We highlighted Canadian cannabis company Cannara Biotech before they reported record Q1 2025 revenue and national market share, which set the stage for continued momentum in 2025.

Some earnings highlights:

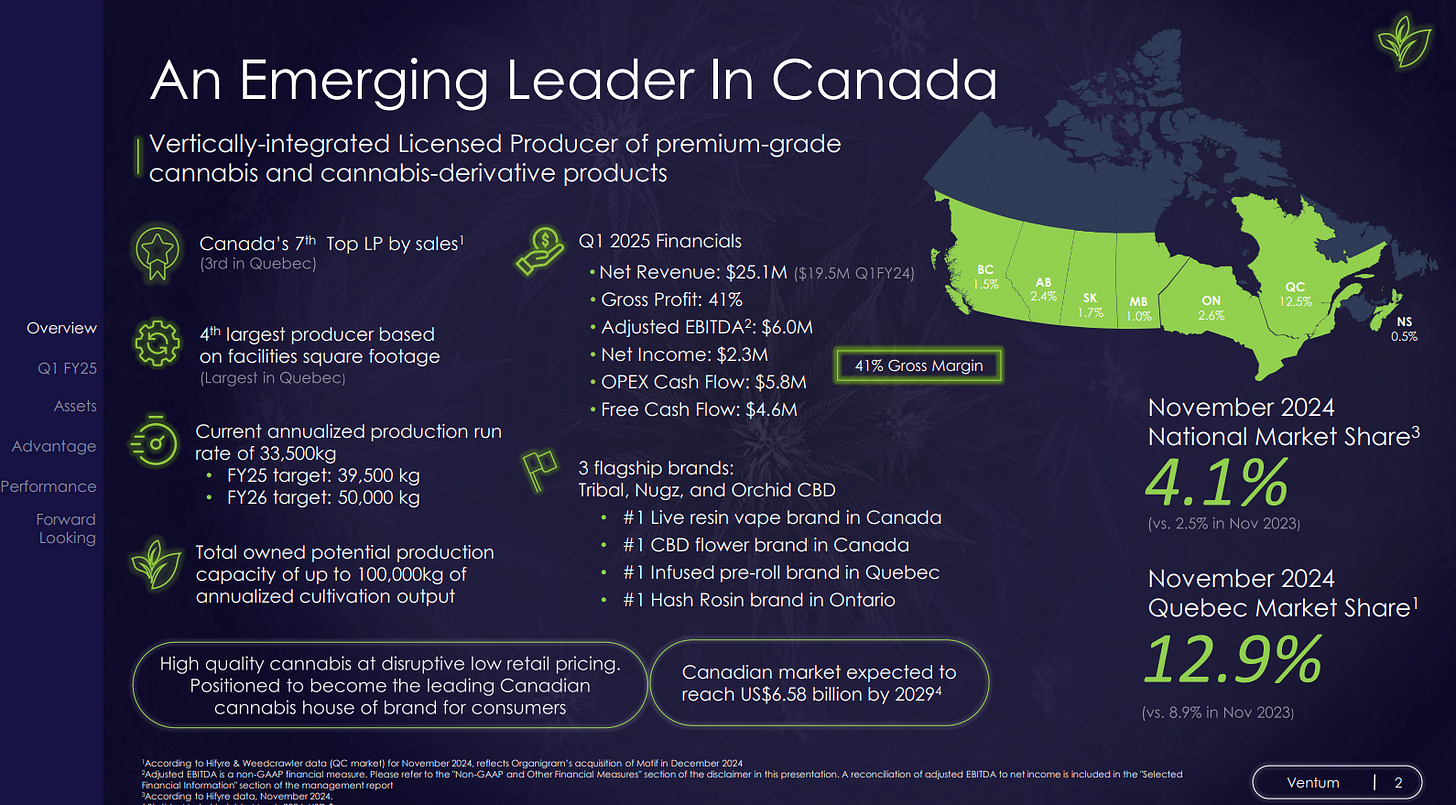

Record Net revenues of C$25.1M in Q1 2025, a 29% increase compared to C$19.5M in Q124, driven by strong demand for Cannara’s premium-grade cannabis products.

Record Market Share: Achieved Canadian market share of 4.1%, representing a 28% increase quarter over quarter, and 58% increase over the same period of prior year with gains across all licensed provinces.

