Daily Recap

A GOP-led House committee unveiled a spending bill that contains provisions that hemp stakeholders say would devastate the industry, prohibiting most consumable cannabinoids that were federally legalized during the first Trump administration.

The 138-page bill contains a section that would redefine hemp under federal statute in a way that would prohibit cannabis products containing any “quantifiable” amount of THC or “any other cannabinoids that have similar effects (or are marketed to have similar effects) on humans or animals” as THC.

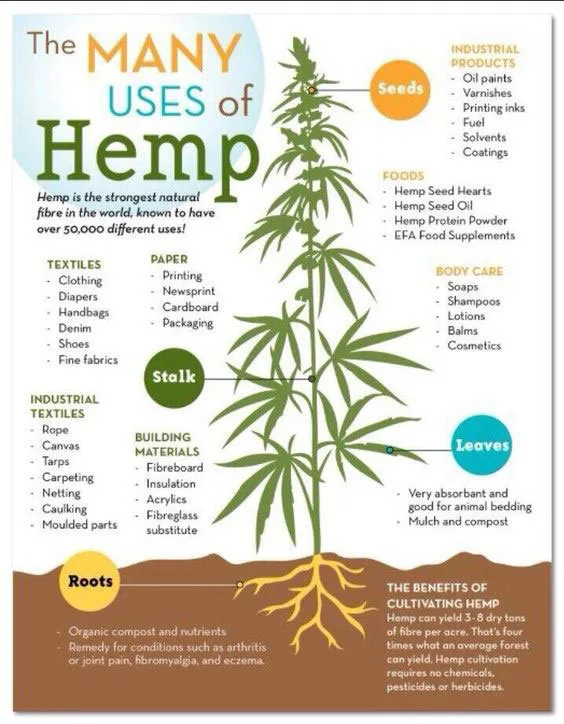

As discussed last week, THC bans would not kill hemp farmers because hemp is the most agile crop in the world and has a litany of non-intoxicating use cases—and safe, tested, regulated THC is available through state-legal cannabis operators, as intended.

The Texas Hedge

The governor of Texas won’t say whether he plans to sign or veto a bill to outlaw all consumable hemp-derived cannabinoid products containing any detectable THC that was sent to his desk last week.

“SB 3 is one of literally more than a thousand bills on my desk—all of which need my careful consideration and evaluation—and I will give all of those pieces of legislation the consideration and time that they deserve.” Gov. Greg Abbott (R)

Paging Dwight Manfredi

The governor of Pennsylvania remains “hopeful” that lawmakers will deliver a cannabis legalization bill to his desk by a budget deadline at the end of this month and urged the GOP-controlled Senate to ‘put their ideas on the table.”

Shapiro said the administration has had “good conversations that have been ongoing and he feels that “folks understand the importance of finally regulating and taxing the issue and we’re going to continue to work through it the next few weeks.”

After approving Ukraine’s initial medical cannabis products earlier this year, national officials announced this week that they’ve granted the first-ever license allowing for imports of cannabis into the country, which legalized medical marijuana last year largely in response to the ongoing war with Russia.

“On June 2, 2025, the State Medical Service issued the first permit for the right to import medical cannabis substances into the territory of Ukraine. The permit was registered in Ukraine and entered into the State Register of Medicinal Products.”

Stocks & Stuff

It was a quiet session on Wall Street as equities were mixed and treasury yields fell as traders wagered on a September rate cut. Canna continued to strugle on light volume, with a slightly better tone from our neighbors to the north.

Below, we’ll top-line today, weigh near-term catalysts, highlight a stealth Canadian winner, see how much teeth the Florida hemp regs will have (and why it might help state-legal operators), and explore how companies are managing receivables risk.

All that and more, just scroll down.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ ETF Notional: $15M

Top Stories

Texas Governor Refuses to Say Whether He’ll Sign or Veto Hemp Ban Bill Amid Intense Pushback

Ukraine Officials Approve Country’s First-Ever Permit to Import MMJ Products

Banks and businesses deserve clarity on the legal treatment of cannabis

NC launches canna task force to regulate THC and study pot legalization

THC Drinks Aren't the New Beer, They're Something Else, Says Tilray

Tracking low-level cannabis use wastes police time, former London chief says

Is the golden era of THCA flower coming to an end?

