When we last connected, we lent some historic perspective to our cannabis journey, touched on the general malaise of investor sentiment (that contributed to the recent 4/20 low), observed the two-sided positioning (Putnam / TIAA-CREF filed as owners while others were forced out) and readied for the upcoming parade of earnings.

A lot’s happened since then.

The MSM caught wind of the custody chatter we touched on a few weeks ago (which btw happened in March) as discussed last week in real-time on Twitter.

Alabama is poised to become the 39th state to legalize medical cannabis after lawmakers passed a landmark measure.

Trulieve and Harvest decided to get hitched in what would be the largest US cannabis transaction of all-time and create, in their words, “the most profitable multi-state operator in the world’s largest cannabis market.”

Curaleaf reported buff Q1 earnings: $260M in revs (est. $253M), Adj EBITDA of $63M (est. $61.4M) and Q2 guidance of $305M-$315M (est. $250-$300M).

And it wasn’t just the financials that were of interest. On the conference call, CEO Boris Jordan had this to say with regard to Chuck Schumer’s cannabis aspirations:

THE FDA!?!? Isn’t that cannabis Kryptonite? And how would that even work? If we moved it to Schedule II, as Uncle Joe thinks he wants, that would fail to address the broad-based criminal justice reform that is central to his legislative ambitions.

[note: as a card-carrying member of cannabis 3.0, or efficacy-driven solutions, and as someone who genuinely believes the cannabis plant is a treasure trove of API, or active pharmaceutical ingredients, I remain both fascinated and terrified to see how the FDA reconciles the medicine with the consumer product]

Consider this: SAFE Banking is movable as is right now but Chuck knows he needs it as the centerpiece of his master plan. That’s a hella game of chicken w people dying @ cash-only dispensaries but I get it; that’s how politics work, when they work.

Hey BoJo, any more you care to share? I know MSO investors can be a spirited bunch; prone to fits of outrage, particularly when sporting pseudonyms in a down tape, but they see the same voodoo that you do and I do, so can you further enlighten us, please?

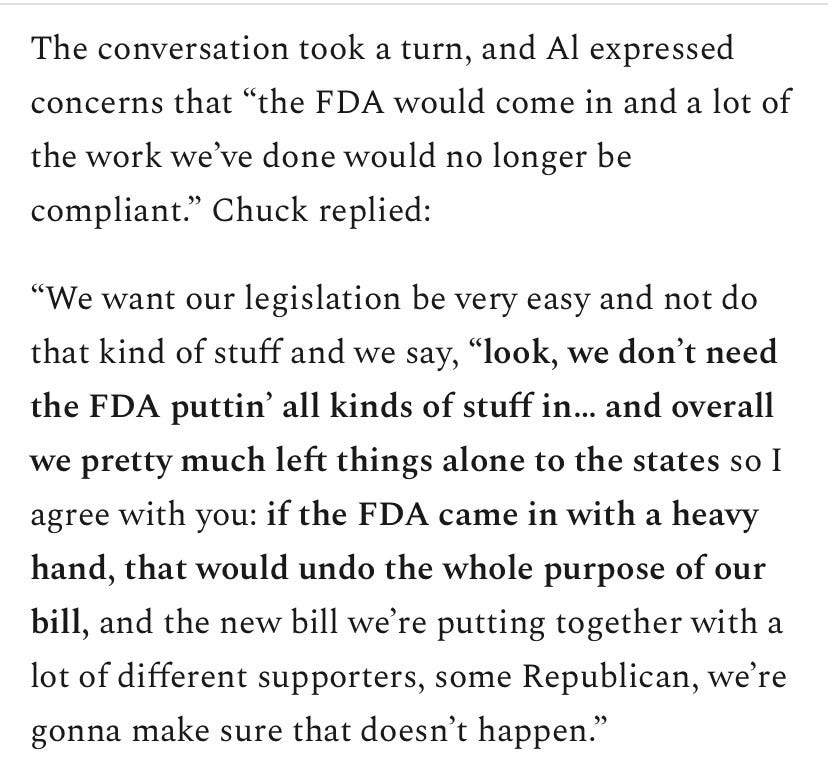

Wow that’s a lot to unpack! There’s the FDA and what that might mean; thankfully, Chuck tipped his hand in January when we first spoke about his grand canna plans.

This made me curious and when I get curious, I Google…

But there’s also an item of considerable importance to the alcohol industry (cough lobby), big tobacco, big pharma… and that’s the issue of interstate commerce…

…which most industry observers believe is inevitable, one day. But with states in dire need of tax revenues, / their constituents needing jobs, and in no small part due to the fact that each state regulates who can grow, process or sell cannabis, even the most cockeyed interstate optimist would concede that it’s likely a few years away.

The single-biggest question, I suppose, the granddaddy of them all, is whether or not comprehensive cannabis reform is even doable this session of congress; and if not, whether Chucky will dangle cannabis as a mid-term carrot / campaign finance tool.

It’s a lot to digest, even without the broader macro / market concerns and late-stage behavior that surrounds us. And obviously, nobody knows how this’ll all shake out.

Can Chuck get 60 votes?

Does he have a legislative Ace up his sleeve?

Would he hold SAFE hostage through the mid-terms?

Oh man, that’s alotta questions. I need some insta-Zen…

Jason Wild, one of the Grand Puhbah’s of cannabis, has a few billion reasons why he should pay attention to every nuance in the space, but he doesn’t. He focuses on the fundamentals and doesn’t waste much time on things he can’t see or control.

The man has a point / touched on something that we’ve discussed for some time but remains lost on most investors: the longer it takes for the federal government to align with state-legal cannabis, the better it is for existing operators (MOAT / brands / EV).

JW also likes this quote from the father of value investing, Benjamin Graham, who once said that ‘in the short run, the market is like a voting machine, tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine--assessing the substance of a company.’

[What matters in the long run is a company's actual underlying business performance and not the investing public's fickle opinion about its prospects in the short run.]

We could talk about the 30,000 yr history of this amazing plant; and we have.

Discuss how it was weaponized as an immigration / criminal justice tool, again.

Jump up and down about the efficacious agility; but we’ve been there, done that.

No, if you wanna know why the cannabis industry will continue to thrive…

Because, you know, there’s a lot of it at stake…

..and while we know it’s gonna be bumpy and there’s an alphabet city of regulatory agencies chomping at the bit to stick their hand in the pot, we now know that one of three things is gonna happen w/r/t US cannabis:

Comprehensive reform that addresses things like states’ rights, banking, taxes, and capital markets, allowing for the institutional adoption of US cannabis.

Piecemeal legislation that provides incremental benefits, such as SAFE banking, but pushes broader legalization / decriminalization out on the horizon.

Nothing, which is widely / wrongly perceived as a negative for existing operators for reasons discussed above.

Fourteen months ago, before the perfect storm arrived, we could have added:

existential risk for the sector if the status quo remains post-election.

But that’s off the table now with states tripping over each other to legalize.

New York / New Jersey don’t even come online until next year and let’s be serious: if Mississippi / Alabama already climbed aboard this train, what does that tell us?

I know what it tells me: be patient, be thankful, and be very excited.

/positions in stocks mentioned