Daily Recap

Adults in Ohio began buying marijuana without a medical card today at almost 100 dispensaries across the state. This comes more than a month before the deadline stipulated in the statute that was approved by voters in November.

Several leading multistate operators, including Verano, Trulieve, Cresco, Curaleaf and Pharmacann began adult-sales today. MJBizDaily projects that Ohio could reach $1.5 to $2 billion in the first year of sales and $3.5 to $4 billion by the fourth year.

The Pick is In

Vice President Kamala Harris, the presumptive 2024 Democratic nominee, has selected Minnesota Gov. Tim Walz as her running mate. The Democratic ticket now consists of two candidates who openly support marijuana legalization, a historic first.

Walz’s record has been consistent: He backed numerous cannabis reform measures in Congress, called for an end to prohibition when he was running for governor and then signed a comprehensive legalization bill into law in 2023.

Pot and Kettles

Top Democratic senators, including Senate Majority Leader Chuck Schumer (D-NY), are pushing the DEA to ”promptly finalize” a rule to reschedule marijuana.

“The proposed rule to reclassify marijuana to schedule III recognizes the medical benefits of marijuana, will improve access for studying the health effects of short and long-term cannabis use, and will provide relief to cannabis businesses that continue to navigate a patchwork regulatory system to conduct legal business.”

Dr. Evil

Hedge fund billionaire Ken Griffin, CEO of financial firm Citadel LLC, announced that he’s spending $12M “to oppose Amendment 3,” the marijuana legalization proposal set to go before Florida voters in November.

Citadel Advisors, a subsidiary of Citadel LLC, is short more than 3.3M shares of U.S. cannabis ETF MSOS, per their latest filing, although some of that exposure may be a hedge (against long underlying stocks) in their role as a market-maker.

Stocks & Stuff

After getting hit upside the head for the better part of three months, the U.S. cannabis sector awoke to better-than-expected earnings from Green Thumb and Trulieve and a cannabis-friendly Democratic Vice-President candidate in Minnesota Gov. Tim Walz.

U.S. cannabis ETF MSOS rallied 9%, recapturing the summer lows that were recently breached, although it remains below the March lows. The ETF is now -1% for the year ahead of a bevy of potential catalysts, including a final rule on rescheduling and the upcoming Florida vote.

Below, we’ll top-line the current set-up, review today’s price action, chew through the first set of tier-one earnings, dig into the new VEEP candidate, review Ohio footprints, and look ahead to the avalanche of earnings.

All that and more, just scroll down.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ ETF notional volume: $82M

Top Stories

Ohio’s First Marijuana Sales Begin at Nearly 100 Dispensaries

Where Vice Presidential Candidate Tim Walz Stands On Marijuana

Schumer, Booker, Other Senators Push DEA To Promptly Finalize Rescheduling

Hedge Fund Billionaire Donates $12M To Defeat Florida Marijuana Legalization

U.S. Cannabis Sales on Pace for an All-Time Record $32B In June

Missouri bans sale of Delta-8 THC and other unregulated CBD intoxicants

How Industrial Hemp Could Save Our World

Marijuana industry wants to be treated like alcohol

Marijuana, Mexican cartels: Inside the stunning rise of Chinese money launderers

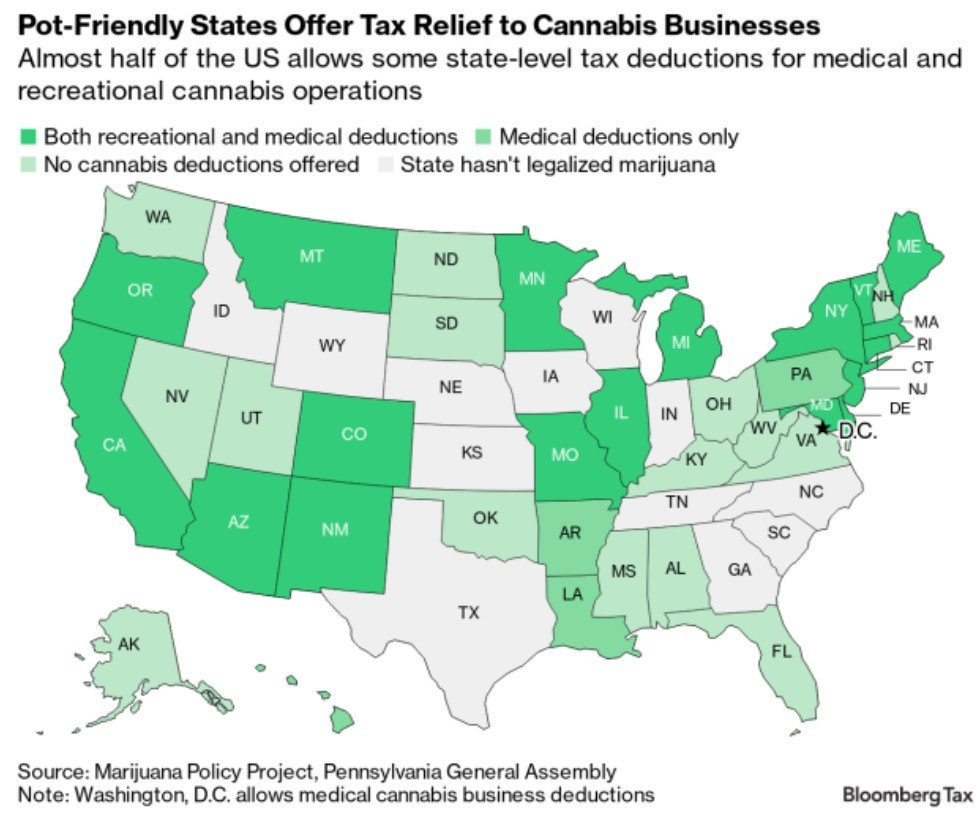

Pot-Friendly States Give Cannabis Sellers Tax Help Denied by IRS 👇

Industry Headlines

TerrAscend Completes $140 Million Debt Financing

C21 Investments Reports Audited Financial Results

Ascend Wellness Earnings + Call Notes

Green Thumb Industries Earnings + Call Notes

Trulieve Earnings + Call Notes

Pregame (written in real-time at 8AM) 👈

After another sloppy session and late-day rug pull, we awoke to two tier-one players reporting better-than-expected results, and while we saw some trade-down in GTI, the sector leaders have thus far made a case that cannabis is 'durable’ not 'discretionary.'

Until we have free and clear order flow (custody and uplisting) and/ or a line of sight on federal clarity, U.S cannabis will remain dust in the macro winds. Volumes have been anemic on a relative and absolute basis, and many if not most of the charts are broken.

Green Thumb did everything Green Thumb could do to impress investors despite messy macro and confused consumers, but the stock will need to recapture ~$11 (most recent break) and the 200day ($11.85) before bulls get too excited.

ofc, that could happen with a single headline, as we saw last August.

If I'm a bear, I want to fade (read: sell) good earnings in an effort to break the bovine will; "if those numbers don't matter, what will?" All is fair in love and war, so time will tell and we shall see, with the summer lows the near-term arbiter of variant views.

The goal, for all of us, is to be in a position to view prices as an opportunity rather than a hindrance; to get off our heels and on to our toes. Been a tall task for a long time but w 90 days until the election/ FL ballot, we’d be wise to keep eyes on the prize.

Between the Bells

The bulls got the earnings they wanted and a pro-pot VEEP, which triggered an early lift in the space. MSOS rallied 6% out of the gate, running straight into the underbelly of the aforementioned summer lows and filling Monday’s opening gap in the process.

The ETF sat there for a few hours, which sorta summed up our technical metric. Since the false breakout > $11 at the end of April, the bears have violated all support levels and thwarted subsequent bounce attempts into the newfound resistance zones.

MSOS summer lows broke yesterday (< $6.80) and appeared to be following a similar script. The initial bounce was intuitive, warranted even, as the bears continued to fade strength, a process they’ll likely continue until the bulls break the cycle.

They sure tried, pushing the ETF to $7.19 (+13%) in the late afternoon, led by double-digit percentage gains in Green Thumb (> $11) + Trulieve ( > 200day), before slipping into the close with the broader market and finishing with a 9% gain.

While the best prints of the earnings season may be behind us, we know that markets look forward and false moves lead to fast moves, as we saw at the end of April. That’s why this jucture is of particular import—the buyers are higher, we just gotta get there.

Democratic Vice-Presidential nominee Tim Walz on U.S. cannabis:

Ohio kicks off adult-use sales today! This is a roughly $600 million/year medical market that we expect to quickly triple in size. It's an MSO-heavy state, with 45 publicly operated dispensaries representing 35% of the market.

Matt “Shooter” McGinley of Needham on Green Thumb:

1H was a very strong start to '24, and we expect GTI to continue delivering efficiency gains and robust cash flow generation this year. With a substantial cash balance and consistent cash generation, GTI is well-equipped to self-fund growth and boasts the strongest balance sheet in the space. We expect capex to decline further in '25, which will likely improve cash generation with or without the elimination of 280E. On an EV/EBITDA basis, GTI trades at 8.1x our 2025 estimate, a 0.8-point premium over the group. We believe this premium is justified, and likely too narrow, based on its superior balance sheet, margins, and cash flow profile compared to its peers.

Matt “Shooter” McGinley on Trulieve:

Efficiency gains and investment in customer-facing initiatives are having a clear and positive impact on margins and sales growth. While seasonality and infrastructure investment will likely pressure 2H performance, operational improvements bode well for long-term growth and cash flow generation. Given its concentrated exposure and large operations with latent capacity, Trulieve stands to gain most from potential adult-use conversion in FL and we estimate revenue could more than double if that state converts. Operational improvements fueled a 77% YTD stock gain but it trades at 5.9x '24 EV/EBITDA, a 2.3% discount to peers. In our view, this reflects Trulieve's position as a medical operator with limited expectation for adult-use conversion.

AGP on U.S. cannabis:

“We expect a final rescheduling rule before the election, which will be the most notable reform in decades and likely the first of several federal dominoes (Garland & SAFER) that’ll allow for custody, institutional ownership and acquisitions/ investments from CPG.”

Summer earnings: AYR Wellness, Verano and Curaleaf are up next

Stems & Seeds

U.S. Anti-Doping Agency CEO Blasts ‘Unfair’ Marijuana Ban for Olympic Athletes

More States Consider Adding Female Orgasm Disorder As A Medical Marijuana Qualifying Condition

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.

just for that, i'm gonna have to break the no gifs during trading hours rule.

you're incorrigible.