Last week we chewed through the U.S cannabis landscape to highlight the strong fundamentals that continue to drive our base-case bull thesis. What we heard since—solid earnings from AYR Wellness and Cresco Labs—has only served to solidify the opportunity set for one of the best kept secrets in capital markets.

I mean, how else does one explain the dearth of volume in the space? I know that Monday was Memorial Day but U.S cannabis stocks trade in Canada and tbh it was pathetic. TerrAscend (big buyers last week) traded thirteen shares (not a typo) as we readied for our Monday lunch, and other multi-state operators weren’t far behind.

Of course, we know how to at least partially explain it: there’s a fair share of f*ckery, continued plumbing concerns and certainly at some level, an uneducated investing audience that needs to grasp the space, but that doesn’t make it any less astounding.

All of which brings us back to the here / now: U.S cannabis ETF $MSOS violated the 2021 bear market downtrend and the 8-day is about to cross the 21-day (both positive technical signals) but volume qualifies price and the marginal buyers (who can access these securities) are no doubt distracted by the other bright, shiny and liquid objects.

We can only control what we can control, both as investors and operators, and as the latter shift their focus from Q1 comms to executing against their respective summer strategies, investors, of course, just wanna know one thing…

…and that is, when is Chuck Schumer gonna share his grand plan for canna reform and what’s the likelihood he has the votes or vehicle to get it done?

We recently spoke about this dynamic, followed the money and talked through several scenarios, all of which, we believe, will prove supportive of states’ rights given the dire need for tax-revenues and employment opportunities in a post-pandemic world.

[note: this reddit thread on the DC process, this interview re: interstate commerce and this article re: canna rumors are prolly of interest to anyone invested in this space]

What, Me Worry?

At the root of most cannabis-specific agita is the fear that if we don’t federally legalize cannabis before the midterms, we likely won’t do so for another 2-3+ years given the historical likelihood that the Dems will lose House or Senate seats next November.

That’s sorta what the markets been saying, right? Many U.S canna stocks have given back their gains since the Senate first flipped and sentiment, as discussed, has done a complete-180. (this is the part where I leave out saying: “If I told you in Feb that U.S canna would be -35% on June 1st w biz improving / Schumer sharpening his pencil…”)

Here’s the thing: nmw this'll take time and in that time states will continue to adopt, brands will continue to build, enterprise values will continue to rise, consumers will become more educated and once we get to wherever we're going, there’s gonna be a buy-build / institutional bum-rush / big-time exit somewhere up and to the right.

Put another way, by the time interstate commerce (one perceived risk to the model) would even be possible, uplisting, institutional ownership, the repeal of 280E, debt financing, all of it, will already be in play as NY, NJ, CT, PA, MD, VA, FLA, OH etc continues to drive the TAM higher. This is a state-led story. Follow the fundies.

In terms of a “nothing done” in this congress and the specter of future FDA oversight (potentially the single biggest risk) we just don't see it bc 1. there would be no tenable criminal justice reform with canna on the CSA and 2. an increasing number of states (and their constituents) are becoming more reliant on the economic canna engine.

[note: I’m specifically not mentioning broader market risk, the many late-stage signs or the difference bw free-market capitalism and a financial machination weaponized as a matter of national security bc of time / space / dimensional constraints]

I do find it somewhat amusing that so many U.S canna holders complain about the price action while at the very same time, institutional fund managers I speak with are complaining about not being able to custody / own these securities given where we are in the cycle. I, of course, see both sides bc I’m also living both sides.

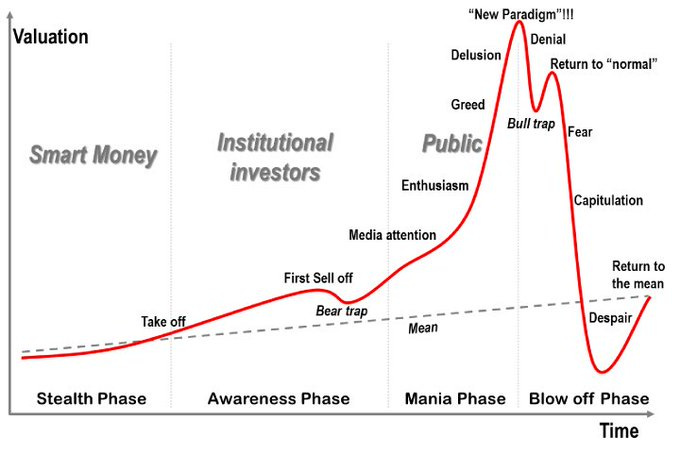

But I remind myself to remain patient; to understand where we are in the big picture…

