What in the Wide Wide World of Sports is a Goin' on with U.S Cannabis?

The growing pains continue for the Great American Growth Engine

It’s been a nutty year for cannabis stocks…

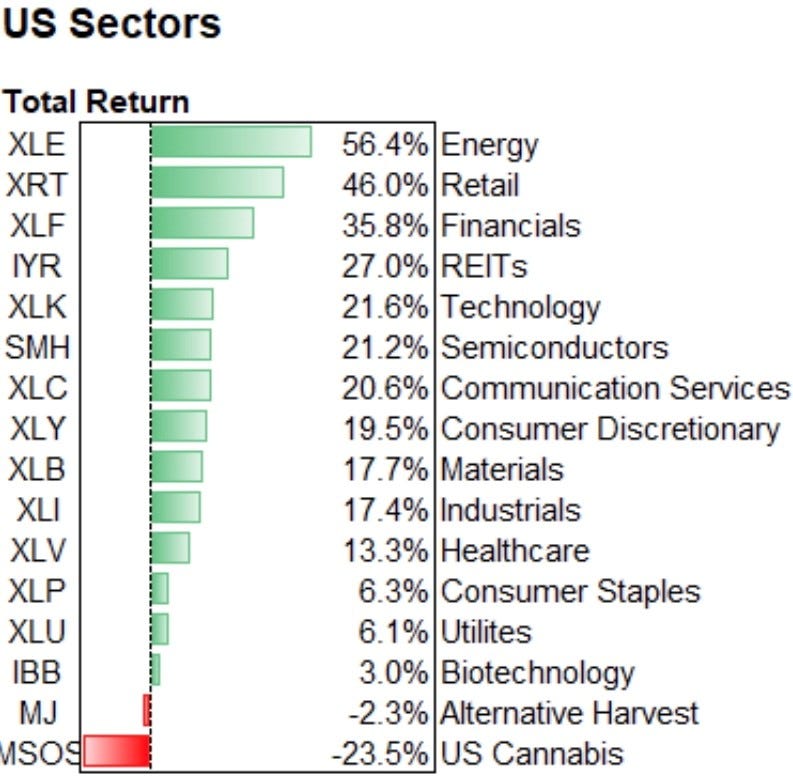

…as pandemic-related fiscal and monetary policies helped fuel superior returns across asset classes of all shapes and sizes. Crypto is going nuts; real estate is off the charts; heck, even trading cards have caught a bid. And stocks? Yep, quite the equity orgy…

…except for that red mess at the bottom of the chart, which also happens to be the one sector that I’ve bet the entirety of my financial fate on.

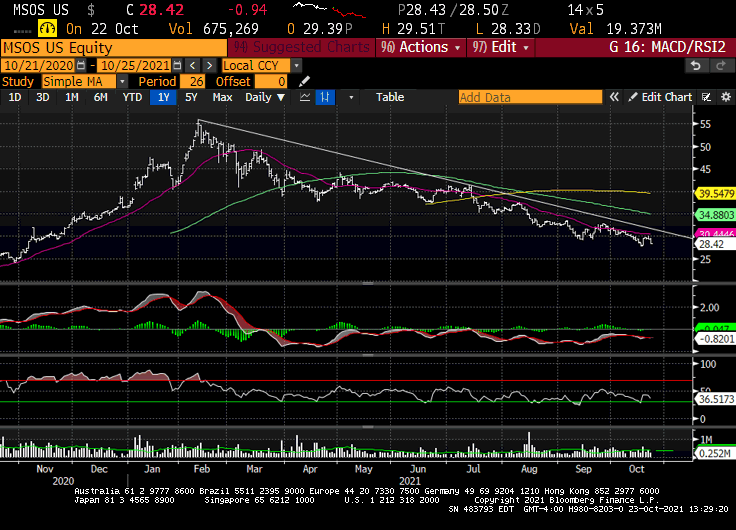

But why? That’s the burning question racing through so many of our minds almost nine months after U.S Cannabis ETF $MSOS ticked north of double-nickels.

A few months ago, we asked, Is U.S cannabis a Value-Trap and we tried to poke holes in our base call bull thesis. We talked about interstate commerce, the FDA, Big Canna and over-taxation while noting how things could get bumpy given the space had lost it’s technical metric. And so they did, get bumpy I’m sayin’. So, now what?

