Yesterday, we highlighted the earnings strength and momentum that continues to evolve at Quebec-based Cannara Biotech.

Cannara Bio Delivered Record Q2 Results as National Expansion Accelerates 👇

Cannara Biotech’s CFO Nicholas Sosiak—aka Niko Dank—was on TDR yesterday…

…and today, he hosted their earnings webcast to talk particulars and answer questions.

Below are some of those highlights:

One of the most cost efficient high-quality operations in the industry.

Leading large-scale producer in Canada.

4th largest in Canada by sq ft, 1st largest in Quebec.

7th largest by sales in Canada, 3rd largest in Quebec.

33,500kg current run rate.

39,500kg online in May.

50,000kg target for FY’26.

Fully scaled opportunity to scale to 100,00kg.

Vertically integrated, full control over supply chain.

Important in today’s Canadian market.

Almost every operation evolved beyond the standard cannabis company.

Real cannabis operators.

Real passion for the plant.

Constantly evolving techniques.

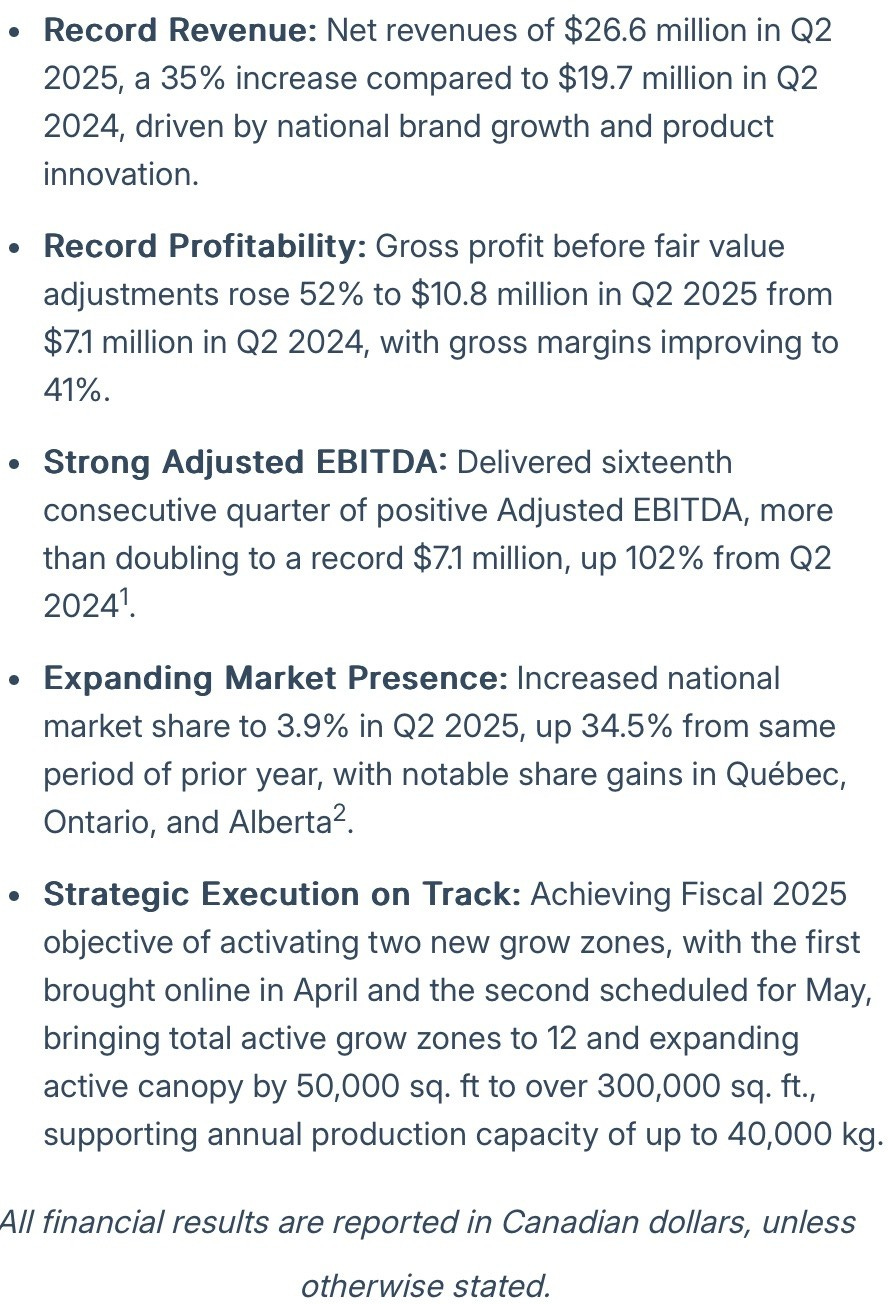

FQ225 represented strongest quarter in Cannara’s history.

Record revenue, record GM + GP, record OPIncome, record aEBITDA.

$26.6m net revs, up 6% QoQ, up 35% YoY.

$10.8m GP, up 11% QoQ, returning to previous record high of 41% GM.

$7.1m aEBITDA, up 18% QoQ, up over 100% YoY growth.

27% aEBITDA margin, up 280bps QoQ and up almost 900bps YoY.

16th consecutive quarter of aEBITDA+, net income+ for 4 quarters.

aEBITDA+ since ’21, opcf+ since ’22, FCF+ since ’23.

Premium quality cannabis at scale.

Disruptive pricing allowing a wider audience.

Genetic focus.

Flavorful profiles.

Highest level post processing techniques.

Significant investment in in-house phenohunting platform.

Partnership w/ 50 time genetics award winner, Exotix Genetix.

Maintain one of the cleanest balance sheets in Canadian cannabis.

No significant near-term maturities until Dec ’27.

Expanding cultivation capacity by 20%, or 6,000kg, for only $1m outlay.

Ability to expand for minimal capex is a significant competitive advantage.

Represents one of the highest ROI opps for any canna company today.

M/share expansion outpaced peers.

12.8% m/share in QC for the quarter, up to 13.4% for March.

Gained 60bps into the month while #2 in QC lost 80bps.

