Daily Recap

President-elect Donald Trump is expected to come to the White House with a laundry list of policies he wants to change or reverse. The Biden administration has moved to ease longtime restrictions on cannabis so, what might Trump's arrival mean for the push to legalize marijuana?

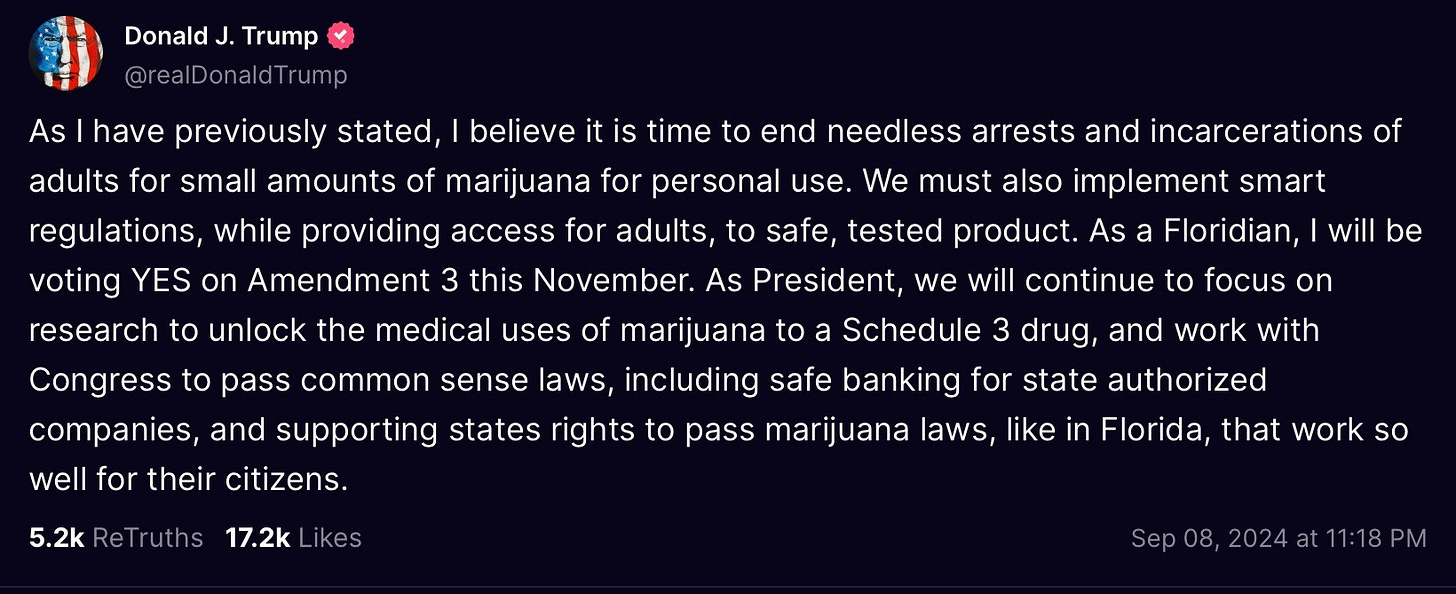

There are signs that cannabis could be a rare issue on which Trump carries a Biden policy forward. The Trump transition team's told NPR that Trump will "implement the promises he made on the campaign trail."

"I think that the president is going to appoint someone that takes a more neutral position or pro position on cannabis reform. And we're going to have people inside this administration like Robert F. Kennedy Jr., who are going to have a prominent role that are pro-legalization champions." David Culver, USCC

Fat Lady Sings

Chris Christie, the former NJ Governor and a long-time vocal prohibitionist, told BZ Canna that "The U.S. government has got to get its act together and decide what it really thinks on the issue [of cannabis].”

For Christie, the current legal status presents an obstacle for the industry, particularly regarding banking and financial services. "The trouble is that a lot of people still won't do business with these businesses because the proceeds are created through a drug that is illegal in the United States."

