Last week we Followed the Money through several dynamics shaping U.S cannabis.

We touched on Curaleaf, which kicked off Q1 reporting season with buff numbers; followed-up with a big-time Colorado bet with an eye toward interstate commerce; which is not to be confused with their prior bet, which helped BoJo circle Europe.

We congratulated Trulieve and Harvest on their pending nuptials, the first hook-up in what could turn into a sizzling summer of canna love.

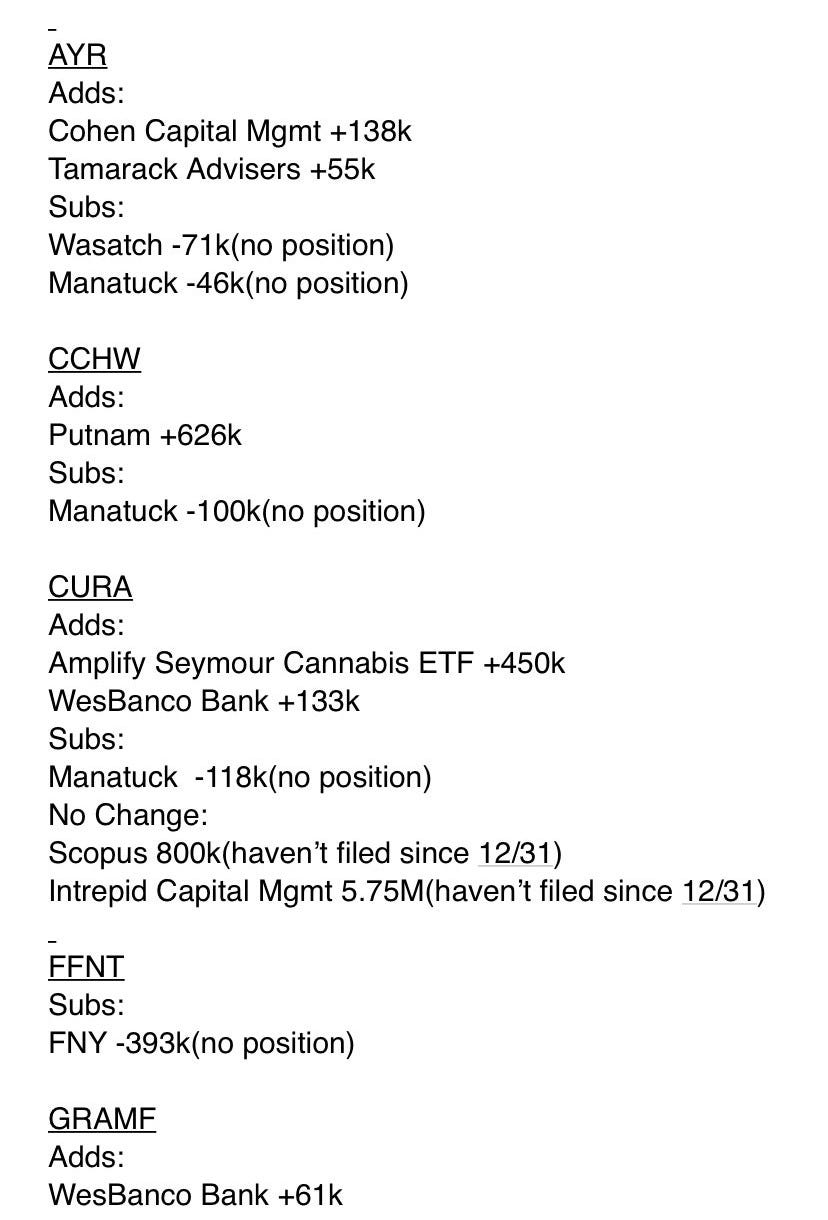

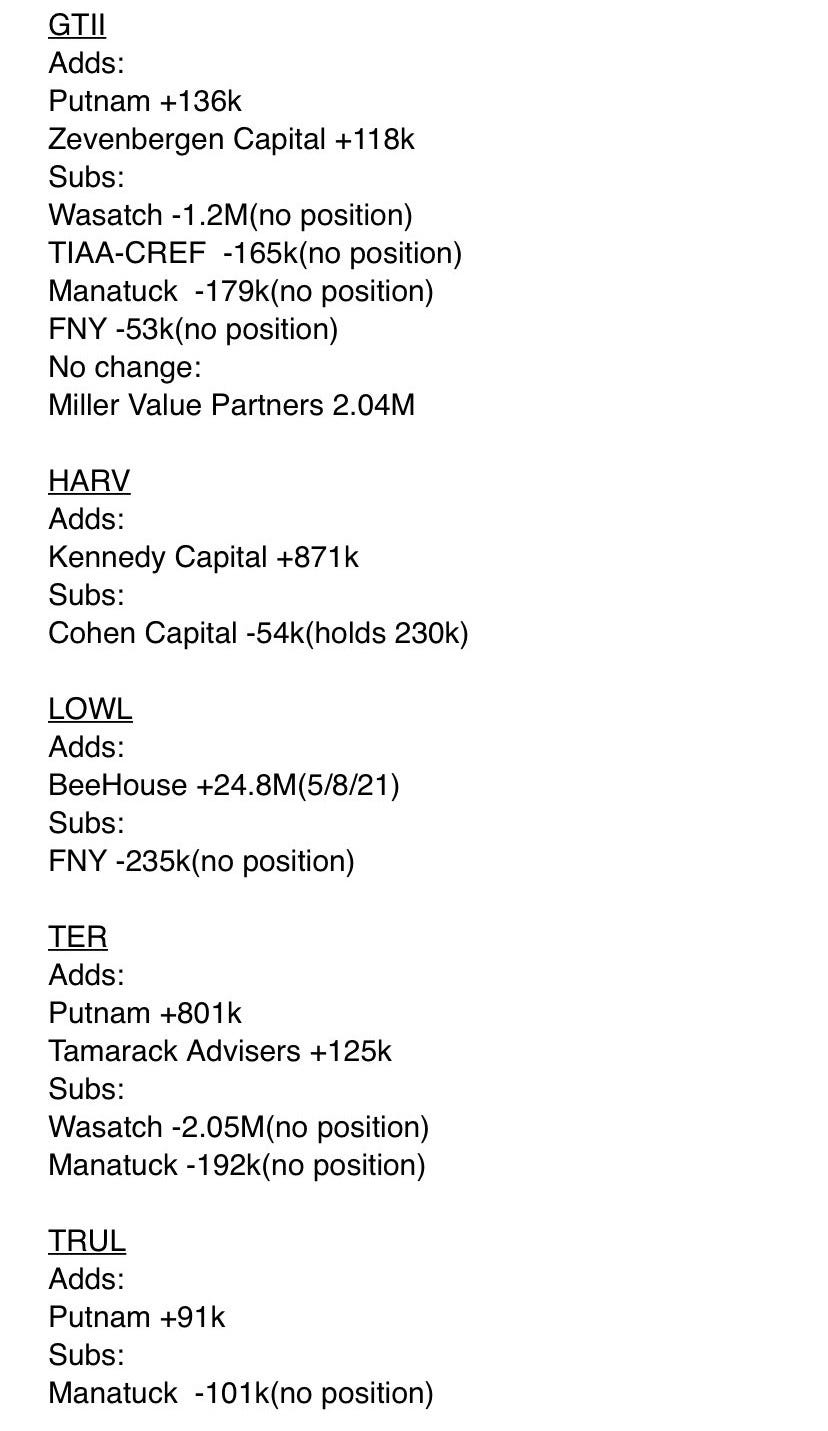

