Random Thoughts on Cannabis

Navigating headlines into month-end.

Note: Cannabis Confidential shifted content strategy in 2026 with more insights from trusted partners, industry insiders, and thought leaders who’ve got something to say. There will be no more paywalls or content fees; think of it as The Players Tribune for the cannabis industry, with an ethos of honesty, trust and respect.

It’s been super quiet across the canna landscape as we started the week digging out from Snowmageddon and spent the subsequent sessions awaiting headlines, staring down another potential government shutdown (Polymarket at 75%) and readying for the next round of sector earnings.

Our peeps, as discussed below, don’t seem all that concerned about the impact of a shutdown on the timing of a final rule, but I’m not sure popular perception agrees, as the space has suffered a steady drip lower to start the new year.

Former AG candidate Matt Gaetz popped on X midday to offer similar sentiments…

…causing a 4% burp higher in the U.S. canna ETF MSOS before the trademark fade in the absence of real/ incremental buyers given the custody and listing restrictions. It ended the session down 2% and is off roughly 10% YTD.

Separately, the recently announced United Center deal is a significant step for the THC beverage category, and we continue to believe that segment is here to stay despite a supply chain that’s an open question post-Nov. given the looming hemp ban. Still 👇

Top Stories

Medical Marijuana Business Booming in Texas

New York Cannabis Steps on Stage

Medicaid coverage for CBD in limbo as Congress removes hemp THC protections

Arkansas Medical Cannabis Sales Hit Record $291 Million In 2025

Canadian Cannabis Prices Level Off as Retail Sales Continue to Climb

Virginia Committee Votes to Legalize Adult-Use Canna Sales, Drastically Increase Possession Limit

Veterans Say Marijuana Helps Manage Symptoms, But Many Avoid Discussing Use with VA Clinicians

Massive Winter Storm Sees Cannabis Retail Sales Surge in Four States

Caribbean Cannabis Growers Eye Budding Domestic Sales and Exports

Industry Headlines

Cannara Biotech Earnings + Call Notes

Cannara Announces Conditional Approval to List on the Toronto Stock Exchange

Random Thoughts

The obvious angst is 1) the timing of a final rule by AG Pam Bondi and 2) the specter of yet another government shutdown on Saturday.

The waiting is the hardest part, and unknowns add further spice to the mix; sentiment continues to fade with each passing day but as we know in this complex, moods can shift in a hurry.

Been getting hit left and right re: the impact of the shutdown and those close (who’ve been right) said, in response, ‘lol’.

I asked if the ‘lol’ was more of a, “relax, it’s coming,” and the response I got was, “I don’t think the shutdown will matter for this.’

That sounds odd to me, but so did 1-2-3 (open govt, shut hemp loophole, EO for S3 < y/e) that we were told when the last shutdown began—and it’s the same source.

Having spent five days in Florida, it was hard not to notice the ridiculous number of smoke shops that continue to litter the Sunshine State.

Florida’s Division of Elections website now shows 760k valid signatures (from 714k two days ago). The campaign still needs ~120k signatures to make the minimum.

^ The signature submission deadline is February 1st.

3.0 looms large on the other side of a final rule.

The three amigos are out there; they just need to be introduced to 2026.

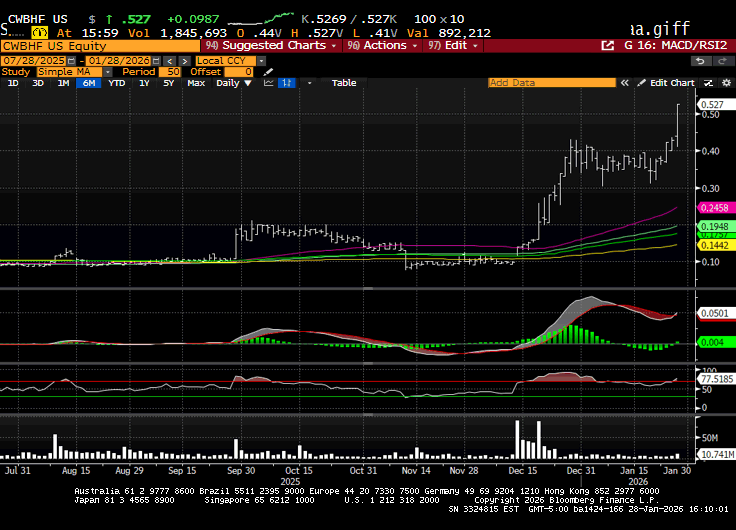

Chart Check: Charlottes Web 🕸️

Is CWEB a CBD tell? 👀

ATB on Glass House Brands

We come off restriction of Glass House with an Outperform rating and raise our 12-month price target to $10.50 (vs. $9.50). Glass House recently announced accelerated 2026e expansion plans entailing:

(i) a return to full production capacity in Q4/25e, following a step back in the previous months (ahead of the Company’s previous target of being back to full production in Q1/26e);

(ii) more rapid buildout of Greenhouse 2, which is on track to be fully planted in Q2/26e (vs previous target of being fully planted exiting 2026e); and

(iii) commencing retrofit and buildout of Greenhouse 4, with plans for supplying CBD and hemp to international markets and eventually supply the domestic reimbursable CBD market.

Once fully operational, Greenhouse 2 is expected to provide an additional 300,000lbs of biomass annually. We adjusted our estimates to factor in accelerated expansion plans, raising our revenue and adj. EBITDA estimates for 2026.

We now expect 2026e revenue of $235.5m (vs. $211.4m) and aEBITDA of $35.5m (vs. $23.4m) as Glass House benefits from substantial operating leverage. Our thesis is that Glass House is one of the few controllable growth stories in US canna, supported by additional greenhouse conversion optionality.

ATB on U.S. Cannabis Uncertain Tax Provisions

We analyze the surging Uncertain Tax Position balances MSOs are accumulating by withholding 280E taxes—liabilities that now often surpass debt. We address four critical questions for investors:

(1) What’s The Ongoing Cost of These Liabilities? Costs may include interest (Federal Short-term Rate + 5%), failure-to-pay fees (capped at 25%), and 20% accuracy penalties.

(2) What’s The Timeline for Resolution? We forecast a two- to five-year process; with Trulieve already receiving audit reports (RARs), we expect Notices of Deficiency to soon trigger Tax Court litigation, and subsequent Circuit Court appeals. Settlements may happen any time during this process.

(3) What Scenarios Could Play Out? We think MSOs will most likely settle with the IRS at a discount; specific terms may be determined by each company’s financial position. We expect the IRS to recognize some “hazard of litigation”, and be interested in settlements to collect as much as possible while keeping businesses operating. A worst-case scenario would involve a full repayment of taxes, penalties, and fees (no settlement), potentially requiring costly appeal bonds following a defeat in Tax court. A best-case scenario would rely on court victories or retroactive amnesty following rescheduling.

(4) What Investors Should Watch Out For: Investors should track “Notices of Deficiency” as the countdown to litigation; we expect this to happen and be disclosed in MSOs’ financials this year.

Bottom Line: We view UTPs as a sector overhang likely resolving only post-2026 via settlements. Importantly, while rescheduling would halt future UTP buildup, it is unlikely to apply retroactively. While tax liabilities are a long-term risk, we believe near-term stock performance will remain driven exclusively by rescheduling itself.

Stems & Seeds

Lifetime Canna Use Leads to Greater Cognitive Performance in Aging Populations

^ see all-time list of studies here.

Have a safe journey, please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in/ advises some of the companies mentioned and nothing contained herein should be considered advice.

.

Todd is a con man...