Made in China™️

The Commies captured U.S. canna.

Daily Recap

A special cross-border media collaboration uncovered “indisputable” evidence that the Chinese Communist Party’s United Front Work Department—Beijing’s foreign influence and intelligence arm—is running illegal canna ops across North America.

These efforts uncovered a sprawling cannabis export and laundering network, one that consolidated legal licenses, exploited illegal migrant labor and shipped massive amounts of canna to the U.S and Japan, and with inroads to Europe, laundering the proceeds back through Canadian banks.

👉 a special shout out to TD-Ameritrade, ”America’s most convenient bank for money launderers” after they forced Cowen to unceremoniously dump U.S. cannabis stock coverage and custody. Interesting, if not an apropos, full circle there.

In this must-watch interview, the hosts compare notes, connect dots, and expose how the networks—rooted in state-directed influence and organized crime—are reshaping the underground economies across North America.

Setting the Table

A Senate committee advanced the confirmation of Terrance Cole to become the new DEA administrator amid the ongoing review of a cannabis rescheduling proposal.

During an in-person hearing last month, he said that examining the proposal will be “one of my first priorities” if he was confirmed, saying it’s “time to move forward” on the stalled process—but again without clarifying what result he would like to see.

Of course, he’ll serve at the pleasure of a president who already shared his eyes.

The Replacements

Approval of adult-use and medical cannabis laws in most U.S. states has allowed individuals to legally obtain cannabis to treat certain medical conditions that had typically been treated with prescription drugs.

Investigators found significant reductions in prescription drug claims per enrollee of $34–42 annually in the small group insurance market following adult-use cannabis legalization. Net prescription drug claims fell 6% after adult-use was legalized.

Stocks & Stuff

It was a green day on Wall Street as equity markets bounced, yields came in, and the dollar continued to field supply ahead of the long holiday weekend. Cannabis stocks were largely quiet, save continued strength from select neighbors to our north.

Below, we’ll top-line the week, dig deeper into the emerging Canadian opportunity—and why one CEO is gobbling up his own stock—review U.S. canna margins, check in with SuperSherpa Graham Farrar, and ramble and rant on current affairs, the fourth turning, new leaders, political bones, and the ticking tocks that never stop.

All that and more, just scroll down—and no paywall today.

note: there will be no Canna Confidential tomorrow. Enjoy the long weekend!

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ ETF Notional: $6M

Top Stories

Senate Committee Approves Trump’s DEA Pick

How marijuana legalization has affected traditional drug prescriptions

Minnesota May Can 'Two Serving' Label Law For 10mg THC Drinks

Craft brewers seeking to cash in on hemp-derived THC beverage market

NYC Mayor Celebrates Progress Closing Illegal Smoke Shops

Footballer admits plot to smuggle £600k of cannabis

Thailand vows to tighten control on canna after tourist smuggling cases soar

One of Four Indian Tribes in U.S. Involved in Marijuana or Hemp Programs

Game Over in Texas? House Approves Bill to Ban Intoxicating Hemp Products

Industry Headlines

Rubicon Organics Clears Conditions for Hope Facility, Advancing Growth Strategy

Pregame (written in real-time at 8:00 AM ET)

The rain pours anew, thwarting my early morning walk for the second day in a row.

