Note: still tooling around substack but as someone who craves information and insight, and constantly montiors positioning and set-ups, I’m gonna beta-test certain content propositions to see what resonates w the audience. Please share w friends if you enjoy, and lmk what you think via comments. and for purposes of disclosure, assume we own all the stocks we discuss, and will note clients* to avoid even the perception of fuckery.

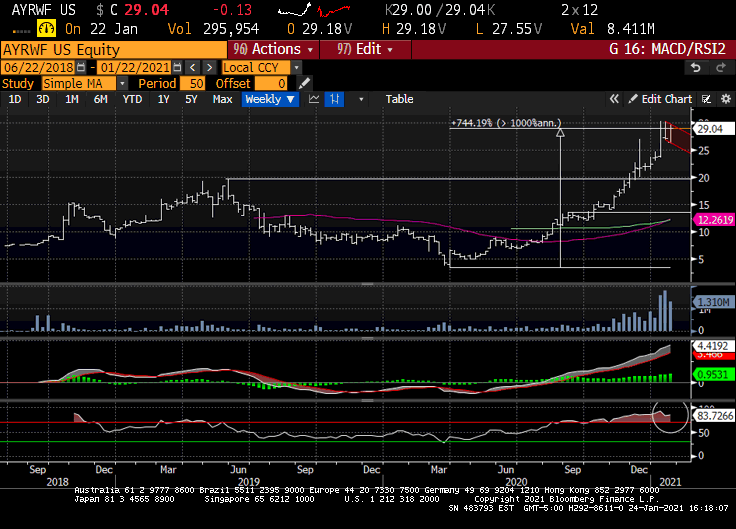

$AYRWF: overbought / integration risks (plural) / +750% since March, yada yada yada we gotta lotta cushion for the pushin’ @ 6X 2022 EV / EBITDA. Note the emerging bull flag and remember that overbought conditions are a by-product of a structural offsides in long-term cannabis positioning. In these early days on the 2.0 frontier, there are still arbs and this is one of ‘em. Bigly, IMO, as long as Jon & Jen execute.

$BMWLF: recent addition to the “I’m comfy enough to put my good name next to this company” and it’s already off the board. BBC (Big Brady Cobb) punches his golden ticket and integrates w Charlie & his Cannabis Factory, giving Cresco it’s fabled Florida footprint and some of the best darn product I’ve, uh, heard about. Still gotta ~16% arb, and we’ve got the Texas two-step on (long Cresco / long Bluma).

$CCHWF*: quietly testing fresh ATH’s following the breakout last month; still comps better-than-well vs. 2022 and is miscast as a medical medical franchise. Meanwhile, it’s got the 2nd largest footprint behind BoJo, they scooped a massive footprint in Cali (Project Cannabis) and Colorado (The Green Solution) when everyone was sour on “mature markets” and they’ll backsplash those SOP’s across this grand land.

$CRLBF: we said Cresco had a date w ATH’s and we’re there now. Some sideways flaggin’ < ATH likely resolves as $TRSSF did a few wks ago. If you think the world is heading toward wholesale (there are tax loopholes in wholesale for medical only states; BBC told me that) Charlie & his Cannabis factory maybe Wayne Gretzky in disguise bc that’s where the puck is going.

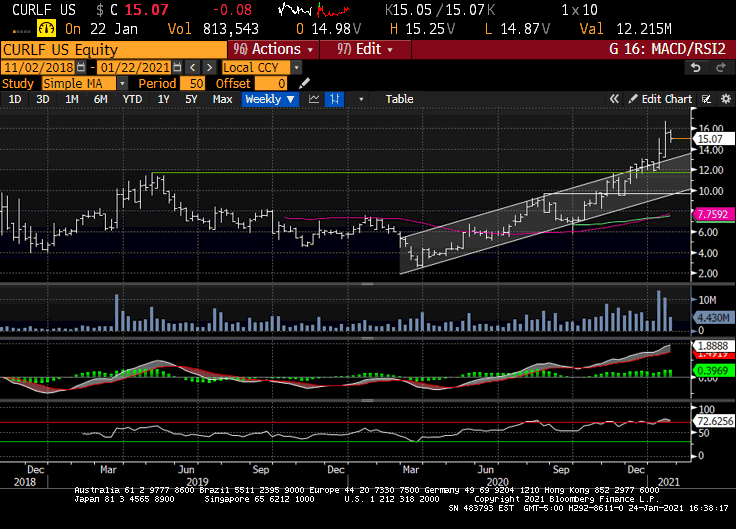

$CURLF: the 800-lb gorilla of US cannabis is navigating blue skies and when the big boys come for cannabis, they’ll come for BoJo & Co. We’ve written about the FANG-ification of US Cannabis and the Barbarians at the Gate so if you don’t know what I’m talking about then ketchup and quick; time is money. And so is BoJo.

$CXXIF*: digesting a monster run, this could be the most accretive acquisition on the board. idk if they’re a seller but math is math is math. Meanwhile, Scotty, er, Sammy J is a must-follow for anyone serious about following US cannabis on Twitter.

$CNPOF: depending on the many moving parts, should have bw C$1.50-1.75 in cash after a slew of transactions and with the right strategy / stewardship, this maybe my sleeper pick of 2021. A grand total of three analysts cover the stock and Jason Wild / JWAM will own 24% or so when the dust settles. Follow the smart money? We bought $TRSSF sub-$2 a yr ago (JW is Pubah there) so yes please; got one eye on the rounding bottom and the other on ATH’s > $7.

$CWBHF: added Charlottes in December (small) bc the new FDA will likely trigger flows into the market leader. I know it’s a saturated category but that’s a different conversation. When the efficacious agility of cannabinoid wellness emerges in cannabis 3.0, it’ll illuminate a halo over the consumer curve. Cue the Spider.

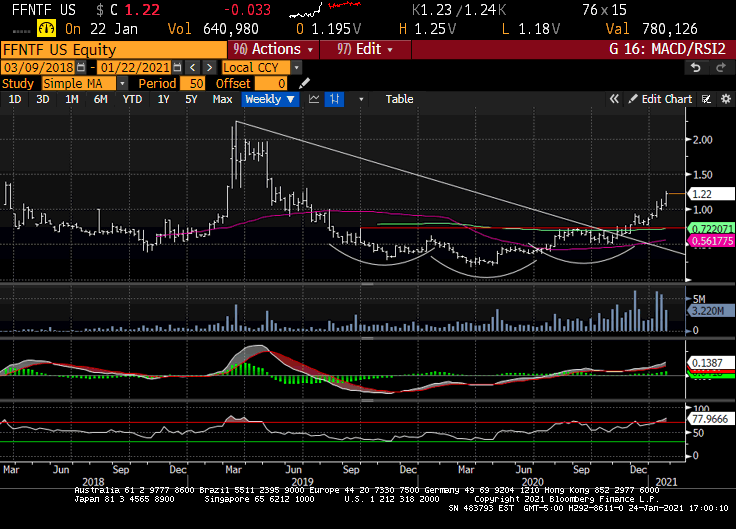

$FFNTF*: that IHS (inverted head n’ shoulders) worked like a charm in a stair-step higher for VFF’s stateside (low cost producer) doppelganger (is that how you spell it?) Comps great (vs. 2022) and it’s less filling. Besides, their on a mission from God.

$GTBIF: it’s gotten to the point w Green Thumb that when it’s red, we simply say “thank you” and buy a little. idk if they’re best-in-breed but if not, it’s darn close. Lee Cooperman owns it. Bill Miller just filed. Ben, Andy and the lot of ‘em are doin’ it, doin’ it, doin’ it right.

$HRVSF: definition of higher risk / higher reward, we added coming into December and pressed the upside on Friday when Arizona shocked the world and flipped the adult-use switched thisquick. The poster child for a tough balance sheet turns into “pretty cheap” when #AZ + SAFE makes that balance sheet less toxic. The Canadian kind (HARV) is > the 200-day, so that’s something.

$JUSHF: all she wants to do is, flag flag (in a good way). Just when you thought she was extending, she wants for more.

$PLNHF: not a name at these levels but she sure has her fans.

$TRSSF: lots of companies raised money but JW & Co. crossed $175M in a private placement, shut out the street and left ‘em wanting for more. This stock was en feugo in 2020 and ain’t no quit in the kid. $CGC buying up here, part of that $STZ - $CGC - $TRSSF - $ACRHF - $SLGWF US cannabis food chain. Top 5 holding for us, still.

$TCNNF: If you believe that Florida, with it’s 3.5X national Rx average / elderly population is the future cananbinoid wellness capital of the world, you should get to know Trulieve. Margins will decrease / multiple should increase with proper execution across an expanded footprint.

$VREOF: Big start to the new year but NM + NY + AZ = sum of the parts w room to run, so long Dr. Kingsley executes. Doctor?

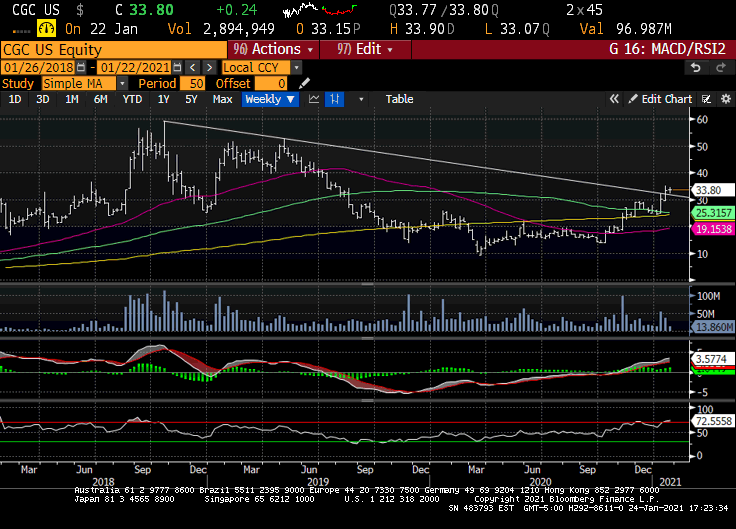

$CGC: CEO David Klein thinks Canopy will be in the US by year-end. If he’s right, it’s gonna be a helluva year. Either way, note the break of the all-time downtrend. I’m a gorilla, you monkey!

$VFF: Best fundies in Canada, global footprint, stealth US play, best CBD distribution in NA; just did a huge raise too. Wake me up > $20 US por favor.

$GWPH: They just pre’d positive, just announced a new product cycle, and… never mind. Just please see the chart. > $144 -> $210 -> $350 -> $500 IMO. pls write it down bc I may have to take this off my screen. Stay humble or GW will do it for you / me.

There’s football on so gonna flip the switch. /positions assumed across the board but it’s not about me telling you what to do vs. shining a flashlight on opportunities we’re involved with. Sometimes right, sometimes wrong, always honest.

You’ll see. Again, and again. And again.

Todd

Love this format. Like that it is emailed to subscribers and better than the small form of Twitter.

A wealth of info Todd. Really great. Would love to get your thoughts at some point on some of the newer opps like $GRAMF and $GNRS (merger dependent, obviously).