Chuck Schumer got off the schneid last week and finally released his long-awaited / widely-expected draft bill for comprehensive cannabis reform. It was a truly historic moment and a necessary first step as the U.S government begins to unwind / address the many damages done by the War on Drugs and the weaponization of this plant.

The market responded quickly and decisively, leaving no doubt as to how it really felt…

There were a few contributing factors for the week-over-week trap door in the space, which were above and beyond the usual custody f*ckery, hand grenades and landmines that U.S canna companies eat for brunch in the summer of 2021.

No… I’m not, just sharing our truth bc if free-markets ain’t even free anymore, I don’t wanna think about what we should call what’s happening in those dark Canadian corners and these stinky pink sheets. Double black diamond if ur trying to trade ‘em but if you step to the right and adjust your lens, it might make more sense.

Still, no matter the toll it takes on those of us playing long-ball for that genna wealth…

Technical breakdowns still matter given the first thing most people do before trading or investing is pull up a chart. And to be sure, we want a full house of positive metrics.

We wrote The United States of Cannabis in November to highlight how all four of our metrics aligned, akin almost to four legs under an investment table. U.S canna ETF MSOS ran 130% from Nov to Feb before these last five months of (cough) digestion.

I would offer two thoughts:

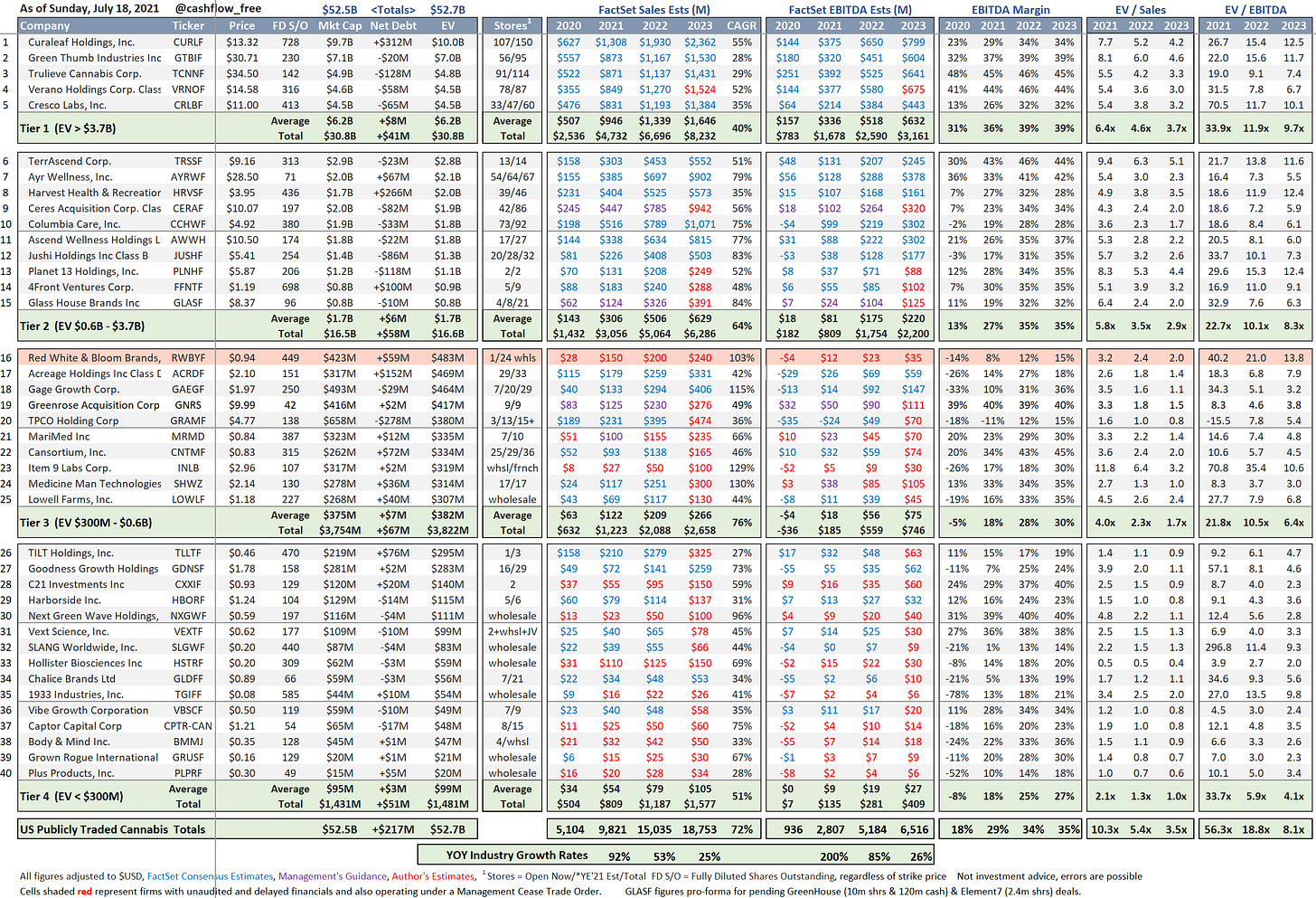

ONE, the weekly charts don’t look nearly as funky as the dailies. For instance, there’s Jefferies #1 pick Cresco Labs (200-day @ $CRLBF $11.31), Curaleaf ($CURLF $13.38)

U.S cannabis ETF $MSOS ($38.84), Trulieve ($TCNNF $36.97) (<- click for charts)

