I penned a column last week, Psychology Patience, that provided a snapshot of the U.S cannabis landscape: the buff earnings and robust outlooks from FANG-type leaders, a transcontinental mega-merger, the specter of comprehensive federal reform; and how none of that has mattered given the forced selling / continued custody f*ckery / A.D.D immediate-gratification mindset of the masses who’ve since migrated to crypto.

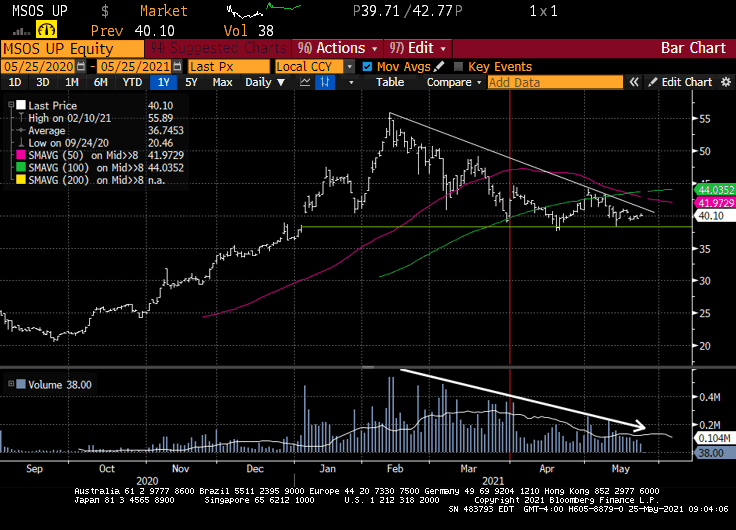

[note the volume trends in US cannabis ETF $MSOS / quarterly decline (red line) as the sector trades back to where it was when the Senate first flipped. the opposite of love isn’t hate, it’s apathy, and we’re a world away from throwing out gang-signs]

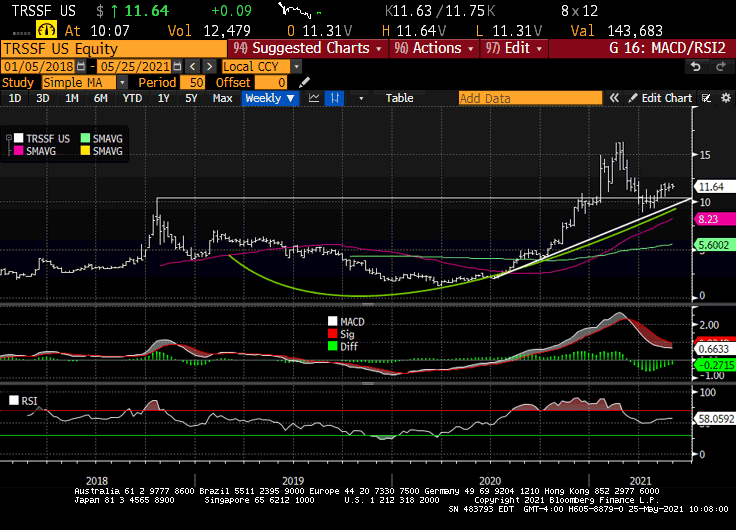

Meanwhile, the fundamental backdrop for US cannabis leaders continues to improve. Since we last spoke, TerrAscend crushed another quarterly earnings report w “record margins ahead of material growth” (Stifel). Analysts rushed to raise price targets after Chairman Jason Wild noted, "We have the wind at our backs; I can find accretive deals in ten different states right now." (<- recipe for persistent upside re-rating)

[me: per last week’s note, 2 million TerrAscend shares were forced on the market a few months ago, depressing the stock; when prices go down as fundamentals improve, that typically provides attractive risk-reward and we’ve added substantially to our position]

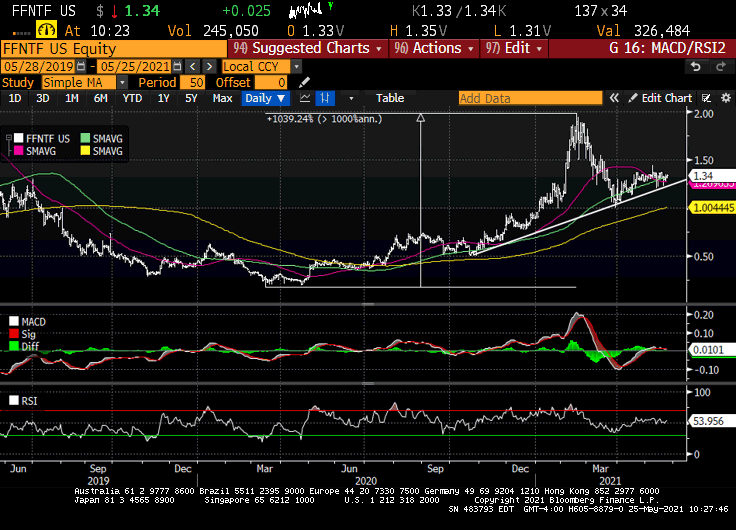

And not to be all Pollyanna but the seasonally soft first quarter has been anything but for U.S canna, a trend reinforced Monday when 4Front Ventures posted solid numbers and reaffirmed their outlook as Big Daddy readies comes online next quarter…

…and the stock, which rallied 10X year-over-year (as in 1000%) pulled back ~50% and has thus far held the uptrend off the November lows. These are big, beefy numbers!

Keeping with the earnings theme, AYR Wellness, the US canna growth stock trading @ (counting fingers on one hand) 5X 2022 EV/EBITDA, will report Wednesday night…

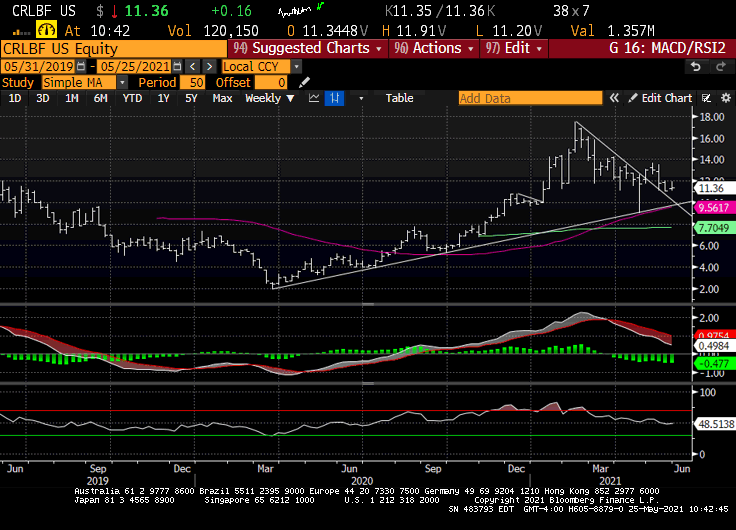

…and Charlie & his Cannabis factory (aka Cresco Labs) will report Thursday morning; as w Terra, there was forced selling in this name to the tune of a few milly and as with Terra, we’ve been adding to our position of late. Doesn’t make it right; just honest.

BTIG previewed the Cresco quarter icymi and you wanna know something? US banks covering US canna just feels right, like pork chops and apple sauce.

[note: AYR and Cresco will both move to GAAP reporting as of this quarter, which could make for some messy compares / one-time write-offs but this preps them to list on U.S exchanges once permissible, which is the bigger takeaway, at least for me]

Despite the strong fundamentals and leaving aside the artificial arbitrages that’ll melt away / re-rate U.S canna on the other side of federal reform, our space continues to be viewed as an immature asset class and not ready for primetime, relegated to a fugazzi exchange like the CSE and Yahoo-message board-era pink sheets.

Two weeks ago Dogecoin was worth more than the entire (listed) US cannabis industry. And this pay-no-mind list, it makes no sense; maybe you’ve been away a long time and haven’t heard: Canna pays big taxes, canna generates jobs, canna promotes wellness… in other words Billy, canna ain’t shining shoes no more!

I’ll leave the crypto craze to others (I believe in the blockchain but feel like I’ve seen this speculative movie before) and remain laser-focused on… wait, no lasers, we’ll just remain focused on the generational opps that we continue to foresee in U.S cannabis, even if it’s hard to sort through the near-term noise / uncertainty @ the federal level.

But this is and will continue to be a state-led story as we ride the tailwinds of the 2020 Perfect Storm. The journey was never going to be a linear—it’s a frontier market and history is littered with the corpses of failed pioneers—but this sector just enjoyed scorching year-over-year gains and the market G-ds took about a third off the top (for whatever reason) and that reset, as mentioned earlier, completely flipped sentiment.

That’s not to say there isn’t risk—one of my favorite market axioms is that commodity vol(atility) typically precedes equity vol and if that again proves true, cannabis won’t be immune. But if there weren’t risk, it’d be called “winning” not “investing” so sack-up (that’s a technical term) if you wanna achieve generational wealth.

It’s almost cruel if you stop to think about it: U.S canna being O.B during one of the wildest speculative eras of our lifetimes, only to be unleashed at the tail-end of it all, but I suppose in some perverted full-circle sorta way, it all kinda makes sense.

But you could take solace in this: if you put 3-5% of your portfolio in U.S canna and we’re right with regard to what’s about to happen over the next three to five years, you’ll have earned yourself some jingle in your jeans. And make no mistake, that would ALL YOU because we’re all responsible for our own investment decisions.

But if we’re wrong—if this whole thing goes to hell in a bucket—you’ll have only lost 3-5% of your investable assets while we, on the other hand, will have lost everything and my reputation? Fuhgeddaboudit. Finut. Dead to me. Sleeping with dem fishes.

So Go Fish. Or don’t. But good luck either way.

/positions in stocks mentioned

/advisor $MSOS $FFNTF

@todd_harrison