The following is a sampling of Cannabis Confidential content—random paragraph grabs, charts and notes, interesting happenings and other stuff— from last week.

You can click the title to access any article; most stock stuff and analysis is behind the paywall and you can access a free trial by clicking below; thanks for your support.

Dehydration 👈

Canna cramps without liquidity.

May 28, 2024

To meet the federal definition of hemp under the 2018 Farm Bill, a cannabis product must contain less than 0.3 percent delta-9 THC. Now, in a new letter clarifying that limit, a top DEA official says the threshold includes not only delta-9 THC but also the related cannabinoid THCA, which is converted into delta-9 THC when heated.

DEA’s position on THCA comes as federal lawmakers reconsider how to address hemp and cannabinoids under a revised version of the Farm Bill. An amendment that would ban intoxicating hemp-derived cannabinoids (such as delta-8 THC) was adopted last week by a key House committee.

Czar Tissue

The White House drug czar says the Biden administration’s move to reschedule canna will have a “historic and long-lasting impact” that could also make banks more willing to work with state-licensed cannabis businesses via “legitimate interstate commerce.”

“Rescheduling is a process that will continue to go on for the remainder of the year. The historic nature of the actions we’re taking cannot be minimized.”

New York Throughway

Chris Alexander, the inaugural head of the New York Office of Cannabis Management, resigned following weeks of public turmoil between the agency and Governor Kathy Hochul’s office. He had served in that role since September 2021.

“I planned to serve out the remainder of my term but I no longer have confidence in my ability to do my job and lead this team effectively under current circumstances,” he said, implying that he effectively lead that team under other circumstances.

Pregame (written 7:55AM) 👈

The most significant canna news in over 50 yrs didn’t arrive without controversy. The proposed rule, championed by President Biden and signed by the AG, wasn’t signed by DEA Admin Ann Milgram because the DEA has yet to make a final determination.

There was already speculation about what could go wrong or where this process may get delayed. While most didn’t expect the DEA plot twist, a still-viable timeline, heavily invested political capital (WH) and the fact the DEA will afford significant deference to HHS's scientific and medical determinations (+OLC) suggest this process remains on track to conclude prior to the November elections.

Still, the additional uncertainty was enough to trap bulls and tip U.S. canna through technical support as shorts pressed and incremental buyers remained gated. With notional volumes this low (sans custody), it doesn't take much to push these around.

The punchline is the U.S. canna thesis continues apace despite the puke-worthy price action. Rescheduling should continue to price-in as the box for each step is checked, we expect the Garland Memo to fill in a lot of blanks, another SAFE Banking push is still floating and there’s the possible GOP pivot given the polling and popularity.

All the while, state-level fundamentals are pointing to a much better 2025 as OH, NY and other states scale and FL + PA ready to perhaps flip the 420-switch. Per Echelon:

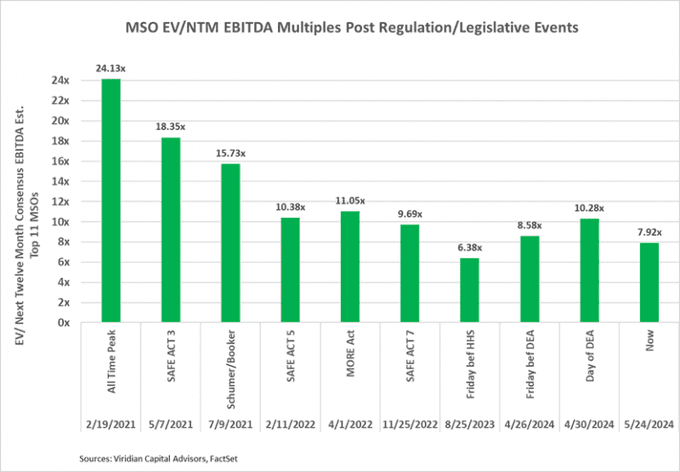

Rescheduling implementation officially underway & de-risked. Large/mid-cap MSOs trade at 9x 2024E EV/EBITDA vs. trough multiples of 6x, peak multiples (Feb. 21) of 24x, and comparable industries (i.e., Beer, CPG, Retail) bw 10x-16x.