[note: Green Thumb ($GTBIF) + AYR Wellness ($AYRWF) both > respective 200-days + we’ve been adding Verano ($VRNOF) into this muck (too young for a 200-day) as it may emerge as the missing “A” in FAANG by the time the dust settles… and even if it doesn’t it, like AYR, is just too damn cheap @ ~5X 2022 EV/EBITA]

TWO, in this ever-loving bizarro world we’re living in, I suppose we shouldn’t be surprised to find our three other primary metrics improving as price degrades…

…and while I totally get the PTSD after Cannabis 1.0, or Canadian cultivation…

…this time is different bc we’re talking ‘murca here. We’ve been through a lot these last few years and well… you can do what you want to us and our P&Ls but we won't sit here and listen to you badmouth the United States of America!

Not when the Perfect Storm continues to take incremental shape, led by all the states that continue to adopt, scale or mature (and still grow) while generating much-needed tax-revenues / driving employment as the fastest-growing industry in America.

We’ve said it before and we’ll say it again: traders vote in the short-term and investors weigh for the long-term. And as long as certain stocks / proxies are under the 200-days, large packs of traders either won’t touch ‘em long or will look to press ‘em short.

And we see all you halfway crooks; so here, let us help you frame the bear case:

soft summer seasonality on top of custody f*ckery / unknowns

likelihood of no federal progress / lotsa political bickering through Labor Day

decent / not blow-out earnings bc share of wallet -> travel / dining; then unlocks.

broken charts -> weak hands -> worse charts -> puke.

soooo thin (GTI opened on 989 shares in CAD last Fri). GTI!

institutions are (literally) locked out.