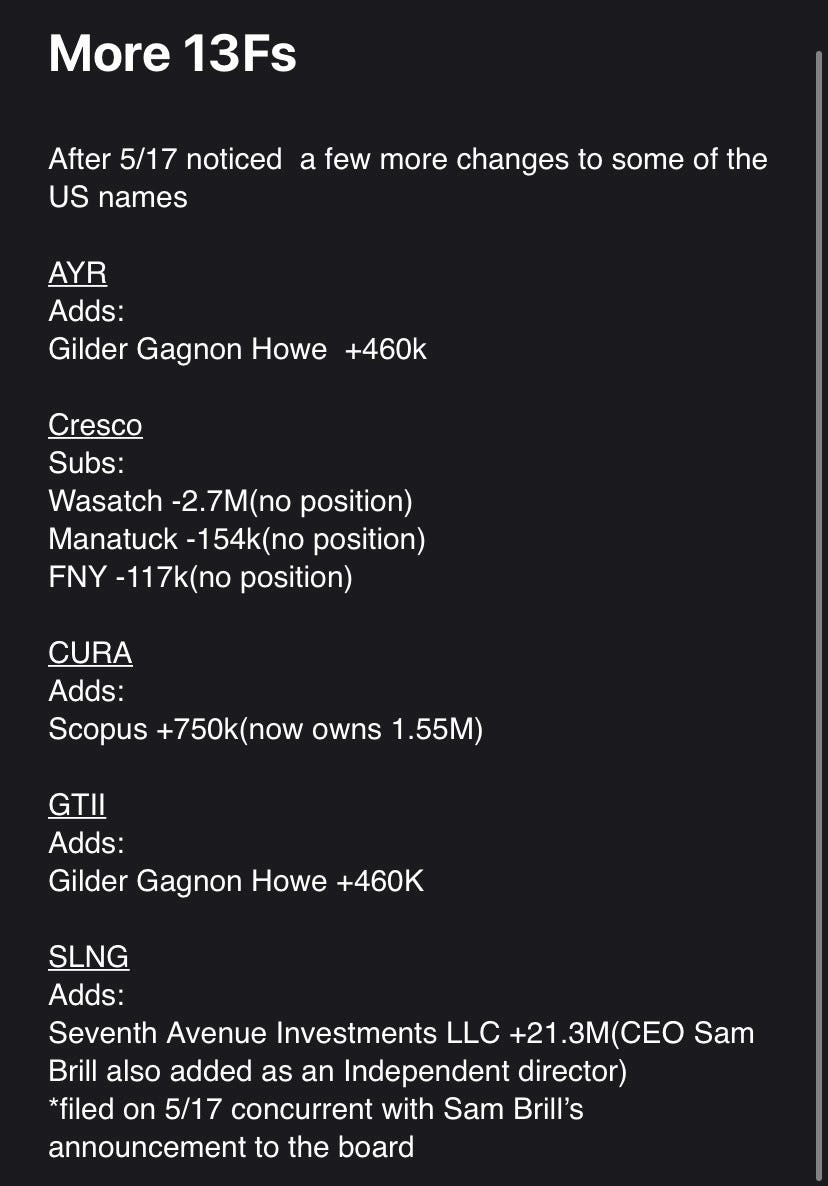

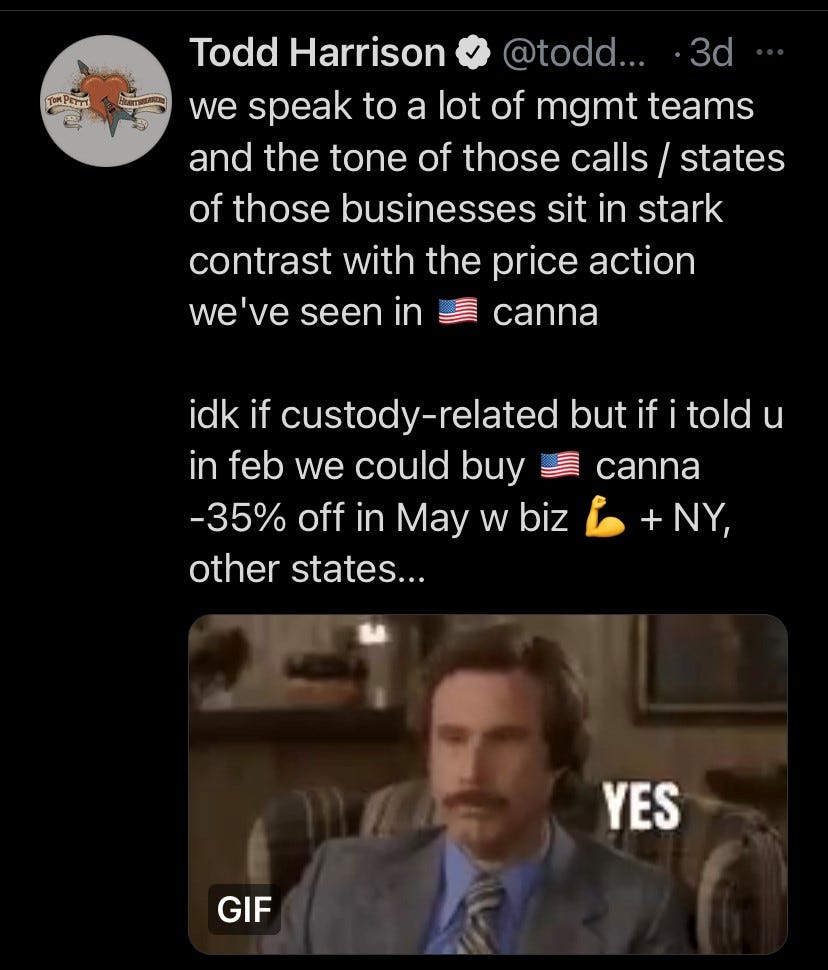

And we spoke about the continued f*ckery that has forced at least one institution to liquidate their U.S cannabis holdings, a fact that was illuminated last week when the quarterly 13-Fs were filed. Among select U.S canna names:

[this 13F bonus observation was added late; thank you AP]

A few things of note:

these names were already whisper-thin given most U.S retail / all institutions (sans Putnam) are unable / willing to own these securities.

