Daily Recap

For the first time since joining the ticket as President Joe Biden’s running mate in 2020, Vice President Kamala Harris has called for the legalization of cannabis, which signals a possible shift in the administration’s platform heading into the elections.

The VEEP told a room of cannabis pardon recipients at the White House on Friday that “we need to legalize marijuana,” a participant in the meeting revealed, which perhaps offers a glimpse into what a second-term agenda/ promise might look like.

“Everything about today—and there were some words expressed about doing more things like this—the White House wants to engage on this policy consistently. That’s clemency, criminal justice, marijuana legalization… right now the White House has an important role to play and they’re doing it.” -Advocate/ Attendee Chris Goldstein

We Are the World

World leaders gathered in Vienna for the first time since 2019 to assess the status of the international drug policy amidst a global drugs crisis that claims hundreds of thousands of lives every year and drives systematic violations of human rights.

In a first ever showing of such unity, a coalition of 60 countries led by Colombia took the floor at the opening of the event to call for the reform of the international drug control system, which hasn’t changed since the height of the War on Drugs.

The joint statement sounded the alarm on the catastrophic consequences of punitive drug policies, which fuel violence, corruption and environmental devastation, while also undermining health, development and human rights.

Boies in the Hood

In a new federal court filing, lawyers for a group of marijuana companies argue that ongoing cannabis prohibition has “no rational basis,” pointing to the government’s largely hands-off approach to the recent groundswell of state-level legalization.

The lawsuit alleges that while Congress’s original intent in banning marijuana through the CSA was to eradicate illicit interstate commerce, lawmakers + the executive branch have since abandoned that mission as more states move to regulate the drug.

“Dozens of states have implemented programs to legalize and regulate medical or adult use marijuana,” and “safe, regulated, and local access to marijuana” in those states “have reduced illicit interstate commerce, as customers switch to purchasing state-regulated marijuana over illicit interstate marijuana.”

Move Over Rover

Two dozen states have already legalized recreational cannabis and five more are now making moves to that effect, which could move more than half the states in our union into a 420-friendly locale (53% of the U.S. population already lives in a legal state).

Florida is front-and-center—if we don’t hear from their Supreme Court by April 1st, it will be on the Nov. ballot and would need 60% to pass—while Pennsylvania (summer passage for Jan. 1st?) , Hawaii, New Hampshire and South Dakota are also in play.

Stocks & Stuff

After last week’s wild ride that started with denial and ended in a smile, U.S. canna stocks picked up where they left off. U.S. cannabis ETF MSOS finished the day almost 7% higher and is now trading at levels last seen… on February 26th.

Below, we’ll chew through today’s price action, frame the current set-up, offer context on our field position, measure the global opportunity and update our weekly comps.

All that and more, just scroll down.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ PT Notional: $205M ($119M)

Top Stories

Flanked by Fat Joe, Harris urges DEA to 'get to it' on its marijuana review

Federal Marijuana Prohibition Has ‘No Rational Basis,’ Companies Say In New Court Filing

Crisis and division at UN drug summit

New York to probe sputtering legal marijuana program as storefronts lag, black market booms

Five states including Florida could see recreational marijuana legalized in 2024

More MSOs follow lead of Trulieve, Ascend on 280E

Businesses ready to go on Kentucky medical marijuana. Why can't they proceed?

Czech Cannabis: Anticipation Builds as Dual Bills Await Government Review

Maine Lawmakers Weigh Bills To Expunge, Seal Marijuana Conviction Records

Industry Headlines

Ascend medical cannabis dispensary opens in Center Twp, Pennsylvania

Manic Monday

A week ago today, a bullshit WSJ article re tensions at the DEA knocked the ETF 8% lower after it had already been waxed the previous month; the mood, as you’d expect, was venomous but as fate would have it, MSOS finished last week on a high note.

Following the ETF’s 15% gain on Friday, the weekend mood on social media was the mirror image, which hasn't translated to positive performance in the past. It also felt a bit premature, as MSOS had only clawed back losses from the previous week or so.

It was and remains way too early to take a victory lap with MSOS still a single-digit midget. The latest sound bites have been encouraging but there is much to be done and plenty of peeps who won’t believe any of it until it actually is.

Still, the positives: MSOS held triple-lindy support (tested on light volume, thrusted higher on big volume); earnings were solid, for the most part; SIII gained a powerful ally, SAFER signals continue to persist and Señor Garland is waiting in the wings.

The trick to our trade, again, will be MSOS, which is the only scalable solution able to funnel the necessary liquidity for a rising tide to lift these boats; and the asterisk on that dynamic remains composition of volume until such time institutions can custody.