Almost #2 in QC now.

QC performance is indicative of ability to capture share in the rest of Canada.

QC has no data deals and very limited sales/marketing allowed.

Only top 7 company to gain share in Canada this quarter.

A leading operator across many product categories.

Tribal flower priced at only $30/8th in Ontario

^ comparable w/ product offerings up to $50/8th.

Tribal #1 share of premium 3.5g flower.

Growing share by over 25% over last 16mo.

Now over 18% share of the category.

22%+ share of premium vape category.

^ sales up over 75% over last 12mo.

Good indication for Cannara to win, even when priced at the top of the category.

Able to capture share through quality, not just through price.

From Dec ’24 to April ’25, grew infused share by 18% to 10% share of the category.

Now #2 nationwide share.

#1 lost 2% share during the period.

#1 also $10/unit higher priced, while Cannara still gaining share.

Facilities are best in class, situated in Quebec.

Over 1.6m square feet total.

Farnham is 625k sq ft.

Valleyfield is 1.1m sq ft.

Purpose-built hybrid indoor.

One of the largest facilities in the country, largest in QC.

24 growing rooms, each 25k sq ft each.

Each room redesigned to replicate indoor growing conditions.

Operate 10 rooms during the quarter, activated 2 more rooms post-quarter.

^ one in April, one in May.

2 rooms will add 6,000kg or almost 20% additional capacity.

Will be at just under 40,000kg post-expansion.

Valleyfield acquired in ’21 for just under $27m. 👀

Facility was built during overspending, gold rush days of Canadian legalization.

Facility was built for over $250m.

No current view of demand ceiling.

Access to exclusive genetic bank to further drive Canadian demand.

Seeing strengthening wholesale market, where Cannara barely participates.

Seeing strength in international markets, where Cannara isn’t focused.

Growth opportunities strengthen Cannara’s strategy to expand internally.

^ seeing demand in the market for additional supply.

Key competitive advantage is ability to turn online rooms for minimal capex.

Rooms 11/12 activated in April/May, cost approx.

$1m in capex to activate.

Expect capital return period within first year of operations.

Facilities could generate $250-300m in revenues.

