Daily Recap

This morning the DEA asked an agency judge to reject a request to have it removed again from the cannabis rescheduling hearings over allegations it actually opposes the reform it is supposed to be defending—but they still declined to clarify a stance.

Village Farms and others renewed their request to have the administrative law judge (ALJ) remove the DEA as the proponent of the proposed rule last week and the ALJ gave the DEA until this week to respond, and they did today…in a sorta suss way.

The ALJ immediately condemned the agency for its “unprecedented and astonishing” defiance and stated that, given “deliberate failure to comply with the unequivocal and repeated directive of the tribunal, the issue of sanction is herein RESERVED for time during the hearing on the merits that the proposed exhibit is offered into the record.”

Insofar as we already know the DEA is conflicted, these lawsuit(s) will serve to make the industry’s opposition to the DEA having discretion over a final rule a matter of public record and thus, subject to legal review should the DEA zig when they’re supposed to zag—precisely as they did 37 years ago. 👇

We sorta view these lawsuits as insurance policies against further bureaucratic fuckery should this three-letter agency somehow sidestep the wrath of DOGE.

The irony isn’t lost on me, either. Most investors don’t appreciate the Village Farms story and those who do attempt to balance their legacy produce business with their Canadian canna success and emerging international opportunity. What most miss is that Captain Jack Mike is a patriot who intends to buzz towers much closer to home.

DJT 2.0

Ahead of the new Trump administration, the canna industry continues to speculate on potential policy changes, and stakeholders remain cautiously optimistic that the new president will honor his promises to reduce regulatory burdens and introduce a better business climate for these All-American businesses.

Two areas of possible change are banking reform and the reclassification of cannabis, both of which were endorsed by Trump on the campaign trail and remain top of mind for industry stakeholders. He also reiterated his belief that each state has the right to decide on the issue for itself.

