U.S Cannabis in the Crosshairs

As fresh custody concerns swirl, a generational opportunity crystallizes

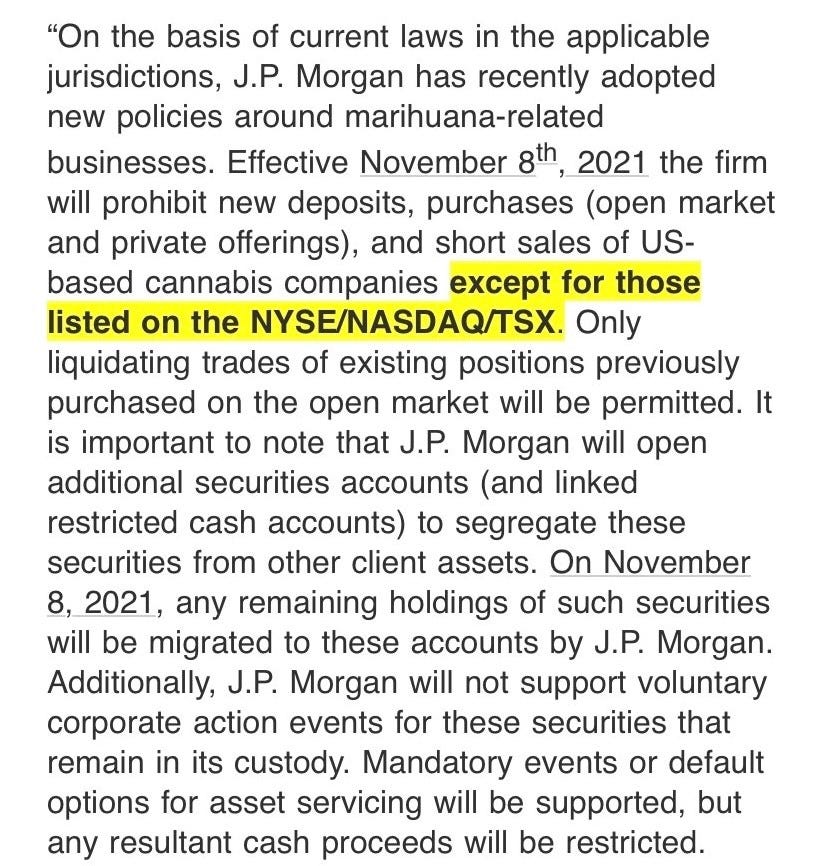

There’s a lot of noise in U.S cannabis of late including the recent speculation that JP Morgan will join a growing list of banks that no longer custody US cannabis stocks.

I haven’t verified if the below text is accurate but did confirm that their policy will become more restrictive November 8th, including no new purchases of US canna / existing positions will be grandfathered (no forced selling).

While the optics are terrible, we don’t believe this move was predicated on new laws / regulations as much as internal compliance. The dedicated funds have other solutions in place and new money has viable alternatives. However, this might help to explain the recent price action / volume / prints, as this was evidently “out there” for weeks.

Industry veterans will remember a similar situation two yrs ago when Pershing pulled the plug on US cannabis custody and clearing, triggering an industry-wide PTSD, or Pershing Traumatic Stress Disorder.

At the time, US canna was on the ropes after a brutal two year bear market, the cost of capital was borderline usury (60%!) and there were existential risks for the industry.

This JPM stuff isn’t that, for several reasons:

Pershing cleared canna for most of the funds that were involved in the space, whereas JP Morgan, while massive, was / is a bit player in U.S canna.

There are other custody solutions / no forced selling (for Pershing either) but it’s entirely possible that some funds might punt / punted their US canna exposure and take what may be the only viable tax-losses in the entire financial universe.

The fundamentals are night and day. U.S cannabis leaders are cashed up and generating FCF despite all the onerous regulations.

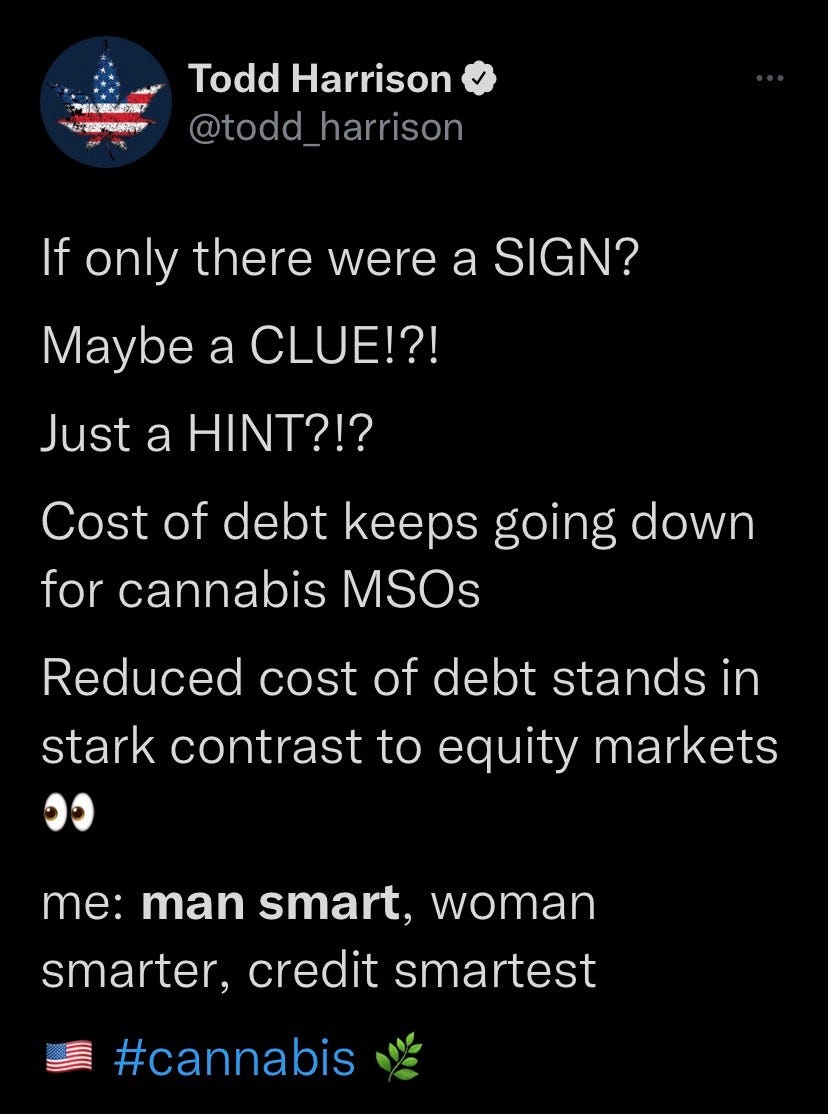

The credit curve improved > 400 bps over the last year (←credit leads equity).

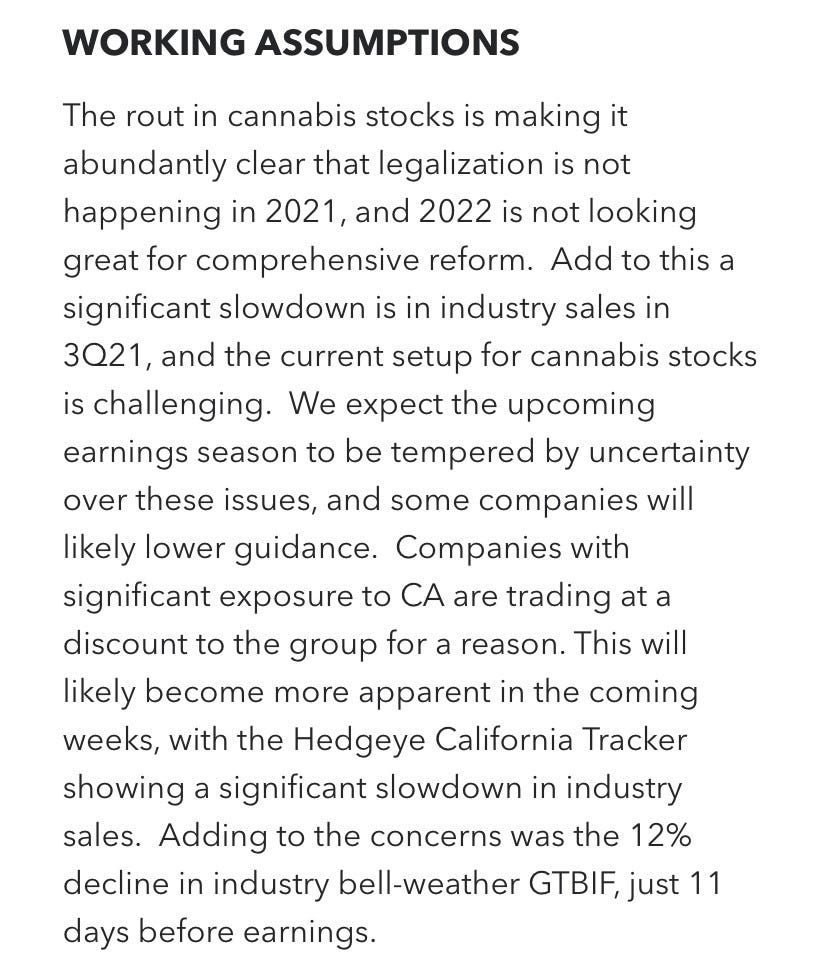

And while there may be cause for pause, per this note from Hedgeye Cannabis…

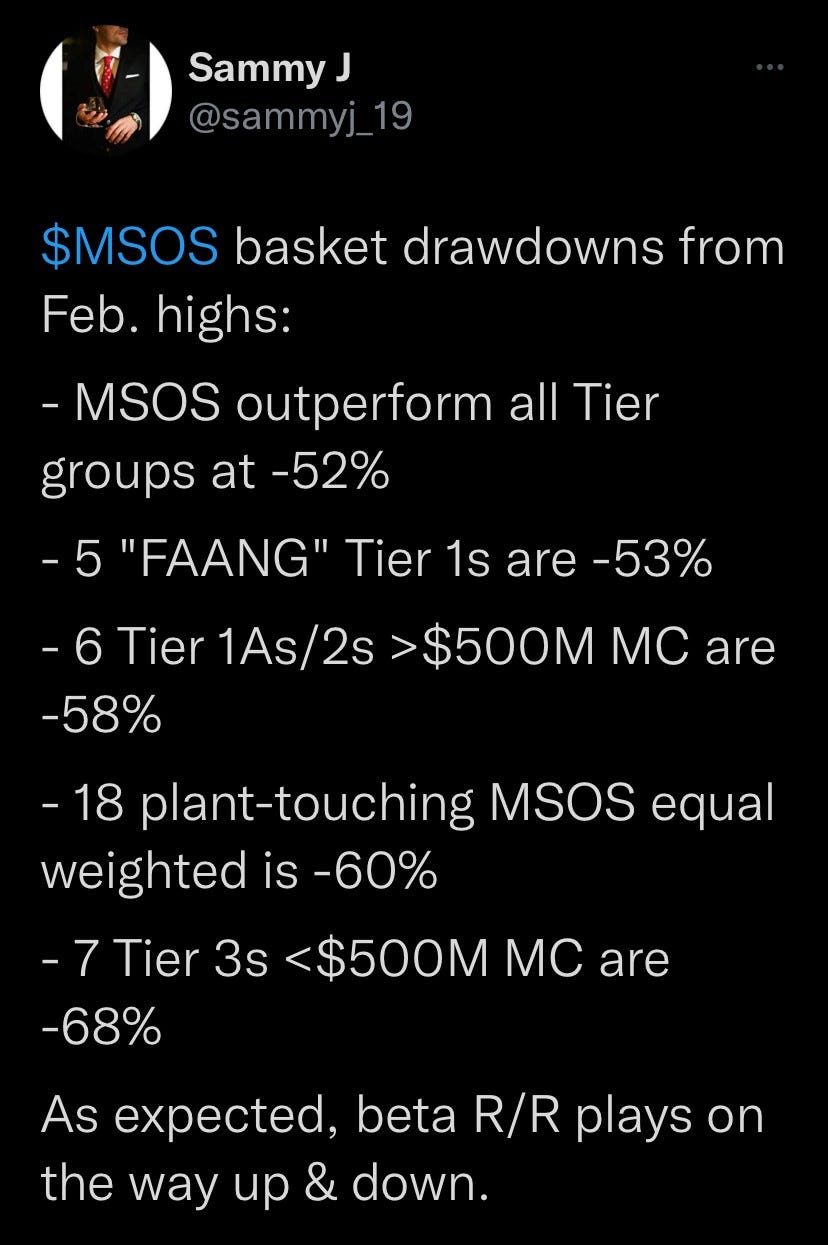

…markets look forward, not back. Nine months ago, there wasn’t a cloud in the sky or a reason to sell U.S cannabis. The market saw through and after the massive year-over-year rally in the space—which began shortly after Pershing pulled their custody plug btw, generating ~1000% gains—we’ve since given back half, or more.

It’s hard to game invisible catalysts (JPM) and even tougher to time the stock market but we wanted to share the other side as we ready for canna earnings the next few wks.

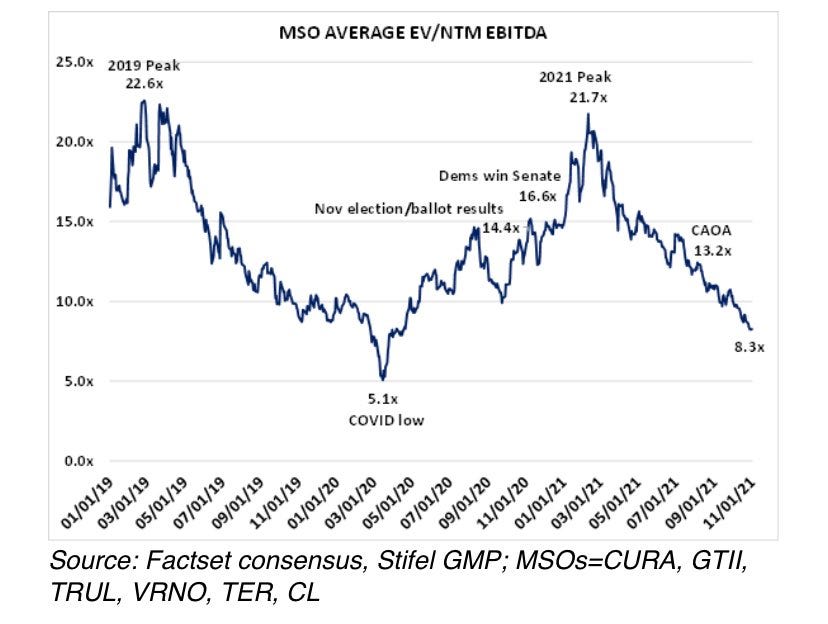

First, this note from The Greek Freak Andrew Partheniou at Stifel, where he talks on the stellar industry fundamentals, the long multiyear tail and his take that SAFE has a 60% shot of passing THIS YEAR via the NDAA

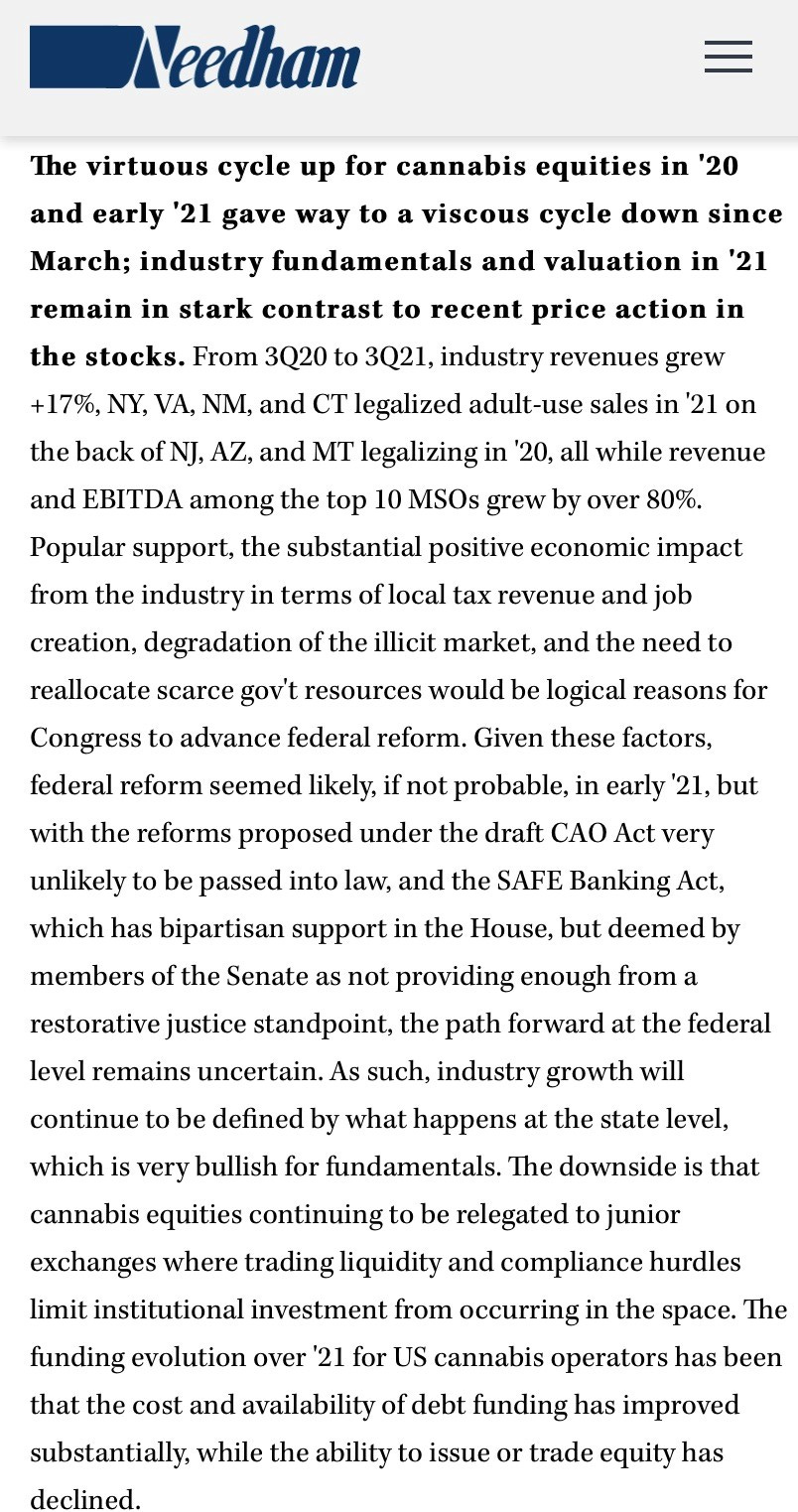

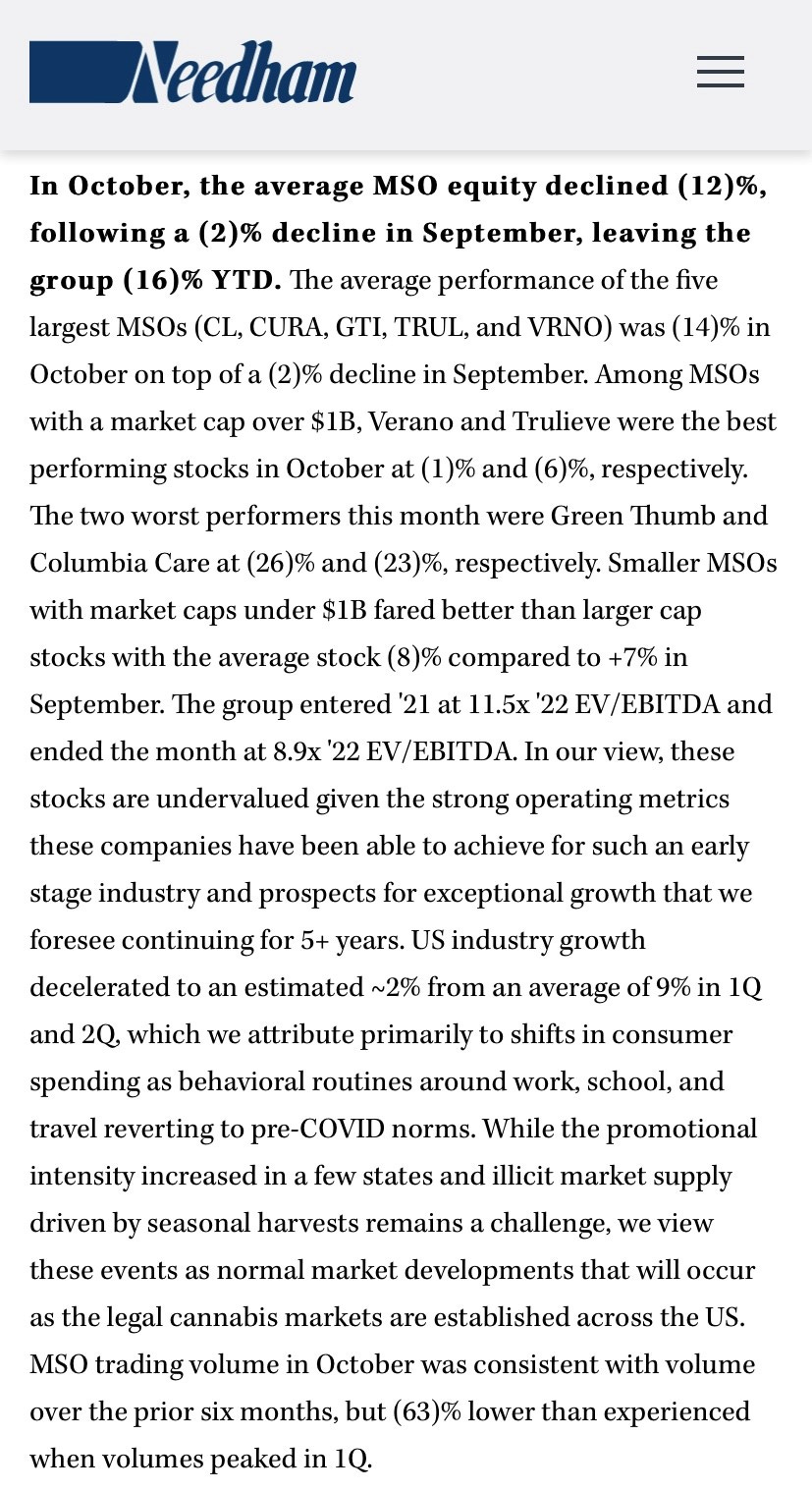

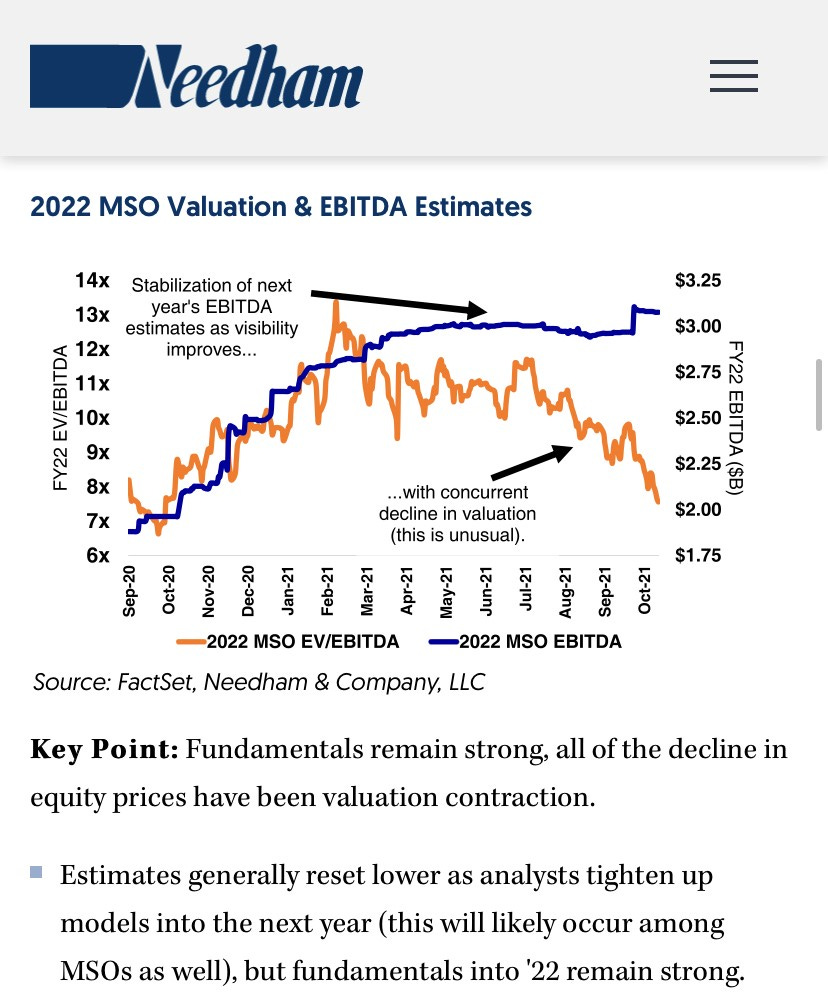

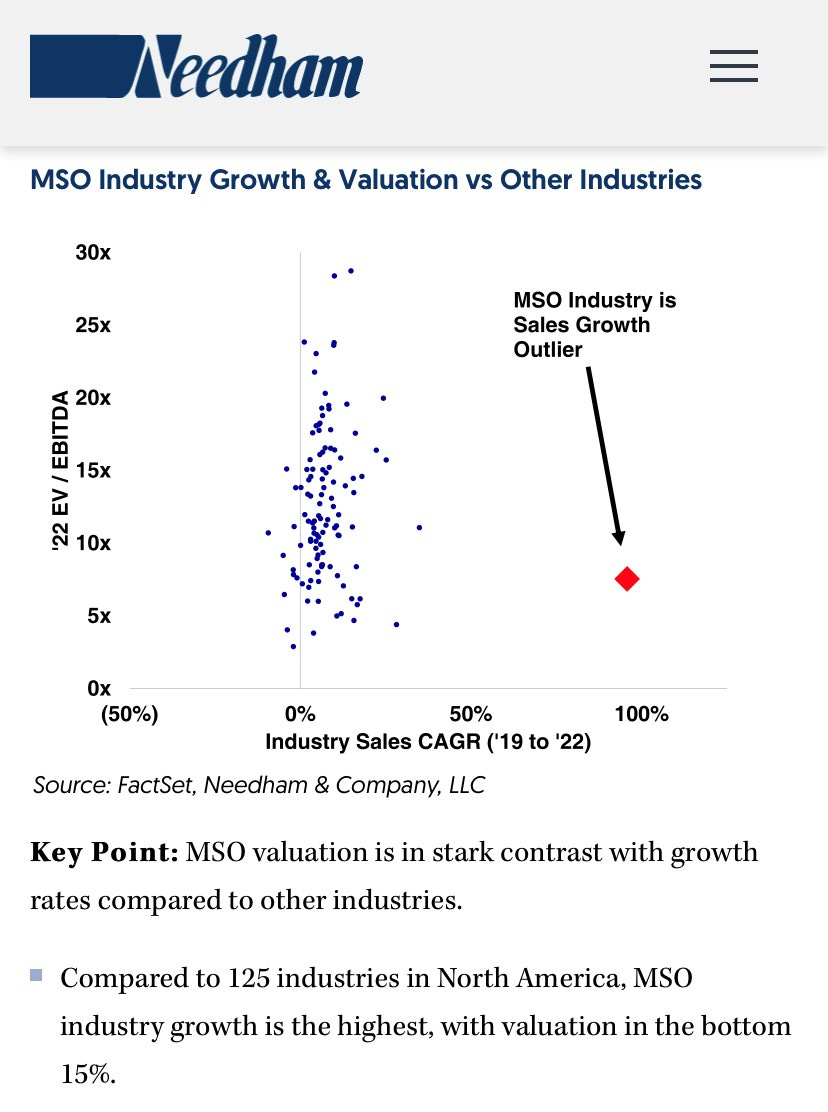

…and there’s this from Matt “Shooter” McGinley from Needham…

The Here and Now

It’s been a wild few years for cannabis stocks: the massive 1.0 (Canadian cultivation) bubble and bust (that erased 92% of the value of global cannabis bw 1/18-3/20); the rise of cannabis 2.0 (US-led CPG; cannabis as an ingredient) that sparked massive gains for cannabis stocks from 3/20-2/21; and the five-finger Sally we’ve since endured, which has everyone asking everyone else what’s going on / what are you seeing / hearing?

I’ll reiterate something I said about a year ago, when many U.S cannabis stock prices were last at these levels: the best case under McConnell would be the worst case under Schumer, and that’s SAFE Banking.

And despite the noise / seething anger / venom that now surrounds the space, I still believe that the script is the script is the script and view these levels akin to a second bite at the apple, one that should be embraced rather than dismissed.

But hey, NEWSFLASH: we’re super-bullish on U.S cannabis / have built businesses that are predicated on the success of this economic-driver and jobs-engine; and given where one stands is a function of where one sits, none of this should be a surprise.

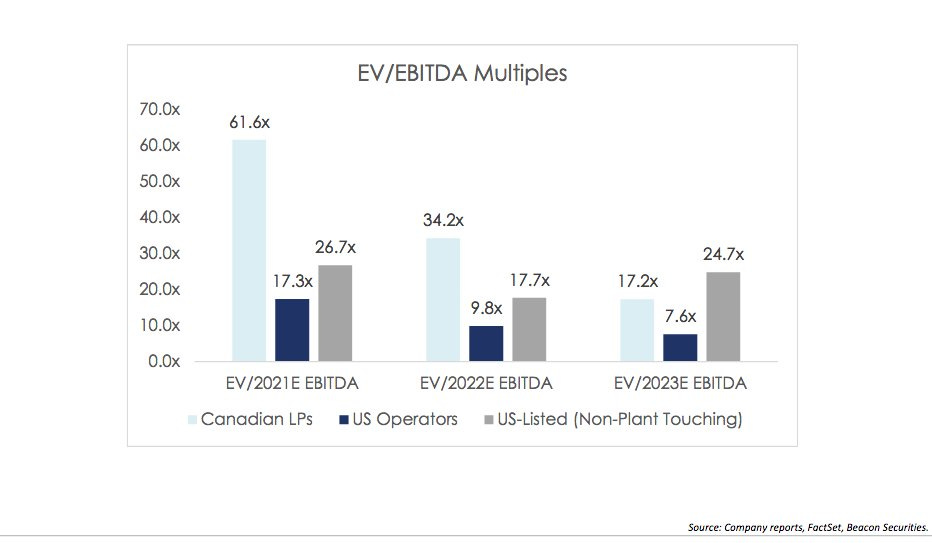

So when we share that we’re buying U.S cannabis because it’s trading at ridiculously cheap multiples entirely predicated on continued state-level adoption—and that we view anything at the Federal level as an upside call option to our thesis—we do so in good faith bc we believe it to be true.

h/t @cashflow_free; click to enlarge

Doesn’t mean we’ll be right, of course, but not only do we like our odds…

…we also like seeing smart money entering U.S canna into this downdraft…

…because wise birds of a feather often flock together.

Good luck, and may peace be with you.

/positions in stocks mentioned.

position / advisor US Cannabis ETF $MSOS