Hump Day Hashish

A random walk through Cannaland

Note: Cannabis Confidential shifted content strategy in 2026 with insights from trusted partners, industry insiders, and thought leaders who’ve got something to say. There will be no more paywalls or content fees; think of it as The Players Tribune for the cannabis industry, with an ethos of honesty, trust and respect.

Recent Recap

The back half of February began the same way the first half of January began: waiting on the Attorney General to move cannabis to Schedule III. White House whisperer A. Martinelli shared this, which aligns with our take but is completely moot until it’s finut:

The White House, however, made clear that the administration is not backing down. White House spokesman Kush Desai told Fox News Digital today that the move is part of the president’s pledge to expand research into marijuana and cannabidiol.

“The President’s historic action paved the way for the development of promising new treatments for American patients, especially veterans,” Desai said, noting that leaders from law enforcement and veterans groups attended the Oval Office signing.

Despite criticism from corners of the conservative movement, the administration appears committed to moving the rescheduling process forward, framing it as a research-focused reform aimed at supporting patients and veterans.

Talk is cheap, we know, and this has been the speculation since the December 18th EO and rug-pull, but with 49 days gone in 2026 and 257 days until the midterms, the rubber and the road are seemingly on a collision course.

We heard several potential reasons for the ‘delay,’ one of which was that the AG is juggling Epstein and Minnesota, another was they’re adding ‘belt and suspenders’ (capital market and exchange listing), but all of it is water-cooler chatter, at best.

In other news, Virginians 21+ may finally have access to canna dispensaries later this year after the Virginia House and Senate passed similar bills, setting the stage for a Democratic trifecta once Gov. Abigail Spanberger finishes what has been a years-long reform process in the commonwealth (would benefit Verano, Green Thumb).

Smart & Safe Florida has asked the state Supreme Court to overturn a recent decision to invalidate 71,000 signatures that would put cannabis legalization on the November ballot, which has obviously massive implications for a potential ballot referendum.

And Organigram made an accretive acquisition of Sanity Group, positioning them to capitalize on Sanity’s near-term plans to enter the UK and Poland and expand existing business in Czechia.

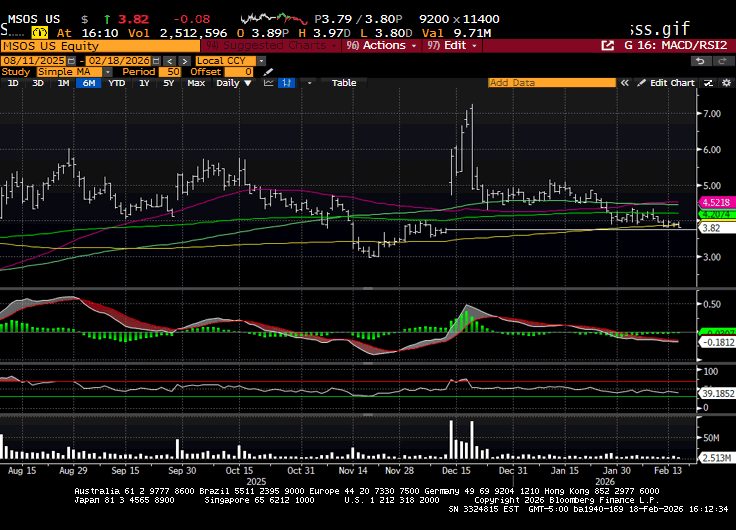

On the U.S. side of the canna equation, MSOS remains fragile as the ETF sits slightly below the 200day MA ($3.90), which is almost where it was prior to DJT’s EO.

A lot of people wished they bought the space at these levels prior to that news but as is often the case, a second bite at the apple doesn’t always appeal as appetizing.

