It’s been more than 20 years since the catalyst for my journey into cannabis occurred; over ten since I started digging into the history, science and set-up; and about five since we started CB1 Capital while trying to contextualize the space / educate others.

And it’s not like this frontier industry was ever really a duckwalk, whatever that is..

…not with the BI Global Cannabis Index some 91% below where it was in January 2018 when the cannabis 1.0 (Canadian cultivation) bubble burst. It’s been one hell of a haul that’s taken a toll of time/ money, while also taxing the energy/ enthusiasm of industry operators and investors alike, but here we are.

[note: cannabis 2.0 is U.S-led CPG and 3.0 is the biotech pathway / efficacious agility]

We recently spoke about sector specific risks and as global markets continue to digest the evolving macro headwinds, the percolating cannabis pessimism continues apace…

…and while this may well be the mirror image of the giddy enthusiasm that swallowed this space when New Jersey first voted cannabis through in November 2020, signaling the tristate adoption, and before the Dems took the Senate, indicating federal reform, it’s somewhat ironic that a year later those catalysts are finally here and nobody cares.

New Jersey, after numerous delays / bitter disappointments, is poised to launch adult-use (CRC meeting is tomorrow). Not only will this generate significant revenues for state-licensed U.S multistate operators, including Verano ($VRNOF), TerrAscend ($TRSSF) and Curaleaf ($CURLF), it will catalyze neighboring states to move faster.

[New York, which is trying to launch its adult-use program later this year, just passed a budget that will allow cannabis businesses to take state-level tax deductions and the Pennsylvania Senate just approved state-level banking protections. It’s been / remains our view that states, as the laboratories of democracy, will continue to drive progress]

The emergence of east coast cannabis markets couldn’t come at better time; bw the post-COVID normalization, a Croptober-driven seasonal slowdown and share-of-wallet concerns given food / energy inflation—and a market not yet mature enough to know whether cannabis is a staple, discretionary, or both—investors have become increasingly and yes, understandably impatient.

Meanwhile in Washington D.C., SAFE Banking is once again in play, this time in the House version of The Competes Act, while Senate Majority Leader Chuck Schumer is soliciting feedback from the GOP before he drops his bill later this month. We don’t believe that the votes exist for comprehensive reform but we continue to believe that SAFE will pass prior to this summer or (more likely) later on this year, with criminal justice elements added and post-midterm Biden clemencies to follow.

What else? Glad you asked; some Random Thoughts in no particular order:

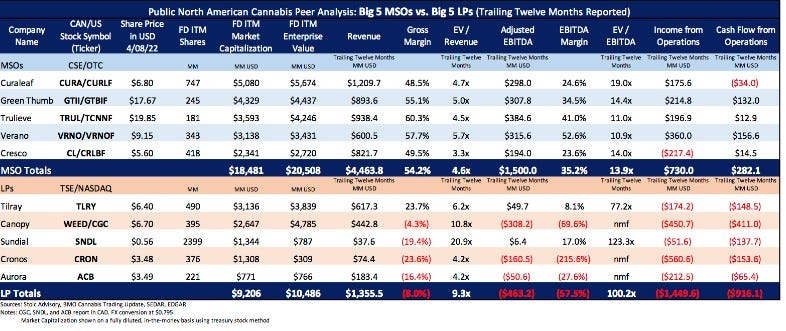

Per Sammy J, the U.S Canna FAANG ($CURLF $GTBIF $TCNNF $VRNOF $CRLBF) EV / TTM (enterprise value / trailing twelve months) Sales of $4.5B = 4.6X w EV / EBITDA of $1.5B = 13.9X. The Canadian Big Five ($TLRY $CGC $SNDL $CRON $ACB) EV/TTM Sales of $1.4B = 9.3X w EV / EBITDA 100.2X…

Maryland Governor Larry Hogan is a Hero as he announced he won’t stand in the way of a cannabis legalization bill if voters approve it this November.

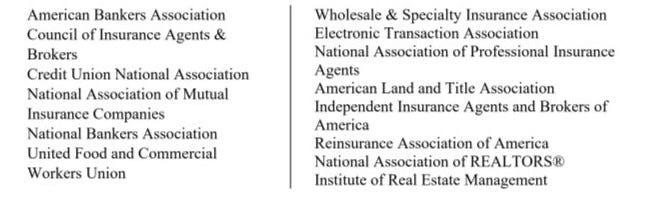

Treasury Secretary Janet Yellen and a federal financial regulator joined the long list of trade groups / associations, with the folks below, in staunch support of SAFE Banking.