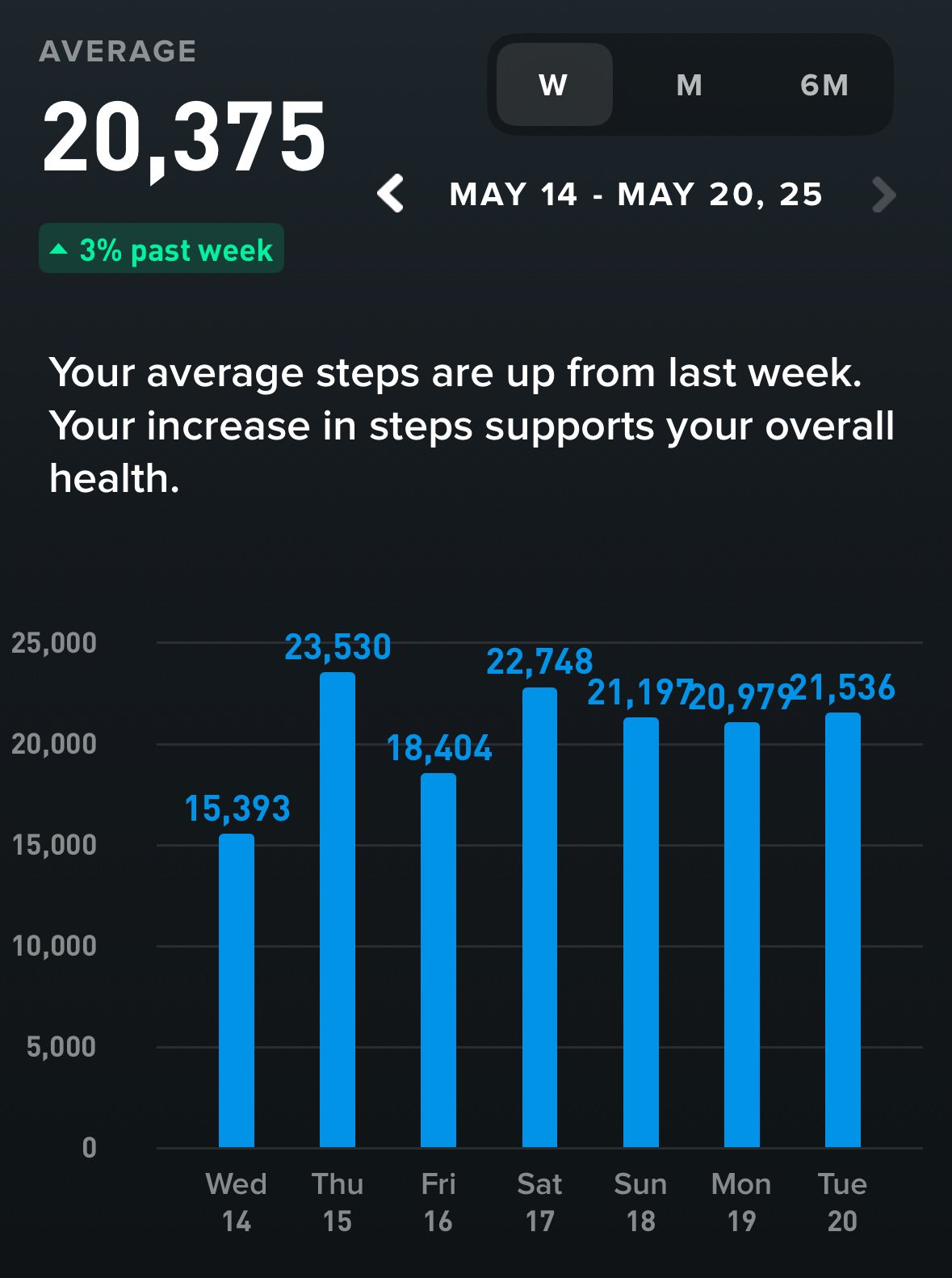

I’ll take the respite after 20K daily steps (with an 18-pound vest) the last two weeks, while listening to Jeremy Renner’s harrowing memoir. Tallied 209 lbs. this AM, which gives me a month to complete a self-imposed milestone and a promise to my kid.

Speaking of milestones, I had it in my head that canna would see signs, a signal—OK, a pulse—by Memorial Day and we’re more-or-less here and there’s still nothing there. We didn’t expect to hear much the first 100 days but as April turned toward May, we believed that we would enter an active zone.

One could offer we have with the introduction of STATES 2.0 and PREPARE but after four years of teeth-shattering right hooks and repeated knees to our proverbial nuts, observers need to see more than just seeds being planted to get involved. They want tangible evidence that DJT will follow through with common sense reform.

There’s an abundance of motion behind the scenes—information requested, being passed back and forth—but that is sausage-making 101. Still, the genuine interest and engagement these days is night and day vs the Biden admin and a galaxy away from the Heisman we got from Kamala during her brief kackle in the sun.

