The Man Behind Verano

George Archos has built businesses, brands and a fiercely loyal team

I knew the backstory: Verano Cannabis ($VRNOF) had won a cannabis cultivation license in 2014 and was the first operator to bring products into the Illinois market.

I saw the growth: they’ve built vertical integration in nine states, have operations in eleven states and licenses in fourteen states; 85 active dispensaries / ~500 wholesale partnerships / ~4,000 employees.

I did the math: they’re profitable / cash flow positive w industry-leading margins / a superb growth profile and the stock is mispriced, trading at 5X 2022 EV / EBITDA. Five times next year’s earnings for the missing ‘A’ in U.S Canna FAANG.

And I knew why: they came public into the February cyclical top / the teeth of a 48% decline for U.S operators, as measured by the U.S cannabis ETF $MSOS (Feb-Sept) as insider stock unlocked, tilting supply / demand into the dearth of trading liquidity.

But what I didn’t know was the people; the human capital. The jockeys. There are a slew of U.S canna horses out there but for / with our money, we bet on the jockeys.

With that in mind, I boarded a flight to Chicago last Wednesday afternoon for dinner with their management team and a day of site visits + sit-downs. This is that story.

The flight to Chicago was seamless and I arrived at my hotel with plenty of time to shower, change and review some notes before I met the team. I had spoken with them several times and knew of CIO Aaron Miles from his previous gig at Cresco but truth-be-told, if felt more like a first date than a business dinner.

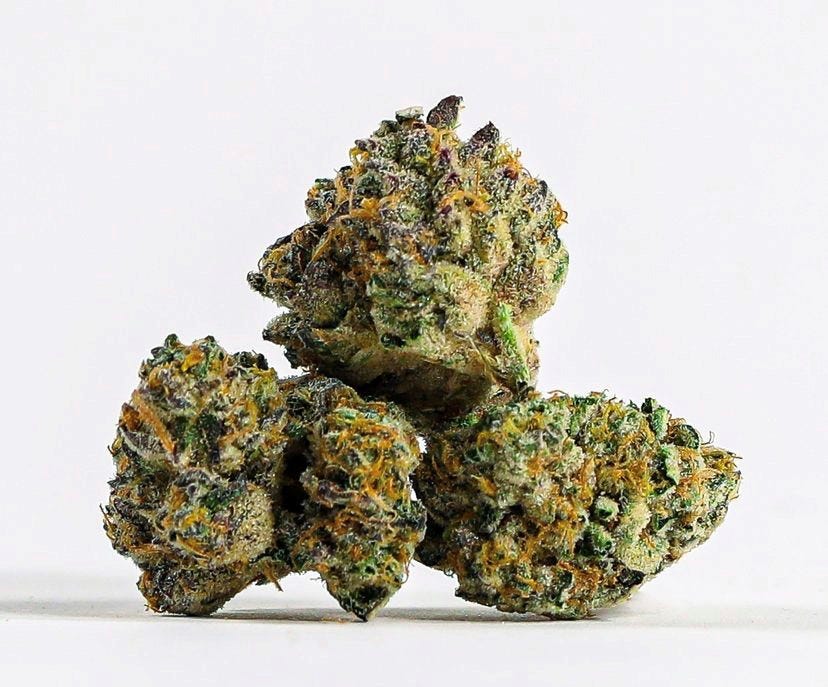

That vibe quickly dissipated when Aaron and David Spreckman, the VP of marketing and comms, met me before dinner with several samples of their private stock flower that I heard so much about but never tasted or felt. They were instantly speaking my language and I liked it; I liked it a lot.

We left for dinner (having only smelled the flower but don’t think I didn’t think about it) and headed to RPM Steak for dinner. I knew CEO George Archos was in the restaurant business and as a bit of a foodie, I was looking forward to a solid Chicago meal. We walked in to find George and CFO Brian Ward, shook hands and sat down.

“So, tell me the story…” I began, looking at George. I could tell he didn’t want to talk about himself but he took a deep breath and obliged me. Keep in mind that I’m stone cold sober / a reasonably intelligent man / paying rapt attention to what he was saying but it didn’t take long for him to toss me.

“My parents came from Greece and were first generation Americans. My father worked tirelessly to open his first restaurant and by the time I was nine, I was working by his side trying to learn everything there was to know about the restaurant business; I did everything from mop the floor to help with the front-of-house, the kitchen and ultimately the bar. When I was 20 and still in school, I maxed out every credit card I could find, including those of friends and family, and scraped together enough cash to open my own restaurant. I was obsessed with the quality of the food, the customer experience; I spoke to all my guests. One of them, an elderly gentleman who dined with us all the time, owned properties across Chicago and took a chance on me with one condition: that I make his one favorite dish and put it on our menu (it’s still there). We expanded to multiple locations across a variety of categories [me: to this day, his are among the highest grossing restaurants in Chicago]. Then I pivoted to real estate and built a portfolio of properties that did quite well… and then an opportunity arose after I saw the inefficient manner in which they were transporting crude across the midwest and I successfully re-engineered the logistics. Then I….”