Robust Profitability: Gross profit before fair value adjustments grew 23% to $9.8M in Q1 2025 from C$7.9M in Q1 2024, with gross profit margins improving to 39%.

Industry Leading Operational Excellence: Delivered a fifteenth consecutive quarter of positive AEBITDA, generating a Company record of C$6M, in addition to record-high operating cash flow of C$5.8M, compared to $0.8 million in Q124, and record FCF of C$4.6M compared to C$(2.0)M in Q124.

Strategic Growth Ahead: They plan to activate two additional grow zones and launch over 20 innovative new products in 2025, positioning them for continued leadership in the Canadian cannabis market.

The company presented at the Ventum Capital Markets event today. Below are the call notes and investor highlights.

Call Notes

Quebec-based.

Highly regarded brands by CDN consumers.

Consistently high quality product while scaling.

Massive purpose-built state of the art cultivation facility.

^ acquired at a fraction of its build cost (~.10 on the $)

Emerging as one of Canada’s largest vertically integrated producers.

Strong financials, innovation, consumer-first approach.

CEO deeply involved on a day to day basis.

Hands on approach from c-suite + team a key to success.

Built one of the most cost efficient operations in the industry.

^ while maintaining leading quality.

Assets require sustainable scalability, a struggle across many operators.

One of Canada’s fastest growing, most consistently profitable producers.

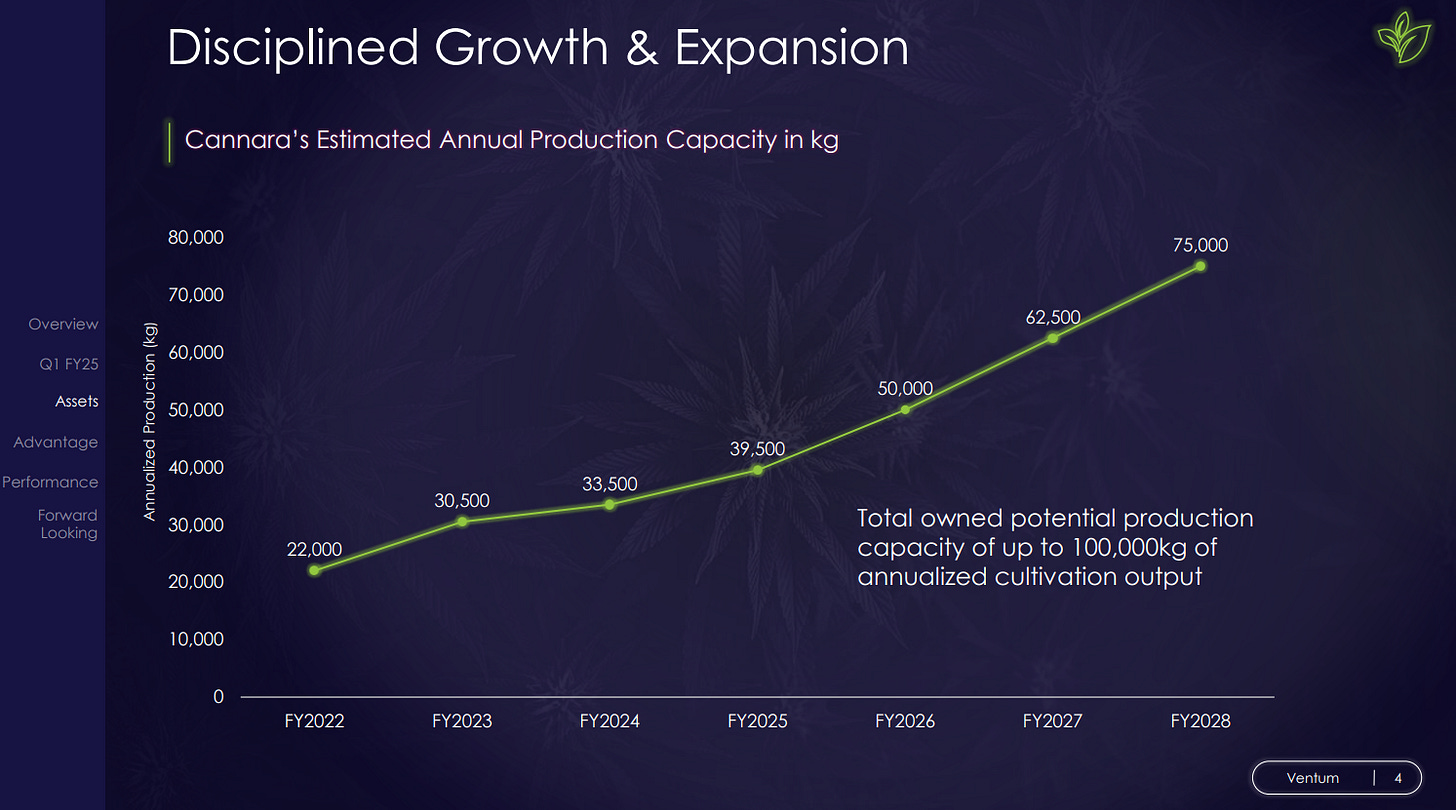

Current R/R of 33,500kg; ’25 target of 39,500kg; ’26 target of 50,000kg.

Quebec some of the lowest utility costs in Canada.

Since electricity accounts for 75% of costs, significant competitive advantage.

7th largest operator in CDN by sales, growing fast as scale.

4th largest operator in CDN by square footage; largest in Quebec.

Third market share position in QC.

^ 2.9% m/share. 4.1% share nationally.

Designed for sustained/profitable growth.

Net revs up 29% YoY, GP up 24% YoY.

aEBITDA up 15% YoY. OPCF up 625% YoY.

FCF up from negative ($2m) to $4.6m, up 330% YoY.

OPCF margin of 23%, FCF margin of 18%.

Top line growth means nothing if it doesn’t translate to the bottom line.

Proud of industry leading cash flow generation / margins.

Over $10m cash on hand.

100% owned facilities are a leading competitive advantage.

Valleyfield facility was built for $250m, and acquired for $27.9m by Cannara.

Provides Cannara one of the largest/ most advanced facilities at a fraction of the cost.

Valleyfield is 1.1m sq ft purpose built for cannabis cultivation.

24 growing room, each room is 25k sq ft and holds 10,000 plants.

Valleyfield is 24 total rooms.

^ 10 growing rooms today.

^ 2 rooms turning on within 4 months.

^ remaining 12 rooms online over the coming years.

Massive uncaptured market share.

Cannara expanding strategically to capture that.

Over next 3 years, fully built out phase 1 goal of being Canada’s top producer.

Produce top tier cannabis at scale.

Hang dry, hand trimmed, slow/cold cure.

Massive expansion potential.

Only 40% of capacity currently activated.

Can scale profitably with minimal investments.

QC electricity rates are 50% lower than ON, 75% lower than AB.

Thriving in Canada by choice when others are leaving the market.

Others cant operate profitably, failing to capture market share/consumers.

From 3.2% share in Q4 ’24 to 4.1% share in Q1 ’25.

Highest ever national market share to date.

#1 QC infused pre-rolls

#1 live resin vape cart brand nationwide

#1 hash brand in Ontario

#1 CBD brand nationwide.

15 consecutive quarters of aEBITDA

Industry leading margins, OPCF+ and FCF+.

M/share up 20% in 1 year.

Dominate in key categories.

No clear view on demand ceiling; still have room to 3x capacity organically.

Built for long term success.

Believe positioned to shape the future of Canadian cannabis.

Firmly believe have one of the strongest teams in cannabis.

Guided by an executive team that leads by example.

Very close relationship with Quebec regulator.

Made in Quebec, for Quebec.

If quality wasn’t high, wouldn’t have 12.9% share in Quebec.

Quebec has no marketing rules.

Cannara organically built market share based in product quality / consumer demand.

Very little marketing efforts taken nationwide.

Another lever in the near-term.

^ replicate nationwide on the % of market share seen in Quebec (12.9%).

Opportunity in Canada is huge.

Cannara proven capturing share.

No point in looking to international until necessary.

Would rather capture low-hanging fruit in owned backyard.

^ further leverage leading brand equity/ consumer demand deeper + wider.

If ever do have excess inventory, may consider looking internationally.

^ once achieved 100,000kg goal,

Right now fully focused on CDN.

As competitors focus internationally, Cannara to take advantage of CDN opportunities.

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has a position in / advises Cannara Biotech and nothing contained herein should be considered advice.