Executive Decision

Trump triggers historic cannabis reform.

Note: All subscription payments for Cannabis Confidential have been suspended and there will be no paywall for a bit. Happy, healthy holidays to you and yours.

This has been a long time coming.

We’ve written that Donald J. Trump was in a unique position to steal the most popular political issue in America here, here, here, and here. I even got dressed up in January and joined my friend Charles Payne on FBN to implore POTUS to do the right thing.

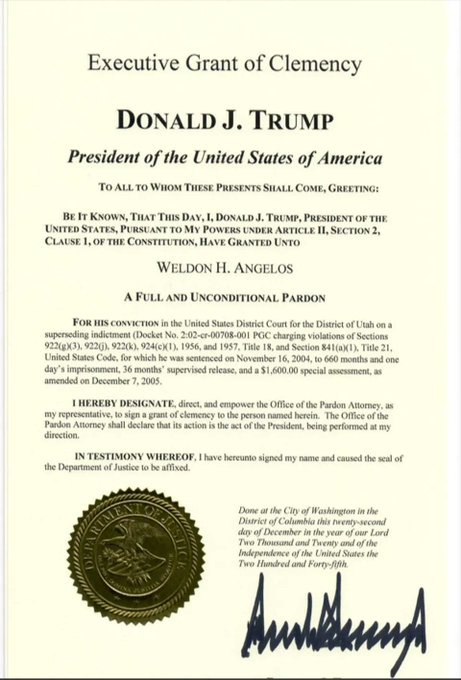

Weldon Angelos, bless his soul, was pardoned by President Trump in 2020 and instead of enjoying his freedom, he became the loudest voice on behalf of the thousands of prisoners serving non-violent cannabis offenses, as shared here, here, here, and here.

Five years ago, he and I began to build The Mission [Green] Alliance to effect positive change through federal cannabis reform and have since been joined by U.S. operators Verano, PharmaCann, Cresco, Trulieve and Ascend, as well as a collection of athletes such as Iron Mike Tyson, a man who played an critical role in advancing the issue.

It takes a Village, as they say—and yes, Village Farms has also supported Weldon—to raise a family or in this instance, stand up an all-American, employment-generating, wellness-creating industry that’s been disparaged, demonized, and almost destroyed by an unjust War on Drugs that long ago lost its way.

DJT pardoned Weldon in 2020 before they worked together on passing The First Step Act, which was the last major criminal justice reform in this country. After four long frustratingly unsuccessful years of Joe Biden, Chuck Schumer and the Dems, President Trump just stole an issue that 90% of Americans agree on, which is easy, peasy politics.

A few thoughts and observations, allowing that I’m currently “offline” for my annual year-end digital sabbatical—but first, some historic cannabis news:

*TRUMP SIGNS ORDER EASING FEDERAL RESTRICTIONS ON MARIJUANA

*TRUMP SIGNS ORDER TO INCREASE MEDICAL MARIJUANA, CBD RESEARCH

*ORDER DIRECTS DOJ TO EXPEDITE RESCHEDULING OF MARIJUANA👇

Also see: President Trump Signs an Executive Order to Reschedule Cannabis to Schedule III by must-read Anthony Martinelli, who subsequently shared,

“A senior advisor to President Trump tells us “This is just the start. Bold clemency action, a directive to Congress to pass SAFER Banking, and the formation of a descheduling commission are all being planned for the first half of 2026.”

