The Pyrrhic Pivot

Just when everyone thought it was over...

Note: Cannabis Confidential is shifting content strategy in 2026 with more insights from trusted partners, industry insiders, and corporate leaders who’ve got something to say—and now a place to say it. There will be no more paywalls or content fees; think of it as The Players Tribune for the cannabis industry, with an ethos of honesty, trust and respect.

I will continue to share real-time insights daily on X-subs, which costs less than what the monthly fee was for Substack—and it’s in real-time—so if you enjoy and are in a position to support those efforts, I sure would appreciate it as we ready for a year to remember in Cannaland. #LFGrow 🌿

A few weeks ago, President Donald J. Trump made history when—as a Republican—he issued an Executive Order to reclassify cannabis to a Schedule III narcotic in a move that hopefully turned Tricky Dick over in his grave.

This is something that we, as an industry, have worked on for years, and while there is still much work to be done—clemencies—the significance of what happened cannot be overstated when considering the Halo Effect that this will create.

The Order to ease federal restrictions on cannabis and increase research of medical cannabis “in the most expeditious manner possible” was consistent with the story arc that we (were one of the few to) narrate and amplify in this space throughout 2025.

The Trump administration spent the last year busting Chinese crime rings and Mexican cartels and shuttering illicit grow operations and vape manufacturers before Congress set a timer on closing the intoxicating hemp loophole.

That left most people thinking that the Trump administration and the GOP-controlled congress were the third coming of Prohibition, which is why the cannabis sector spent the first half of the year in the toilet, but promises made were promises kept.

Meet the new boss—same as the old boss 🎶

As the S3 croutons baked, the story leaked and by the time the EO finally arrived—to deliver the best news in the history of the canna sector—the annual year-end rug pull had already begun, a tradition unlike any other.

There were several stories written about that particular trading activity:

Trump Is Warming to Cannabis, but Investors Aren’t Impressed (WSJ)

The Great Cannabis Arbitrage: How Washington Just Handed Wall Street Its Last Generational Trade

THE PAUSE BEFORE THE STORM + math from Professor Emeritus Bruce Macdonald.

The ongoing fuckery that’s been in play since the sector was first introduced didn’t dull any of the disappointment.

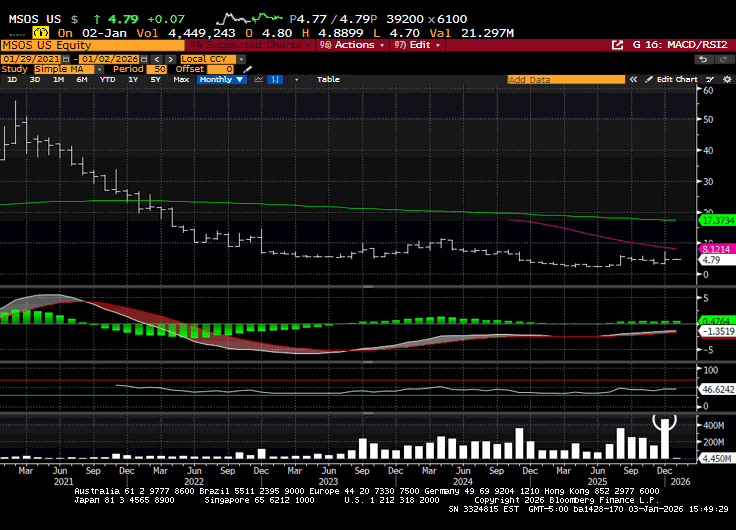

U.S. cannabis ETF MSOS closed at $3.76 on December 11th. The story leaked and MSOS rallied 94% in five sessions into the announcement—only to get slammed by over 40% that session.

“Sell the news?” Yeah, some. Only an Executive Order (rather than an actual S3)? That too, although any non-tourist knows POTUS can only direct the AG to finalized S3 and the only reason that’s possible is because Biden started the process years ago.

But this was more than that. It was quant shops and algo-driven funds preying on a broken market structure for U.S. cannabis stocks, as custody and exchange restrictions keep most institutions (and institutional squeezes, and M&A) in a land far, far away.

The timing on December 18th was the Chef Kiss. Select elements of the EO leaked 40 min. prior to the press conference, as traders aggressively added puts and sold calls to act as an accelerant to the sell-side—but absent a legal debate about how short-sale exempt rules were seemingly used in a predatory manner, idk if any laws were broken.

The order was given but the rule wasn’t final and with even optimists saying, “weeks, not months,” year-end winding down, and tax-loss decisions being made in real-time, what was to be a triumphant day for the long-beleaguered sector morphed into an anticlimactic reminder of where we stand in the global financial pecking order.

Green Skies Ahead

Despite that, U.S. cannabis ETF MSOS finished 2025 +25%, outperforming other canna-related ETFs, as well as NASDAQ (+20%) and the S&P (+16%) but as we know or least should, there is an asterisk on that performance dating back to hashtag gangs.

MSOS almost hit $56 in Feb. 2021 after Joe Biden and the Dems swept into office and the specter of federal reform danced across our brains like grateful bears, before they flexed their flaccidity, laid themselves down, and let perfect be the enemy of the good.

It was also around the time red states stumbled across something called “intoxicating hemp,” which was almost as awesome as canna because in most cases, it was canna. That bogarted about half of all THC sales over the last five years, which is notable as that loophole is slated to close in November as those puppies turn eight.

Pretty much every wart and worry that could have metastasized over the last five years has but the three amigos for a new canna bull spent the holiday season fetching fresh salsa and positioning for a proper Pot Piñata.

In the still-uncertain weeks prior to the Executive Order, I shared the thoughts below, which I’ll repeat to help explain the sudden sequence of Español and to help make the point that I was originally trying to make.

Everything we believed would happen for US canna over the last five years happened for US canna as measured by THC growth, adoption, and normalization.

In other words, the industry doesn’t have a growth issue—it has regulatory problem.

So, what the three amigos are needed for a new U.S. cannabis bull market?

Growth, which will ✅ as the hemp loophole closes and new states flip.

Regulatory parity: will ✅ when S3 hits + halo effect (custody, banking, et al).

Uncertain tax provisions (UTPs): will ✅ via settlement, litigation, or both.

We understand that the Schedule 3 Executive Order was the definition of anticlimactic fuckery but as shared from afar, we also believe the greatest trick the devil ever pulled was convincing the world that S3 already occurred.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ ETF Notional: $48M

Top Stories

How Trump Became the Unlikely Champion of Easing Marijuana Restrictions

Trump’s embrace of pot has Republicans in Congress fuming

What’s in Store for the Global cannabis Industry in 2026?

Three trends affecting the U.S. cannabis industry in 2026

SCOTUS sets March Case Challenging Federal Gun Ban For Marijuana User

New Cannabis And Hemp Laws Take Effect Today Across Multiple States

Florida Medical Cannabis Sales Hit $142M In December, $1.65B For 2025

Florida Senator Files Bill To Expand MMJ Supply Limits, Ease Requirements

Ohio Marijuana Sales Top $3 Billion, New State Data Shows

New York’s Legal Pot Shops More Than Doubled In 2025, Sales Surpassed $2.5B

Industry Headlines

Wyld Acquires Grön in Major Industry Transaction

AGP on U.S. cannabis

Our analysis suggests ~200% upside vs current levels (which are +125% vs. Apr 2025 lows) with our base case scenario not taking into account a potential lower cost of capital in a Schedule III scenario and upside in growth rate from additional states legalizing cannabis. We believe the analysis below paints a picture of how cannabis stocks are meaningfully undervalued post the EO calling for the DOJ to reschedule cannabis (we expect final/effective rule in 2026), on a DCF and EBITDA basis (61% discount to CPG & high-growth retail combined average).

Stems & Seeds

CBD May Boost Chemotherapy Effectiveness Against Aggressive Brain Cancer

Have a safe journey, please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in/ advises some of the companies mentioned and nothing contained herein should be considered advice.