As discussed in December, when the effort to include SAFE in the NDAA came up short, the “unprecedented” support reverberated across the Hill and a certain House Speaker likely made a horse trade with a Colorado Congressman; and with midterms approaching, we simply don’t see a scenario where Schumer / Booker return to NY / NJ w/o functional banking for their social equity programs, a view shared by recent policy hawk-turned-dove Isaac “Lightning” Boltansky @ BTIG:

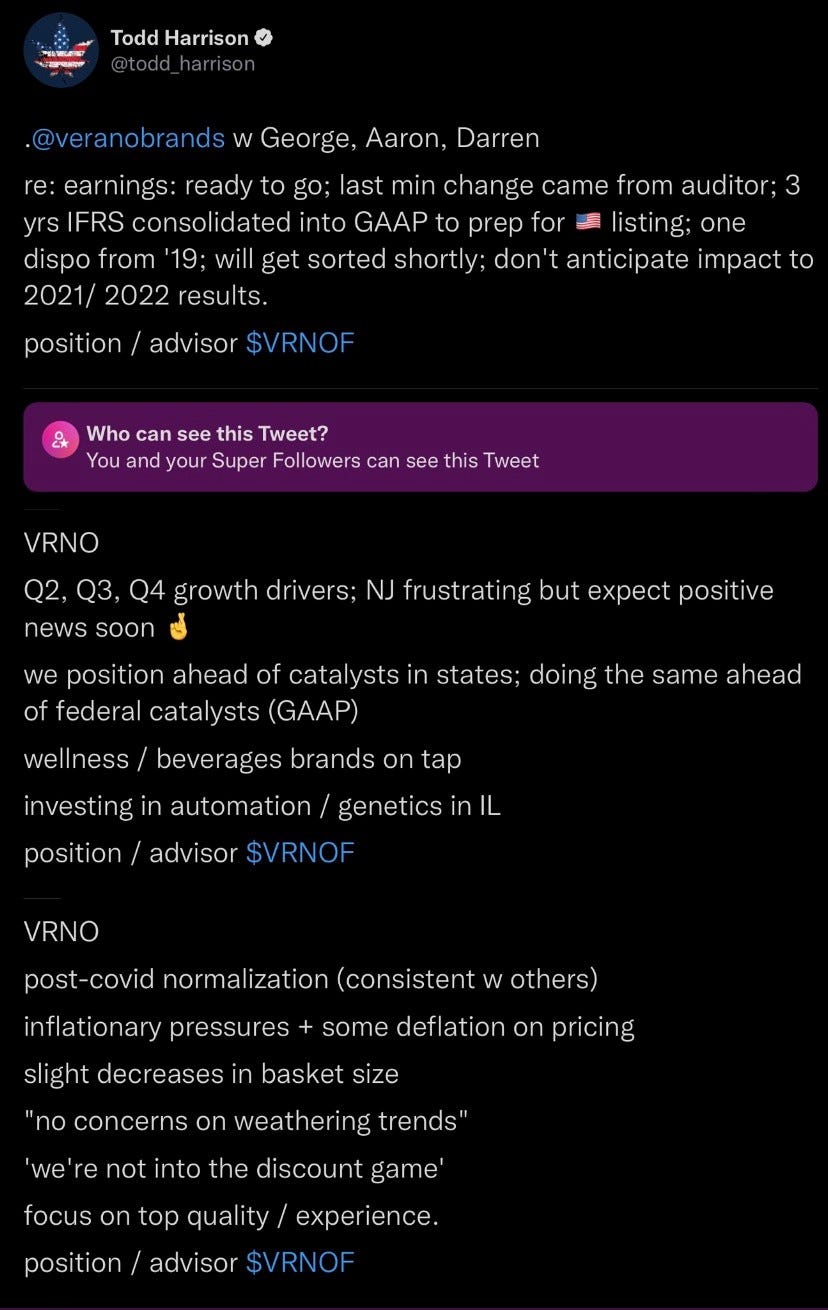

I recently launched @SuperFollows on Twitter (available on iPhones / Androids). I’ll continue to post news / other views on Twitter proper and dig deeper into the stock side on SF. It’s a small toll and a trial run to see if community w/in community sticks.

Jeff Schultz, Brady Cobb and I hosted a Twitter Spaces last week with the man in the criminal justice arena, Weldon Angelos. You can listen to it here + if you would like to support his efforts to release non-violent cannabis prisoners, you can do so here.

And finally, last but not least, have a great week and hey, hey, hey…

/positions

/advisor $MSOS $VRNOF