Daily Recap

As cannabis becomes a regulated global industry—spanning across pharma, CPG, exports, and healthcare—the U.S. is falling further behind a self-inflicted curve. 👇

With more than 100 countries adopting some form of legalization and cross-border shipments rising quarterly, cannabis has officially arrived on the world stage. To wit,

Germany imported 72 metric tons of medical cannabis in 2024 (31 tons in Q4).

Colombia exported $11 million worth of cannabis to Europe, Australia, and Israel.

Israel is projected to reach 242,000 registered medical cannabis patients by 2027.

Lesotho, Morocco, and South Africa are all rolling out cannabis exports.

Whitney Economics estimates the total canna TAM could reach $483B and that’s just the THC side. Their models also suggest that hemp, which is used in everything from textiles and cosmetics to concrete and automobiles, has a potential global market of $456B; slap ‘em together and we’re talking about a ~trillion-dollar plant.

But canna remains classified as a Schedule I narcotic under The Controlled Substances Act, a throwback to an era that weaponized something that was already recognized by the American Medical Association. The fuckery continues to this day, manipulated by special interests and used as a political football that has never seen a first down.

That means U.S. operators have been stymied by onerous tax obligations, banished to second-tier Canadian exchanges, frozen out of capital markets, debanked en masse, and treated like second class citizens—and all that’s done is punish the pioneers and entrepreneurs that have historically made America great.

“There’s still time to catch the wave,” writes my friend Javier Hasse, “But the rest of the world isn’t waiting.”

Money Ball

Cannabis company Trulieve contributed $750K to President Donald Trump’s inaugural committee following his election last November, Federal Election Commission (FEC) records show. Add the $250,000 from Curaleaf, and the Trump team took in at least $1M from the cannabis industry ahead of his second swearing-in ceremony.

Interestingly, the banking system seemed to work just fine for those transactions.

Viking Briss

Minnesota’s cannabis industry just crossed a major milestone. The Office of Cannabis Management announced that the final rules governing the state’s adult-use market were officially published, greenlighting the next phase in launching the industry.

When Tennessee hemp was regulated in 2023, there was a THCA loophole but a bill that just passed Tennessee’s Senate in a convincing 23–9 vote effectively bans hemp-derived THCA, and that is now making its way to the Governor’s desk for signature.

Stocks & Stuff

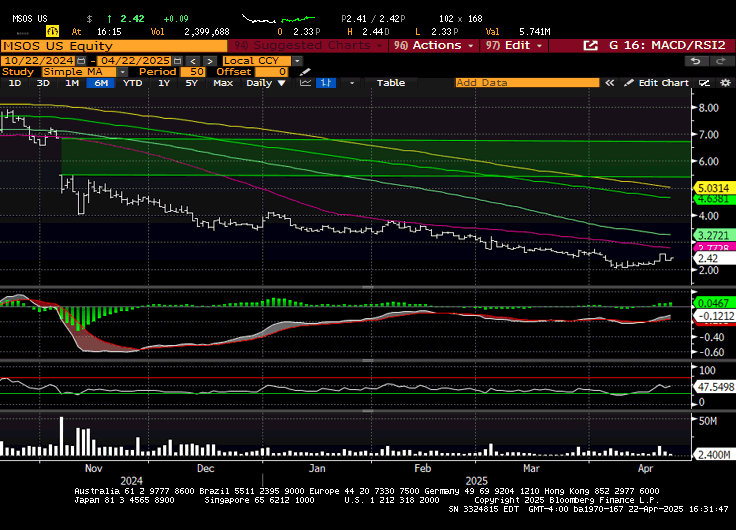

Turnaround Tuesday lived up to its name as stocks and the dollar bounced and yields paused. Canna caught some of those macro tailwinds on both sides of the border, but volumes on the U.S. side remained light. MSOS finished the session 4% higher.

Below, we’ll top-line our universe, continue coverage of the two-sided tariff tantrum—including potential domestic implications of the fading perception of exceptionalism—and offer random thoughts on everything from hemp regs to the lowest hanging fruit.

All that and more, just scroll down… because there’s no paywall today.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ ETF Notional: $6M

Top Stories

Is America Missing Out on the Global Cannabis Boom?

U.S. Cannabis Companies Donated At Least $1 Million To Trump’s Inauguration

Minnesota Finalizes Cannabis Market Rules, Paving Way for Business Licensing

Tennessee Lawmakers Closes Hemp THCA Loophole

Kentucky Gov. hopes medical cannabis available in late summer or early fall

DEA Officials Face Dismissal in Trump's Schedule F Workforce Reform Plan

Israel’s Finance Minister pushes back on tariffs on Canadian cannabis

Industry Headlines

Village Farms Refinances and Extends Canadian Cannabis Credit Agreement

The Cannabist Launches Adult-Use Sales at Mays Landing in New Jersey

SNDL Launches Rise Rewards Loyalty Program

Pregame (written in real-time at 8:45 AM ET)

Welcome to Turnaround Tuesday, a day that many bulls hope lives up to its name.