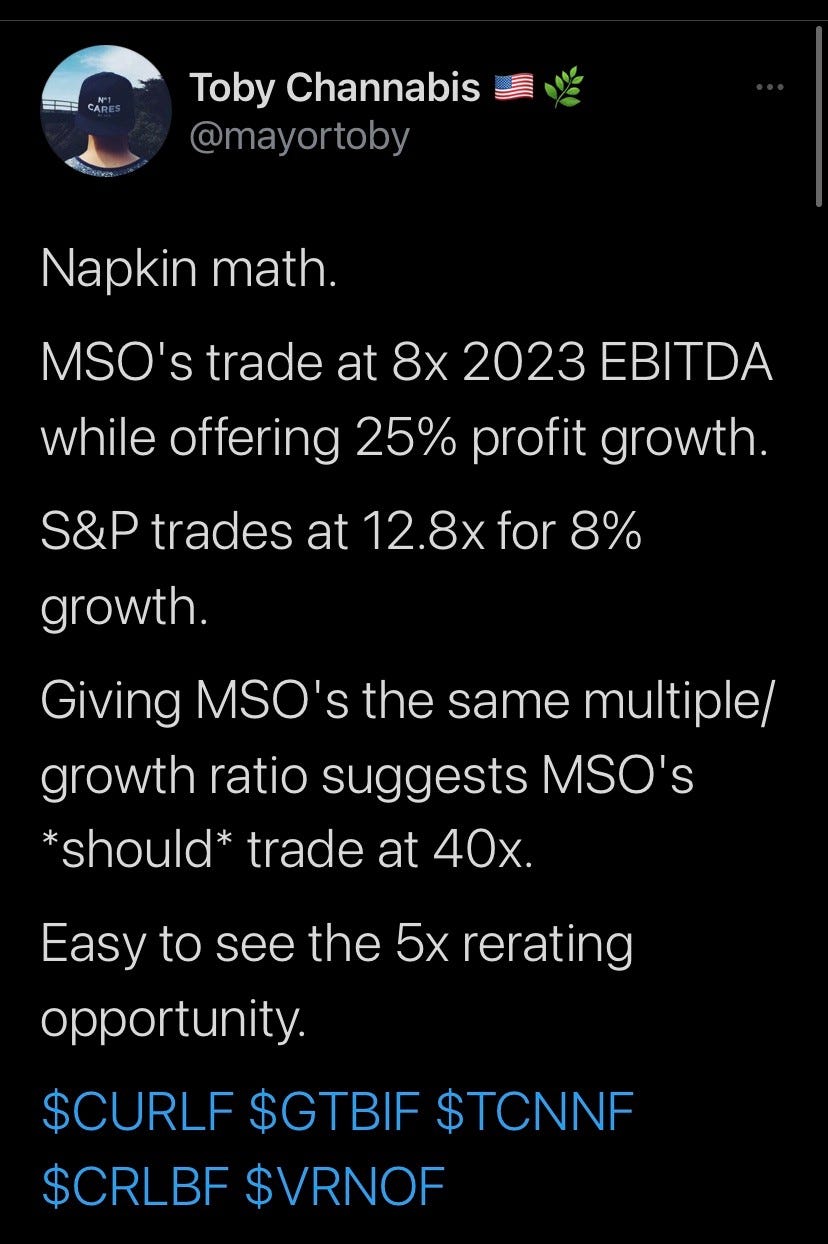

But here’s the thing: charts change; prices change, bc prices will always / typically…er, eventually reflect the underlying fundamentals / growth trajectories. @cashflow_free took a swipe @ 2023 multiples and we’re talking literal hat sizes for secular growth.

Traders are more concerned with the path they take vs the destination they arrive at; heck, most don’t even care what the destination is as long as they get paid along the way. That mentality fed my belly for many years; it is, or was, my (first) vocation.

But I’ve done my best to pay attention through the years, and learned how to adapt my approach to the environment, to the opportunity. Not always well, mind you; 30+ yrs on the street, I could tell you stories but I do strive to get better and learn from others.

So whether it’s Peter Lynch, who astutely observed that individual investors have inherent advantages over large institutions because large firms won’t / can’t invest in small-cap companies that have yet to receive attention from analysts or mutual funds…

…or Ian Cassel, who is among the many wonderful free resources on twitter that offers persistent insight for anyone willing to look / pay attention / put in the time…

…or even my friend Jason Wild, who famously said, “they can pay us now or they can pay us more later,” there is strength in numbers and unity in community as long as you surround yourself with the right collection of human capital / work hard to contribute.

And given we’ve put in the time / still believe this emerging secular growth story is in the early innings—and in part bc we’re keen to cultivate our long-term capital gains—we’ll continue to build / trade around our core U.S canna holdings, try to use price to our advantage, and attempt to remain patient with our eyes on the big picture prize.

By our lens (<-worth a click) everything we heard last week from Schumes / Booker was telegraphed in advance / a necessary step / part of a political process that will yield incremental federal change this fall / spring to supplement superb-state level growth.

[fast fwd: we believe states will always control who can grow / process / sell cannabis, the FDA will eventually have oversight (as they should) and interstate is coming but there will always be regional hubs for purposes of redundancy / force majeure]

Anyway, I’m up against the data limit again but before I go, lemme squeeze in this link bc anyone serious about investing in cannabis should have a basic understanding of the political process and this will do that: Understanding Washington: The Draft Bill.

Thanks, good luck, and let’s be careful out there.

/positions in stocks mentioned

/advisor $MSOS