I penned a piece last week, 1-800-GET-ME-OUT which ICYMI you may wanna read because it’ll provide the situational awareness for this stream of consciousness…

…but if you don’t have time, it spoke to the forced liquidations / indiscriminate selling in US cannabis stocks that has accelerated each month and pushed valuations through COVID lows despite the tristate / east coast adoption that de-risked the state-led US cannabis investment thesis.

[yes there were a multitude of reasons for these stocks to trade lower including year-over-year post-COVID sales normalization, frustrating state-level delays and banal leadership at the federal level]

[yes the Ukraine invasion was an adrenaline shot to the heart of inflation w the Fed behind the curve as the US consumer (70% of GDP) weans off the government teat]

[yes retail investors have been eviscerated by meme stocks, crypto and (sorry) cannabis]

But there’s more than forced liquidation / retail capitulation in play. We’ve already fingered the curious correlation bw US canna ETF $MSOS and $ARKK, both of which are “retail-laden growth” despite meaningful differences in math / multiples…

…and as the bottom line on Wall Street is the literal bottom line, it doesn’t matter why prices are cascading but sometimes it’s helpful to understand what the other side of your trade is thinking:

Are fundamentals a value trap?

Are states gonna turn off taxes / turn away jobs?

Will the US government re-embrace The War on Drugs?

All of this was rattling around my crowded keppe when I got a BBM on Tuesday from a colleague / large investor in the space who said:

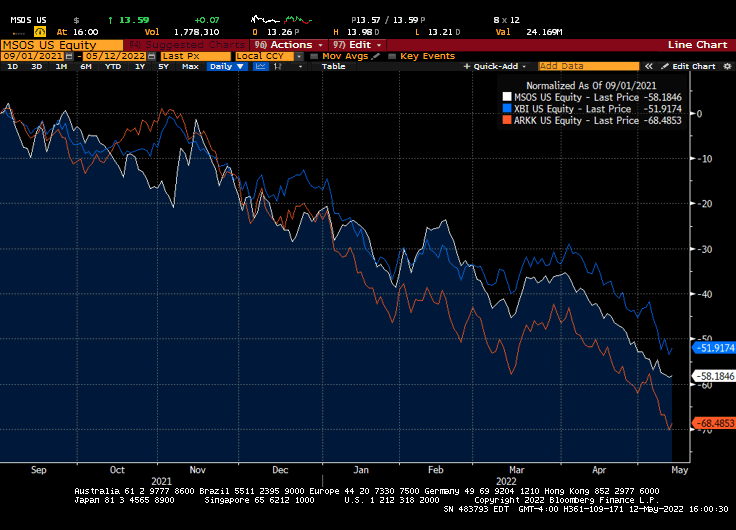

Fourteen months? Jeez, we better take a closer look. $XBI is biotech; $MSOS is US Canna and we’ll toss Cathie’s $ARKK Wood on the fire for shits and giggles…

Hmm, interesting. Can we zoom in to say, a one-month chart?

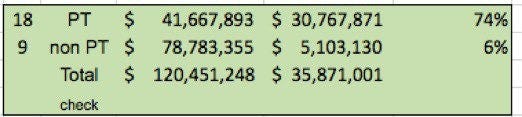

Wow; but if this is true, wouldn’t short interest be super-elevated in the $MSOS?

OK then + we know from last week that w institutions gated / new funds being told they cannot custody plant-touching US operators, arb-related activity is north of 74% of daily plant-touching volume most days, leaving retail, which is some 96% of the average US cannabis cap table, to fend for their young child’s fragile eggshell minds.

In full disclosure, Syracuse University spit me out 32 years ago and I somehow landed on the global equity derivatives desk at Morgan Stanley…

…so I’m no stranger to these option scummers desks but given “XXX from XXX” was supposedly the “it” trader in an ever-changing / increasingly algorithmic game—and given he arbitrarily flagged to A. Friend that US canna stocks were being bastardized in this process—we were eager to learn more.

[he also said he’s “never seen anything like it,” it’s being pressed to “dangerous levels” and “there’s only so far they can go before this blows up in their face.”]