Quebec 2nd largest province with over 9m people.

Some of the lowest labor/utility costs in Canada.

Low electricity rates at $0.053/kw ($0.136 in Alberta).

Have a preferred electricity cost of $0.37/kw at Valleyfield.

Electricity/labor is 75% of cannabis COGS.

Able to flex this competitive advantage in the market.

Quebec has no data deals and very limited sales/marketing.

Quebec success is a derivative of product quality, not marketing / data deal spending.

Clean balance sheet, industry low interest rates.

FQ2 results promising, given the typical seasonality during the period.

See further room for improvement in gross margin line as expand into capacity.

Maintain strong cost controls, $6.1m OPEX, under 23% of revenue.

Reflects positively against prior quarter/year.

OPEX represented 24% and 31% of revenues, respectively.

Delivered record high aEBITDA of $7.1m, up over 100% YoY.

27% aEBITDA margin, 280bps improvement QoQ, almost 900bps improvement YoY.

16th consecutive quarter of aEBITDA+.

OPCF/FCF negative for the quarter, a rare quarter of negative.

^ prepaying tax obligations of $3.5m + $1.5m+ in advanced deposits on packaging.

Generated Net income of $3.3m, $0.04EPS.

In Feb, announced extension of $34m BMO credit facility ot December ’27.

Floating interest rate currently below 7%.

Also extended smaller $6m convertible debenture to ’28.

Guidance – Growth in revenue/aEBITDA on an annual basis.

OPCF+ and FCF+ for this FY.

Operators failing to efficiently operate in Canada, turning to international markets.

Cannara fully built their processes from ground up.

Not just another cannabis company.

Passionate cannabis advocates, boots-on-the-ground operators, disruptors.

World-class operations.

Financial performance speaks for itself.

^ 16 quarters of aEBITDA, industry leading margins, m/share up over 30% YoY.

Dominate key categories with leading brands.

Have ability to triple capacity through organic, high-ROI expansion opportunities.

Quebec cant conduct any sales/marketing activities.

Value proposition speaks highly to sales generating in Quebec.

Leading quality across every segment/category, and better priced than competitors.

Launching new genetics/products.

Launched Tribal Trifecta in Quebec this week, a very unique infused pre-roll.

Premium priced.

Triple infused, using flower, flower-specific live resin, and flower-specific diamonds.

Product is extremely hard to replicate, and no diamond-coated joints in Quebec.

Believe this product will really take traction as it hits the market.

Launching Meat Pie and Port O’leche.

Launching vapes into Quebec in November.

Brand new category.

Cannara already a leader of live resin vapes in the country.

^ bringing it to Quebec brings strong confidence into that category entrance.

Neon Sunshine and Bubble Up genetics were launched this year.

Takes over a year to get genetics to market.

Both strains showing fruits of labor.

Both catching up right under some of Cannara’s best selling strains.

^ now #2 and #3 in the product portfolio.

Launching Trifecta into BC and Ontario as well.

Fastest growing multi-pack infused pre-roll nationwide.

Took a ton of time to get this product right.

Priced $10 higher than #1 leader in the segment.

Showing strength of quality/brand, premium priced at highest price point.

^ able to still capture share at higher price points based on quality.

Not interested in increasing pricing to drive margin.

Can drive margin through other means, through yields, through genetics.

Cannara’s genetics roster has THC/flavors the market wants.

^ but most importantly have high yields.

Average yield now around 85 grams/plant.

Some plants growing over 100 grams/plant.

^ finding the right high-yielding genetics will impact margins.

As grow more, its on a fixed cost basis.

Costs $700k and 5 people to turn on 1 room.

^ can generate over 3,000kg from that room in one year.

Fixed costs staying the same, but generating stronger revenues on the same base.

If wanting to increase brand pricing, create a new brand and approach it that way.

Asset held for sale has potential interested parties.

Confident could see a transaction very soon.

If do sell the building, would use that cash to continue investing in the business.

Have 12 rooms to build out, next phase moving from 12 to 24 rooms requires a processing building ($7m spend).

Then have to buy lights for the next 12 rooms.

^ costs to turn online 1 room move to $1.2-1.5m.