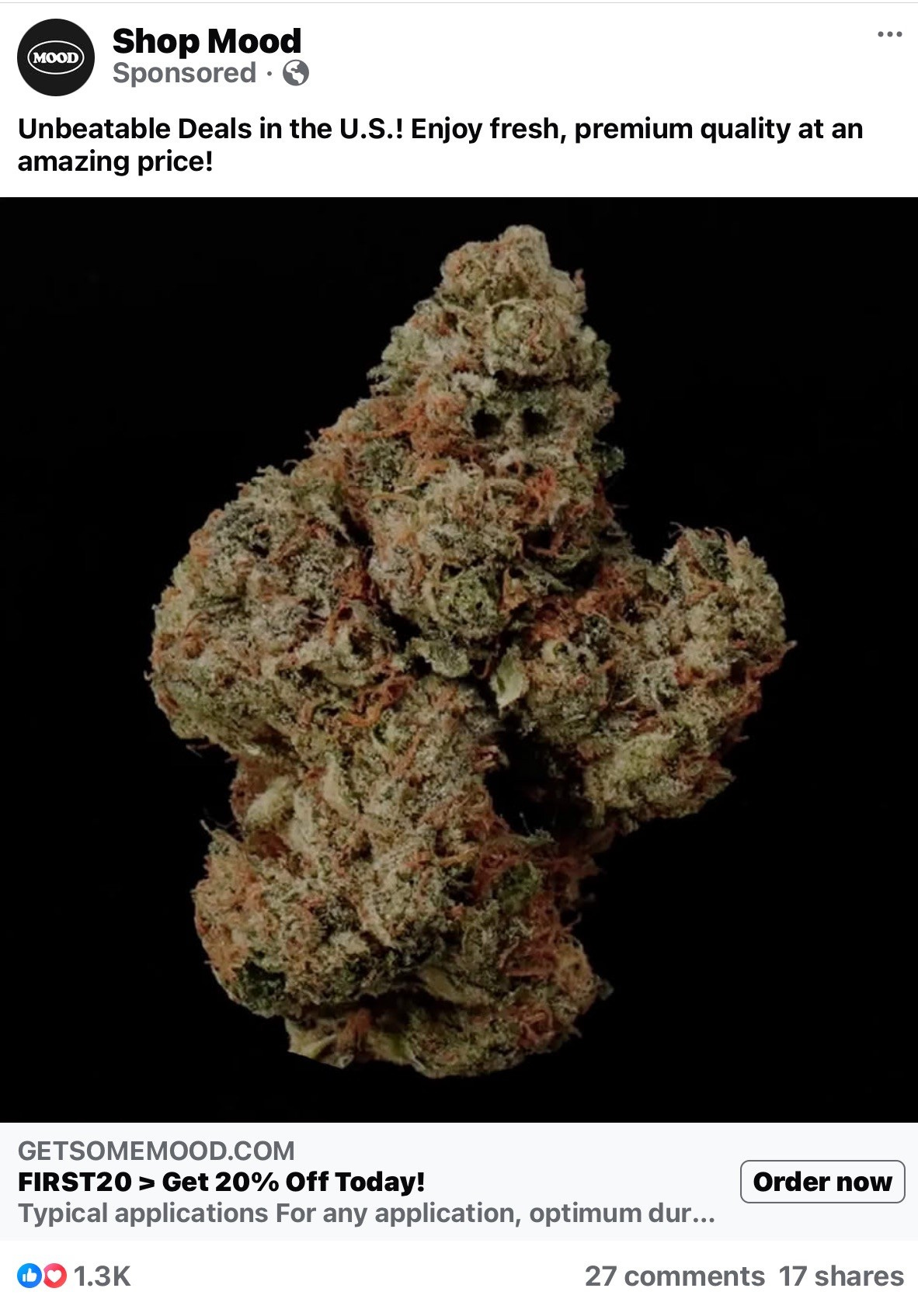

Two-Face Book

Despite new changes to content moderation announced earlier this week, Meta—the owner of Facebook, Instagram and Threads—appears not to be changing its practices as they continue to block search results for words like “cannabis” and “marijuana.”

Meanwhile, any kid on Facebook can purchase untested (intoxicating hemp) cannabis without so much as age verification due to the farm bill loophole. Do better. 👇

Blue Grass Armory

Newly filed bipartisan legislation in Kentucky urges the state’s congressional reps to amend federal law to clarify that users of medical canna can legally possess firearms.

The new measure comes as Kentucky prepares to launch its MMJ program, with Gov. Andy Beshear (D) saying in his State of the Commonwealth address last week that patients will have access to cannabis sometime “this year.”

Stocks & Stuff

Canna stocks, as measured by U.S. cannabis ETF MSOS, tested their all-time low for the third time today—and a 50% decline since the November election—before a late whiff of demand erased those losses to notch a small gain on light volume.

