In too VEEP

Kamala confuses Cannaland.

Daily Recap

Vice President Kamala Harris posted a video to social media on Friday that cited the Biden administration’s moves to reform federal marijuana laws in an effort to appeal to young voters. There’s just one problem: her specific claim that cannabis policies have already been “changed” is blatantly premature.

“We changed federal marijuana policy, because nobody should have to go to jail just for smoking weed,” - VP Kamala Harris

Tiger by the Tail

February marks the first anniversary of legal cannabis sales for adult, non-medical use in Missouri and the state averaged nearly $4 million in cannabis sales per day—which equates to around $1.3 billion in cannabis sales over the course of the year.

Quaker Ridge

Pennsylvania’s governor said he thinks state officials “don’t even have a choice anymore” on legalizing cannabis and feels that there is enough bipartisan momentum for lawmakers to leverage to get the job done.

“This really comes down to an issue now of competitiveness,” as the state is currently “losing out on 250 million bucks a year in revenue that could go to anything from economic development, education, you name it.” -PA Gov. Josh Shapiro (D)

Clearing Customs

Canopy Growth told investors it was planning to file its definitive proxy statement around February 13th for Canopy USA, setting up a shareholder vote for April 12th.

Once successful, the company expects to proceed with its anticipated acquisition of Jetty, Wana, and Acreage.

Through the removal of Section 280, we expect value appreciation across our US assets, which would see a significant financial boost through reduced corporate income taxes, improved cash flows, and strengthened balance sheets.

Stocks Stuffed

U.S. cannabis stocks continued their recent retreat as investors’ Great Expectations remain unmet despite what appeared to be a victory lap by the Administration. U.S. cannabis ETF MSOS fell 8% to start the week but is still clinging to 26% YTD gains.

Below, we’ll talk through today’s price action, game theory the VEEP video, look at a few levels, chat on potential price objectives, channel check the math, refresh comps and otherwise just try to keep it real on our way from here to there.

All that and more, just scroll down.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ PT Notional: $176M ($99M)

Top Stories

How Marijuana Could Become a Political Issue in 2024

Missouri sells $1.3B in marijuana during first recreational year

Colorado Regulators Move on New Framework Around Intoxicating Cannabinoids

Marijuana brands, ex-employees say MedMen owes them thousands

Woman who felt like giving up on life has been completely changed by cannabis

Thailand’s ‘wild East’ cannabis industry braces for regulatory earthquake

Michigan's cannabis industry turns 5 this year: What to expect

Industry Headlines

Canopy Growth preps for Canopy USA filing

Reading the Tea Cannabis Leaves

We powered up a fresh five-session set shaking off our Super Bowl hangovers and trying to make sense of that late-Friday Veep video.

We’re assuming one of three things happened:

The administration is gaslighting the snot out of their constituency and hoping they’re too dumb to realize the inherent conflicts between what she said on that video and what’s been done to date.

A sloppy and disorganized Democratic party jumped the gun by releasing the video before the announcement; embarrassing but somewhat on brand.

The decision was lined up for late last week but the it got pushed after the leak + someone forgot to tell the VEEP’s office to delay the video, too.

While we can’t assign a zero percent probability to #1, we can assume an extremely low likelihood given all the chatter + 252 pages of documented proof.

I haven’t the slightest idea if it’s #2 or #3 but assuming either is true, it would likely be more of a positive than a negative with the variable of timing still twisting in the wind.

We remain of the view that SIII + Garland will find their way into the public domain with the latter timed as a function of the former, and hopefully we’ll get SAFER too.

Even if we leave the last leg of that trifecta on the backburner for obvious reasons, the DEA decision, either via proposed or final rule, and the Garland Memo, are either on their way or (per the VP of the United States) already done.

Cliff Dive Notes

It was thin and sloppy out out of today’s gate as the post-ripper probe continued and U.S canna worked off short-term overbought conditions. By midmorning, MSOS was down 4% and mood, as it does in this space, followed price.

Volumes picked up in the early afternoon ($85M/$40M) as Green Thumb tried to lead by example, positing a 3% gain while MSOS was still off a deuce (2%). We shared:

tryin' keep loose grips as a potential future bull flag take shape. I have more confidence in the next $4 vs. the next .40 but I suppose we'll see.

At 3:13PM, with MSOS -7% at $8.93, I shared:

switchboard starting to light up again with the 'what'd I miss?' idk if we missed anything given we've discussed composition of volume (fast $ tourists), s-t overbought conditions + structural impediments (-> outsized vol); always possible the FL SC ruling or some other fundamental catalyst is out there but that would be news to us.

The space rallied almost 5% from there—only to give it back and then some. MSOS closed near the lows and below the Sept. 11 close ($9.13). It also breached the trend-channel that has been in place since mid-December, which is worthy of a mention.

Not the best look or feel but also just another step in what we knew was gonna be a hairy ride. With crypto hot again, it’s likely that some of the fast money tourists that piled into the space last week on the leak said, ‘fuck it, crypto is easier than this.’

February expiration is coming up on Friday as well, so there’s that.

Water Cooler Chatter

A fund manager who owns canna pinged me this morning to ask this question:

Out of curiosity, if we do get rescheduling news, where do you think MSOS goes? We've heard of new funds doing the work and likely entering once news official but curious where your head is at?

My response, which was decidedly guarded as I’m not a fan of price targets:

“MSOS was $15 on maybe SAFE Dec. ‘22 and SIII a much bigger event (+ not mutually exclusive); biggest Q for me is composition of volume (fast $) bc best case it’ll take a few months for sticky money to custody.

Obvious variables include: 1. where we are when the news hits, 2. whether we get the Memo or other elements that reveal the forward path, and 3. what’s going on in the broader markets/ with risk appetites when that news finally drops.

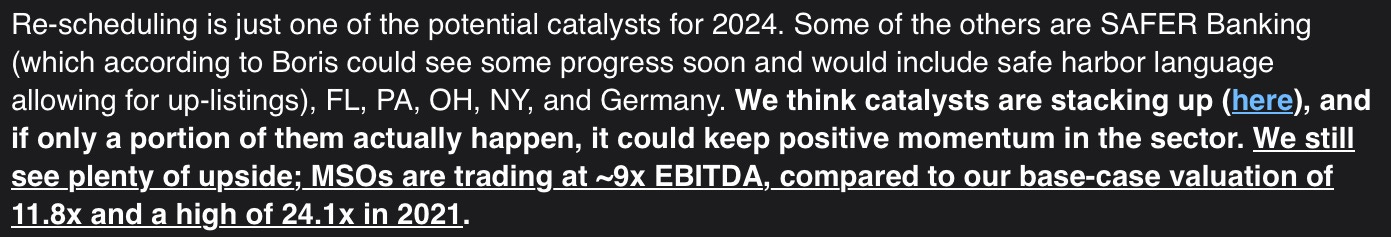

ATB on U.S. Cannabis:

U.S. Canna Comps (CB1 Capital):

Stems & Seeds

Wonder drug: is the UK ready for the green rush of medicinal cannabis?

Richard Branson: Why cannabis regulation makes sense

Enjoy your night, stay safe and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.

Good headline day: standouts

In too VEEP (4 star rating system): ⭐️⭐️⭐️⭐️

Section headers:

Cliff Dive Notes: ⭐️⭐️⭐️⭐️+