Deep State DEA

Lawsuit filed to disqualify conflicted agency.

Daily Recap

Every party that applied to argue against moving marijuana to Schedule 3 of the Controlled Substances Act has full standing to participate in an upcoming landmark hearing, a top U.S. Drug Enforcement Administration judge ruled late Tuesday.

But only one organization supporting marijuana rescheduling will have full standing for the highly anticipated Dec. 2 hearing, according to DEA Chief Administrative Law Judge John Mulrooney II.

An “Interested party” is defined as “any person adversely affected or aggrieved by any rule or proposed rule issuable” under 21 U.S.C. 811.

Deep State Drilling

A DEA judge is being asked to remove the agency from its role in the upcoming hearing on the Biden administration’s cannabis rescheduling proposal, with a new legal filing citing alleged statutory violations that include “unlawful” communication with a prohibitionist group.

The lawsuit was submitted on behalf of Village Farms and Hemp for Victory, which were both invited to participate in the rescheduling hearing that’s set for next month—that is, before they were told to not bother to showing up.

“It is our belief that the DEA cannot lawfully act as the proponent of the Proposed Rule and that its actions throughout the administrative process demonstrate that it opposes the proposed transfer to Schedule III and is therefore compromised.”

Sugar Shane Pennington, Partner, Porter Wright

Wizard of Oz

President-elect Donald Trump’s recent selection of physician and TV personality Dr. Mehmet Oz to oversee the Centers for Medicare and Medicaid Services adds another pro-medical-marijuana voice to the forthcoming administration.

In recent years, Dr. Oz has encouraged audiences to be open openness to therapeutic cannabis and advocated for sweeping policy changes around the drug.

“We ought to completely change our policy on marijuana. It absolutely works,” he said in a 2020 interview, calling cannabis “one of the most underused tools in America.”

Big Red

Nebraska Attorney General Mike Hilgers pledged Tuesday that his office’s ongoing civil and criminal investigations into two medical cannabis measures won’t impact whether he certifies the election results.

“I see no reason sitting here today to not certify. We know the judge will look at all the arguments and the facts carefully, and so we’ll wait for a ruling.” Nebraska AG

Stocks & Stuff

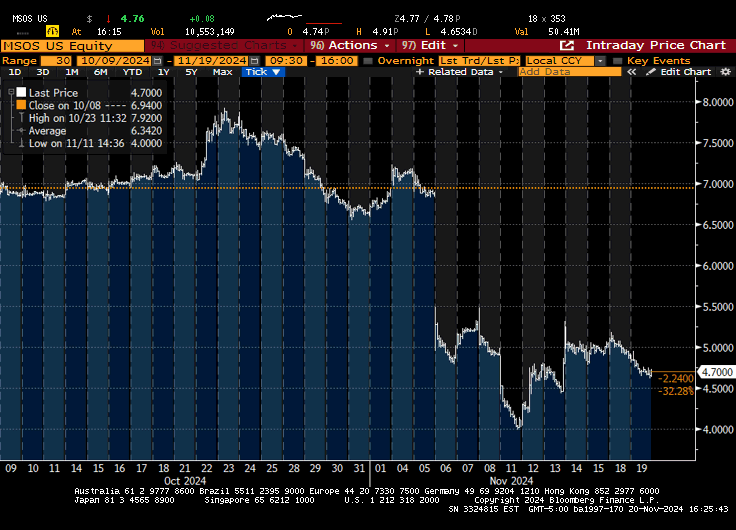

It was a tense session in Cannaland as the space wrestles with year-end tax selling and overwhelming financial fatigue and attempts to ready for the Red Dawn. U.S. canna ETF MSOS finished the session +2% as it toggled between technical levels.

Below, we’ll synthesize the collective crosscurrents, digest current events and tell it like it is ahead of two days of travel and a brief digital respite.