The Forward Path

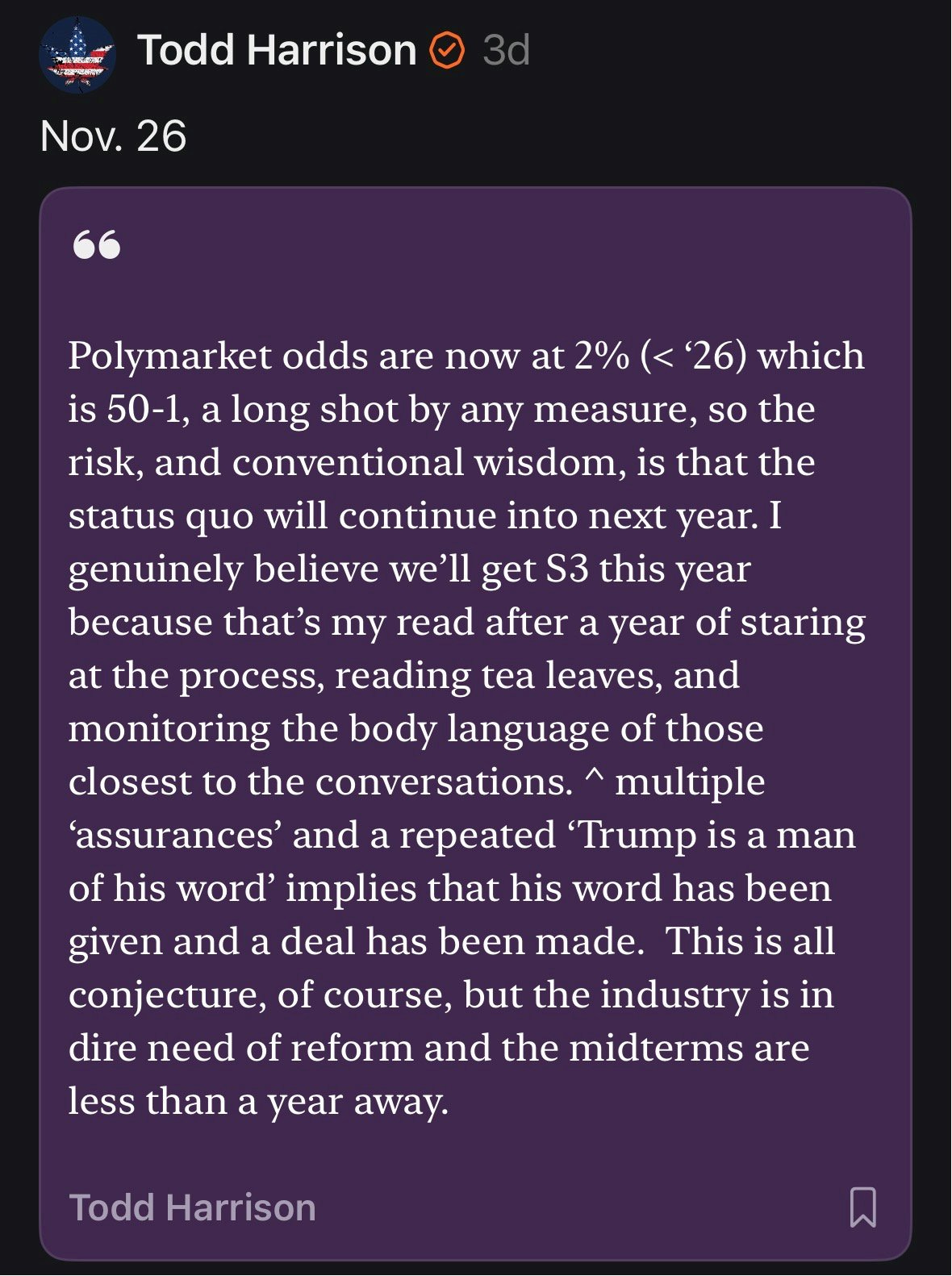

Last Monday, I shared the below, which will land on the point that I’m trying to make:

By now, you know the rules of engagement: the Trump administration spent its first year cracking down on illegal crime rings and cartels and shuttering illicit grows and vape operations before Congress set a timer to close the intoxicating hemp loophole.

That means one of two things:

The first is Prohibition 3.0, as the uneven status quo in the state-legal framework and the new federal definition of hemp will further pressure this fledgling industry.

The second is that the government is dismantling the illicit market and removing the bad actors, all of which will benefit state-legal operators upon regulatory parity.