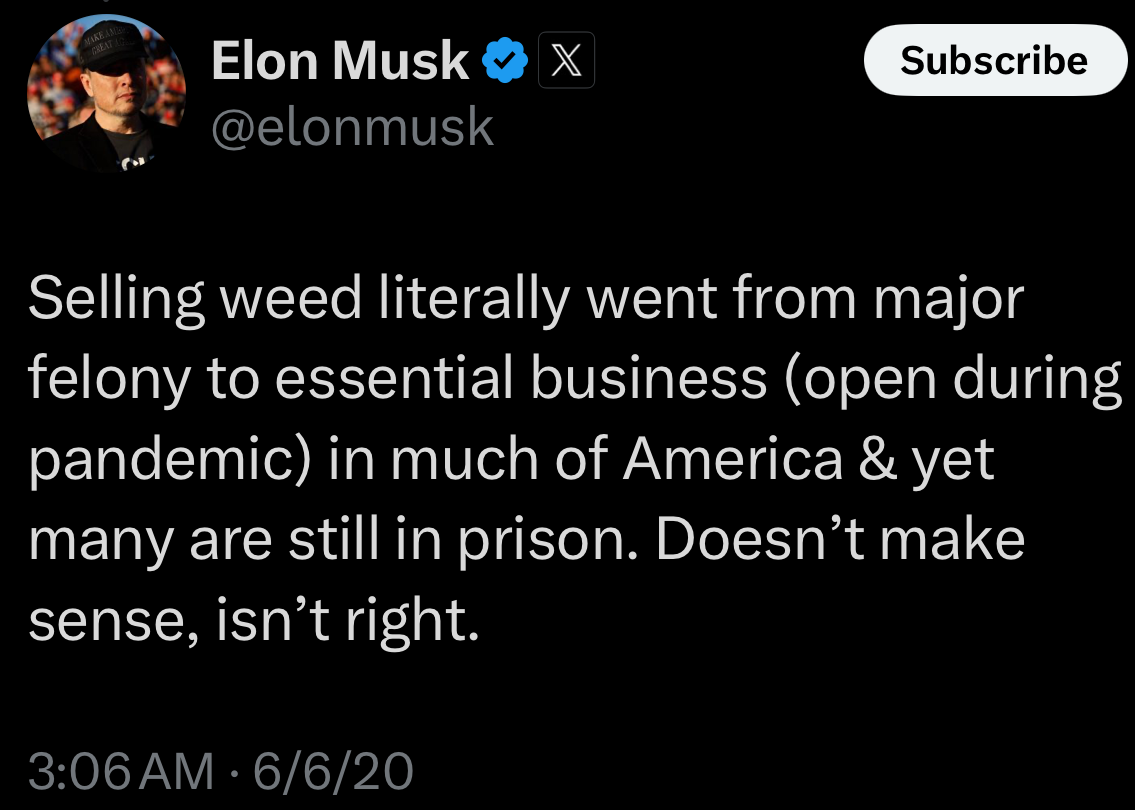

Christie suggests that descheduling cannabis—removing it from the DEA's list of controlled substances entirely—could provide a workable solution. President Trump passed criminal justice reform during his first term, and he signaled there is more to come while he was on his campaign trail.

Turtle Soup

With Republicans winning control of the U.S. Senate in last week’s elections, a key question for cannabis reform advocates and stakeholders is what the selection of a new GOP majority leader will mean for future reform.

With Mitch McConnell (R-KY) having announced that he will not be seeking to return to the leadership position, this will the first time since 2007 the GOP will select a new majority leader, and Republican senators plan to meet tomorrow to do just that.

The names atop the current list aren’t cannabis fans but it remains to be seen if any of them would stand in the way of the President’s desired agenda.

Stocks & Stuff

The volatility continued in Cannaland as Turnaround Tuesday lived up to it’s name.

Canna stocks bounced after an article highlighted Chris Christie’s 180 degree turn on the issue awoke folks to the notion that the GOP may not be the boogyman.