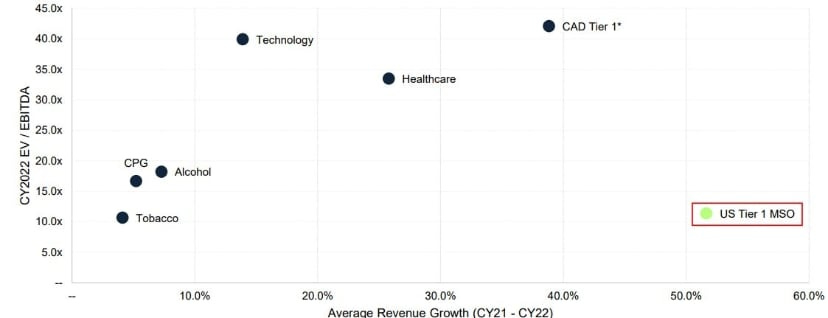

It’s odd, to say the least, that the fastest growing industry and jobs creator in America isn’t participating in the Everything Rally, especially given the mind-blowing growth @ value multiples that we’ve so-often detailed in this space.

Some blame the banks for shutting down custody / clearing operations for cannabis-related securities. Others blame politicians, whether it’s the President for turning his back on campaign promises, or those in Congress for all of their political posturing that’s thus-far yielded zero progress. Still others blame the algos for their constant feasting on low-liquidity / retail-rich prey, or the pervasive / abusive naked-shorting.

The truth is, it doesn’t really matter; it was likely a combination of all of those things, with the added weight of any number of culprits: a relative slowdown / normalization in 2H21 growth post-COVID-induced pantry stuffing; the still-sticky illicit market; slower-than-expected state roll-outs (NJ, NY); tax-selling (to offset other capital gains); and, of course, the growing sense that cannabis legislation is dead at the federal level and that, and that alone, will dictate the fate of the U.S cannabis sector.

[SAFE Banking is in the current House version of the NDAA with the Senate expected to pick it up the first week of November. While those in the know have made educated / lucid arguments as to why this won’t make it through the Senate, there are some who believe the GOP will engage in political calculous / support the measure / attempt to force Schumer to publicly remove it, which would be thorny for obvious reasons]

[^ I’m 50/50 on SAFE via NDAA by year-end but my optimism is an outlier and unless capital market protections are added along the way, the current / boilerplate language would simply trigger FINCen / AML guidance to update, which would be a second-derivative / incremental positive step toward the eventual U.S up-listing.]

I will also / again note most U.S cannabis stocks had MASSIVE runs from March 2020 lows to February 2021 —TerrAscend ($TRSSF) +1250%, Green Thumb (GTBIF) +885%, Trulieve ($TCNNF) +830% to name a few—and a cyclical bear market within a multi-year secular bull market is not only normal and natural but also quite healthy. Like a forest fire, it’s scary, dangerous and ultimately necessary for a fertile rebirthing.

[TerrAscend lost 66% since Feb but is still +355% vs. March 2020; Green Thumb, -40% since Feb, is still up 530% since March 2020; Trulieve, -50% / +376%. Timing is everything, as we know, but this is more about looking forward than looking back]

It’s not like the thesis has changed. The state-led fundamental story remains strong to quite strong, even if every / this quarter won’t blow out expectations bc growth will be lumpy as the industry lurches forward and regulators / agencies try to feel their way through the new frontier. But the opportunity is real; I mean, even Cantor sees it…

…and credit conditions continues to trend better, as evidenced by Verano’s scoop of $250M non-dilutive paper last week @ 8.5% (+$100M in their back pocket). And yes, 8.5% is a ridiculously high cost of capital in the real world, which speaks to the broader rerating that awaits the space when the playing field eventually evens.

I mean, even the IRS is lobbying for SAFE Banking…

…joining a growing list of signs of normalization seemingly surrounding society.

But don’t tell that to investors, who are sullen and salty after not only losing money in cannabis stocks but also the opportunity cost associated with being in cannabis stocks rather than idk, anything else. Ask me how I know?

Meanwhile, some of the smartest investors I know are planting their US canna flag…

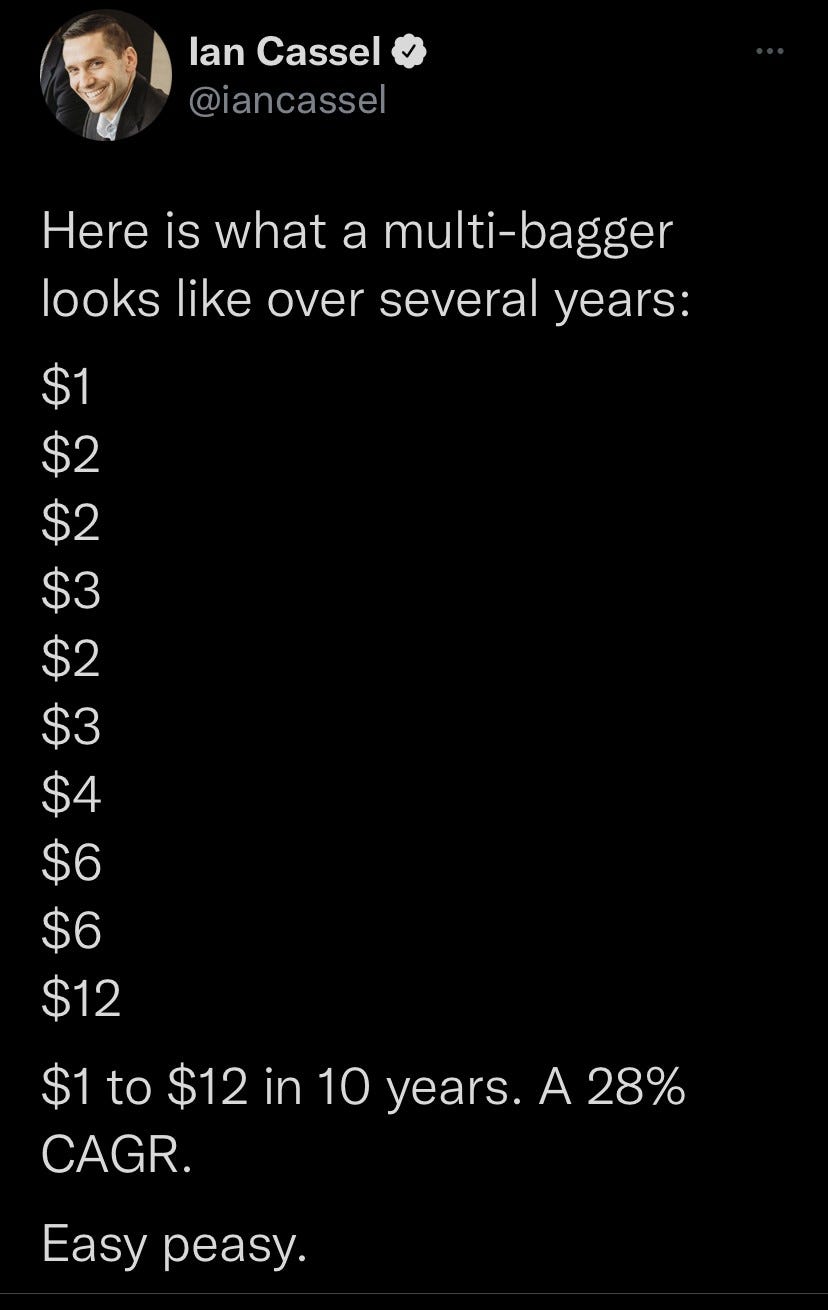

…anyone who’s been around the block a few times knows how multi-baggers work…

…and, as the rest of the world inflates and tech valuations fly sky high…

…U.S cannabis is trading back at levels last seen last November. I won’t say there isn’t risk—US canna is down 23% YTD despite the rising tide; what happens when the tide recedes?—but I will say that in my 31 years of watching tapes and surfing cycles, I’ve never seen more compelling, asymmetric opportunities than we’re seeing now.

[most investors can’t play the U.S space given the litany of custody restrictions and those who can, let’s be honest, why would they venture into the pink-sheets / CSE when they can’t buy Tesla, Bitcoin or Amazon? The buyers are higher, this much I know, and when they finally come for these names, they’re gonna come big]

[U.S Cannabis ETF $MSOS is NYSE-listed and avail to most; more on that here]

And one more thing, my grandfather Ruby taught me that all a man has is his name and his word and I’ve spent my life honoring his legacy / staying true to his lessons.

So when peeps on Twitter call me a paid pumper…

…I’m super aware that my name / word are draped all over this company, which is why I’m more than happy to share the who, what, how and when behind the why we built Verano into a top holding. I didn’t have to write / share any of it either but did so for a few reasons, one of which is that I’m pretty sure George and his team will reflect well.

If you believe that an efficient market will eventually reprice U.S cannabis, I’m not sure there’s a better single-stock vehicle than a US canna FAANG that is 1/2-off vs. a peer-group that is already trading 80% below the S&P growth multiple. Do the math in your head if you like, I know I do almost every day.

Just do me a favor: remind yourself this is a movie, not a snapshot. I don’t wanna be judged on this observation tomorrow or next week bc tbh idk on the timing. But I do believe Verano will eventually trade par and when it does, we’ll think back to the last few months of 2021 when any one of us could pick up the shares for ~$11 each.

At that point, let’s remember how we felt right now; our mood, our mindset…

…and let’s take a moment now to remind ourselves that the purpose of the journey is the journey itself, and we should be good to others and better to ourselves.

May peace be with you.

/position in stocks mentioned

/advisor $MSOS, $VRNOF