Here’s the part that I try to force myself to remember:

Everything that we believed would happen for US cannabis over the last five years has happened for US cannabis as measured by THC growth, adoption, and normalization.

In other words, the industry doesn’t have a growth issue—it has regulatory problem.

So, what are the three boxes to ✅ for a new U.S. cannabis bull market?

Growth: will ✅ as the hemp loophole closes + new states flip.

Regulatory parity: will ✅ when S3 hit + halo effect (custody, banking, et al).

Uncertain tax provisions (UTPs): will ✅ via settlement, litigation, or both.

Chart Check: MSOS

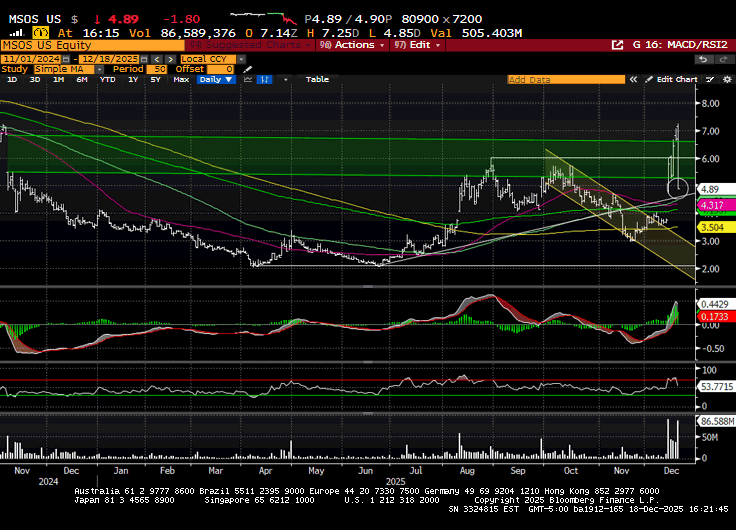

U.S. cannabis ETF MSOS filled the 2024 election gap on Monday after an 87% rally since last Thursday as the specter of historic federal reform began to bake in, before adding another 4% yesterday as a tickle.