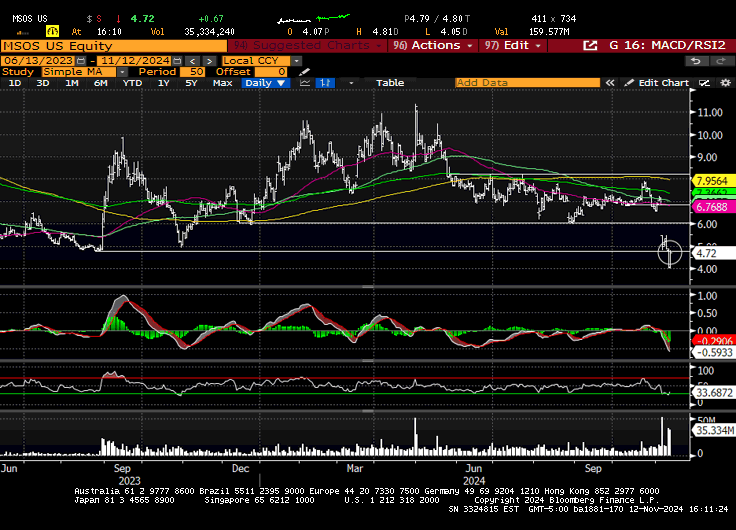

Of course, given the 44% week-over-week post-election carnage, coupled with the fact that MSOS rallied straight into the (previous) all-time low from which it broke, it remains to be seen if the bulls will be able to follow through. The ETF finished the day +18%, yet is still nursing an 32% YTD loss.

Below, we’ll dig deep, talk straight and put it all out there, for better or for worse.

All that and more, just scroll down.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ ETF Notional: $160M

Top Stories

Trump plans to revoke many Biden policies. Where does that leave marijuana?

GOP Senate Majority Leader Candidates Opposes Marijuana Legalization

Veterans want Georgia lawmakers to increase access to medical cannabis

DeSantis, Trump, state lawmakers: What's next for marijuana in Florida?

Idaho Activists File Cannabis Legalization Ballot Measure For 2026

NJ Retailers still waiting for cannabis consumption lounges

Group for small pot farmers sues N.Y. and warns industry 'at risk of collapse'

Polish Parliamentary Committee Sends Cannabis Decriminalization Petition To Prime Minister

