Maple Haze 🍁

Four Canadian LP's to watch.

As U.S. canna awaits reform, we’ve been keeping an eye on our neighbors to the north as Canadian markets attempt to firm, evolving international opportunities emerge and a handful of operators are seemingly poised to prosper.

2025 themes could include the tightening of supply/demand (wholesale pricing finally trending higher), smaller/ tax-burdened operators going out of business, international expansion opportunities and possible excise tax reform (Canadian equivalent of 280E).

The entire cannabis sector has been left for dead but when there is news, traders and investors are conditioned to reach for the U.S.-listed Canadian names, rather than the U.S. operators, which are paradoxically listed on third-tier Canadian exchanges.

The leaders coming out of crises are rarely the same as the ones who entered them, and that’ll likely prove true anew for Canadian canna. While traders typically reach for CGC 0.00%↑ TLRY 0.00%↑ or ACB 0.00%↑ as liquid short-term vehicles, there are a handful of LPs that are making their case for the longer-term race.

In no particular order:

Village Farms is a leading, profitable, international, controlled environment agriculture company operating in the cannabis, produce, and wellness channels, and is the longest-tenured hydroponic grower in North America with 35 years in operation.

As of Q324 filings, Village Farms is the overall #2 ranked producer in Canada, #1 in Quebec, #2 in Ontario, #2 in pre-rolls nation-wide, and was the fastest growing LP over the last year.

Village is one of the very few leading operators in Canada that has achieved market share dominance organically through operational excellence and product quality, without requiring M&A to defend against declining market share.

One of the largest legal growers of marijuana on the planet, they are also one of Canada’s leading exporters of medical cannabis, with 111% international sales growth YoY in Q324 driven by exports into Australia, the UK, and Germany (where Village holds the #1 and #3 strains in market as of Q324).

Village also owns 1 of 10 recreational licenses in the Netherlands, a leading limited-license European market opportunity untapped by other major industry players, and are on track to generate their first sales in Holland in Q125.

Village has more recently emerged as a key figure in the U.S. cannabis industry’s ongoing efforts to transfer cannabis to Schedule III of the Controlled Substances Act, as their recent lawsuit(s) unsurfaced controversial behavior of government officials and demonstrated the DEA’s position as a proponent of the rule was untenable.