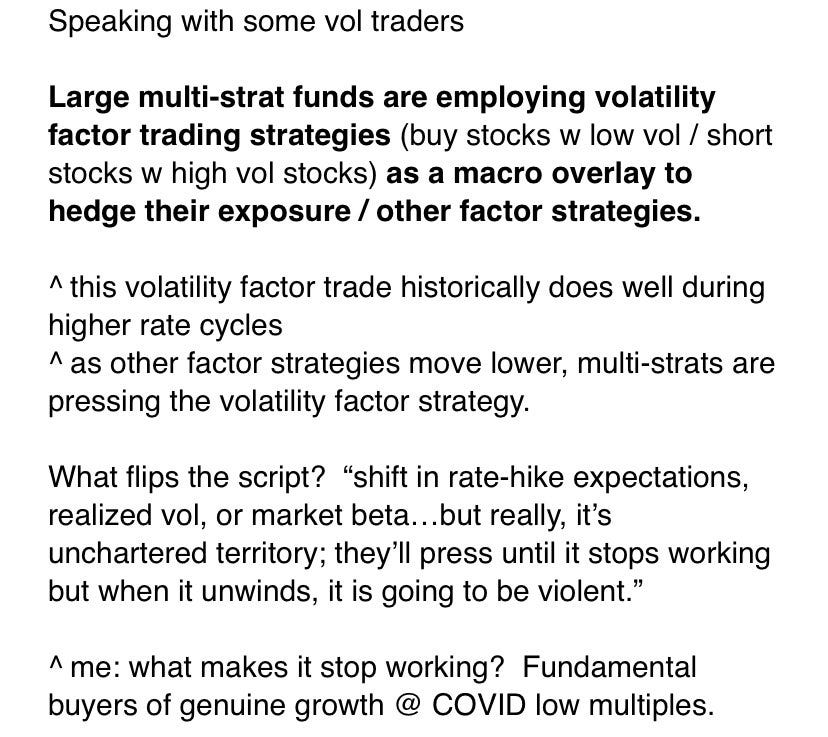

So we got on a call today: Me, Mr. Triple X Vol (behave), several fund managers, our compliance guy and a few smart Fokkers to see what kind of color we could find…

Of course there’s nothing illegal about a volatility strategies (or naked shorting on the CSE, evidently) but at scale it can / will overwhelm a sector and create dislocations, particularly w 96% retail holders, gated institutions and new funds being deferred…

…but at the very least—at the very very least—they’re most def amplifying momentum bc as we know / have learned, algos have no conscious, they only know levels.

[again / of course, this isn’t the only reason US canna stocks are lower but quantitative strategies are designed to exploit inefficiencies, fundamentals be damned]

[speaking w prime brokers, borrows aren’t “tight” so the coiled spring is a function of the magnitude w which this trade is employed as a hedge against other factor trades]

On the bright side, we now have a better understanding of why these names trade as a monolithic asset class in tandem with other high-volatility ETFs. For those who have an eye for value and the patience of Job—or those cowering in a corner murmuring to themselves to buy when bloods in the street—this perspective could go a long way.

Financial markets have always been multilinear; you know it, I know it, him knows it…

…but sunlight is always the best disinfectant particularly when it’s as dark as it is now.

I will leave you with a passage from A. Friend who is as decent a man as he is quality thinker / successful investor; and I quote:

“Everyone has the narrative completely wrong: now is not the time to worry about slowing sales or margin pressure. MSOs are particularly attractive bc any slowdown is due to the illicit market being oversupplied / underenforced and it does not change the fact that a handful of companies get to participate in a landgrab that is off limits to small / big competition alike. Current margins aren't relevant bc enforcement will increase over time and the illicit market will eventually fade given safety concerns and w the adoption of additional form factors.

What’s relevant? Gaining share and building brands. The illicit market helps prevent any real competition from smaller players, as does 280E (←this is a feature not a bug); big box CPG can't compete bc federally illegal so status quo best case for MSOs. This will seem super obvious in a few months but in the fog of war, people only want a sensible explanation for why things are so bad so these excuses for weakness are reverse engineered.

All that matters right now is that quants are shorting everything and they will continue to do so until correlations start breaking. I wouldn’t be surprised if quant funds / their commission dollars encouraged custodians to pull back from US cannabis… and IDK if it’s Citadel that has this trade on in massive size but whoever it is, it sure looks and feels like a Citadel-type fund.”

The world may never know.

position / advisor $MSOS