Industry News

Ascend Wellness Announces Q3 2024 Financial Results

Cronos Group Reports 2024 Third Quarter Results

Marijuana brand Unrivaled declares bankruptcy in bizarre investor feud

Cannabis stock valuations, investments hobbled by regulatory uncertainties

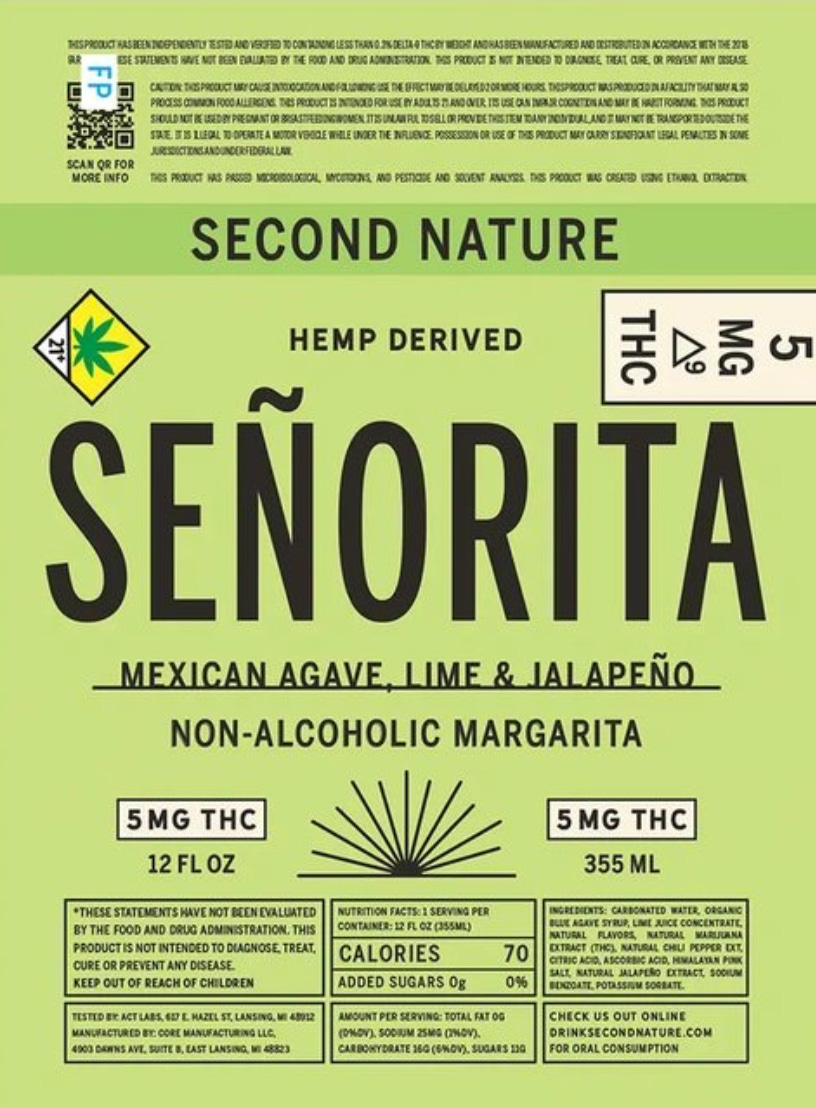

Agrify Announces Plans to Acquire the Señorita Brand of THC Beverages 👇

Pregame (written in real-time at 7AM) 👈

Cannabis investors limped into Turnaround Tuesday to find MSOS down 44% since last week’s red sweeps with one question in mind: what in the actual fuck?

Yes, Florida's failure was a brutal blow to the growth narrative at a time the sector was in desperate need of good news. True, many in the red regime remain prohibitionists. Ofc, we desperately need a line of sight on reform, not only for cannabis proper, but for intoxicating hemp products, as well.

Add in the fact that the 2024 Everything* Rally excluded cannabis, making the sector an obvious tax-loss candidate, on top of the primary (only) trading vehicle breaking to fresh all-time lows and the popular perception that this sector is dead through (at the very least) year-end, and you’ve got yourself a recipe for high anxiety.

As someone who spent the last decade focused exclusively on this space, it is hard for me to fathom the magnitude of the disappointment surrounding the lack of progress, the financial toll or the opportunity cost. And to think, in March 2014, after sitting on a MarketWatch bitcoin panel, I contemplated crypto as the other viable forward path.

We can’t change the past, we can only attempt learn from it, and while there are tried and true market axioms about “buying when there’s blood on the street,” and ‘news is always worst at a bottom,” there is real fear out there the status quo will continue for the foreseeable future.

We don’t think that will happen—we have genuine allies in this administration—but questions re: Trump’s desire/ priorities/ ability to follow through on his promises will continue to manifest until such time we see movement, or at least some assurances that this industry remains on his radar.

Time will tell and until it does, the animal spirits will do what animal spirits do, which is to probe and press the path of maximum frustration. Given incremental buyers have been MIA all year and current holders are (beyond) financially fatigued, it’s super hard to gauge the timing or price of a potential turn.

We enter the session with the ETF the most oversold it’s been all year, and the bears (and I’m sure some bulls) waiting for a bounce to $4.80 to reload and/or lighten. On the earnings front, we had Ascend and Cronos this AM, a few ancillaries later today, AYR Wellness and Glass House tomorrow, and 4Front on Thursday.

Good luck today, and remember to breathe.

Random Thoughts

If there's a readthrough on AGFY 0.00%↑ it's that the category isn't going away.

There is speculation a (Wyden-type) cannabinoid regulatory bill is in motion, which would help clarify the regulatory framework, which is much needed.

BBG reported a companion bill is being drafted in time for the lame duck, but they speculated it would bleed into the next congress—which is a concern re: SAFER.

^ if the GOP can better shape laws in a few months, why would they rush stablecoin legislation, which is rumored to be the companion bill/horse trade for SAFER?

Chart Check

The Chris Christie article hit at 11:45 AM and triggered a squeeze all the way up to… $4.80 (+19%) before bears mobilized to defend resistance. This way, they can argue that today’s move was yet another dead cat bounce with the benefit of hindsight. If/ when the bulls are able to breach that level, it would amount to a solid *first step* on the long road to redemption.

Stems & Seeds

Herb’s Fat Buddha Glass Review: Bongs, Pipes, And the Full Experience

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.

Todd, I'd love to see a review of the cash flow of the top MSOS companies. Are they making money net of expansions now, or do they require other developments to be cash flow positive? Thanks, appreciate your work.

Hmmm. Do you know of any peer reviewed studies of how many times a dead cat can bounce? TIA.