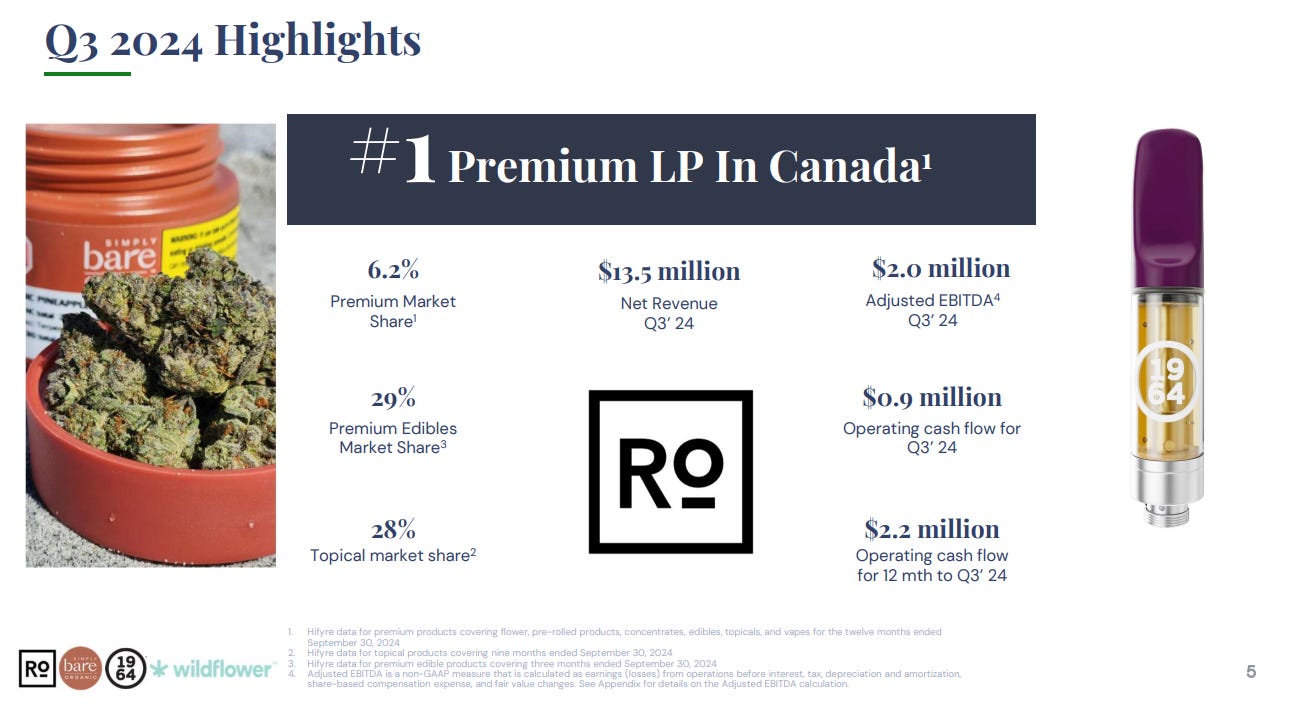

Rubicon Organics is Canada’s leading premium producer, one of the few consistently profitable companies operating in Canada, and one of the most discounted operators in Canada on a comparable basis.

Rubicon has an industry leading operational focus and leading product quality among premium operators, which has created a dedicated, sticky consumer and budtender base for Rubicon’s leading premium brands.

Rubicon achieved net revenue growth in Q324 of 34% QoQ and 15% YoY, largely driven by the strong, well-received entrance into the premium vaporizer category, now the fastest and widest product launch in Rubicon history.

This brand strength and execution is also referenced in Rubicon’s Q223 entrance into the edible category, which quickly captured 23% / #1 of the premium edible category within 12 months of launch (now 29% share).

Additionally, Rubicon’s wellness brand owns a 28% share of the topical market in Canada, while being priced at a significant premium to competing products.

Rubicon recently announced a C$10m credit agreement at 5 years and 6.75% annual interest, providing ample opportunity for further growth as they continue to further capture unmet demand for their leading brands.