“Hold on a second,” I said. “You pivoted from pancakes to real estate to… crude?”

“I’m a problem solver,” he said. “I rethink processes; that’s what I do. And when I visited Colorado in 2014 and saw how much money some of those mom & pop shops were making despite how inefficient they were, I knew there was a massive opportunity. I took my entire hospitality team—my executive chef, the architects, the construction crews, people who’ve been with me from the start, and we began to build Verano with the same eye on quality, execution and profitability.”

[inner thoughts: George is a self-made guy; a grinder; thrives on turning obstacles into opportunities. He did it in the highly competitive / notoriously dangerous hospitality realm; echoed that success in real estate, accumulating inventory during downturns; optimized a logistics matrix nobody knew needed optimizing; now he’s all-in / hands-on building a canna business that shares a DNA / attention to detail as his restaurants. Not bad for 42; I need to up my game]

“People, Process and Product,” he said, a battle cry that would become increasingly familiar over the next day. “People, Process and Product.”

And just like that, George was gone with the wind. “Gotta catch a plane,” he said before dessert arrived, grabbing his bag, “enjoy your stay and I’ll see you in Ojai.”

The Morning After

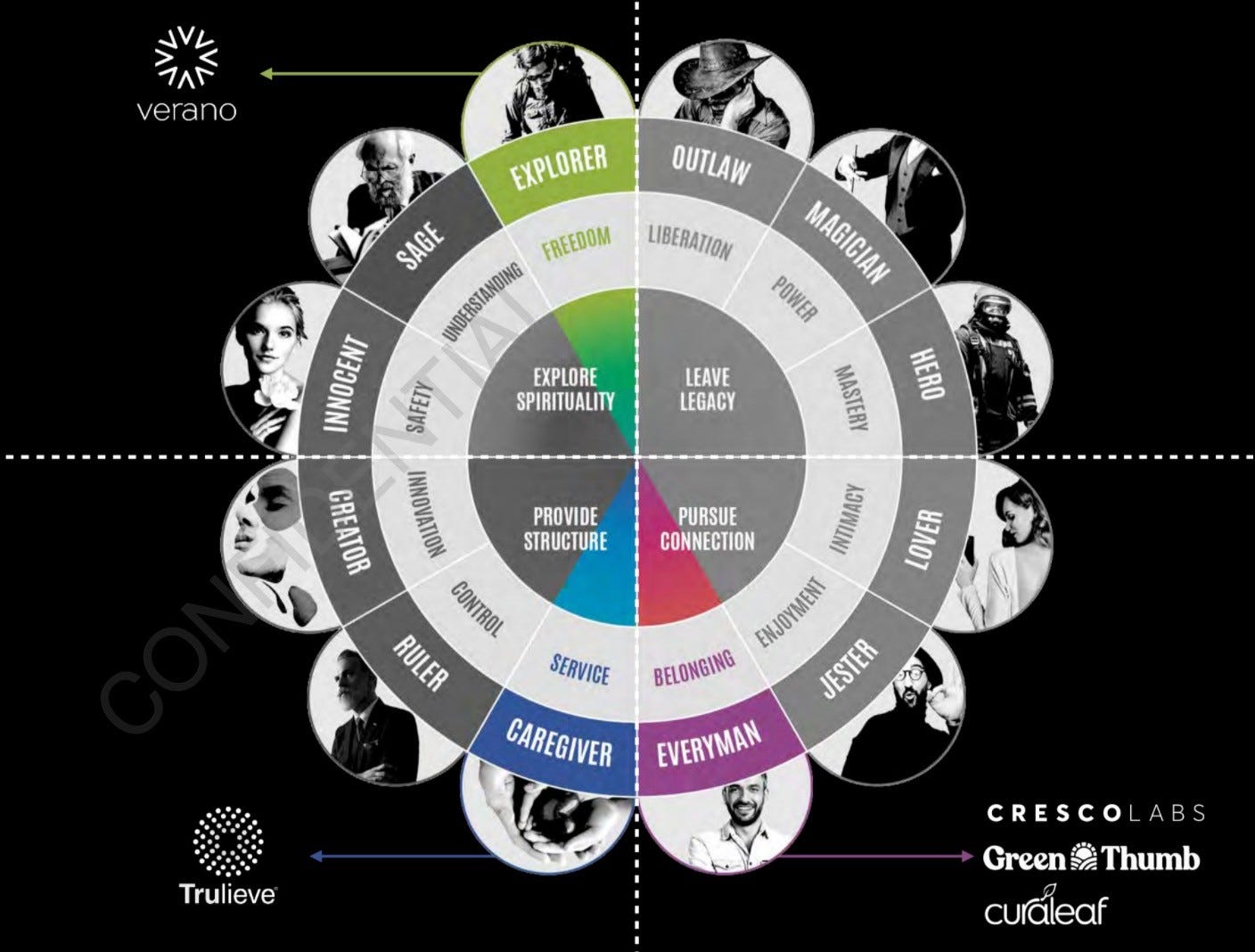

I was up early and headed to the Verano corporate offices, where I met David, VP of comms. David has a youthful energy and a Flock of Seagulls coif but after exchanging a few pleasantries / swapping stories about the Dead, it became crystal clear that this guy is a killer; and that was before he launched into The 12 Jungian Archetypes and where Verano sits vs. a few of their peers.

We spent an hour or so chewing through his near-term focus—new product and brand relaunches, the introduction of additional form factors, a completely redesigned visual identity, proprietary software solutions to improve the customer experience—before he booted me out of his office so he could get back to work. His passion was evident and I scribbled a few notes before heading down to Aaron’s office.

Now let me tell you about Aaron Miles. He was at Cresco / helped them come public—and listing on the Canadian Stock Exchange isn’t nearly as sexy / fun as listing on the NYSE or NASDAQ—before meeting the team at Verano and joining as CIO. “I had no interest in taking another company public,” he told me, “but once I met them and saw what they were building and how they were building it, I pushed in all my chips.”

It wasn’t just Aaron’s certifiables that struck a chord; it was his demeanor, his energy and his positivity; and given his uncanny resemblance to Jason Sudeikis, he had me at hello as we continued our conversation about his roles and responsibilities.

He has a large charge—building a better cap table, lining up long-term holders, identifying lower costs of capital, optimizing the portfolio and getting ready for U.S uplisting—but he noted the “co-op mentality” and flat reporting structure where everyone helps each other to move the ball down the field.