In other words, same as it ever was but this time with a lot more eyes + much higher stakes, which feels about right as The Everything* Rally shows signs of fatigue + US canna readies to flex after 1132 days of hardcore training + somber soul-searching.

“Ding, Ding”

After trading as high as $9.35 premarket, MSOS came for sale out of the opening gate and tested $8.95 (+.08) less than fifteen minutes into the start of our new week.

Buyers + volume emerged with $60M total notional ($32M via MSOS) in the first hour (an entire day last week) as traders positioned for what promises to be a busy Spring. Canadian cannabis stocks were active too as thematic tourists grabbed those shares.

[we rented TLRY + CGC recently; VFF is the only CAD name we currently wanna own]

We revisited the premarket highs twice before the lunch crunch arrived to quell the swell. Our sense was that some sausage was getting made (MSOS creations + dealer hedging/squaring) but that was pure speculation as we watched total notional swell.

Into 1PM ET, I shared:

pushing $120M ($65M) as we absorb the press attempts; Tier1s are still < Sept highs if you're looking for perspective/ context although none of us would be shocked to see more rug-pull attempts throughout this process of price discovery.

Cannaland vacillated in the final hours—some names more than others—as the bears tried to stem momentum and the bulls dared to dream after five years of nightmares.

MSOS flagged before breaking higher into the close to finish right near session highs.

Solid showing but remember Paul Revere, the cap raises are coming, which isn’t a hint as much as an observation. Capital markets opening, when they do, will provide much needed relief for some and proactive capital for others.

Chart Check: MSOS

Volatility is the Opposite of Liquidity: This is Insane btw

The Globe And Mail Jail Sail

The Legal Marijuana Market size is expected to be worth around $86.3B by 2033 from $19.4B in 2023, growing at a CAGR of 16.1% from 2024 to 2033.

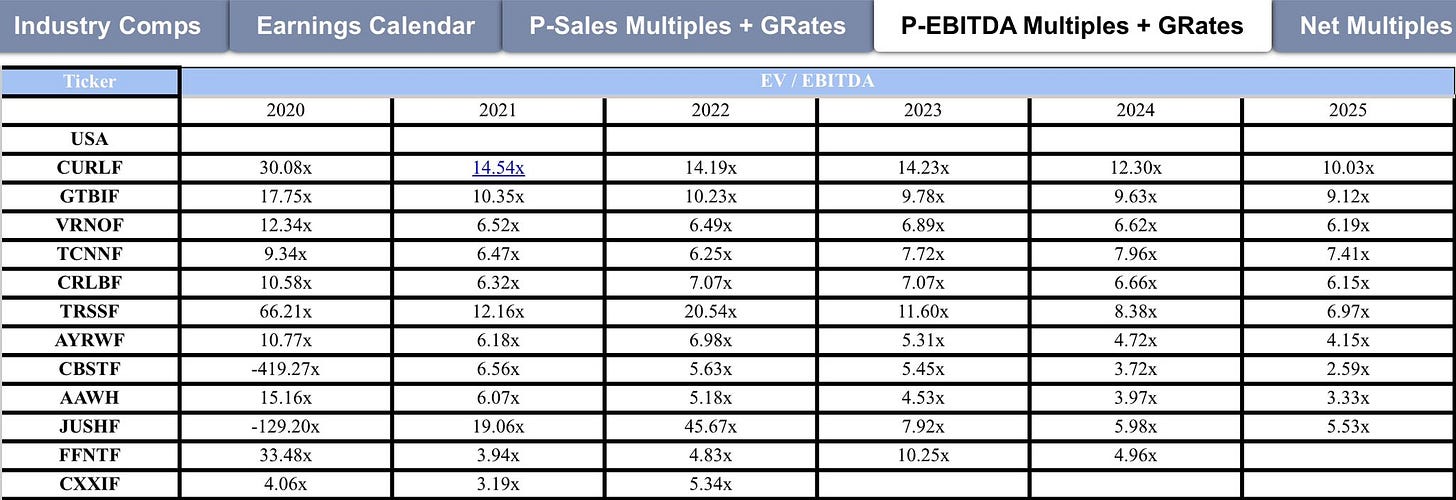

U.S. cannabis comps (CB1 Capital)

Stems & Seeds

Cannabis, what countries allow it?

Illinois Panel Votes To Add Female Orgasmic Disorder As Medical Marijuana Qualifying Condition

Enjoy your night, stay safe and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.

Will Schumer schmuck SAFER in April?

Do we expect perfect to be the enemy of the good this time around? Calls for legalization are nice. But rescheduling, safer banking… I like wins and not dangled carrots