When we last whispered to one another, U.S cannabis volumes were super-quiet…

…and that continues as we edge into summer. Given we discussed our base-case bull thesis (state-level adoption) and multiple federal scenarios last week, there’s not much to add except to address this one particular story that seemed to ruffle a few feathers.

While the stock market already signaled that the Senate Majority Leader doesn’t have the votes for comprehensive reform—stocks are again trading where they were when he first took office—the thing that so many people seem to miss is that the Senator from New York has other promises to keep.

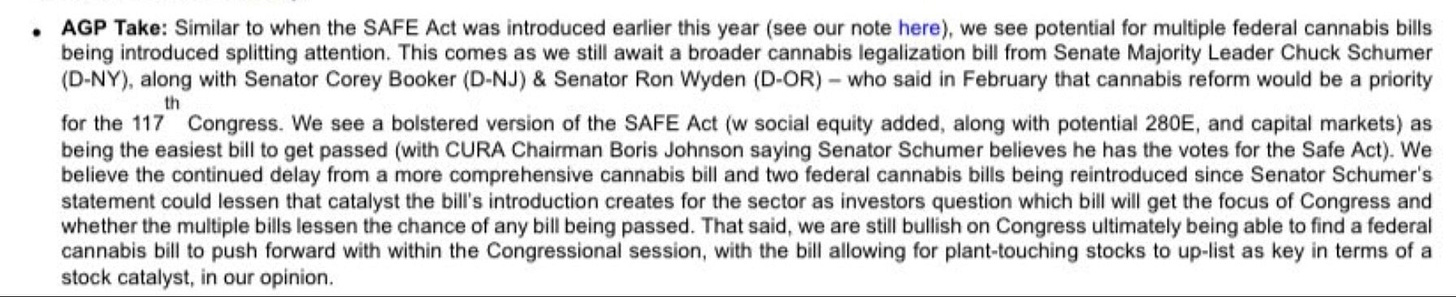

Alliance Global Partners seems to agree bc in a note to clients a few days later…

…they said, “we see a bolstered version of the SAFE Act (w social equity added, along with potential 280E, and capital markets) as being the easiest bill to get passed.”

Sorta makes sense, right? State-level reform takes years—Connecticut worked on it five years before (possibly) passing legislation this week—so it stands to reason that federal change and all that entails would pose additional challenges / take more time.

But the simple truth is this: functional banking is a necessary first step if state-led social justice initiatives are to succeed. With NY & NJ coming online in a matter of months and state budgets dependent on new tax-revenues, there’s little time to spare.

I wouldn’t blame Chuck Schumer if comprehensive reform falls short—it certainly wasn’t for lack of trying—but as I’ve said before, I’ll assign a ZERO-POINT-ZERO percent probability the Senate Majority Leader leaves his post w/o canna reform.

Eye of the Storm

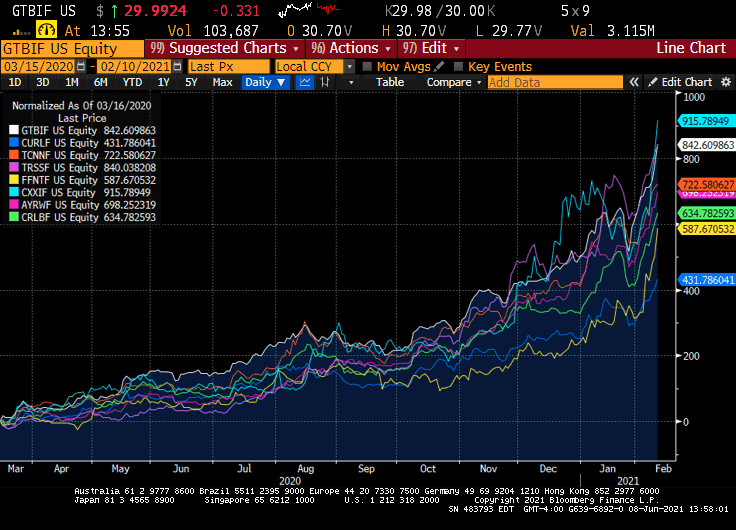

Last year was a slow-motion perfect storm for cannabis, a dynamic aptly captured in this RealVision segment that Tony Greer and I taped in November. And to be sure, the space sailed the high seas from the March 2020 low to the recent Feb highs…

…before a slow-motion shipwreck gave back some of those treasures.

Indeed, this most recent four-month bear market in U.S canna took about a-third off the top after obscene year-over-year gains and in the process, completely flipped sentiment from frothy to frugal as traders cut-bait for shinier, more liquid objects.

It’s hard to blame ‘em. The price action has been terrible and every single piece of good news, from New York adult-use to terrific quarterly earnings, has been sold and seasonality suggests some sloppy seas ahead as the dog days of summer do their thing.

Our take, either a critical distinction or desperate post-rationalization: the price action has been shaped by artificial impediments, custody f*ckery and forced liquidations as business conditions continue to improve/ TAM continues to expand and consumers continue to adopt regadless of what happens or doesn’t happen at the federal level.

We don’t have a crystal ball nor do I have the slightest idea when all this late-stage behavior will prove telling with the benefit of hindsight. And idk whether this grand financial experiment we’re enjoying ends with watershed deflation or painstaking hyper-inflation. (requires two separate gameplans btw. <- check this timestamp)

No, I don’t know much but I do know that if we find good companies at reasonable to attractive valuations in a largely misunderstood / institutionally under-owned industry that has emerged as a post-pandemic economic / employment / wellness engine, we best hold on to that generational opportunity through the most vicious of conditions.

He’s the trick—the risk, really—timing is everything. While most peeps seem to sense it’ll be a soft summer for the space, we’ve dug in on our faves and trust that the market will become more efficient in time and we’ll be rewarded for our patience.

IDK when that will happen if I’m being honest, I just know that it will.

Incrementalism is frustrating for investors and criminal justice advocates alike but it appears to be the only tenable path forward. Paradoxically, it would also prove to be best-case scenario for the existing oligopoly of U.S operators that’ll continue to build scale and capture share as industrial CPG sits on the outside looking-in.

Taking a step back, we enjoyed twelve months of a raging bull market as a rising tide lifted all equity boats, followed by four-months of illiquid frustration that resulted in many questioning their underlying thesis.

When we arrive at our year-end destination in less than seven months, however, we might just find that this was simply the eye of the storm.

/position in stocks mentioned

/advisor U.S cannabis ETF $MSOS