel that isn’t affixed to the front of a train.

We just gotta go through it to get to it.

/positions

/advisor $MSOS

Note: We deep-dive into the cannabis space @SuperFollows on Twitter each day, if you like that sort of thing.