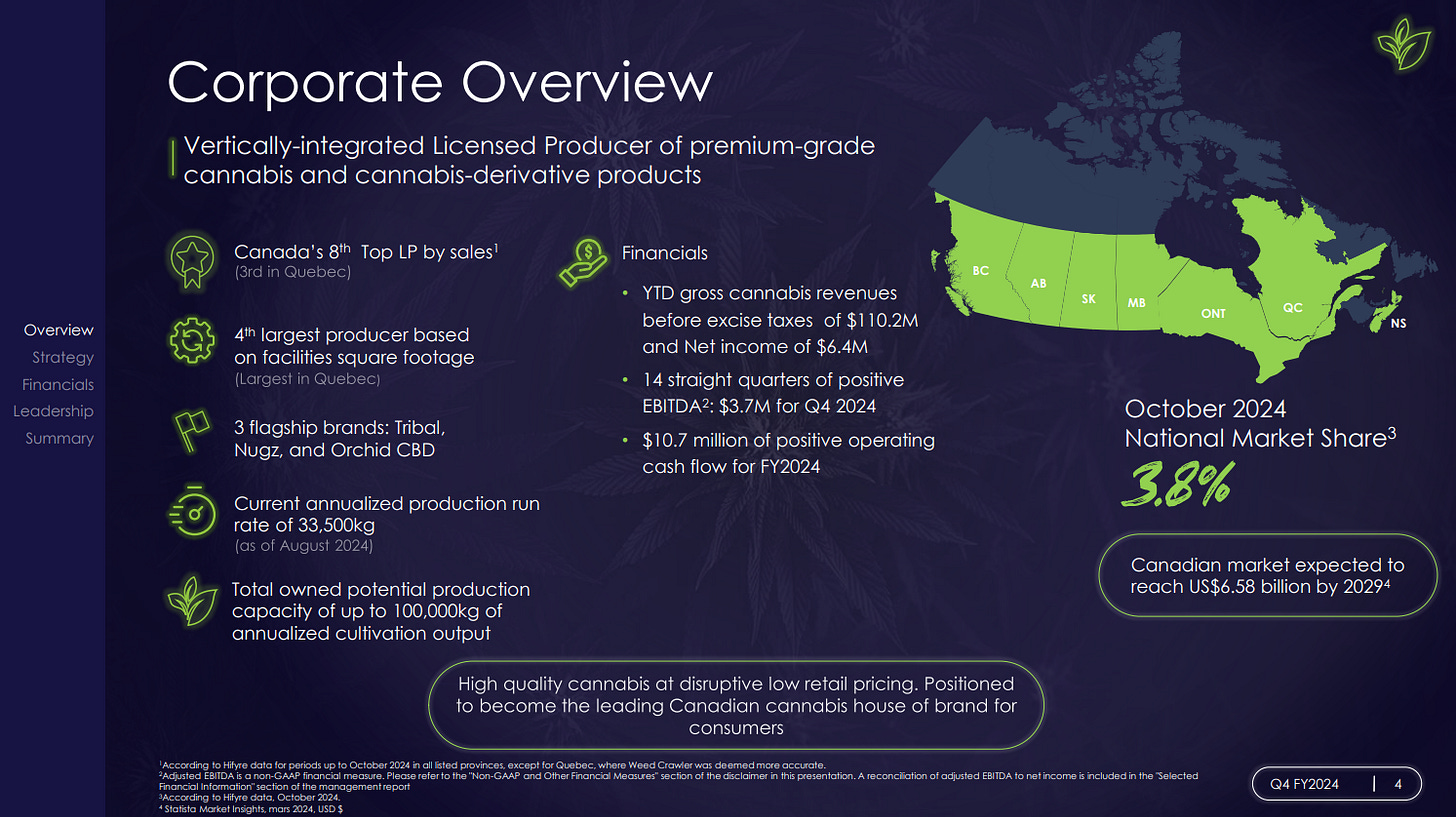

Cannara Biotech is a leading operator in the Canadian canna industry. They achieved their highest ever market share in Oct. 24, +39% from the prior year and now have the third largest market share in Quebec (12.6%), and eighth largest nationwide (3.8%).

Cannara maintains one of the strongest profitability profiles of any Canadian operator, delivering 81% increased operating cash flow improvement year over year, to $10.7m for FY’24 (against $82.2m revenues), and strong free cash flow generation (one of few LPs to generate FCF).

Cannara is one of the only operators in the cannabis industry with a strong M&A track record, having purchased TGOD’s $250m state-of-the-art cultivation facility for $27m and they boast the largest cultivation footprint of any operator in Quebec, Canada’s 2nd largest province with the cheapest electricity pricing nationwide.

Cannara’s 1m sq ft state-of-the-art facility has ample room for capacity expansion, with strategy in place to add an additional 50,000 sq ft of capacity in FY25 to the existing 250,000 sq ft in operation, which will alleviate current supply constraints across the company’s leading brand architecture.

