It’s been two weeks since our trip to Washington DC and we’ve already seen a slew of movement. Weldon Angelos, who we often refer to as the man in the criminal justice arena, stepped into the actual arena and testified @ the Senate Judiciary Subcommittee Hearing on Decriminalizing Cannabis at the Federal Level…

…which, in and of itself, is a pretty big deal. I mean, here’s a man who spent 13 yrs in prison for selling a few hundred dollars worth of weed and has earned the perspective of considering himself lucky because his original sentence was a mandatory 55 yrs.

Since being released in 2013, Weldon has fought tirelessly on behalf of the thousands of non-violent cannabis offenders who can’t afford to fight for themselves. While his seat in the Senate was the culmination of hard work by many different individuals and organizations, he alone has emerged as the determined face of criminal justice reform.

Last week, on an otherwise slow summer Friday, some of those DC efforts—the stuff we were asked not to publicly discuss until it was announced—sprung to life…

…when Reps. Troy Carter (D-LA) and Rodney Davis (R-IL) sponsored the Marijuana Misdemeanor Expungement Act, which would create a process to expunge federal misdemeanor convictions and allow courts to recommend presidential pardons.

While the significance of this was lost on many, those who’ve been paying attention…

…understood what it meant for the specter of incremental federal legislation which, while worthy of an eye-roll, has always been the script is the script is the script.

This isn’t post-rationalization, tin-foil conspiracy or wishful thinking on our part; all we’re doing is paying attention to what’s being said by those closest to the situation.

But we get it, we do. Most people aren’t paying attention to criminal justice bills and the average investor doesn’t know who Weldon Angelos is, at least not yet.

This past Monday, however, Senator Cory Booker (D-NJ) signaled that same story…

…when he said SAFE Banking is “very important” legislation and he’s a “supporter” but he wants the bill to be “balanced with some restorative justice as well.”

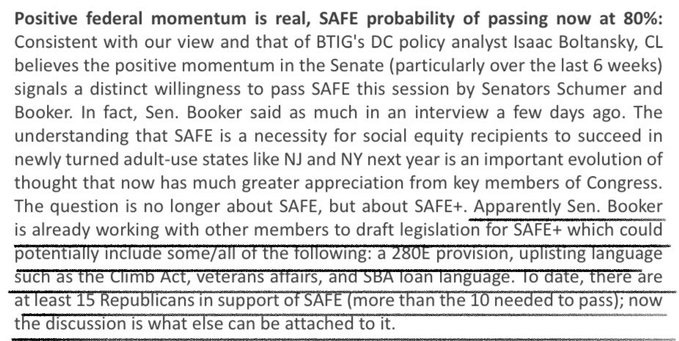

Insofar as there seems to be more than enough votes for SAFE banking…

..and we evidently now have the “+” in place…

…the question we’re left to wrestle with is: what other low-hanging legislative fruit can we affix to this Fokker before the 117th Congress is no more?

The fine folks at Cresco took a stab at that salad on Tuesday…

…and while we understand that the scope and slope of this legislative package is still taking shape, it’s worth noting that everything we heard in DC has since been made public and signaled to the masses. And the market’s reaction, thus far?

[note: we’re told that SAFE, SBA, MME, protections for veterans and research are the current policy tentpoles and that 280e / up-listing / HOPE remain “in play.”]

[note: we’re told that the timing is likely the lame duck session (Nov-Jan) bc the GOP doesn’t wanna give Dems the win prior to the midterms]

[note: we’re told President Biden intends to honor his campaign promise re: federal clemencies and the number of senators needed to de-schedule is edging ever-closer]

The collective yawn from investors thus far is likely a function of multiple choice:

A) they don’t believe

B) they don’t care

C) they can’t custody

D) the world sucks

E) all of the above

The simple truth: we’ve come a long way from Sen. Booker ‘laying himself down’ in front of SAFE banking and while many investors have been quick to find fault with him, there are thousands of prisoners and their families who’d respectfully disagree.

Besides, that was then and this is now…

…and while there are definite sector / consumer / macro / geopolitical ghosts that’ll continue to crowd our young child's fragile eggshell mind these next five months, the specter of incremental federal reform will likely price-in between now and then.

Why? Because sequencing matters. If U.S cannabis companies have an even playing field—if they could take credit cards, get insurance, raise capital, have US exchange listings; if institutions were able to buy their stocks—then the hunted would become the hunters and this emerging secular growth story can finally fly under it’s own wings.

It’s been over two months since Attorney General Merrick Garland said that the DOJ would address marijuana issues ‘in the days ahead,’ which begs the query: what’s he waiting for? Some have speculated the eventual messaging will be coordinated with FinCEN and / or other regulatory agencies, as has been done in the past.

The good news, for all of us? We’re not going to have to wait very long to find out.