“I would run through a wall for George and I’ve only been here a year,” he told me, “imagine what the people who’ve been with him from the start would do.”

We walked back upstairs to sit with Sammy Dorf, the instantly likeable co-founder, and Darren Weiss, who is their Chief Legal Officer / General Counsel on paper but seems to do a lot more IRL. We got into a discussion about Verano, the culture, the opportunities and some of the concerns on the Street.

“George and I met in 2014,” Sammy began, “I was out one night and we happened to be seated back-to-back. We immediately connected and began discussing the many opportunities in cannabis. We shared a vision of what we wanted to build, something hot, sexy, profitable… something different.”

I've known of Sammy for some time; he is a pioneer in the space and has a reputation for solving problems. This, however, was the first time I met him; color me impressed.

Darren’s story is a bit different but equally relatable. An attorney from Maryland, he was opposing counsel on litigation in 2016, when he met George and Sam. “He tore us apart,” Sammy told me, “ by the end of the case, I turned to George and said, “We need him on our side.”

“Best I can tell,” I said, slowly sucking the air out of the room, “there are three chief beefs with Verano, above and beyond the industry-wide f*ckery and the unfortunate timing of your go-public strategy.”

1. the street wants to know why you’re not reserving more cash for taxes.

2. there are continued concerns about future unlocks and

3. there is a perception that margins have nowhere to go but down.”

“Why would we reserve cash when we can earn cash-on-cash returns and still satisfy the entirety of our obligations?” said Darren, checking the box on the first item.

“We’re well aware of the unlock concerns,” chimed Ted, er Aaron, reminding me of our earlier discussion where we swapped notes about some of the interested funds that could collectively swallow these unlocks whole, “we’re working on it.”

“Margins may trend lower industry-wide but the MOAT in limited license states and likelihood of incremental federal legislation should protect our economics as we build our business. Balance sheet is in great shape, plenty of cash, we’ve never done a sale-leaseback and we have access to some of the lowest cost of capital in the industry.”

From there, it was time for lunch and I was keen to visit one of George’s restaurants so I could see for myself what all the fuss is about. “You like pancakes?” asked Aaron as we headed for the door, evidently a trick question bc who doesn’t like pancakes?

“Sure,” I said, thinking about my recent pledge to get myself in better shape.

We arrived at Wildberry Pancakes & Cafe at 2PM and the place was packed inside and out with a impressive waitlist. Aaron and I were ushered through the crowd toward a table in the back as I took inventory of the dishes being ferried about. Didn’t see many healthy items either; this was going to be a challenge.