All that and more, just scroll down.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ ETF Notional: $50M

Top Stories

DEA judge’s choice of marijuana rescheduling participants tilts toward opponents

DEA faces legal challenge as uncertainty clouds plan to reclassify marijuana

Here’s why Trump’s most indefensible picks might get confirmed

Nebraska AG: Investigations won’t affect medical cannabis election certification

Florida’s Marijuana Industry Could Benefit from a Gaetz AG Position

Dr. Oz Could Elevate Medical Marijuana Support As Trump’s Medicare And Medicaid Director 👇

Industry News

Curaleaf Wins First Massachusetts Cannabis Research License

Hedgeye Fireside Chat with Sammy Armenia, VP of Corp Dev at C21

Pregame (written in real-time at 7:30 AM ET) 👈

We hike to the hump with the same race in place: clarity (S3, AG, SAFER) vs. ongoing agendas, including tax-loss selling and liquidations, if not outright capitulation.

Given the vulnerability across our four primary metrics (technicals, fundies, structural, psychology), the search for clarity has perhaps never been more acute, particularly in the aftermath of the failed Florida vote.

Last night, I spoke with a top constitutional law expert regarding the viability of Gaetz and in particular, possible pathways, including traditional Senate confirmation, recess appointment and potential designation as the temporary AG, something that DT1 has previously done (with Matt Whitaker).

I was curious about the guardrails surrounding that last option, given I’d seen solid due diligence that it wouldn’t be applicable, but it was more an excuse to catch up.

The first topic that arose was the ALJ, where he proffered that he fully expected anti-cannabis parties would be given the opportunity to be plead their case.

[conversation occurred prior to the news]

“They should have every opportunity to demonstrate that they’ve been aggrieved, such that subsequent legal challenges will show that they’ve already been heard.”

His view, fwiw, is that S3 is the worst-case scenario under DT2, and the fact that this rescheduling process is so far along bodes well for its completion early next year.

When I pointed to the past processes that never finished, he noted the evolution of the issue and that the incoming POTUS already pledged his support and has since been surrounded by pro-cannabis advocates.

[he opined that S3 would also be good to go under others, such as Todd Blanche, who is among the names bandied about as potential back-ups if Gaetz falls short. \

[note that after the market closed, the House Ethics Committee declined to release their report on Matt Gaetz]

[note: Whitaker was appointed as the U.S. Ambassador to NATO this morning]

Regarding the appointment of Gaetz as the temporary AG if the other routes fail, our friend opined that that remains a viable mechanism, if needed. I didn’t catch all of his legal reasoning but it included context on presidential powers to fill a vacancy.

None of this will matter, of course, until it does… and while we have a handful of items to monitor in December (ALJ, Boies, lame duck), the conventional wisdom is that this space is dead money through year-end, if not beyond.

We can point to how cheap these names have become (understanding that many are cheap for a reason) but those metrics haven’t mattered for a long time as operational headwinds persist (hemp, pricing pressure) and capital markets are closed.

It makes intuitive sense that a brutal four-year bear market would end w a bang rather than a whimper, but the aftershocks remain an open question. Bulls will look to put in a higher low above $4.50, while the bears will continue to press until it stops working.

Random Thoughts

It remains to be seen if the red sweep will be the mirror image of the blue sweep in terms of reform (we believe it will) but the mindset (selling blips vs. buying dips in late 2020) is already the mirror image.

The DEA is perhaps the most glaring example of “deep state bureaucratic overreach in the history of bureaucratic overreach and that’s saying something. I never used to believe in such stuff but watching what they’ve done/ how they’ve done it, I do now.

Take this fwiw but my confidence that we’ll see legitimate federal reform under DT2 continues to uptick. IDK when the market believes but peeps are underestimating the intentions of DT and the pro-canna voices that currently surround him.

ATB hosted TerrAscend management today and Chairman Jason Wild said that their case against the Federal government could be in front of the Supreme Court by the summer, ahead of schedule. Oral arguments begin on 12/5.

CEO Ziad Ghanem added that growth will come from the conversation of the illicit market, as well as new state adoption (despite the reality that markets and prices will normalize over time).

Chart Check

Zooming in on the ETF since the election frames the current technical crossroads as bulls attempt to put in a third higher low and turn their attention to the post-election gap while the bears look to take out last week’s, if not all-time, lows.

Stems & Seeds

“Cannabis-based medicinal products show promise for chronic pain.”

Weed for PTSD? Eager for Better Cannabis Science, F.D.A. Clears Study

Ric Flair: Marijuana Edibles Got Me Off Xanax

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.