The following is a sampling of Cannabis Confidential content—random paragraph grabs, charts and notes, interesting happenings and other stuff— from last week.

You can click through the title to access any article; most stock stuff is usually behind the firewall + you can access a free trial by clicking below; thanks for your support.

Canadian Goose

U.S. canna takes off up north.

January 15th, 2024

The U.S. government released hundreds of pages of documents related to its ongoing review of marijuana’s status under federal law, officially confirming for the first time that health officials have recommended the Drug Enforcement Administration place cannabis in Schedule III of the Controlled Substances Act.

The Department of Health and Human Services released 252 pages of documents that explained cannabis has “a currently accepted medical use in treatment in the United States” and a “potential for abuse less than the drugs or other substances in Schedules I and II.”

Canadian Bake-In

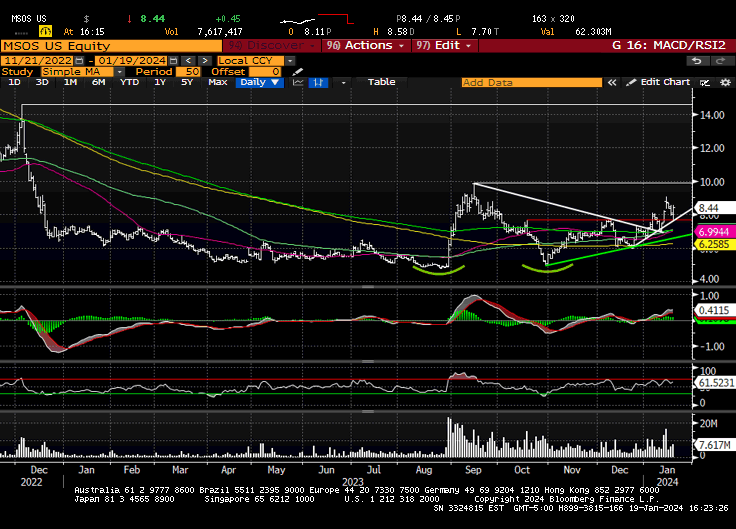

U.S. markets were closed in observance of Martin Luther King Jr. Day but U.S. canna stocks traded in Canada. Despite the NYSE-listed ETF MSOS being sidelined, most underlying stocks finished the session higher, with AYR leading the way (+22%).

We’ll see how much this translates—who was buying today to sell to eager US traders coming in hot tomorrow, vs. how much new money will come in but our guy Sammy J calculated that MSOS intrinsic value landed today at $8.81 (vs. $8.20, or +7.5%).

The Heartbeat of America

Illinois is blazing a trail to becoming one of the largest legal cannabis markets in the United States. Since adult-use kicked off in January 2020, the industry raked in over $5 billion for the state, with adult use cannabis sales setting a new annual record in 2023, exceeding $1.6 billion and set to reach $45 billion in sales nationally in 2027.

Terrapin Station

Maryland canna sales set a new monthly record to close out 2023, with nearly $96.5 million in combined purchases between the state’s medical and adult-use markets.

All told, the state saw $787.5 million worth of legal marijuana products sold in 2023—even with the recreational market launching halfway into the year.

It’s in the Game

This was something I wrote years and more % than I care to calculate ago, but the thesis still stands: MSOS is the Trojan Horse into the U.S. cannabis space and will remain so until the underlying equities can by custodied by large institutions.

Jefferies on U.S. Cannabis:

“If DEA agrees with HHS on SIII, then in addition to the cashflow benefits from 280e going away, we also think this Schedule could have possible implications for uplisting to major exchanges and opening the space up to more institutional involvement. This is something which is very limited to date, and the main reason — in our view — that multiples are so depressed and do not accurately reflect the fundamental outlook.”

Follow the Science

Investors revisit U.S. cannabis.

January 16th, 2024

New York Governor Kathy Hochul (D) is calling for the elimination of a THC potency tax as part of her executive budget in an effort to reduce costs for consumers in a way that could make the regulated market more competitive against illicit operators.

Her 2025 budget would repeal the potency tax and replace it with a wholesale excise tax of 9% in a way that “simplifies, streamlines, and reduces the tax collection obligation.”

Last Dance with Mary Jane

Nine cannabis-related bills have been introduced into Indiana’s legislative session, with most aimed at legalizing the plant in some capacity. Lawmakers have cited tax windfalls in states like Illinois and Michigan as incentives to finally go green.

Full Circle

After gapping 8% higher on the opening, U.S. canna ETF MSOS almost made all gone before buyers emerged late in the day to steady the space. The total notional volume of U.S. plant-touching stocks was $250M, with $141M of that via the ETF.