moving that kind of size def exacerbated what woulda been a well-deserved / perfectly natural retracement following massive year-over-year gains for U.S canna; maybe a 20-25% pullback ~> 35-50% for those in liquidation.

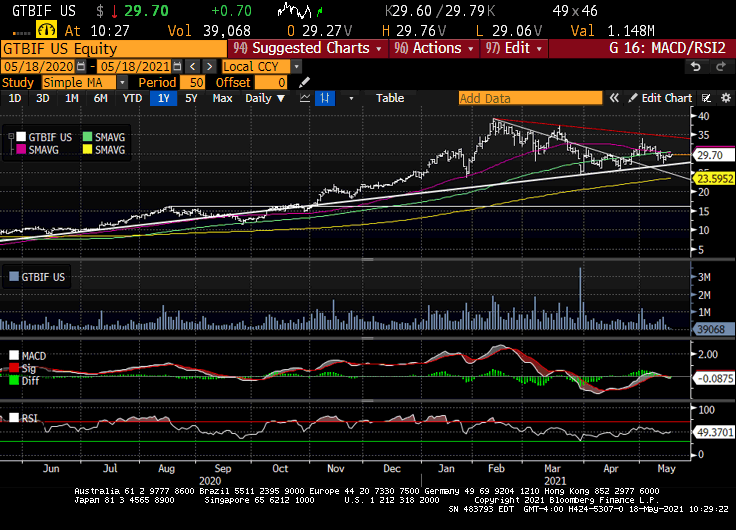

institutions were / are / always will be drawn to best-in-breed, which is why they owned seven-figure size in Green Thumb (GTBIF), TerrAscend (TRSSF) and Cresco (CRLBF), among others.

the forced selling created a negative feedback loop of piss-poor price action -> worsening technicals -> retail sellers -> piss-poor price action…

these headlines will likely continue; whether it’s BAML re-articulating custodial policies on cannabis-related securities or other banks doing the same, we’ve mentally prepared for a Bananarama-style summer / possible war of attrition…

…bc we see what you see: the inability of our sector to rally with a risk-on tape; ghost-like volumes as the rest of the world sloshes in liquidity; U.S canna FANG trading .70-wide / by-appointment while everyone else chases shiny new objects with laser-eyes.