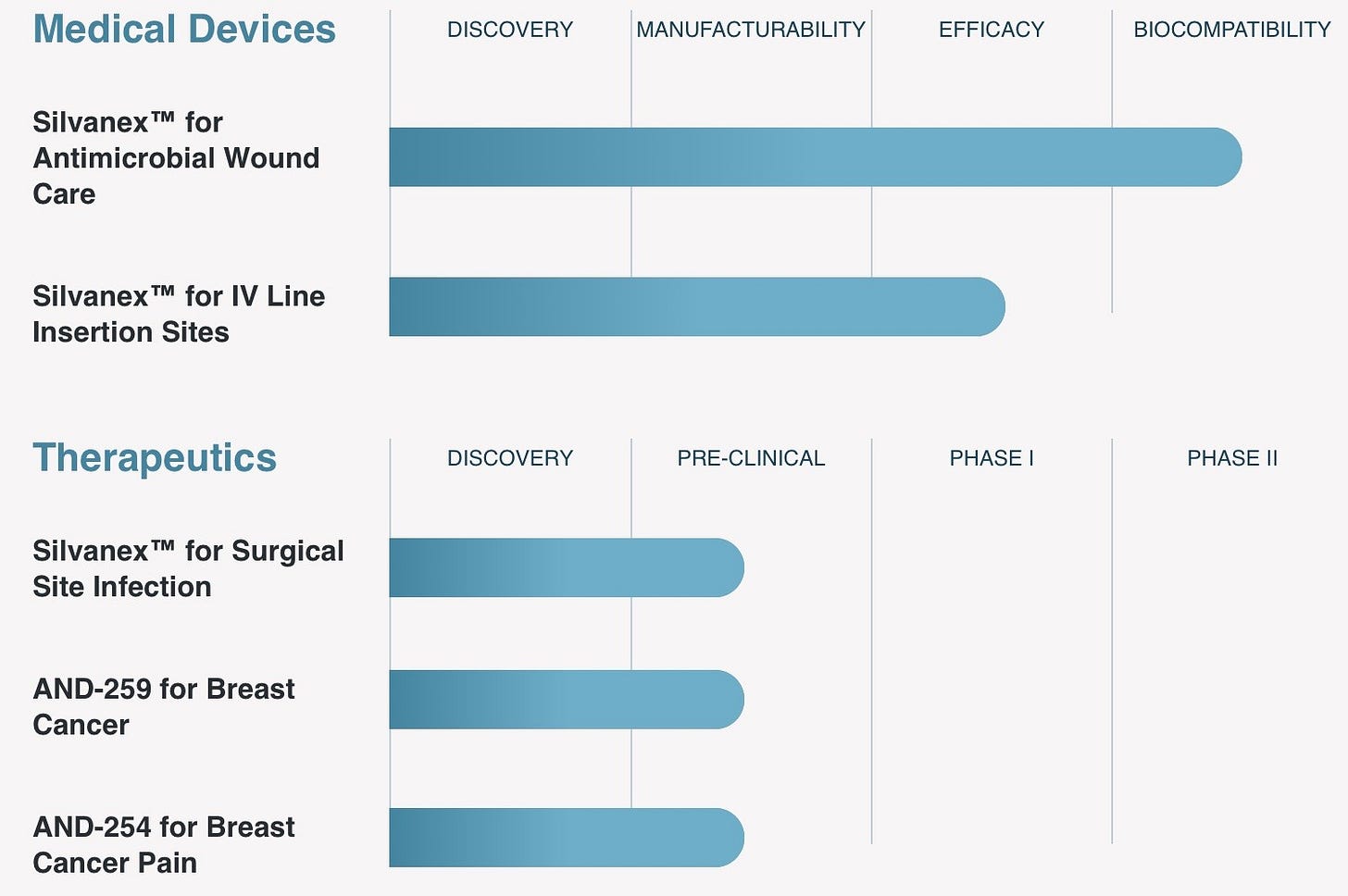

Below, we’ll top-line the landscape, sniff at a potential catalyst later this week, chew through the confirmation schedule, offer an honest take of the state of the canna union and cast an eye toward the biotech and medical device pathways of 3.0.

All that and more, just scroll down.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ ETF notional: $15M

Top Stories

Could new Trump administration ease federal limits on cannabis?

Bipartisan Kentucky Lawmakers Push Congress To Protect Medical Marijuana Patients’ Gun Rights

Cannabis Store Operators Call for Loan Forgiveness

Six Cannabis Industry Legal Cases, Policy Reforms and Trends to Watch in ‘25

Kentucky Gov Shares Tips On How To Register For Medical Marijuana Access

How will consumer preferences shape cannabis retail in 2025?

USDA Adds More Hemp Industry Stakeholders To Trade Committee Promoting The Crop Globally

Industry News

Miami's First Medical Marijuana Dispensary Finally Opens

Ascend Enters into Agency Agreement to Issue $15M of Senior Secured Notes

High Tide to Enter German Medical Cannabis Market

SUNDAY SESH: WHAT'S ON MY MIND, by Scott Grossman

Andira Welcomes David S. Liu, MD/PhD to Advisory Board 👇

Pregame (written in real-time at 8:00 AM ET) 👈

Another quiet morning as Cali burns and our space churns, both of which won't be missed after they pass. I went to high school in Encino and have family in Tarzana and continue to send white light west to all the people and pets still in harm’s way.