Housekeeping

We have our bets placed—some trades, some cores—but we’ve manicured our risk a bit as we were top-heavy Tier-ones (which will get the lion’s share of 280E benefit) vs. select backend boys which, while riskier, should see some relative beta.

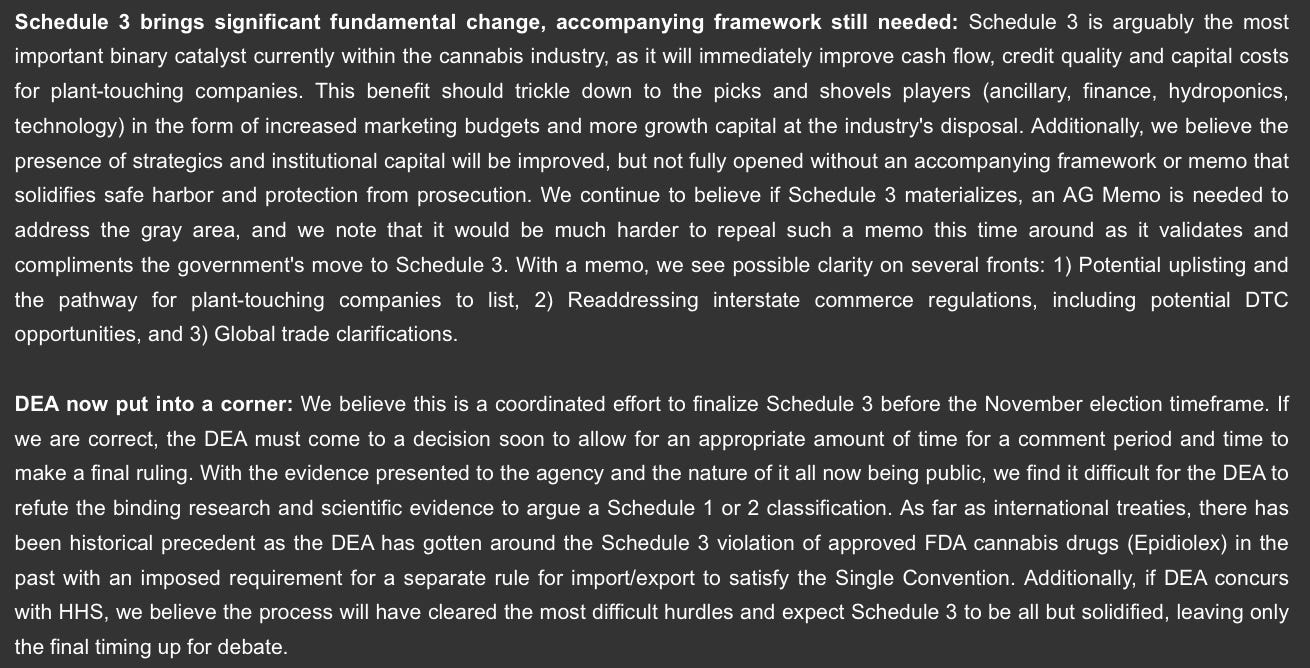

Roth on U.S. Cannabis

"We believe this is a coordinated effort to finalize Schedule 3 before the Nov. election.”

AGP on U.S. Cannabis

“Top MSOs trade at ~7x 2024E EBITDA multiple, compared to CPG at 14x & high growth retail at 14.5x + potential for MSOs to trade at a premium to traditional categories.”

Pablo (formerly of Cantor) Zuanic:

"A company with, say, 20% retail share on a $150Bn market would have sales of $30Bn (not factoring in non-US sales, which could add another $50-100Bn to the global market). Adjust that number to wholesale (using 0.5x), take 25% EBITDA margin and a 20-30x EBITDA multiple, and that said company could be worth by then over $110Bn"

Coming to America

U.S. cannabis is about to arrive.

January 17th, 2024

The Michigan state cannabis industry sold over $3 billion worth of ganja last year—or about $305 worth of marijuana for every man, woman and child in the state. That’s more than the gross domestic product of 51 nations, nearly reaching the GDP of the African nation of Zamunda Burundi.

Old Bay City Rollers

Maryland legal cannabis shops sold just under $800 million worth of products since the adult-use market launched in July. There are now 96 dispensaries, 18 growers, 23 processors, five testing labs and 32 “ancillary” businesses in the Old Line State.

Glad, Glad, Leroy Brown

The Illinois Department of Financial and Professional Regulation announced that the state’s adult-use cannabis sales exceeded $1.6 billion in 2023, setting an annual record for the third consecutive year.

"From day one, my administration has put equity first to build the most accessible cannabis industry in the nation." -Gov. JB Pritzker

Bowl Cuts

We hiked to the Hump in this abbreviated week with a 24% three-day gain (MSOS) and a buzz that’s attracting attention across new crypto and MSM circles.