Political sidebar: if it sounds like I’ve soured on the Dems…

…it’s because I have. I never believed in the Deep State until I had a front row seat for the war on drugs and bastardization of cannabis. The special interests, bureaucratic fuckery, political maneuvering and those lying sacks of…. never mind.

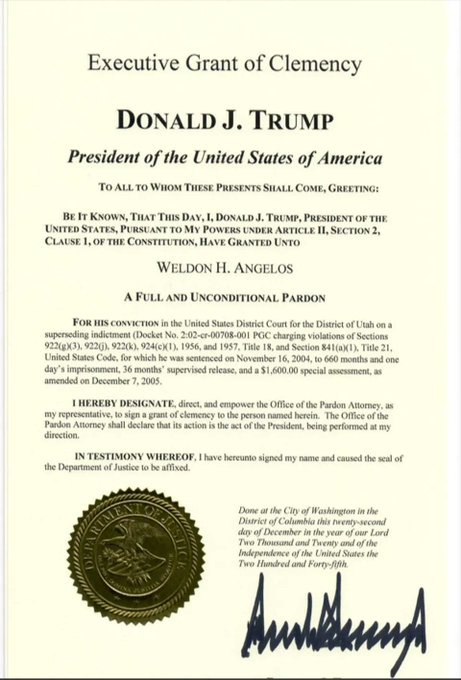

In the last election, I was a single-issue voter—and it wasn’t canna, it was the safety of our two Jewish children in college and one who’s on the way. I’ve worked my ass off to advance cannabis through the Biden administration and we got bupkis. Now, we’re working with a POTUS who already pardoned Weldon and passed the First Step Act.

I’ve said that if wishes were knishes, I would cut off both political red zones and be a happy man. The world, navigating a fourth turn, is changing before our eyes, and the leaders coming out of whatever-this-is won’t be the same as those who’ve entered.

Yes, I looked at bitcoin when I just wrote that, the no-coiner than I am, but there will be other paradigm shifts as a function of both need and want.

Plant-based medicine will be one of those secular themes and if we’re being honest, canna is already there, it’s just splintered between channels that must align if we’re to crowd out the crime rings and cartels.

While I’m down this rabbit hole of non sequiturs, and as we tip-toe toward summer, I’ve promised myself to balance my time a bit more. All three kids will be home, once our boy returns from his bearcat pilgrimage through Vietnam, and I’ll soon be… 56.

Time is the most precious commodity are words I’ve written 1000 times over 25 years, which is ironic considering how much screen time that alone required.

Back to reality, the ETF is bid slightly higher this morning after an article last night said anti-weed group SAM was warning lawmakers might slip SAFE on to the crypto bill. If that’s true, I haven’t sniffed it but wouldn’t that be a nice surprise.

We’ve heard S3 will be the first domino—we’ve heard many things through the years, so keep a shaker of salt handy—and the administration wants Cole confirmed before moving forward. That process took a step forward today and will likely be completely next month.

The tape—and hopefully my body—will continue to thin as we edge into the summer and that could exacerbate volatility, given they are the mirror images of one another.