Convertible debt is open ended.

^ make more investing that cash into the grow rooms than paying off debt.

When have excess cash flow, could deploy that into the highest interest rate debt.

Working every day on process improvement.

Building a fully vertically integrated cannabis company.

Processes all built / refined since day 1.

Continuously improving operations.

Trials to get more yields, reducing costs, efficiency implementations.

^ bought pre-roll automation machine during the quarter.

Improving inventory transport costs.

Investing in supply chain to streamline supply of packaging.

Saskatchewan/Manitoba market share down QoQ.

Got a new in-market partner for Saskatchewan during the quarter.

^ will bring in new additional revenues/distribution in the province.

In Manitoba, prioritizing products to the highest volume markets like QC ON AB BC.

Impacted overall share in that market.

Have to scale in QC ON AB BC, main markets, need to dominate there.

Full vertical integration allows Cannara to avoid any third party manufacturing.

Ensures consistency and quality across all Cannara products.

Only open cultivation rooms as increase demand / support for products.

Still #7 nationally in Canada.

Climbing ranks and increasing share QoQ.

Extremely diligent in planning, have sales forecasts in extreme detail.

Want to launch new genetics.

Have a roster of genetics w/o room to plant them.

^ need to open new rooms to service that.

Think vape will be 10% of sales in QC.

^ want to play meaningfully in that market, cant be out of stock.

That volume could increase significantly, need to be ready for that.

A lot of unknowns internationally.

Believe international businesses create a lot of risks right now.

Tariffs could be implemented.

All competitors going internationally.

Cannara sees the opportunity in Canada, need to stay focused / consistent.

As grow, may have some overages.

^ will use B2B / international markets to absorb any extra capacity.

When reach top 3 in CA, w ultimate goal being #1, will look international.

Will bring brands built / strengthened in Canada to international markets.

Paid taxes before the end of the month.

Usually pay this on time, this time paid it early.

Sales team very educated on products.

^ working to educate budtenders on product / forward launches.

Able to go into stores, look at limited Cannara SKUs on shelf, add further SKUs.

Strengthening overall relationship with those stores.

Continuing to pound the pavement, expanding retail engagement/ distribution.

Right now seeing early impact of market share increases.

Will build quarter over quarter as build out sales force.

Worked very hard on building Tribal 3.5g market share.

Proud of that category / premium mass market leadership in 3.5g category.

Evaluating 7/14g category under Tribal.

^ strongly believe there is a good place for Tribal in 3.5g.

Want to be a house of genetics under Tribal, want 20+ genetics.

Having 3.5g SKUs gives customers options for mixed genetics variety.

If targeted 7/14g in the future, would be multi-packs w/ multiple genetics.

For now, want to dominate the 3.5g market under Tribal; most accessible.

Nugz brand plays in 7/14g bags.

Seeing wholesale market on fire.

Prices have almost doubled since last year. 👀

Reason why this exists is because of international demand increasing

^ and most LPs in Canada closed down their production space.

Previously industry was oversupplied.

^ feel confident now saying that the industry is undersupplied.

A lot of cannabis going international.

^ causes pressure on Canadian offerings, increases prices.

^ makes it harder for people who don’t own their supply chain to generate profits.

Cannara can utilize wholesale market for extra cannabis in inventory.

Think wholesale avenue only begins building.

No capacity coming online in Canada and only increasing international demand.

Trifecta in Quebec is going to make waves.

Think Trifecta outside of Quebec is already making waves.

A super exciting product.

Not just 1 product, it’s a format for Tribal, with multiple genetics.

New Tribal genetic Port O’Leche is very exciting, a cherry, red wine, creamy gas notes.

New Nugz genetic Meat Pie is exciting as well.

Continuing to expand vape segments.

Expanding through Tribal and Nugz, all new genetics will get vapes.

Recently launched live resin all-in-one vape for Tribal brand in Ontario.

^ as well as cured resin all-in-one vape under Nugz brand.

Also looking at solventless vape under Nugz.

Working very hard on the process.

Need to find the right hardware, as solventless rosin reacts differently than live resin.

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has a position in / advises Cannara Biotech and nothing contained herein should be considered advice.