…and to remember that most people still view cannabis as this…

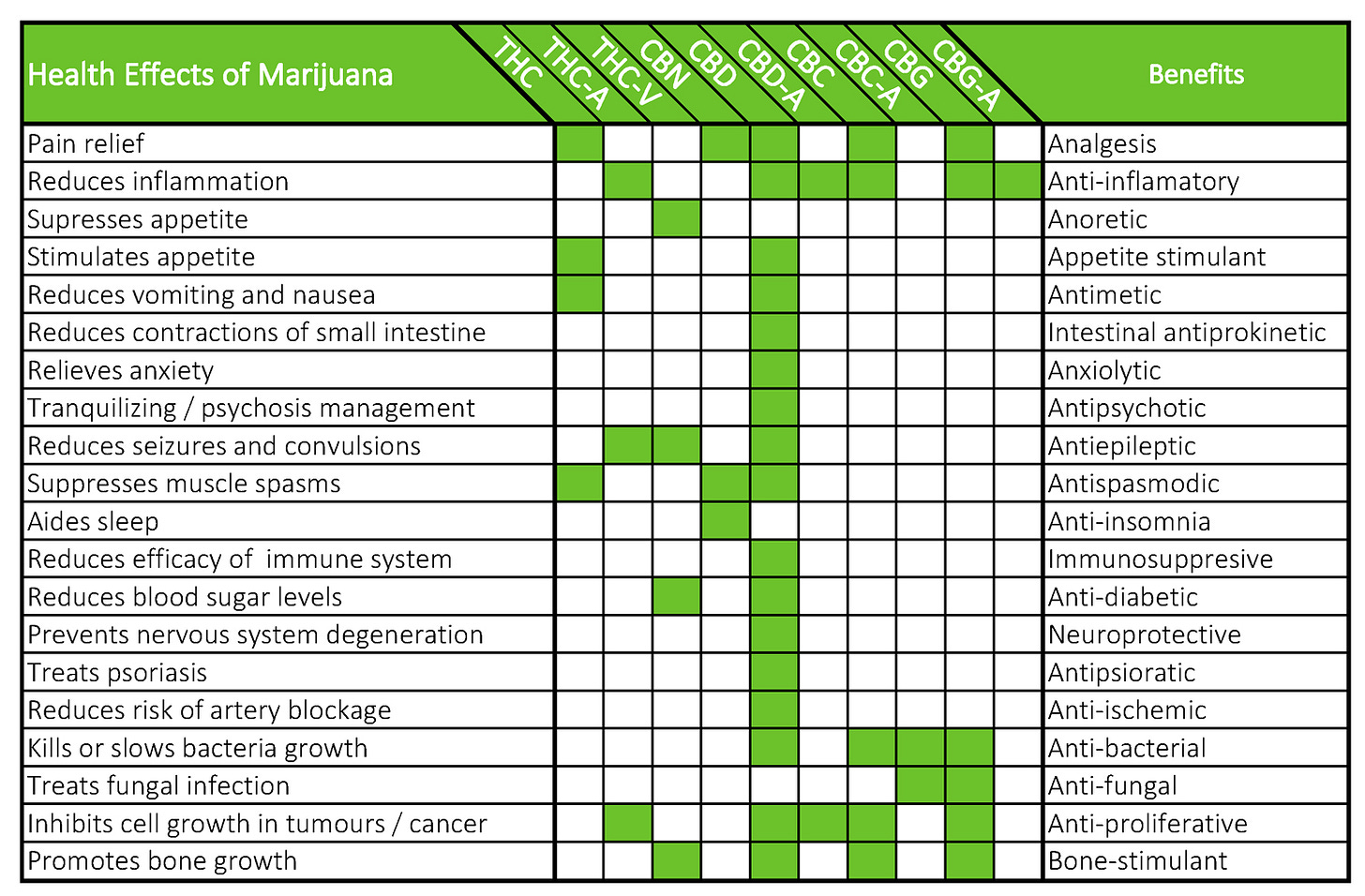

…when in fact, it’s all about this…

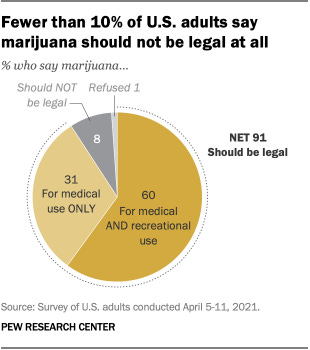

…and this…

…and this from Needham this morning…

…and even this…

…because if the chasm bw perception and reality is where profits are found, well, I suppose I’ll just see y’all on the other side of the shark.

/positions in stocks mentioned

/advisor US cannabis ETF $MSOS