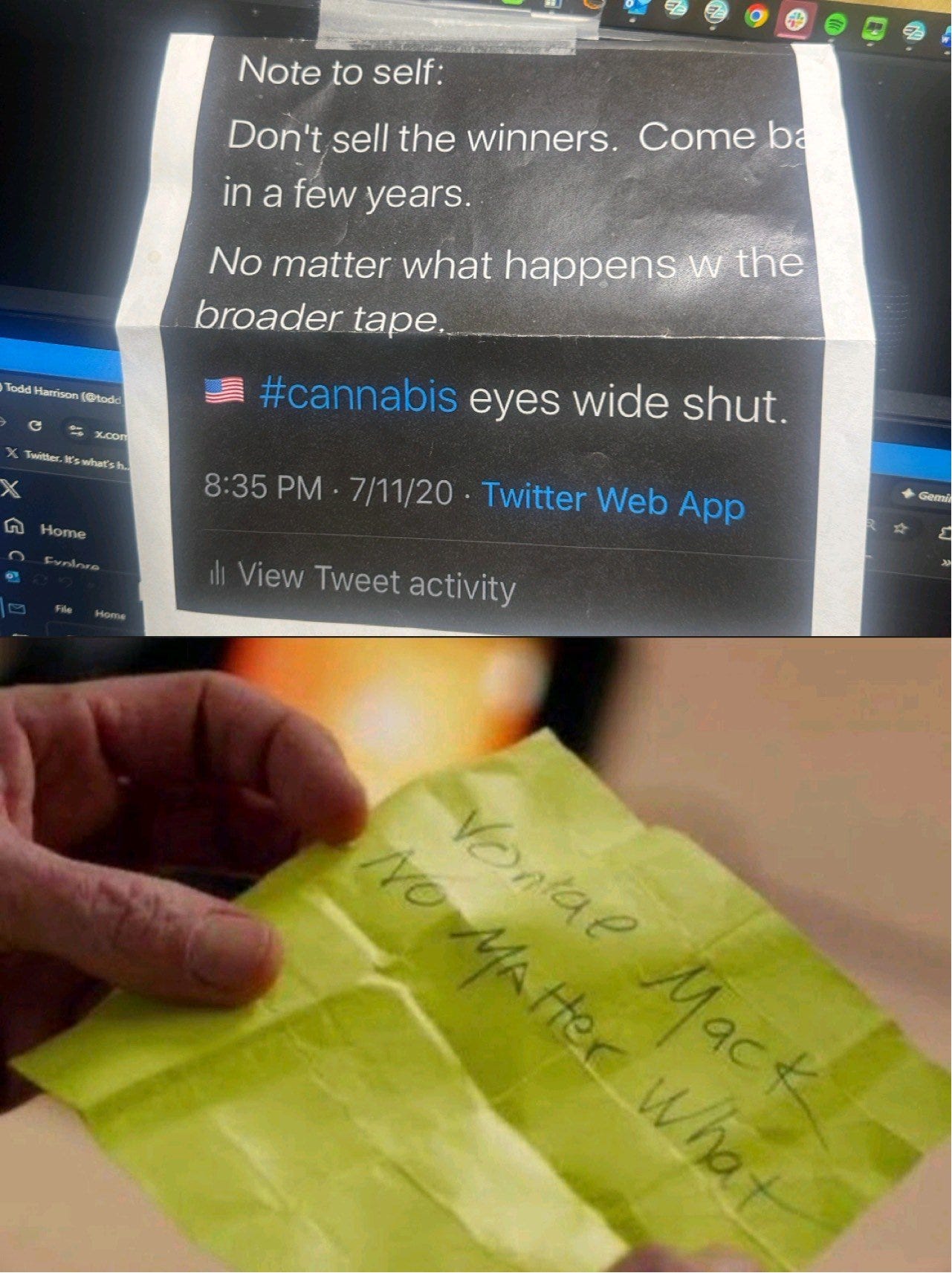

Understanding how difficult the last five years have been, I’ve tried to stay locked in a zone to focus on the front-and-center. Still, I couldn’t help but peek at X this morning and what I witnessed was the definition of no bueno as I penned this to subs:

“too many victory laps on X (sorry I looked). nothing done yet and even if we get what we expect we dk where the process of price discovery will lead; while I believe that any sell-the-news will be transitory, this complex is still dominated by algos and quants w deep pockets.”

So, what happened as the headline hit today? While some posited that the street was ‘looking for more’ (banking) and others noted that DJT’s EO ‘is not the same thing as a final rule,’ traders who bought the rumor, sold the news, slicing 27% of the ETF (ffs).

The price action will remain violent and nonlinear. We expected a spike on the news, a bout of profit taking, and a grind higher but the spike was short-lived (pre-news, due to a leak) and the profit-taking more violent than expected; old habits, I guess.

There will be a vicious two-sided process of price discovery due to retail holders, algo agendas, and the fear of G-d in the structural/ naked/ pernicious shorts ahead of a now-telegraphed final rule from AG Pam Bondi, in addition to ‘other’ directives.

Zooming out, as I expect many traders and investors will do this weekend as they dig deeper into the implications and significance of this news, one would expect that the risk-reward of a potential turn should begin to price-in as we spy our three amigos.

Random Thoughts

The reform headline provided exit liquidity for some and an onramp for others, but institutions will remain next year’s business, at best. Hedge funds, family offices, and traders will be (y)our holiday guests for the trippy year-end volatility.

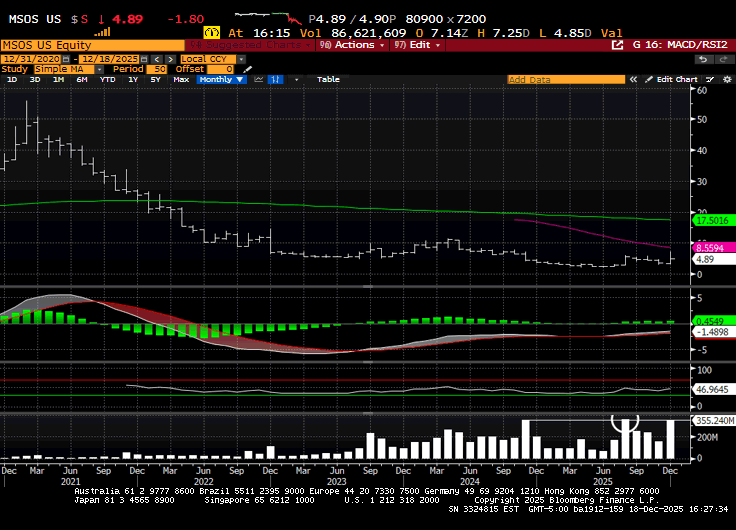

The ETF was double nickels with Uncle Joe was sworn in. I know a lot changed, warts were exposed, and every possible negative that could have happened, happened, but alotta traders will pull up a five-year chart of the ETF after this news, particularly w so many other asset classes extended.

With intoxicating hemp going away, regulatory parity on tap and rumors of an IRS settlement, the bear thesis has started to crack, and it’s not like national THC demand hasn’t already mooned.

Capital raises, opposition lawsuits, and other unsettling headlines will cross the tape and vie for industry attention so be smart, keep your head on a swivel, and good luck as we flip the page to a brand new year.

Truth Bomb

It’s hard to describe the emptiness that I felt as I pushed this out on 11/26 with the ETF trading $3.30 but I shared because I believed in it and all a man has is his name and his word—and nmw happens, they’re both coming with me to the 🏝️.

Shifting Gears

I’ve been writing about financial markets in real-time since filling in for Jim Cramer on TheStreet.com in Y2K. That was 26 years ago, with the last decade-plus dedicated to cannabis. I told my friend Jane a few years ago that I desperately needed a respite, but that I was determined and resolute to wait until we got genuinely good news.

And here we are—S3 won’t be a panacea by any stretch but it’ll be an extremely hard-fought federal first down and the single-biggest positive for the plant since Tricky Dick earned his nickname in more ways than one.

Yesterday, I offered the following random thoughts on X-subs:

I would like to manifest the following reality:

S3 EO this week.

^toss in clemencies bc that’d be boss.

Manage risk to the best of my ability.

Delete X from my iPhone through year-end.

Be genuinely present with my family next week 🏝️

^ unlike last year(s).Get outside more/ be a better person/ visit interesting places.

And, there will 💯 be a rescue dog sanctuary in my future.

As I contemplated that and more, I decided that it would be appropriate to suspend payments for substack effective immediately and through year-end, if not longer.

The current leader in the 2026 content thought clubhouse is to exclusively focus real-time data, info, and ideas on X-subs, spent less time on X (important headlines only), and free Substack to share content, both from myself and industry thought leaders.

That is Plan A. Plan B, which came in a close second, is also available as needed…

What you won’t see, because it would be silly, tone deaf, and wholly inappropriate are victory laps, I-told-you-so’s, or shaming because we should all be self-aware enough to know that despite this historic turn, the U.S. cannabis ETF was trading at $55 when Joe Biden and the blue sweep filled our heads with false starts and empty promises.

There’s an abundance of wood to chop and if we don’t learn from the past, we’ll be destined to repeat it, but I believe an amazing industry has been rebirthed and the benefits—American jobs, economic strength, the overall wellness of society, and the substitution of alcohol and opiates—is a story that will only be fully appreciated with the benefit of hindsight and the wisdom of history.

Have a safe journey, please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in/ advises some of the companies mentioned and nothing contained herein should be considered advice.