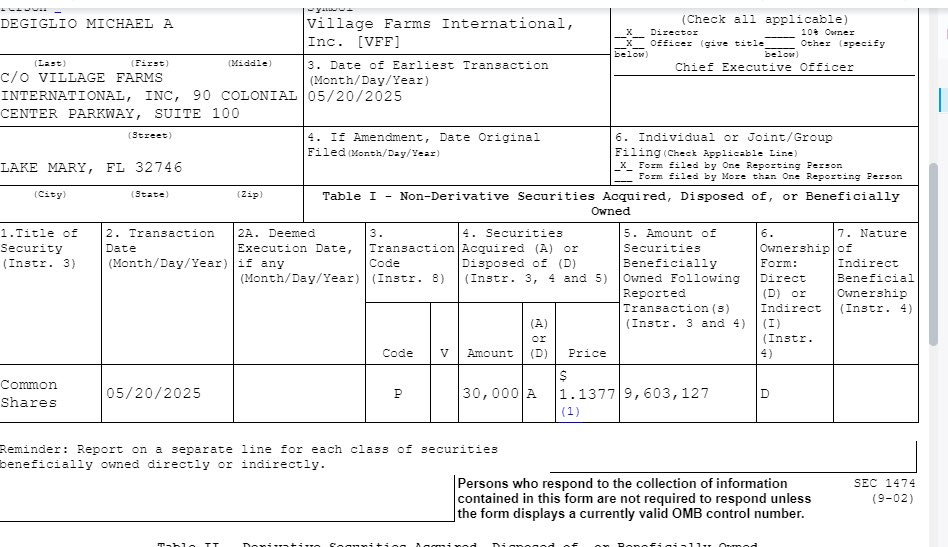

Keep an eye on the Canucks, as ATB is echoing what we’ve been saying, and Villy in particular after Captain Jack Mike continues to lead by example.

Village Farms CEO Mike DeGiglio scooping up his own stock. It takes a Village.

TDR: Glass House Sherpa Graham Farrar

ATB on Canadian cannabis 🍁

We are making a contrarian call and turning bullish on certain Canadian LPs.

We think there’s an asymmetric opportunity as the sector flies under the radar, with few investors interested due to the industry’s track-record of value destruction.

But, past performance is not indicative of future results, and that truth goes both ways, for the negative and for the positive.

We are seeing (1) strong international growth, and (2) modest price improvements in the Canadian recreational market.

Over the last quarter, LPs reported an avg increase of 107% in int’l sales, 25% in net canna sales, 580bp improvement in adj. GM, and +650bps aEBITDA margins.

Stocks are trading 6.6x LTM EV/EBITDA. This is a trailing metric, so if we continue to see improvement, there’s upside potential from multiple expansion.

Useful data points on international sales growth include:

+120% increase in dried flower imports in Germany in 2024.

+100% increase in medical cannabis units sold in Australia in 2024.

+50% increase in medical cannabis prescriptions in the UK in 2024.

+180% increase in cannabis sales in Poland in 2023.

Our pecking order is Village Farms, Organigram, Aurora, and Decibel.

Village Farms has seen strong momentum after the announcement of their produce divestiture. Their CEO Michael DeGiglio has been buying stock in the open market.

We like the stock after the removal of the produce bc low-cost, large-scale cultivation capacity, Netherlands presence, pro-forma net cash position, downside protection with greenhouse ownership, attractive valuation, trading at ‘26e 3.5X EV/EBITDA.

Viridian on U.S. cannabis

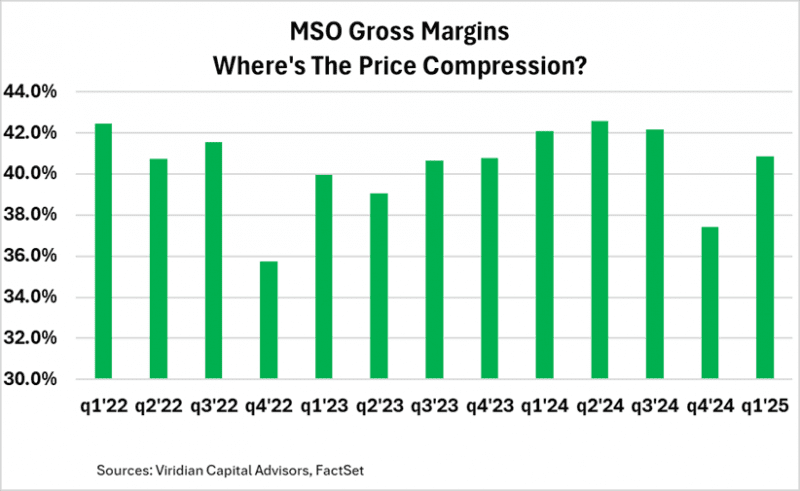

The chart below looks at the last thirteen quarters of reported gross margins for a group of twelve MSOs; aggregated gross margins for the group are shown.

We expected this to show evidence of the margin pressures exerted by wholesale price compression, since gross margins should be directly hit by reduced pricing.

Surprisingly, we see only modest evidence in the aggregate numbers. Gross margins for 2023 and 2024 actually appear to have trended upward! Q424 and Q125 did show the kind of margin erosion we expected to see but curiously, the data don’t show the impact earlier.

Stems & Seeds

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.