Following yesterday’s puke, premarket futures are green, gold topped $3500 for the first time, the dollar starts the session flattish, and rates remain stubbornly sticky.

While the reverberations of the trade war continue to manifest on the global stage, the consequences are being felt much closer to home. Fed mouthpiece Nick Timiroas penned a WSJ article this morning that sums up the fears felt by small businesses:

“Basically, what we’re doing is eating our inventory and hoping that it will last us until this gets settled,” said the CEO of Basic Fun, a Boca Raton, Fla.,-based seller of children’s toys. “If it doesn’t, we’ll be out of business.”

As someone who stared at markets for 35 years, this particular brand of financial crisis is both familiar and unique. The former because every crisis stress tests the “full faith and credit of the U.S. government,” and the latter given how abrupt the global order disrupted, how quickly 'full faith' was shaken, and the uncertainty surrounding repair.

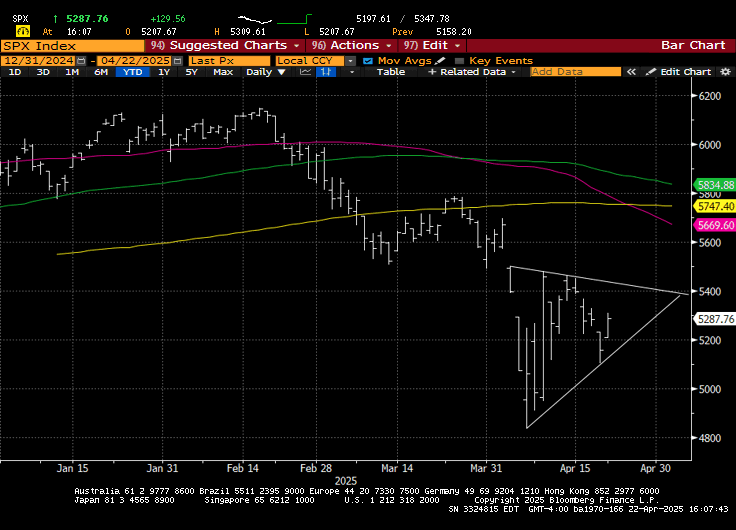

Of course, the market already knows this, hence the process of price discovery and outsized volatility. What we don’t yet know is how bad it’ll get. Market observers are watching the April lows for guidance, and 🙄🔫 they’ll be tested over time.

“The unwind of the US exceptionalism trade has seen the S&P 500 tumble 8.1% so far in April, compared with a 0.4% dip in a measure of global peers. That’s the largest monthly lag in 32 years.” WSJ

In our little corner of the universe, MSOS gave back last Thursday’s brief double-digit gains, which I would attribute in equal parts to 1) Pavlov’s pups selling any semblance of green, 2) the broader market melt, 3) politics take time (and most peeps don’t think this will pass), and 4) Monday ends with the letter “y.”

As we continue to see states take intoxicating hemp matters into their own hands—an incremental positive for state-regulated cannabis that will filter through over time and as a function of enforcement—the real question is whether STATES Act 2.0/ PREPARE was it, in terms of near-term federal progress, or if there’s more to come.

We hope to have further color regarding some of those intentions in the near future but none of it will matter for today. Sector bulls will try to hold a higher low for the ETF—they gotta start somewhere—while sector bears have no reason to adjust their gameplan, at least not yet.

Chart Check: MSOS

Higher lows, sure, but context is important; the green channel is the election/ Florida gap lower and the further we zoom out, the less significant/ evident it becomes. The ETF has become a defacto call option on federal reform; there’s alotta wood to chop.

Chart Check: S&P

Bulls gonna wanna take out the top of that flag bc those patterns typically resolve in the prevailing direction, which in this case is lower.

Random Thoughts

We'll see some trade deals cross the wires but that confidence thing looms large, like a thick, dense economic fog. Credit of a different breed—that of credibility—is what ties our finance-based global economy together.

The uncertain tax liabilities are getting in the way of cannabis deals, restructurings and as we’ve seen in real-time, the appetite for U.S. cannabis stocks writ large.

The rush of state-level intoxicating hemp reform seemingly signals that canna and hemp will be left to the states (can't piss off farmers during a trade war!)…

…but the Mexican cartels and Chinese crime rings operating in plain sight under the guise of 'legal hemp’ could shift that political calculus.

I still sense the most likely catalyst—the lowest hanging fruit—is Schedule III, as PB can bypass the ALJ and publish straight to the Federal Register. That would check the box on a DJT campaign promise and give RFK Jr. cover for his desired research.

Marijuana Mathlete

$483B in THC + $456B via hemp =$939B, or $61B shy of $1T—and way ahead of schedule—but tbh I envisioned there’d be more jingle in my jeans by now. 👇

The DeSantis Swamp Music ain’t going away, which is nice.

Stems & Seeds

USDA National Hemp Report Covering 2024 Crop Year Released

Former cannabis executives share tips for successful exits

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.