Composition of Volume

Uncle, Sam 👈

Towels and cookies get tossed.

May 29, 2024

DEA Administrator Anne Milgram has come under fire from GOP congressmen over the apparent divergence of opinion surrounding cannabis rescheduling. Per the AP, DEA deputies were informed in March the DOJ would sign the document instead of her, while the DOJ is understood to have overruled the DEA’s request for more time.

GOP congressmen Andrew Clyde and Ben Cline have written to Milgram to press for an explanation of why she failed to sign the proposals, while citing ‘grave concern’ over her repeated refusal to respond to questions’ from members of congress.

SAFER Neighborhood

Cannabis stores and products that operate in four-fifths of U.S. states are regulated by state rules and are not in compliance with the CSA or the FDA, and rescheduling from Schedule I to Schedule III doesn’t change the federally illegal status of marijuana.

After rescheduling, financial institutions may be more likely to take the risk of banking marijuana-related businesses but exposure to federal anti-money laundering and racketeering laws will persist, which is why SAFER Banking is still needed.

“The solution is the bipartisan SAFER Banking Act, which allows banks to provide services to the canna industry in states where it’s legal. Passing that legislation in Congress would address the ongoing legal limbo, while enhancing public safety, tax collection and transparency.” -American Bankers Association

Out of Africa

South Africa’s president signed a bill to legalize marijuana possession and cultivation.

The reform has been years in the making, with lawmakers well past a deadline after a Constitutional Court ruling in 2018 deemed the prohibition on simple possession and cultivation of cannabis to be unlawful, mandating legislative change within two years.

Hello, Cleveland

A group of rules that will guide the operations of Ohio’s adult-use cannabis program go into effect today, including one that gets rid of patient and caregiver registration fees for medical marijuana use.

That puts Ohioans one step closer to being able to purchase cannabis products from dispensaries, since another rule that went into effect today has to do with applications MMJ dispensaries will submit to become dual-use dispensaries.

Context

Since our space awoke on the HHS leak last Aug, the ETF has seen seven 30% moves (twelve 20% moves) either way, each triggering intense feelings of joy or pain, at least, that is, until the switch flipped and those feelings swapped.

U.S Cannabis Election Year Seasonality

Trust Issues 👈

Cannaland contemplates the future.

May 30, 2024

The replacement of alcohol with cannabis is a trend that's gaining popularity in the United States. In a unique finding, a recent study found that for the first time ever, daily cannabis use, irrespective of form, surpassed daily alcohol use in the country.

While more people still drink alcohol on occasion, cannabis is now legally accessible for adult use in 24 states and the District of Columbia, as well as for medical purposes in 38 states and the District of Columbia.

He Said, She Said

A DEA official reportedly said that the agency is aiming to complete the review of comments “within 60 days” at the direction of Attorney General’s office, with a final decision coming soon thereafter. The official said it’s possible the review might be completed quicker, with a finalized ruling coming “by the end of September but as soon as the end of August.”

An anonymous statement from an unverified source isn’t the most reliable input for our beleaguered space—but the same official informed the same outlet in January that DEA would reschedule canna by the end of summer, correctly predicting that a rescheduling announcement “could come even sooner” (DOJ moved on April 30).

Hey Joe

President Joe Biden, who has previously stated on several occasions that his cannabis pardons also expunged people’s records—they didn’t—has now acknowledged the limitations of his action, stating that for clemency recipients, “their records should be expunged as well.”

Veteran Move

Bipartisan congressional lawmakers filed a series of new amendments that seek to authorize U.S. Department of Veterans Affairs (VA) doctors to issue medical cannabis recommendations to military veterans, prevent cannabis testing for federal job applicants in legal states and prohibit the denial of security clearances over use.