To my credit, I did order a salad—and it was delicious—but Aaron also insisted on a pancake. “You can’t come here and not try a pancake,” he said and I knew he was right. Besides, you can learn a lot about a man by the way he makes a pancake and Kevin Bethyo, who had come to greet us, had already put in an order of the Berry Bliss.

While we waited for our food, I got to talking with Kevin. He’s been with George since the start, his right-hand through it all. “I’m 20 years old, thinking about the things 20 year olds think about and here’s this guy who’s my age telling me how he’s going to open a chain of restaurants and build a real estate empire. I didn’t know much but I knew enough to stay close to him; it was the best decision of my life.”

This must be one of those 10-wall guys that Aaron told me about, I thought to myself as the waiter put an edible orgasm on the table. I told myself I was only going to take one bite but when I looked back down, 3/4 of it was already gone. I pushed the plate toward Aaron, “please get involved,” I said, saving myself a modicum of dignity.

We ventured on to one of the ZenLeaf Dispensaries, where we were greeted by Joe Ascaridis, the assistant manager. Joe took us on a full tour, including the stockroom, when the words “Is this heaven?” left my mouth before I realized what I said, and I was struck by a few themes: first, how passionate and fiercely loyal to George he was and second, the parallels between successful restaurants and successful dispensaries.

In an effort to complete as much due dilly as humanly possible, I played the role of customer and purchased a few items—you know, just to see what the experience is like—before we made our way back to the office, where I picked up my suitcase and headed back to the airport to complete my 24-hour turnaround.

[note: due to a ground stop in NY for severe weather conditions, I spent > 30 hours stranded at the airport / hotel before getting home last night; but thanks to my friends at Verano, I didn’t mind all that much. Shout out to G-Purps on the assist!]

The Bottom Line

We had done as much research as possible from afar and quantitatively, the metrics all spoke for themselves. That’s the thing about math, it doesn’t lie and the Verano math is extra spicy, trading at a discount to a group that’s already trading at a discount, like a discount double-check or something.

Here, look for yourself:

2021

3.5x ’21 projected revs (vs. 5.25x avg for the top 5 tier-1s)

7.5x ’21 projected adj ebitda (vs. 16x avg for the top 5 tier-1s) (← wow)

2022

2.3x ’22 projected revs (vs. 3.7x avg for the top 5 tier-1s)

5.1x ’22 projected adj ebitda (vs. 10.1x avg for the top 5 tier-1s) (← wow)

38% rev growth QoQ, 2nd among the top 13 companies we track; vs. 20% avg for group.

50% gross margin for Q2 (58% removing 1-time items); mgmt guided to normalizing EOY margins back at 60% (← incredible for a company w/ this size footprint)

29% opex margin, the best opex margin by far among the top 13 companies we track; 38.7% opex margin for top 5 peer group.

Top 3 MSO by real (current) + projected revenue / adj ebitda.

OK, so the numbers are impressive and we think we understand why there is such a disconnect between this stock and it’s immediate Tier-1 peers; we’ve talked through the timing issues / the chasm b/w perception and reality. And we know George sees it too bc he purchased another $1M of stock on the open market a few weeks ago.

But I didn’t know the culture, the team or the mindset and that has now changed. It didn’t take long for me to see what Verano was all about, the passion and purpose that so many of them share, the people, the process and the product that they take so much pride in, up and down the ranks / across George’s various enterprises.

I also noticed that George doesn’t fuck around. He’s all about results, accountability and forward progress, and he sets that tone by walking the walk / setting an example daily. And he’s not shy about it either, as evidenced by the giant rules that are posted by the door of the office that he and Sammy still share:

I know what you maybe thinking. Todd has a giant position in Verano and he / CB1 Capital are advisors to the company. Both are true; Verano has already crept into our top five and we’ve recently been engaged to help them navigate several initiatives as U.S cannabis migrates from a cottage industry to an industrial complex.

But ask yourself this: in all of my years writing online (21) or immersed in canna (10), how many times have I written about a particular company? The answer is once: GW Pharmaceuticals, which has since been scooped. And, how many articles have I ever written about a client? The answer is none; this is the first.

So why I am doing so now? Because it’s not often that a man can be stranded at an airport > 30 hrs and be totally / completely grateful the entire time.

Grateful that I get to work with clients I respect so much.

Grateful that timing / circumstances have combined to offer what I believe to be a generational opportunity.

Grateful that I have the ability to share this story and affix my name / word to their future success.

But mostly, it’s the simple fact that it takes a lot to impress me and since I returned home last night, I haven’t been able to stop thinking about that pancake or the flower, nor have I been able to identify which one I miss more.

Damn; might be time to head back to Chicago.

PS- To listen to the Twitter Spaces w George / Verano mgmt, click here!

position / advisor $VRNOF