Last week we discussed the Dead Calm in U.S cannabis markets and the pivot on the hill as Senator Schumer from NY and Senate Majority Leader Chuck Schumer squared off on the issue of functional banking for NY’s transformative social justice initiatives.

Earlier we pubbed our monthly Letter to Investors with a deeper dive into what we’re seeing and how we’ve chosen to position heading into this thus-far cruel summer.

As if that wasn’t enough over-exposure, I hosted a WTF Q&A on Twitter last night that was supposed to last a half-hour and a glass of wine and turned into a Kim Crawford-infused TMI-fest. Haven’t had time to circle back for an edit either, but prolly should.

Insofar as redundancy is a pet peeve—along w close talkers, loud chewers, arrogance, liars, and assholes—I’m gonna keep this note fairly tight, chew through a few random thoughts and finish up with several charts for those who care about such things.

Great Expectations

Camilo Lyon @ BTIG has joined AGP in helping to shift investor expectations away from the comprehensive reform that Schumer so badly desires (but doesn’t have the votes for) toward the more politically tenable incremental movement taking shape.

With US canna stocks near January / pre-Schumer levels, the market seems to have already priced-out sweeping federal reform. But if Camilo and others we speak with are right—if SAFE+ is attached to must-pass legislation this fall—the market, as a forward-looking discounting mechanism, should begin to sniff that out sooner v. later.

TSX Rumors, Eh?

So this is going around, along with a multitude of interpretations as to what it might mean if U.S plant-touching operators were suddenly allowed to list on the Toronto Stock Exchange (TSX). Responses ranged from “it’ll be a game-changer” to “it’ll be a nothing-burger.” But is it even true?

There are definite discussions at the highest levels and we’re told that the TSX is itching to move forward but visibility on a final decision / timing / the necessary legal blessing is currently above my paygrade.

IF this proves true, we believe it would be a significant positive for several reasons:

Volume qualifies price and it’s been anemic as a function of continued custody / clearing f*ckery (read: the plumbing of the equity markets). The TSX may not solve all of these issues but it will 1000% improve liquidity on the margin.

Naked shorts, bottom feeders that they are, are allowed on the CSE but not on the TSX. This would be huge step for transparency and would help mitigate some of those pernicious algos; and that’s after the short-squeeze higher.

It would add incremental compliance confidence given the uneven / uncertain landscape with an added boost for international / Canadian institutions.

It’s a possible M&A trigger if well-capitalized LP’s choose to delist from the NYSE / NASDAQ and move to TSX only; the $TLRY’s, $CRON’s, $CGC’s of the world have to at least consider it given the opportunity to enter the U.S.

Incrementalism. With sweeping reform seemingly off the table, these types of half-steps measures to improve access to investor capital will continue to benefit U.S operators as business fundamentals improve with continued state adoption.

So would this be the end all, be all? No. But given the Dead Calm we’ve been forced to endure, even the smallest pebble has the potential to create a profound ripple.

Select US Canna charts

U.S canna ETF $MSOS back-testing downtrend and filling Jan pre-Senate gap (again) on lower (and lower and lower) volume.

The Cresco Kid weekly $CRLBF

Curaleaf weekly $CURLF

Green Thumb weekly $GTBIF

[also, someone scooped $200M worth of GTI and it’s not Johnny Retail]