Pregame (written at 7:30 AM) 👈

We fire up our systems a month to the day that news broke the DEA would reclassify canna to Schedule III. At the time, the proposal needed to clear the OMB, a process that could have lasted 90 days but was pushed through in a matter of weeks.

There was a twist: on May 16th, we learned DEA admin Ann Milgram hadn't signed the proposed rule, leaving her boss, AG Merrick Garland, with the honors. Schedule III remains on track to finalize before the election, but that hair was an unexpected scare.

U.S. cannabis ETF MSOS has now lost 1/3 of its market value since that news hit, which is either par for our prickly course (we’ve seen seven 30% moves + twelve 20% moves since last summer) or the market is screaming for us to pay attention.

I spent much of yesterday asking industry stakeholders a simple question:

“Does the market not believe S3 is happening, or does it not care?”

The former would fit with much of what we’ve heard: 'we don't think the govt gets this done,' 'not sure AG has the authority;' 'we'll believe it when we see it,’ while noting the structural flaws and popular perception that custody and uplisting are the real brass rings. This would be the bullish take.

The latter would open the door to a different discussion: concerns surrounding state-siloed business models, a line of thinking that assumes the current financial construct is efficient rather than fugazi, and the algos that dominate our day-to-day see to that.

“The greatest trick the market ever pulled was convincing investors it wasn’t efficient.”

Either way, the prevalent perception, per a pal…

"I don't think institutions will buy until rescheduling is finished, uplisting is in sight, Garland, SAFER banking or some combination. For now, there's no new news and there probably won't be through summer; lots of other shiny objects out there, too."

...will likely persist, and that should be weighed against expected fundamental upticks next year, the historic federal steps (that many still don't believe), the horrid sentiment and the reality the U.S. cannabis industry was built by the states, and for the states.

Random Thought (11:45 AM)

the biggest moves for our space have been triggered by unknown catalysts; DOJ was widely expected post-HHS (DEA not so much) but we knew that it was coming. at this point, SAFE would be a surprise, as would a Trump pivot supporting states’ rights, or any type of guidance from Treasury.

^ idk if the Garland Memo qualifies as a surprise but I have a hard time seeing DOJ guidance as a negative, particularly if it contains language for banks that work with state-legal operators.

ATB on U.S. cannabis valuations

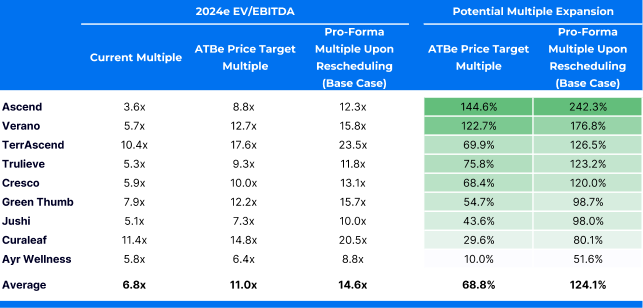

The rescheduling process is ongoing, but MSOs' valuations appear to not be pricing in any reasonable probability of rescheduling happening. The MSOS ETF is down 21.3% since the DOJ announced the beginning of the rulemaking process on May 16, and MSOs in our coverage are trading at an average 2024e EV/EBITDA multiple of 6.8x compared to our average target multiple of 11x, which doesn’t consider rescheduling.

What would be the pro-forma value accretion+ multiple expansion in our coverage if we were to bake in rescheduling? In a pro forma base-case scenario, which considers 280E removal and a 2% lower discount rate due to interest tax shield and increased capital availability, we estimate fair value 2024e EV/EBITDA multiple of 14.6x, which implies a 252.8% potential upside to current equity values. (a 14.6x multiple would be roughly in-line with a blended average of Alcohol and CPG.)

Random Charts

Enjoy your weekend, stay safe and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice