RIC (whispering): It's all happening. Zeppelin is at the Plaza. So's four other bands They're partying up there right now. Sapphire, and Miss Penny Lane too...

There’s a lot going on in the world and if you haven’t been paying particularly close attention, you mighta missed the remarkable recovery in cannabis.

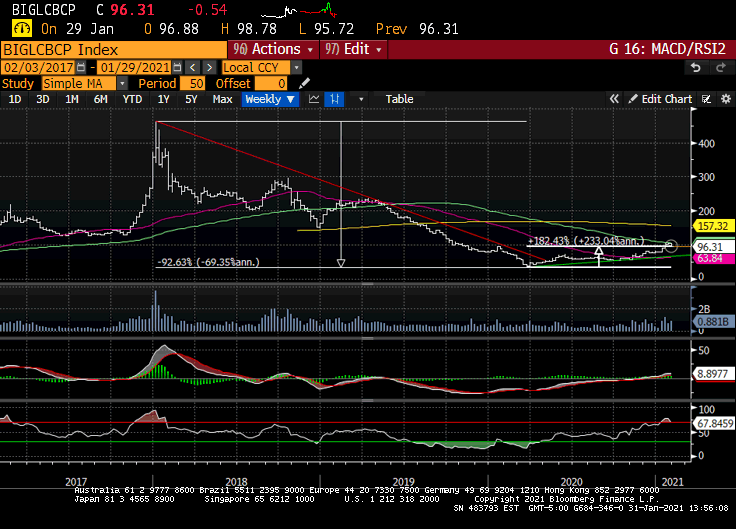

After getting smoked for 92% from Jan 2018 to March 2020, the BI Global Cannabis Competitive Peers Index has rallied 182% since which is huge, but also relative.

While sector successes were shared on both sides of the border, at least in terms of stock price appreciation, we’re gonna focus our attention on the opportunities in U.S cannabis for reasons I’m about to explain.

People are pissed at RobinHood for restricting certain stocks but a year ago, the entire cannabis industry was basically told to go fuck itself. Pershing clients could no longer buy cannabis stocks, just sell them. Not this stock or that stock. Any stock. GTFO.

The timing was special. It was just after vape gate but well before we would learn the illicit market was to blame. I was on the way to shul for Rosh Hashanah when I got the email from Pershing saying they would no longer custody or clear U.S cannabis-related securities. I remember thinking: they custody everyone.

Next the virus arrived and the industry wrestled with some sobering existential risk. I can’t speak for anyone else but I certainly had my Lou Mannheim moment. There was no access to capital markets, there was an exodus from the space and, well, it sucked.

Then cannabis was deemed essential and it became clear that states —every state—would need additional tax-revenues to repair their broken balances sheets; and that people who were displaced by the pandemic would need jobs.

And then, all of a sudden, social justice shined a bright light on the War on Drugs.

It was goddamn perfect storm (<- stellar RealVision segment from Nov).

I’ve spent 30 yrs on the street and studied this amazing plant, the history, and science behind cannabis for over a decade. I am passionate about what I’ve learned, heavily invested in the space and motivated to help others find their way.

I’ve also shared my process, best ideas, random thoughts and pretty much everything else online these last 20 yrs+. ‘Sometimes right, sometimes wrong, always honest’ so please don’t @ me if I’ve been smoking Peyote for six straight days and none of this really exists.

I can jump up and down, screaming at the top of my lungs that U.S cannabis has asymmetric risk-reward / is in a secular bull market / that the time is now bc most investors were flushed / institutions & U.S retail can’t yet buy, and I will. I am.

At the end of the day though, you’re responsible for your decisions, and markets have a way of humbling us all, so all I’m saying is be careful. I’ll share everything I know, both here and on Twitter, but please, be smart, and good luck.

The Set-up

Context is important so I encourage you to click the links and delve deeper into the underlying dynamics. There’s a lot to this so I’m gonna try to synthesize it best I can but the entire space is a rabbit hole for the intellectually curious, so go deep!

The U.S Cannabis long squeeze is a function of the outsized demand that is waiting for the regulatory changes that will allow for investment in U.S plant-touching operators. As it stands, institutions, along with many if not most U.S retail investors, are on the outside looking in, unable to access this emerging asset class.

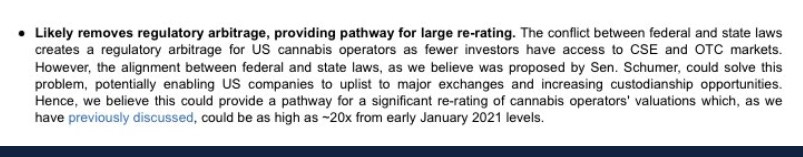

Why? Given federal regulations, U.S cannabis stocks are relegated to the pink sheets and the CSE but once the regulatory arbitrages unwind at the federal level, these stocks will list on the NYSE / NASDAQ. That, the repeal of onerous tax code 280E, access to debt financing, lower cost of capital—an even playing field: all coming.

I wrote in August there were Barbarians at the Gate and that a few institutions had actually slipped through and filed as holders of U.S cannabis companies. As someone who had just done the Andy Dufresne backstroke for two years, and as that was what we’ve been waiting on, it certainly piqued my attention.

In the back-half of 2020, as the FANGification of US Cannabis took root and cannabis emerged as part of the post-pandemic solution, we wrote about the MASSIVE opportunity for U.S cannabis here. That column is worth another sniff but it also needs to be updated as I wrote it before the Senate was painted blue in January.

If you’re new to this space, lemme just tell you: that Senate flip was seismic.

In the week or so that followed, US MSOs (multistate US operators) raised a billion dollars (easily) to go shopping for accretive acquisitions, and the space traded higher before profit-taking emerged last week on whispers SAFE Banking would be pushed.

The recent hedge fund turmoil impacted cannabis as well, as “long US cannabis / short Canadian cannabis” strategies were seemingly unwound.

The shorts have presssed the downside. Rat-bastards. But institutions were happy because they want the space lower so they can buy cheaper once they finally get the green light from Congress. God forbid they have to chase.

Here’s the best part: the reason that SAFE isn’t expected to be in the next COVID-19 relief package isn’t because cannabis won’t be a priority for the Biden Administration, as was the sudden and sweeping concern last week.

It was bc the Senate Majority Leader Chuck Schumer is in the process of writing comprehensive cannabis legislation to legalize / decriminalize cannabis, which will leave the decisions to the states and incorporate important social justice reform.

This news was out on Thursday but it was largely ignored by a MSM mesmerized by GameStop, #wallstreetbets and a million other things vying for our mindshare.

Here’s the second best part: our bull thesis isn’t predicated on any movement on the federal level; it relies on continued state adoption that will drive the total addressable market (TAM) higher. And if anything, that is moving faster than expected.

Here’s the third best part: the pent-up demand is magnitudes larger than the number of publicly traded US cannabis stocks currently listed. There maybe a 15-20 right now vs. every institution X multiple fund managers X U.S retail, and that’s before the late-cycle adopters realize that cannabis is actually good for you.

But really, it’s about the fundamentals.

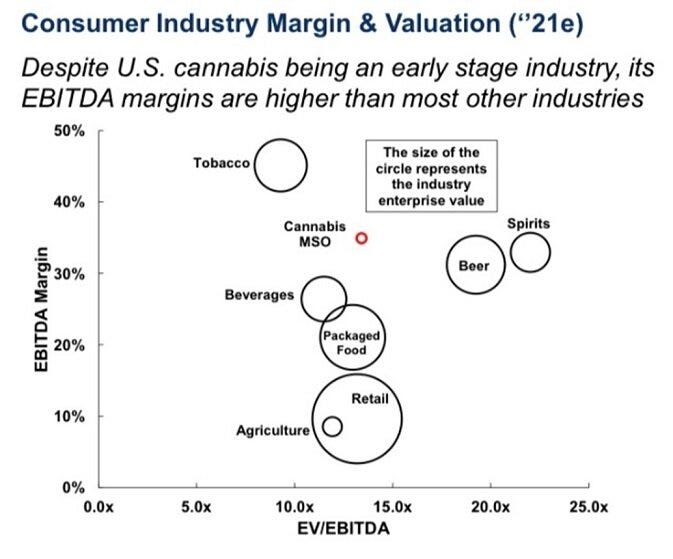

Based only on state-level adoption, U.S cannabis stocks are growth companies trading at value multiples. That’ll change once institutions usher in efficient markets but tbh the current off-sides, in terms of the positioning and perception of cannabis, is epic.

Institutions are chomping at the bit to buy into this generational opportunity. It’s gonna be volatile af and noisy as hell but I’ve been staring at screens most of my adult life I’ve never seen such a compelling investment set-up.

Don’t take my word for it. Stifel GMP analysts A-Part had a note out Friday; and yes, he’s saying US cannabis stocks could trade 20X early January levels (that’s not a typo).

Depending who you are and where you live, you may not be allowed to buy individual US cannabis securities either.

But US Cannabis ETF $MSOS listed on the NYSE in September with a few million dollars (AUM is $582M now) and provides exposure to the U.S cannabis through performance swaps. U.S cannabis on the New York Stock Exchange. Gorgeous.

We advise $MSOS but this isn’t a pitch as much as a head’s up bc it’s the only NYSE listed product with US cannabis exposure and as it runs, the stocks that comprise it will rise in-kind. If you can access the broader universe of individual securities, I encourage you to explore them; if not, or even if you do, this is a helluva proxy.

The walls are coming down around cannabis. Fidelity, Putnam, Vanguard, Wellington, Blackrock and small cap growth managers throughout the land are hating this column because they’re all gonna want a a piece of this industry; because they’re smart enough to see the mispriced merchandise and off-sides positioning; because they get it.

The Barbarians are at the Gates; and $MSOS just may be your key to step on through.

PS- I’ve had the diamond hands thing going w US cannabis since last summer. Not bad for a Gen-X, right?

States in the NE are falling like dominos to align w their neighbors and glean tax revenues. Watching your neighbor rake in hundreds of millions from cross border buying is motivating at a time when state budgets are distressed.

the overall federal framework is becoming untenable for the industry. Once lawmakers get the wheels back on the bus MJ policy should be a priority. I think we all have been waiting to see if they take up SAFE or go for something more comprehensive. Maybe it’s time. Go get em, Chuck!

Thanks for the insights!

Bruce Springsteen's ghost writer? This guy is The Boss.