Trulieve weekly $TCNNF

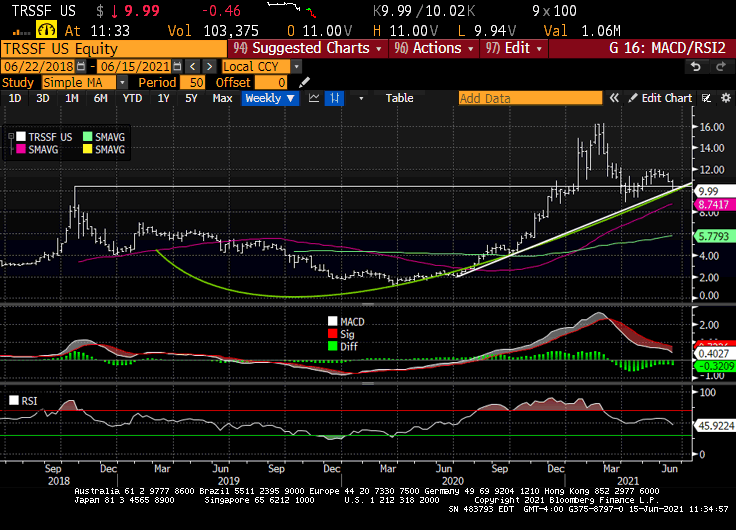

TerrAscend weekly $TRSSF

Just remember, there are only six more days of Mercury Retrograde…

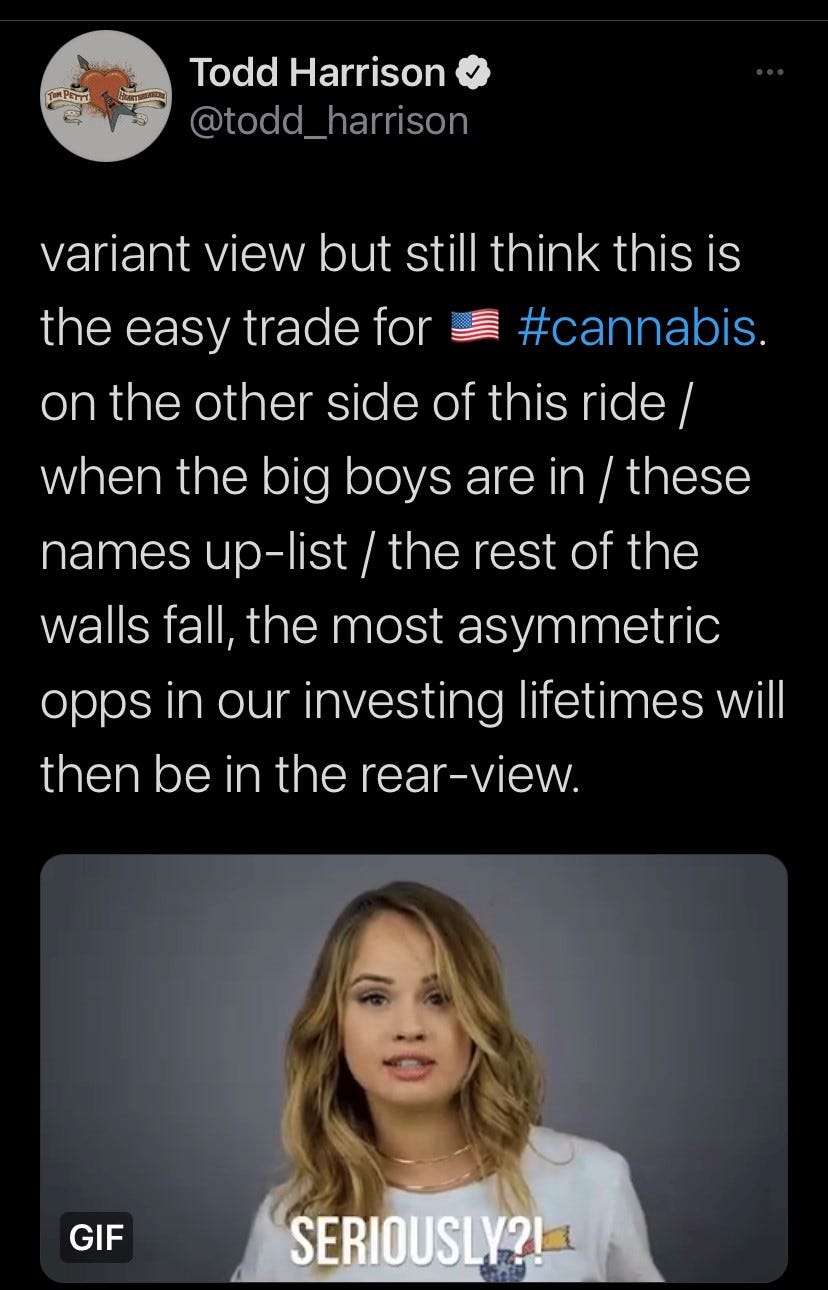

And it’s important to maintain perspective (despite the typos) given this…

and this…

…while accepting ownership for our own investment decisions…

Because no matter what happens day-to-day, we should always remember that…

and it’s much bigger / more profound than anyone currently realizes, myself included.

/positions in stocks mentioned

/advisor US Cannabis ETF $MSOS