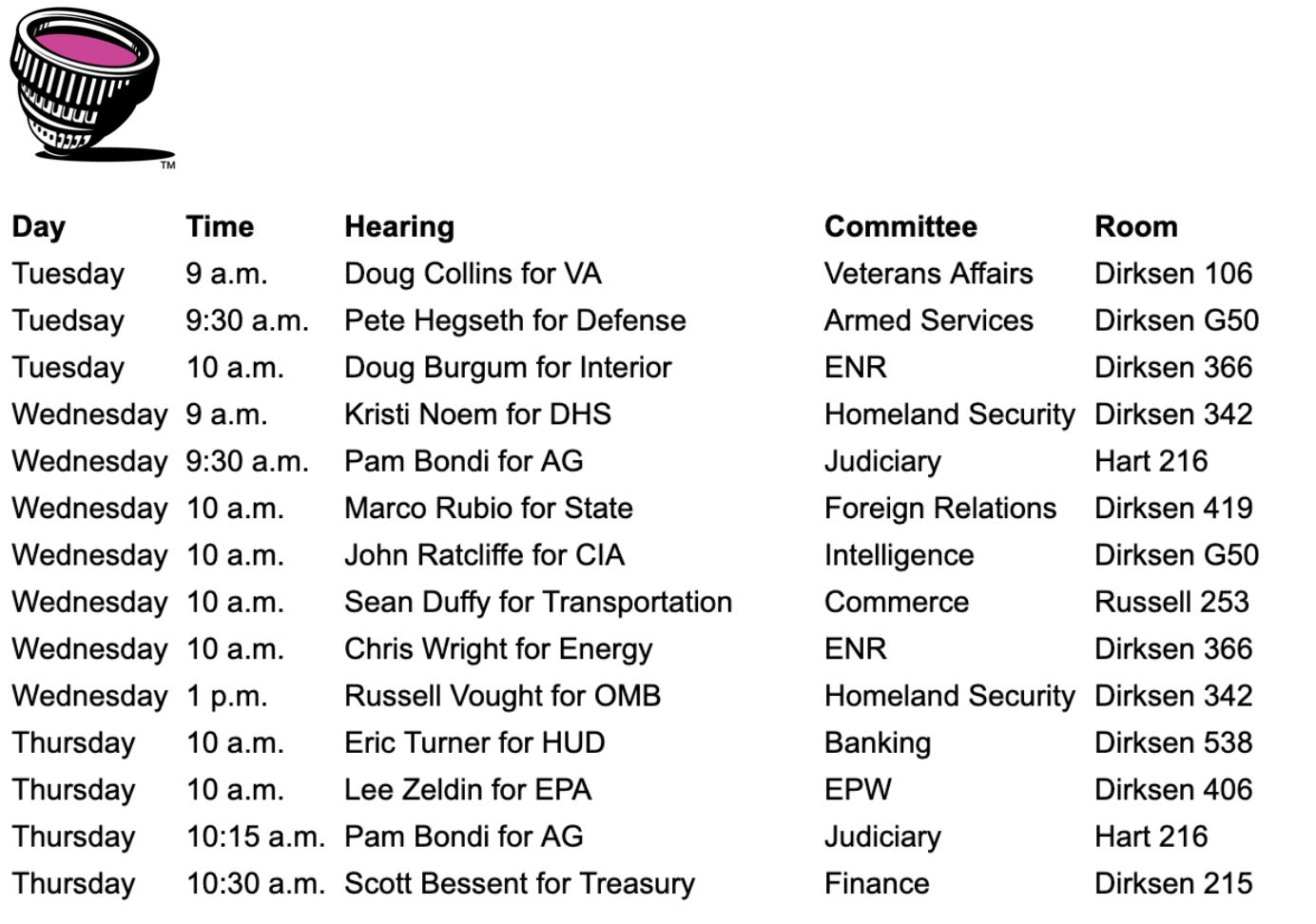

We're a week from the inauguration and with it, the new regime, which I share as the confirmation hearings are set to begin in D.C. Bondi is the biggie for our space, as is RFK Jr. in a few weeks, but Pam is first up Thursday so we should get a better read on her thoughts on the issue.

[hint: she backed her boss on FL A3, and she’ll back her new boss too, we believe.]

The blue sweep of 2020 triggered a sharp pop followed by a prolonged drop, and while it remains to be seen if the red sweep will shape a mirror image, it’s thus far tracking given the initial carnage (-49% since the election).

In the meantime, the DEA should respond to the ALJ this week so we'll look out for that as we continue to navigate a wild start to 2025.

Honest Abe

Wanna know what I was thinking about on our way home from Amishland last night after our daughter’s field hockey tournament (other than how proud I was of her)?

About when the U.S. canna industry launched and the optimism that surrounded it; the new states (NY! NJ!), the friendly feds (so we thought), an abundance of growth on the horizon, and the opportunities for those involved.

Fast-forward five years, past the state-level snafus and the flaccid feds to the handful of viable companies that are still fighting despite a bevy of balance sheet constraints, and who are now competing against intoxicating hemp (sans 280, w DTC, interstate...).

This isn’t what most of us signed up for and we see/hear that fatigue given how many conversations we're having with operators, analysts and what's left of investors. There are pockets of optimism (hemp bevs, mostly) but that’s been drowned out by distress.

I don't profess to know when the current malaise will lift or when the winners separate from the pack but it'll likely require unlocking the bureaucratic hot-box that’s stymied the state-legal industry since inception.

We think we have a bead on the better pubcos but until structural issues are solved—or there’s a line-of-sight on custody, listing, or even Schedule III at this point—these names remain vulnerable given how thin liquidity is in the absence of clarity.

"Where the heck is growth?" Likely on the other side of (regulatory + operational) consolidation but until then, we'll have to settle for sparks in the dark that have the potential to ignite broader optimism and light up some green screens.

Rescheduling, banking, capital markets and clemencies have all been signaled by DJT and we believe that he'll get what he wants in that regard. The question is timing and priority, which will help shape who will still be in a position to benefit.

Stems & Seeds

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice