The Three Amigos

A checklist for a cannabis bull market.

Note: Cannabis Confidential is shifting content strategy in 2026 with more insights from trusted partners, industry insiders, and corporate leaders who’ve got something to say—and now a place to say it. There will be no more paywalls or content fees; think of it as The Players Tribune for the cannabis industry, with an ethos of honesty, trust and respect.

I will continue to share real-time insights daily on X-subs, which costs less than what a monthly fee was for Substack—and it’s real-time—so if you enjoy and are in a position to support those efforts, I sure would appreciate it as we ready for a year to remember.

Post-Rationalization Syndrome

The Three Amigos discussed how our decade-long cannabis thesis proved true even if the P&L didn’t reflect it. I’ve learned a lot of lessons along the way, witnessed things I hadn’t seen in 36 years of staring at screens, stuck to guns and saw some true colors.

We believe 2026 will be the year of the plant, not just on the federal side but for states like Pennsylvania and Florida, both of which could flip, in addition to Virginia and the 26 other state CSA’s that are tied to the federal CSA.

It’s coming and nobody will trust it once it does given what happened last month, but there’s a “stacking” of 2026 catalysts that we expect to follow, as shared below.

The flex below ran on Hannity last night. They know what’s up and that crypto is down with the midterms coming up quick. We expect DJT to follow up on ‘promises kept’ by continuing to support his Make America Green Again™️.

You know what would help express that train of thought to the American Public?

TDR: Mission [Green] Founder Weldon Angelos: The Man in the Arena

TDR: former college football player turned entrepreneur Jerry Haymon

Rescheduling Would Bring Some Immediate Changes, But Others Will Take Time

U.S. Senate Confirms Sara Carter, Supporter of MMJ, as White House Drug Czar

Ohio Marijuana Sales Top $1 Billion in 2025

New York’s Legal Cannabis Shops Reach New High, Doubling In A Year

California Canna Sales Hit $348 Million In December, $3.64 Billion For 2025

Ozempic and cannabis: what happens when you use both

Thailand: 7,000+ Cannabis Shops Close As Rules Tighten—Patients Assured

Germany’s MMJ Bill Faces Test As Experts Warn Of ‘Unenforceable’ Framework

Cannabis Retail In Canada: What 2025 Revealed And What 2026 May Bring

Industry Headlines

Alpha Nooner - Todd Harrison on the 2026 Outlook for U.S. Cannabis 📺

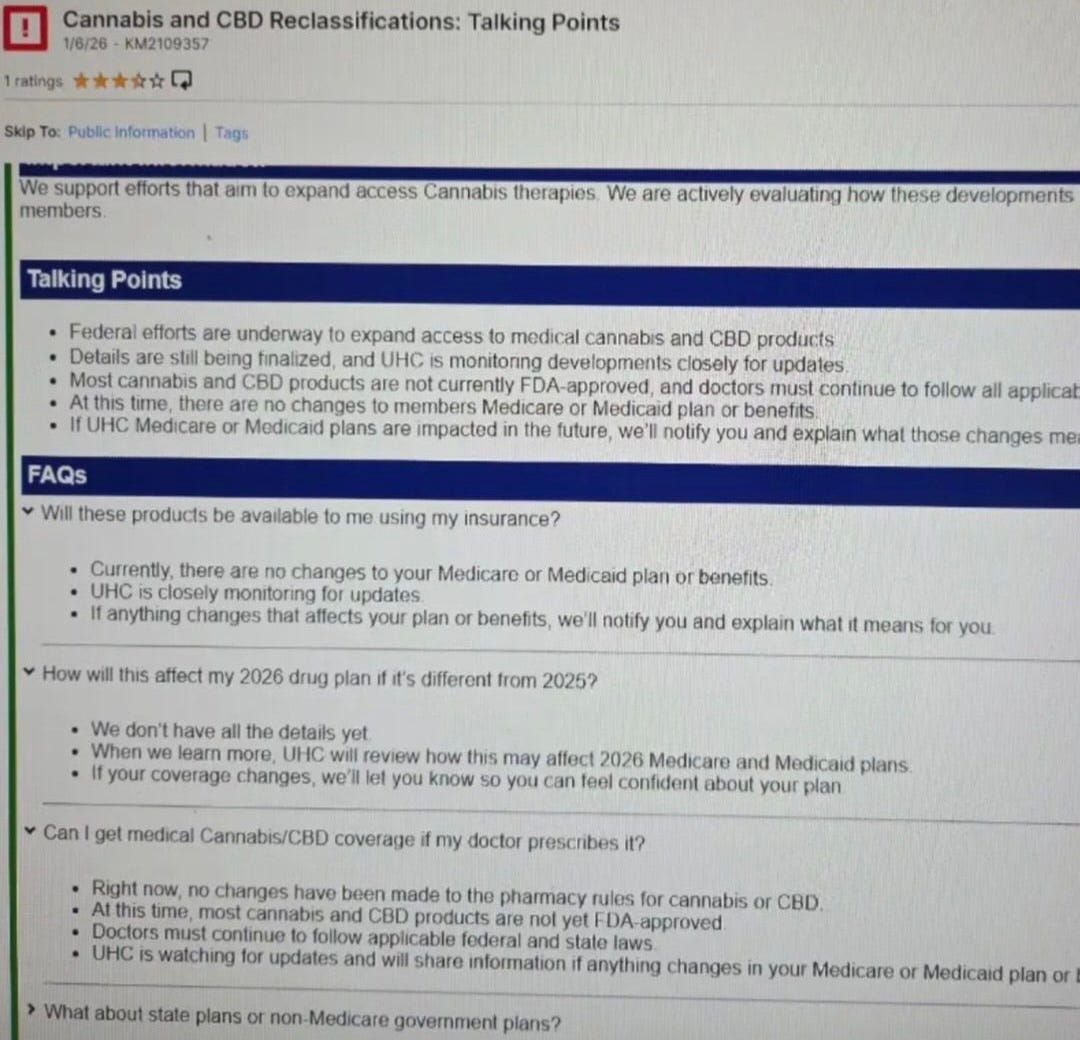

Evidently taken from the United Healthcare Website

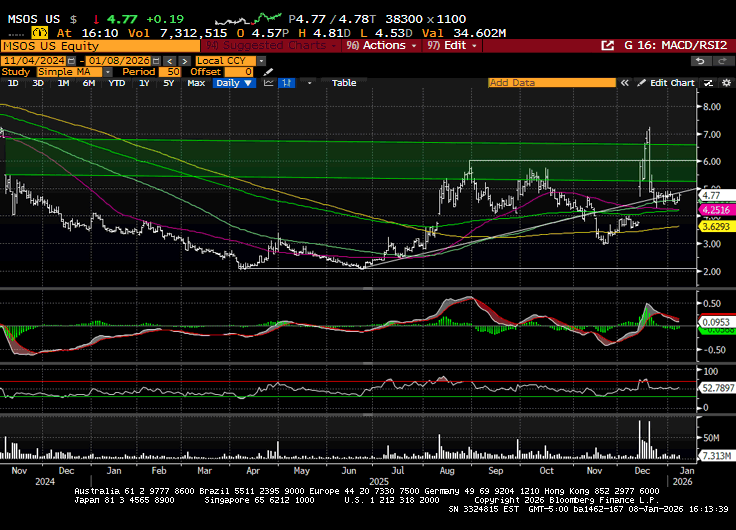

Chart Check: MSOS

Reference point for the 🤖 are set for when the real thing hits.

Heard on the Street

I awoke yesterday to the following message from a Wall Street sales trader:

We are hearing that Pam Bondi was ready to sign the rescheduling final rule on Monday this week, but things got delayed because of Venezuela and news cycle.

ATB on Cannabis

We enter 2026 with a bullish call on US MSOs, viewing the current valuation as an attractive entry point with visibility toward +100% equity upside.

Our constructive thesis pivots on a "stacking" of catalysts in 2026:

(1) the finalization of rescheduling to Schedule III (ATB Probability: >75%; Impact: Extremely High);

(2) a regulatory "clearing of the deck" (even if partial) regarding intoxicating hemp competition (ATB Probability: 50%; Impact: High); and

(3) state-level reform where high-probability legalization in VA (>75%) offers incremental gains for specific companies, while FL and PA (50%) present high-impact upside to the entire sector given the scale of these existing medical markets.

While we acknowledge historical regulatory fatigue and remain cognizant of rescheduling delay risks, we believe the sector's 2026 risk-reward profile is heavily skewed to the upside.

With valuations that do not materially price in these independent, high-impact catalysts, we believe investors should be long the sector to capture what we anticipate will be a stepwise multiple re-rating as the year progresses.

We note that Tier 1 operators are trading at ~6x EBITDA, compared to ours and investors’ expectations (based on our Fall 2025 Survey, here) for a >10x EBITDA multiple upon rescheduling alone, with potential further multiple expansion on the stacking of the aforementioned state-level catalysts.

Viridian on Cannabis

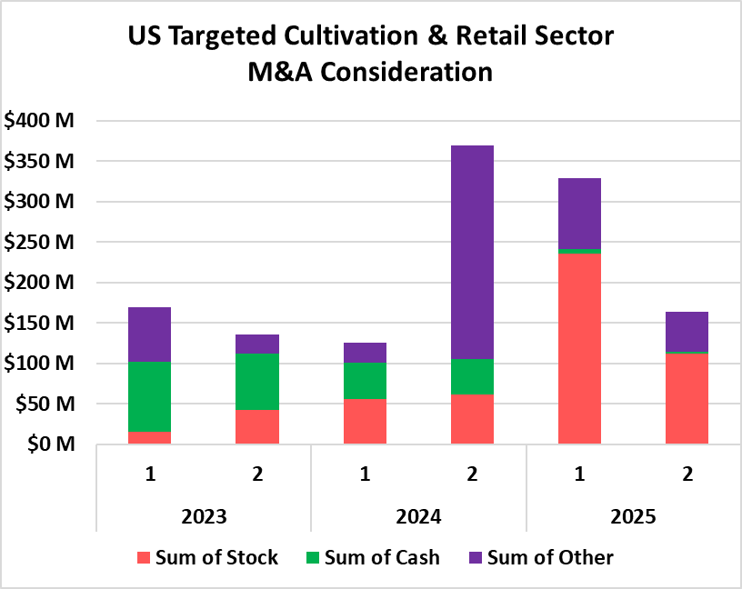

The Viridian Chart of the Week looks at M&A consideration for transactions in which the target company was a member of the U.S. Cultivation & Retail Sector, and where the breakdown of consideration was disclosed.

Several things about the chart are notable:

• The use of stock compensation has increased dramatically, attributable mostly to Vireo Growth (VREO: CSE), which completed 6 transactions in 2025.

• The amount of cash in 2025 transactions hit a low point, at less than 2% of total consideration, on the deals for which we have solid data.

How will Rescheduling Change the picture?

• Increased Stock prices will enable other companies to use stock as consideration for M&A deals. We have not seen much of an increase in stock prices yet, but we view this as largely due to healthy market skepticism about the timing and details of S3.

Investors have heard rescheduling and other reforms, like SAFER, proposed too many times left incomplete. We believe this time is different and would not be surprised to see stocks bounce by 100%, while leaving valuation multiples at reasonable levels.

• S3 will foster the trend towards intrastate consolidation.

• We are likely to see new players completing deals. On Friday, market rumors swirled about a soon-to-be-announced transaction in the brand space. Will this be a merger of significant brands for product line extension? Or could it be a deal where a brand enters new markets through a merger with an MSO? We are anxious to see!

• Will S3 bring more cash into M&A deals? Maybe, but at a lag.

• S3 is likely to increase equity issuance, but some of this will initially be targeted towards balance sheet repair.

• S3 will increase debt capacity, which may allow for more cash in deals.

• S3 by itself will not drastically increase the inflow of investor dollars into Cannabis (popular perception is that SAFER banking is needed).

We believe Rescheduling will spur and coincide with a meaningful increase in M&A activity in 2026.

Stems & Seeds

A review concluded that “cannabinoids, especially CBD, may improve anxiety and sleep disturbances.”

Have a safe journey, please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in/ advises some of the companies mentioned and nothing contained herein should be considered advice.

The "stacking" framework from ATB is the piece that actually matters here. Single catalysts get priced in quick (or fail to materialize), but having Schedule III + state reforms + hemp regulation overlap creates a diferent setup entirely. I remember tracking MSOS during the last rescheduling rumors in late 2023 and the sector faded fast when nothing happened. The skepticism is warranted but the valuation gap at 6x EBITDA vs expected 10x+ post-reschedule leaves room for asymetric upside if even one or two of those dominos falls.