Industry Headlines

AlphaNooner with Mackenzie Peterson and Todd Harrison 📺

Cannara Biotech at the Rivemont MicroCap Cocktail Event 📺 🔦 👀

Pregame (written in real-time at 7:00 AM ET)

We hike to the hump to find broader markets giving the economy the benefit of the doubt (for now) as the broader market “V-bottom” vs. the April swoon remains intact.

There is fresh labor data this morning, which could help color the price action.

Our space? I couldn’t help but channel Fletcher Reade when I opened my eyes today..

…as we await the next catalyst, which will likely arrive in one of two ways: Pennsylvania getting it’s shit together and passing adult-use (we’ll know by the end of this month) and/ or Schedule III finally publishing in the Federal Register.

On the latter, we’ve been told this process is waiting on the DEA administrator to be sworn in and that’ll happen as soon as today. While we shouldn’t hold our breath this will be one of his first to-do’s, we’d be wise to remember his own words:

“If confirmed, it’ll be one of my first priorities when I arrived at DEA to see where we are in the administrative process. I’m not familiar exactly where we are, but I know the process has been delayed numerous times—and it’s time to move forward.”

We’ll continue to keep our eyes peeled on the growth crew, even if some of them are the definition of illiquid, as we take a deep breath and ready for whatever comes next.

Either way, the Benzinga conference begins in four days, where the people, products—and seeing old friend—is always good for the soul.

Gas Station Weed

I asked an attorney pal if this provision in the Florida hemp regulations would prohibit intoxicating hemp flower.

His response:

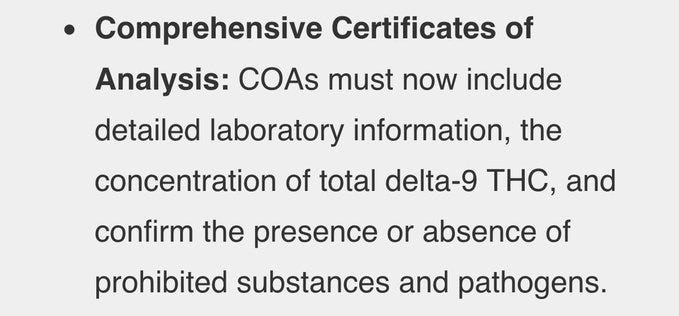

“FL hemp regs didn’t accurately reflect updates in the industry so now the definition of THC concentration (<0.3% on dry weight basis) includes all THC and isomers like THCa. So that rule should effectively kill “thca flower” which we both know is really unsmoked weed, and also ensures there’s an accurate COA for other form factors.”

Joe Rogan and Bill Murray hit the nail on the head 🎯

ATB on U.S. cannabis receivables

A Sale Isn’t A Sale Unless You Get Paid For It.

A theme that has recently emerged relates to Accounts Receivable (AR) risk, with certain MSOs deciding on a more strict criteria to wholesale only to creditworthy customers (and placing holds on certain accounts who have not been paying).

Although this decision amplified the pressures already seen on wholesale sales, we agree with the view that a sale isn’t a sale if you don’t get paid for it.

The chart shows MSOs' quarterly AR balance as a percent of net wholesale sales the past two years. We use net wholesale sales (vs. total sales) as the denominator bc we believe it better controls for sales mix.

Across the Tier 1s, the AR balance exiting Q125 represented 77.7% of net wholesale sales in the quarter, reflecting an increase of 2.5% q/q (3.2% y/y); among the Tier 2 companies that have reported earnings, AR represented 50.1% of net wholesale sales, reflecting an increase of 2.2% q/q (and 5.9% y/y).

Based on this metric, AR balances have increased in proportion to wholesale sales, which could indeed indicate that retailers are stretching payment to wholesalers.

Short-Term Pain For Long-Term Gain? Verano and Cresco specifically spoke to AR risk in the most recent quarter. Verano is working with wholesale customers on payment solutions, supporting a ~15% reduction of AR dollars since the high point in Q324.

Stems & Seeds

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.