We know expiration influences will remain in play—there is outsized open interest at $8 and $10, which are magnets into Friday—and as volume composition is fast money, retail, algos and a handful of funds, we expect presses and stresses as we traverse this road to redemption.

See You Next Tuesday

Ever since Jason Wild said that the HHS data dump last Friday was akin to a massive confession by the U.S. government, I can’t stop thinking about how right he is. The government response to the/his federal lawsuit is due on Tuesday, btw. #LFG

Bloomberg Intelligence on Cannabis:

'Market sentiment toward the U.S. cannabis sector appears to be around its lowest point over the past five years... as of mid-Jan., valuations of the leading operators were below the S&P 500, a contrast to the broad premiums before Q122'

Eyes of the World

Focus shifts to the D.E.A

January 18th, 2024

The American Nurses Association is applauding the U.S. Department of Health and Human Services’ recommendation to move cannabis to Schedule III, saying it’s “a positive step toward developing an evidence-based approach for marijuana and related-cannabinoids use in disease and symptom management.”

“This marks the first time HHS has publicly acknowledged marijuana’s medical use.”

Market Stuff

We entered today’s session fully expecting an early press, per |X-Subs:

if you aren't expecting a press lower you haven't been paying attention; we have some room in context of higher lows/ highs. lotta lenses depending on your risk tolerance/ time horizon so find your rhythm; expiration influences def in play.

Three thoughts:

the magnet at $8 will disappear tomorrow (expiration).

the trend channel (higher lows/ highs) remains intact.

we’ll hear from the DOJ on Tuesday in response to the lawsuit.

Answer I Really Wanna Know?

Which CPG executive is speculated to have paid $10M personally for 1,000,000 shares of Green Thumb at $10? We know Ben and Anthony sold—but who was the buyer?

Smarty Pants

First time I’ve seen Bloomberg intelligence hosting a cannabis webinar. If you would like to listen on February 6th at 10 AM ET, you can click here to register.

Kingpin

U.S. cannabis digests expiration.

January 19th, 2024

President Biden stands to make significant political gains if cannabis is rescheduled under his administrative directive, according to a new survey that reveals a majority supports the reform.

It also found that voters favor marijuana more than Biden and former President Donald Trump, which really isn’t all that surprising.

Kathy Ire-Land

New York’s Gov. Kathy Hochul (D) is proposing the elimination of the state’s potency tax on canna products, which would be a win for the industry. The effort comes amid growing momentum in the New York market, which has been a shit show struggled since launching a year ago but now seems to be moving in a better direction.

“Taxes are one of the biggest impediments to accomplishing a legacy-to-legal transition and pose the greatest disadvantage for legal operators in their ongoing efforts to compete.”

Inside Baseball

Government health-related agencies released 252-pages of evidence late last Friday arguing that cannabis should be (at least) Schedule III. The U.S. canna ETF MSOS closed at $8.20 just prior to that news and this morning, it was offered at $8.

By 3PM, MSOS was +6% at $8.47 ($80M/$42M) as the natives did what natives do: be in a better mood when the screens are green; everything’s funny when your making money.

our space held where it had to at Dec highs/ trend channel low, which is better than a stick in the eye as we ready to exhale; dk if the Tues deadline will be the trigger but sure looking forward to hearing what they have to say; real change is afoot either way.

We closed slightly off the highs and +3% for a week that felt, in a word, digestive, with technicals intact as we get off the babysitter put our pens down for the weekend.

Plumber’s But

In several conversations with (big x) big fund managers, there is definite interest in getting involved once the custody situation is resolved.

It’s been a consistent theme—I hear it from bankers, RIAs, FO’s and other funds—and to me, it also serves as a stark reminder that the composition of the volume will remain fast + loose until real money can access + real companies get cap tables they deserve.

Regardless of the timing of our perceived forward catalysts, it’ll take time to unfreeze custody and run the traps that’ll get institutions comfortable with direct ownership.

Until then, MSOS remains the only NYSE-listed vehicle with the capacity to service such demand at scale, should it materialize.

Capital Call

Friendly reminder: as stocks find sponsorship after three years of capital starvation, we not only will see equity raises, we should see equity raises.

The lack of (cash flow) visibility to service debt has been the anvil around the neck of this industry. Confirmation + timing of Schedule III and clarity around other drivers (Ohio, Florida, SAFER) will help drive the demand needed to de-risk balance sheets.

The best type of raise? Strategic, for sure; CPG is waiting in the wings and some of those conversations have already taken place. Private placements are another route and would be much preferred to ‘bought deals’ that allow the scoundrels to cover.

And one last thing: Where the hell is Beeks Garland?

/end

Enjoy your weekend, be safe and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.