Organigram OGI 0.00%↑

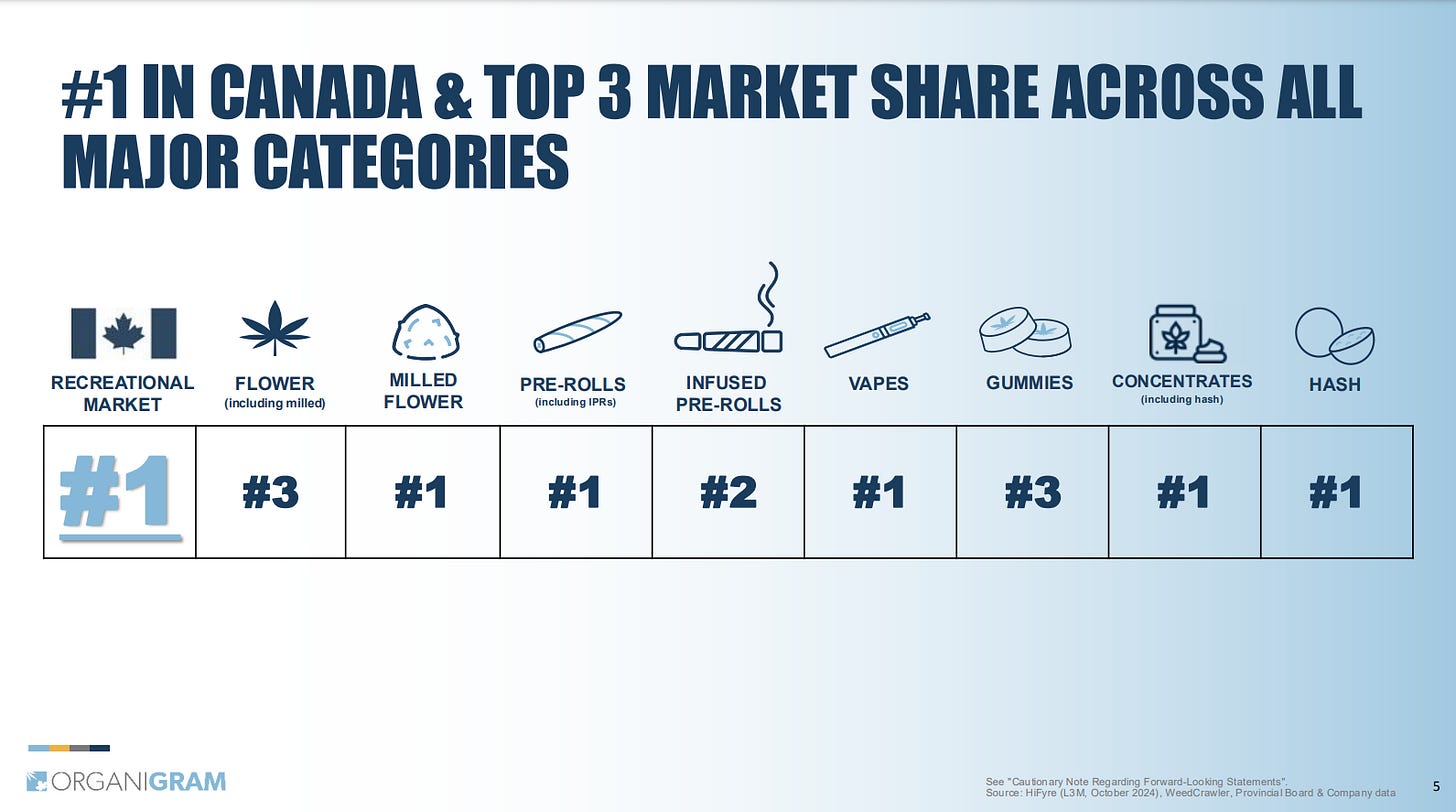

Organigram is a leading Canadian cannabis producer and the largest indoor operator in the country.

Strengthened by a recent acquisition of leading vape and infused pre-roll operator, Motif Labs, Organigram now holds #2 national market share position at end of Q424, #1 positions in vapes and pre-rolls and top 3 positions in every major category.

Organigram holds U.S. exposure through two strategic investments, exports into the UK, Australia, and Israel, and holds Germany exposure through a $21m investment into German cannabis leader, Sanity Group GmbH.

In 2021, Organigram received a $221m strategic investment from British American Tobacco when they acquired a 19.9% equity interest in the company. In 2023, they entered another strategic partnership with BAT to invest into strategic initiatives in the U.S. and international markets, with $125m available for follow-on investments.

Liquidity remains a challenge for the sector and a few of these names in particular but, as Jeff Bezos once said, the stock is not the company and the company isn’t the stock.

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice