After a long, dark, dreary summer for U.S cannabis stocks, investors entered the new month ready to take a leap of faith. The first half of September had other plans…

You can’t blame cannabulls for feeling nostalgic as we reminisce about the rallies of yester-yore; the conditional elements for a ripper have been in place for some time: the fundies are fantastic, the sector is super-oversold and heavily shorted. The charts are broken; sentiment terrible…

All that’s been missing is a spark in the dark; something unexpected that would catch the brazen bears and naked shorts offsides. Something seismic that would give those gonifs an equity enema for the ages. Something….

Actually, it is SAFE; Banking, that is, and while this language is widely perceived to be the catalyst that’ll begin to re-rate U.S canna stocks, it’s actually a necessary precursor to state-level social justice programs / small businesses. It’s also baseline decency for the fastest-growing industry in America and the single-biggest driver of jobs.

[fun fact: Federal prohibition prevents the US Department of Labor from counting state-legal cannabis jobs so there are ~325,000 gainfully employed workers who aren’t counted by the BLS. That’ll change and I’ll betcha a dollar it’s during an election year]

But the fast money left U.S cannabis long ago to chase brighter shinier objects…

Some dedicated money was chased away by the continued custody f*ckery…

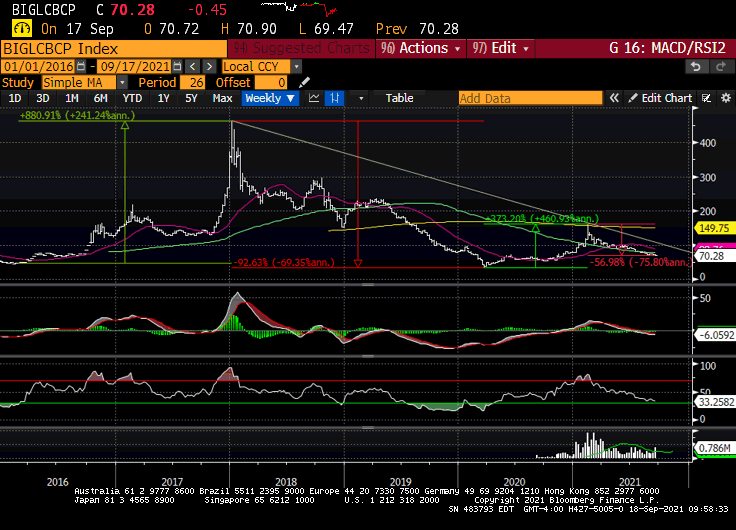

….even many die-hards tossed in the towel and it’s hard to blame ‘em. Those who’ve been in this space a while know it’s wicked volatile and prone to bipolar fits; the BI Global Cannabis CP index ran 880% into January 2018 before losing 92% into the start of the pandemic; it then ran 335% into February before this latest 57% slip.

Meanwhile, we’ve maintained the script is the script is the script—that despite what may be the most noble of intentions, Schumer never had the votes for comprehensive cannabis reform and he would eventually back-in to SAFE+ (criminal justice) through the front door or slip boilerplate SAFE language through the back door, if necessary.

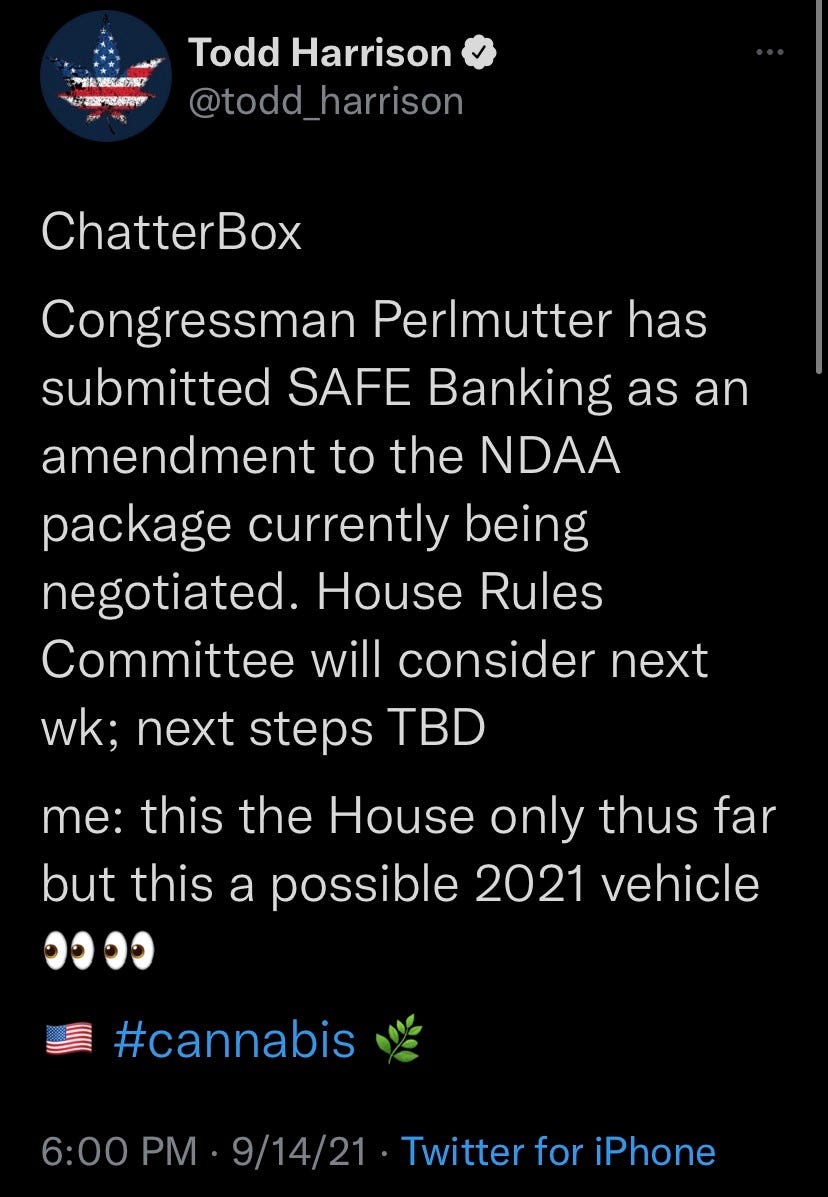

So late Tuesday, when the UHF antenna atop my crowded keppe began to vibrate…

…it dovetailed perfectly into our U.S Cannabis Town Hall a few hours later, where Big Brady Cobb, Jeff Schultz and I chewed through it all. The link above is a recording of that discussion, although further details have since emerged.

[sidebar 1: the original update from the Schumer camp (before the NDAA news) was as follows: they were going through comments to determine next steps; SAFE has the votes but they’re looking to see what elements of “+” (criminal justice reform) can be wrapped around it; and staffers are beginning to understand that social justice is fully dependent on banking / business deductions / tax reform /access to capital markets]

[sidebar 2: in the Town Hall, I mistakenly said SAFE Banking via the NDAA wouldn’t have to be approved each year when in fact the NDAA is an annual process. The key here is that if the boilerplate SAFE passes, it would automatically trigger FinCEN / AML guidance w/in 180 days, which we believe would lurch our industry toward the promised land of an even playing field]

Our thinking on Tuesday was that if SAFE made it into the final House version of the NDAA (we’ll know for sure this week but our sources are super-confident), it would put SAFE banking on a crash course with the Senate, where it would land at the feet of the Senate Armed Services Committee.

[sidebar: The Senate Armed Services Committee has 26 members, 21 of which live in states that have an active adult-use or medical program; 8 members of the committee are currently co-sponsors of SAFE]

Assuming there isn’t an objection from the committee, the bill would seemingly force the Senate Majority Leader to make a decision. He could publicly remove the SAFE Banking language and in the process, deny his constituents / social justice applicants functional banking—or he could take the incremental win and build from there.

Or, that’s what we thought because on July 22nd, the senate quietly passed their own version of the 2022 NDAA and the reason most people are missing that is because it was never filed after it was passed.

You may be thinking to yourself, why would they do that? I’m glad you asked.

There is evidently a Parliamentary trick that goes something like this: the House will pass a bill with their own language and the Senate will effectively take the bill, erase everything after the title and replace it with their own text (which they have handy).

Once the bill is passed in the Senate, it would go to conference—and this is the most likely path b/c the only reason the Senate would hold the NDAA in their back-pocket is to do something like this—and while Perlmutter will continue to push for it there, Schumer would likely be shielded from having to publicly torpedo it.

So the next few weeks become a step-function: 1. Does SAFE make it through the House version of the NDAA on Monday and if yes, 2. when the Senate eventually releases their version, will it include SAFE? [If it doesn’t, it’s not dead, it’ll just get debated and industry insiders I spoke with gave it a 60-40 chance]

If the NDAA passes w/o SAFE Banking and SAFE+ remains D.O.A—will the GOP let Dems have a win ahead of the midterms?—there will be other opportunities to back-door SAFE (such as the infrastructure bill, or through a budget rider) and the odds are we’ll be having this conversation again real soon.

Bottom line: we wish we could rip the War on Drugs off like a Band-Aid but the most likely path forward is incremental movement at the federal level over the next several years. In the meantime, U.S cannabis remains a state-led story and that will continue as New York, New Jersey, Connecticut, Virginia and others ready for launch as others, including Pennsylvania, Maryland, Florida, Ohio—big states!—line up behind.

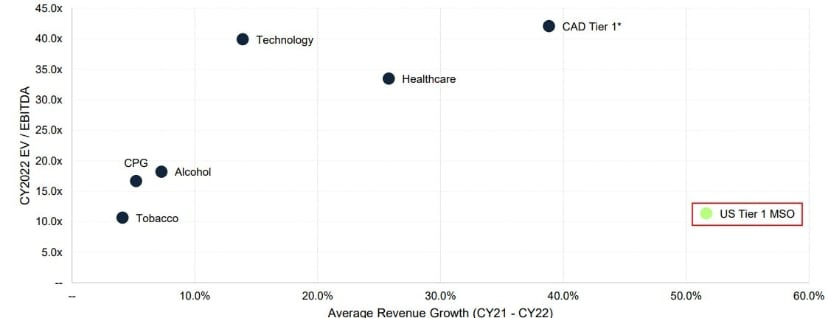

Meanwhile, leading U.S operators continue to build MOAT, capture TAM and drive enterprise values higher while big box CPG / institutional investors chomp at the bit to get involved. I mean, look at the “Growth at Value” multiples we flashed last week…

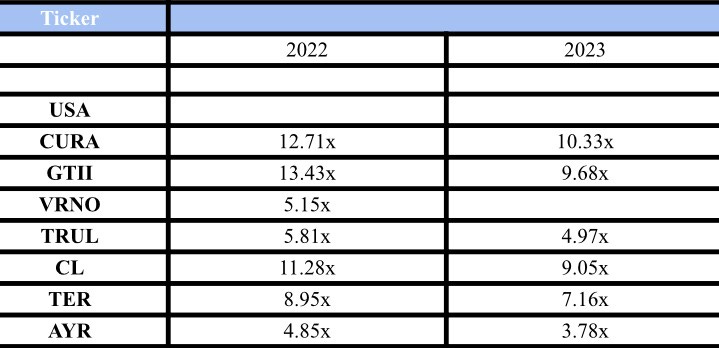

…and actually do the math bc there are mind-boggling generational opportunities in our midst if these management teams continue to execute / remain good stewards of capital. A snapshot of U.S canna 2022 / 2023 EV / EBITDA multiples are so obscene, they’ve been deemed illegal in seventeen states. No but seriously….do the math.

[note: the pro-forma Terra-Gage 2022 multiple is ~5-ish which is just…Wild]

It’s no secret U.S cannabis lost it’s technical metric a while back and given we view the financial markets through the lens of four primary metrics, the last few months have been akin to driving around with only three good tires. It’s been… bumpy.

But if markets vote in the short-term and weigh over time as the adage insists, fundies will lead the technicals higher. And given the way this space trades, I’d be willing to bet those multiples overshoot the other way once the barbarians bum-rush the gates.

Random Thoughts

Needham analyst Matt “Shooter” McGinley recapped U.S cannabis on Friday and had this to say: “Our primary conclusion is that the fundamental outlook remains outstanding and by 2025, we expect this industry to generate > $40B in revenues, have an economic impact > $100B and employ over 500,000 people.”

We know several dedicated funds that were planning to deploy money into U.S cannabis but wanted to see better price action first. I guess it’s hard to blame them but that does support our longstanding suspicion: the buyers are higher.

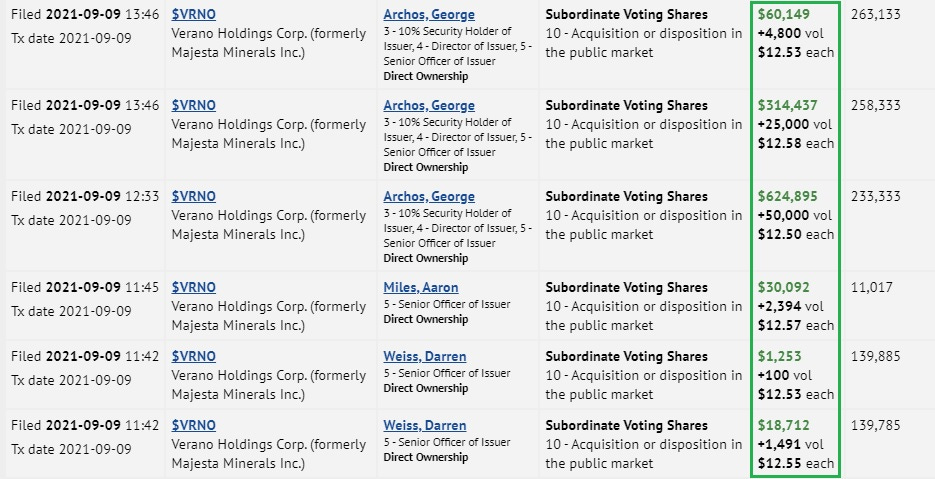

We’ve touched on Verano, which we believe is the missing ‘A’ in the U.S Canna FAANG and is trading @ a fraction of other Tier 1’s—they came public into the Feb cyclical top as sector flows reversed; terrible timing, no fault of theirs—and insiders know it. This is not to be confused with a stock buy-back, it’s upper management slapping their cold hard after-tax cash on the table. #LFGrow!

There’s been concerns re: the California flower glut, plateaus in Illinois and Pennsylvania, and pricing pressure in Florida and sure, that stuff will happen on the way from here to there. But if we’re going to talk about fundamentals, we must discuss the other side, including the magnitude of demand on tap and that math thing we touched on above.

Stifel on Trulieve: “Our C$132 PT is based on applying a 30x multiple in our FY2022e EBITDA estimates.” me: stock closed (checks screen) at C$33.51.

Brady, Jeff and I will be hosting another U.S Cannabis Town Hall on Twitter Spaces on Tuesday, Sept 21st from 8PM-930PM if you would like to come hang.

If you find this substack helpful—or even if you don’t and would like to support the cannabis charity of your choice while scoring some super-soft shwag, please visit Canna4Good and pick-up your karma upon check-out. Thank you!

May peace be with you.

/positions in stocks mentioned.

/advisor $MSOS, $VRNOF