But don’t despair. SERIOUSLY. Focus. SERIOUSLY. bc this next part is important:

Now, I obviously don’t know if that’ll play through—the macro / market will have a huge hand in our financial equation—and let’s be real: if you’re reading this for free, odds are you’ll get what you pay for—but it’s true that while everyone was running around pulling their hair out on 4/20 bc Chuck didn’t drop his master plan, the 2021 low for U.S canna registered, at least thus far.

[this reminds me of how many people are bashing the Senate Majority leader rt now; the same guy who just crazy-glued his entire political legacy to U.S cannabis reform]

There’s also the dichotomy bw the strength of the underlying businesses / continued state-level adoption that’ll drive TAM higher for years vs. the pullback in stock prices for the few, proud holders who are actually able to buy and custody these stocks.

But don’t take my word for it. Ask Big Ben of Green Thumb, who reported $194M Q1 revs (est. $187M) / $71.4M adj EBITDA (est. $66M) before tossing his Cookies on the Vegas strip (so to speak).

Or Kim @ Trulieve, who boasted $193.8M Q1 revs (est. $189.9M) / $90.8M adj EBITDA (est $84M) before she and Harvey file a joint tax-return.

Yes, business is good.

State-level adoption will continue.

The U.S opportunity is… insane but NOT bc of what may happen at the federal level…

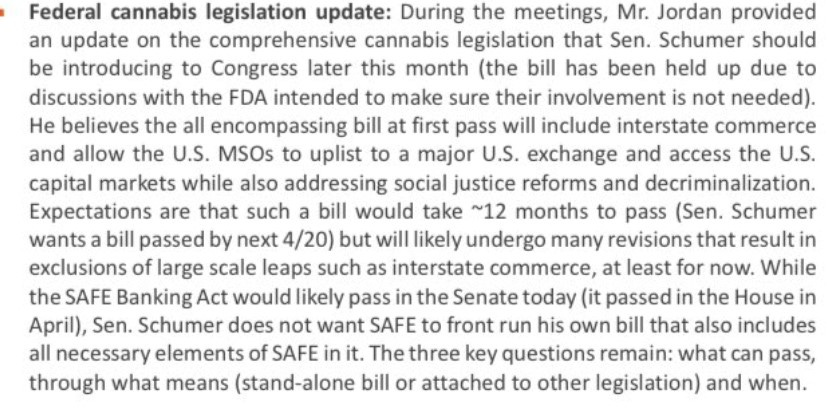

[the below recap is courtesy of Camilo Lyon @ BTIG, who was channeling Bojo]

…because that’ll take time / highlight the duration mismatch between most of the current retail holders (who want their baby back baby back now) and the eventual promised land [knowing the FDA is on the bench, understanding the interplay bw states’ rights and interstate commerce, implementing social / criminal justice reform; repealing 280E / debt financing / institutional ownership / uplisting to U.S exchanges]

IDK when we’ll get his initial language and I definitely don’t know 1. what it’ll look like on the other side of the ride, 2. if he’ll have the 60 (51?) votes needed to pass the Senate, or 3. if he’ll attach it to must-pass legislation as a measure of last resort.

And I’m OK with all of it—wanna know why?

This you should know, or should, but if you don’t, we spent last week talking about it and encourage people to read up, learn the space and follow the science.

This is one fascinating plant my friends and if our antennae still work, it’s gonna disrupt Western Medicine before it’s all said and done.

We’re trying not to overthink things. As shared in our monthly letter to investors that pubbed Monday, it’s only natural to question your thesis when a sector drops 35% in three months, especially given the special circumstances that surround our space, and the powerful agendas in play.

While I can’t speak to your risk tolerance or time horizon, a huge driver of our forward success will likely reside in our ability to ignore the noise, follow the fundies and know that patience brings price… even if we don’t know when.

This space isn’t for everyone—actually, as several unhappy fund managers would tell you—so let’s be thankful for the opportunities we have, choose our vehicles carefully, right-size our risk and please, everyone, myself included, take a deep breath.

By the time we get to where we wanna be, the journey will have ended.

/position in stocks mentioned

/advisor US cannabis ETF $MSOS