Daily Recap

Three years ago next month, I penned an article called Barbarians at the Gate after several institutions began to creep back into the U.S cannabis space. It was notable at the time bc after Jeff Sessions pulled the Cole Memo in January of 2018 (two months after we launched CB1 Capital), the ability for U.S companies to bank/ access capital/ custody securities had become, how shall we say, a complete and absolute shit show.

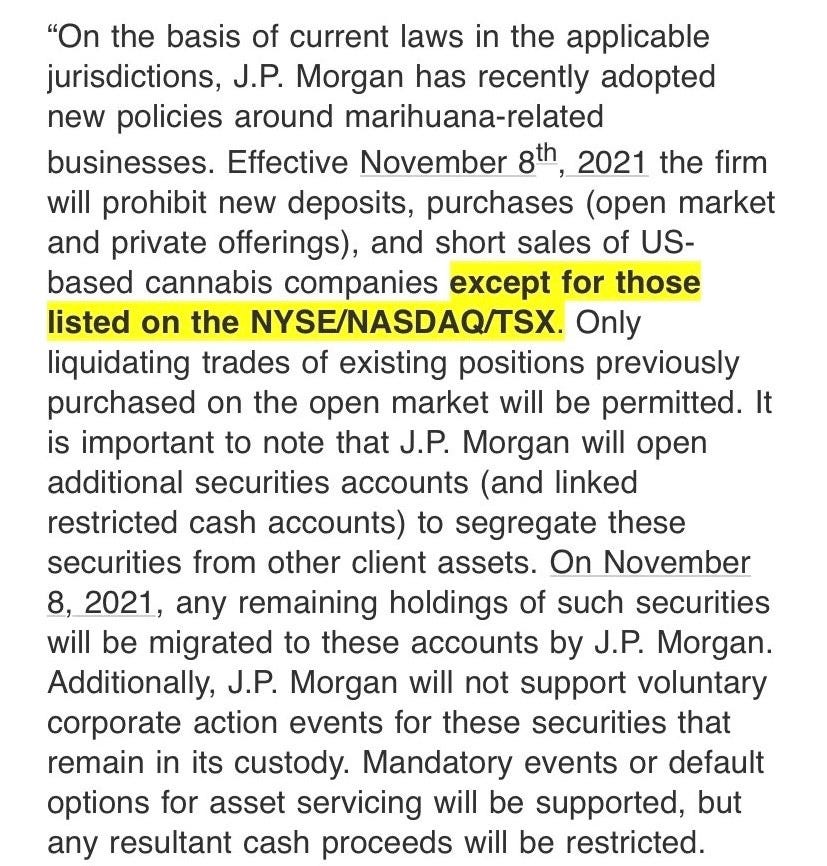

We were, um, a bit early. Since then, we’ve seen bank after bank after bank choke-off access to U.S plant-touching companies—we wrote about it here after JP Morgan told the industry to go frost itself—and, well, capital flows are oxygen for an emerging, nah fuck that, for any industry if it is to survive, much less thrive.

That’s what made the recent TerrAscend listing on the TSX so intriguing; as we have chronicled through the years—but kept closer to the vest in recent months—the TSX is carved out of almost every MRB (marijuana-related business) restriction at virtually every custodian bank, including Pershing, Cowen, and yes, even the House of Morgan.

So when TerrAscend Chairman Jason Wild shared this tweet this afternoon…

…I sat up and took notice. BC custody is a matter of compliance, not a matter of law, and we don’t see a scenario where Morgan Stanley allows their investors to custody a plant-touching U.S cannabis operator and their competition watches all that business trade away.

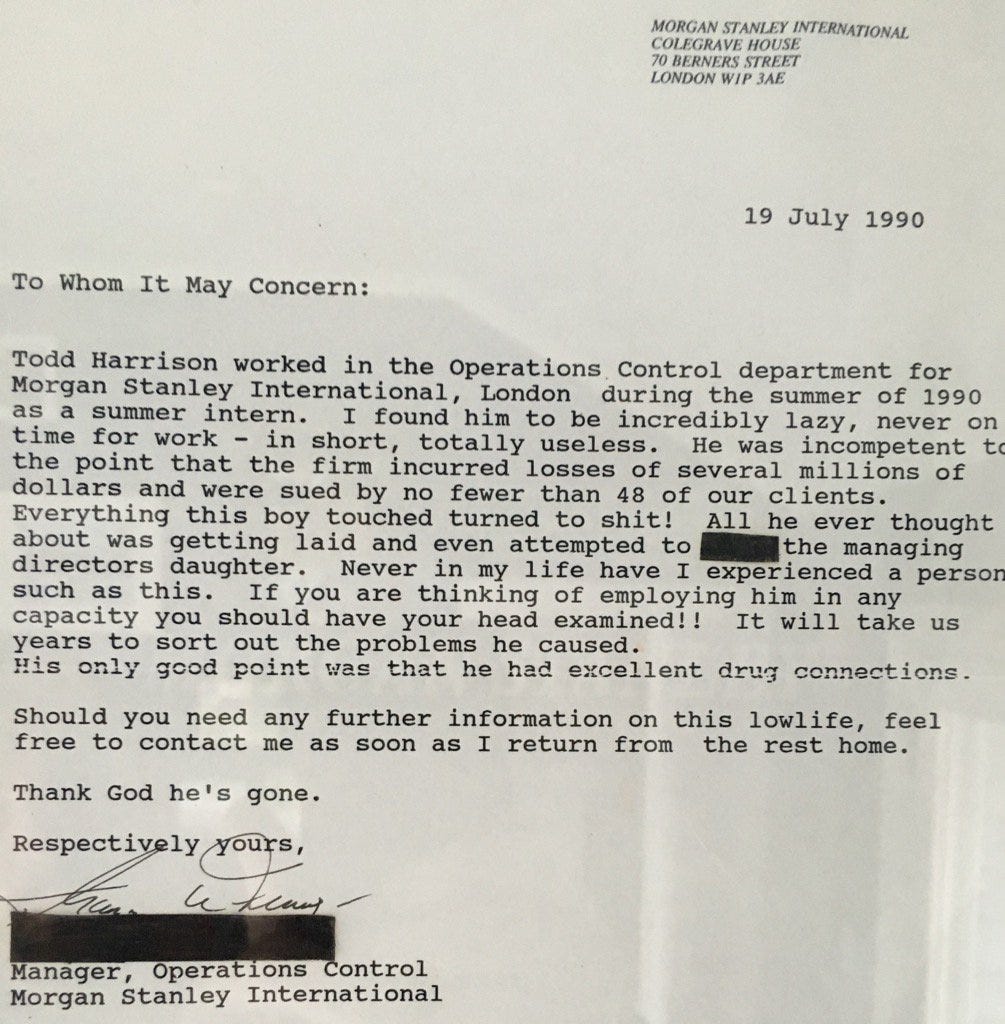

Thank you, Morgan Stanley. I always knew you had it in you.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ notional PT volume: $43M

Top Stories

Keep reading with a 7-day free trial

Subscribe to Cannabis Confidential to keep reading this post and get 7 days of free access to the full post archives.