Top Stories

If America Has A Cannabis Problem, New York Times Wants To Make It Worse

The Legal Weed Business is Booming; Banking Access Isn’t

CRS Weighs 280E’s Constitutionality For Cannabis Businesses

Virginia Adult-Use Cannabis Sales Appear Inevitable Under Democratic Trifecta

Massachusetts cannabis sales surpass $9 billion milestone

Florida 2026 Cannabis Legalization Campaign’s Valid Signatures Lawsuit Sent To Supreme Court

Wyoming Lawmakers File Bipartisan Bill To Reclassify Marijuana As Schedule III Substance

“I think we are on this precipice, teetering on this little thing where we have no problem discussing how bad marijuana is — but don’t attack alcohol, because that’s a part of our culture. Well you know what, people get behind the wheel drinking everyday and kill people.”- Joey Jones, Fox News Anchor

Industry Headlines

C21 Investment’s Sammy Armenia 📺

CB1 Capital Partner Loren DeFalco 📺

Cannara to Host Investor Webcast on February 19th, 2026

B.C. court orders former U.S. cannabis CEO to pay $7.4M after deal collapses

Canopy Growth Announces MTL Cannabis Shareholder Approval of Acquisition

Organigram Announces Proposed Acquisition of Sanity Group — Germany’s Leading Cannabis Company

ATB on Virginia

Following Tuesday’s crossover deadline, several key Virginia marijuana reform bills have advanced:

- Adult-Use Sales (SB 542 & HB 642): Both chambers passed legalization measures for commercial sales. While Governor Spanberger supports the move, the bills currently differ on tax rates, oversight, and start dates (late 2026 to early 2027).

- Legal Protections: Legislation advanced to establish automatic resentencing hearings for prior convictions. Additionally, HB 942 passed the House, preventing legal cannabis use from being the sole factor in child custody or neglect cases.

- Medical Access: The House passed “Ryan’s Law” (HB 75) nearly unanimously, allowing terminally ill patients to use medical cannabis in healthcare facilities.

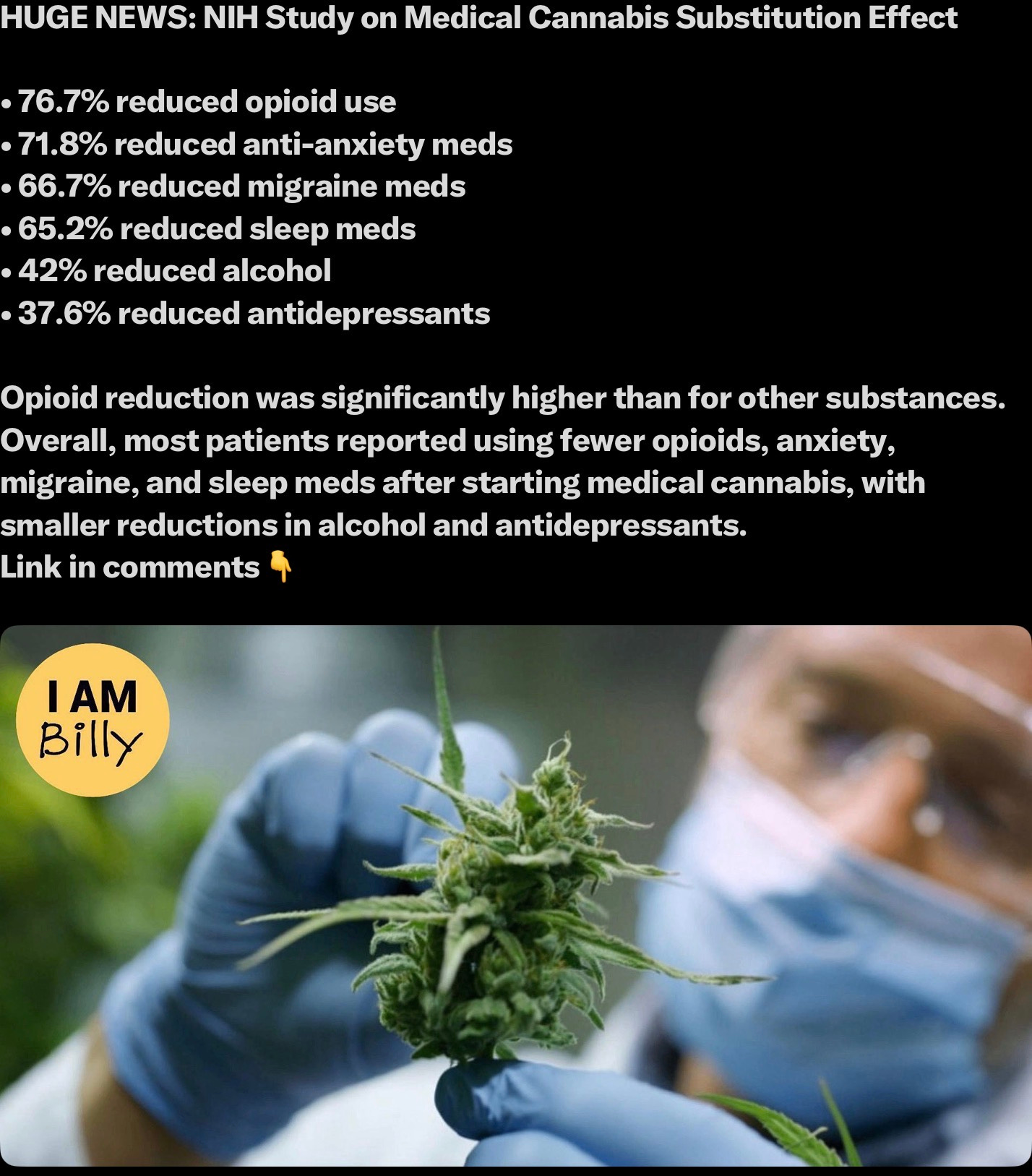

Cannabis is Medicine

ATB on High Tide

I’m going to start by saying look at the one-month CWEB chart, for context.

We hosted High Tide’s CEO Raj Grover for a meeting last week. While the core retail thesis remains robust, management highlighted an overlooked valuation lever re: HITI’s US CBD e-commerce portfolio.

Based on HITI’s stock market reaction since Dec 18, investors are completely neglecting the potential value of HITI’s US CBD assets (NuLeaf, FAB CBD). However, following Trump’s Executive Order regarding Medicare reimbursement for CBD, there could be significant US CBD incremental value that is not priced into the stock.

HITI’s US e-commerce platforms are struggling due to broader industry headwinds, with management previously considering divestiture. The landscape shifted Dec 18, 2025, when President Trump issued an EO encompassing a CMS pilot program, which would allow Medicare beneficiaries to receive up to $500/yr in no-cost CBD products.

This would be a game-changer for the US CBD industry, subsidizing demand for the demographic most likely to use CBD for pain and wellness management.

Since the EO announcement, Charlotte’s Web (CWEB) rallied +230% (vs HITI -18%), reaching a market cap of ~C$150mm. CWEB now trades at 2.8x LTM EV/Sales, compared to HITI’s consolidated multiple of just ~0.5x. High Tide is generating ~$19mm in annual sales from its e-commerce platforms. If we apply the CWEB multiple to HITI’s segment, its value would be +C$50m (+C$0.58/share).

Investors should watch out for the launching of the CMS pilot program. Dr. Mehmet Oz has mentioned a target launch date as early as April 2026.

Stems & Seeds

Teen Marijuana Use Falls to Near 30-Year Low, Down 40% From 1999 Peak

CBD Targets HER2-Positive Breast Cancer Cells, Triggers Cell Death Pathways

Have a safe journey, please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in/ advises some of the companies mentioned and nothing contained herein should be considered advice.

No guess on timeline Todd? Does it happen before the summer or before midterms?

The video add is POWERFUL and I am shaken to my core. Thank God for a natural remedy to seizures that helps both the afflicted and their care givers.