Daily Recap

The US Supreme Court’s June decision in Loper Bright Enterprises v. Raimondo offers immediate support for cannabis companies to challenge IRS interpretations of the Internal Revenue Code.

With the elimination of Chevron deference to agencies when laws are ambiguous, cannabis companies may be in a stronger position to use this tax code section to mitigate the onerous tax consequences of Section 280E.

Thankfully, that legal process is already in motion.

F.U.B.A.R

The U.S. Department of Veterans Affairs issued a reminder that, while Ohio’s adult-use cannabis market launched this week, government doctors are still prohibited from recommending medical cannabis to veterans as long as it remains a Schedule I.

“The U.S. Department of Veterans Affairs is required to follow all federal laws including those regarding marijuana,” it says. “As long as the FDA classifies canna as Schedule I, VA health care providers may not recommend it or assist Veterans to obtain it.”

But thank you for your service.

Get Bucked Up!

Adult-use cannabis sales in Ohio have been legal for a week and business is booming.

Sales are rivaling some of the top cannabis markets in the country and customers are coming from nearby states, where adult-use cannabis isn’t yet legal.

“We’re seeing numbers at dispensaries that rival numbers in established markets like Illinois, that have been up and running for years. We’re seeing that in the first week in Ohio.” Jason Erkes, Cresco Labs

Home Cooking

Among cannabis consumers in states with legalization laws, nearly 8 in 10 say they purchase all or most of their marijuana from licensed retailers, supporting advocates’ arguments that enacting regulated markets can detract from illicit sellers.

NuggMD found that 77% of people in legal marijuana markets buy all or most of their cannabis from regulated stores. Specifically, two-thirds of all respondents get “all” of their products through legal outlets, while 12% said they get “most.”

Stocks & Stuff

Cannaland remains in show-me mode as we ready for the home stretch into the Nov. elections. We all know what could happen catalyst-wise but investors crave clarity after so many false starts and empty promises.

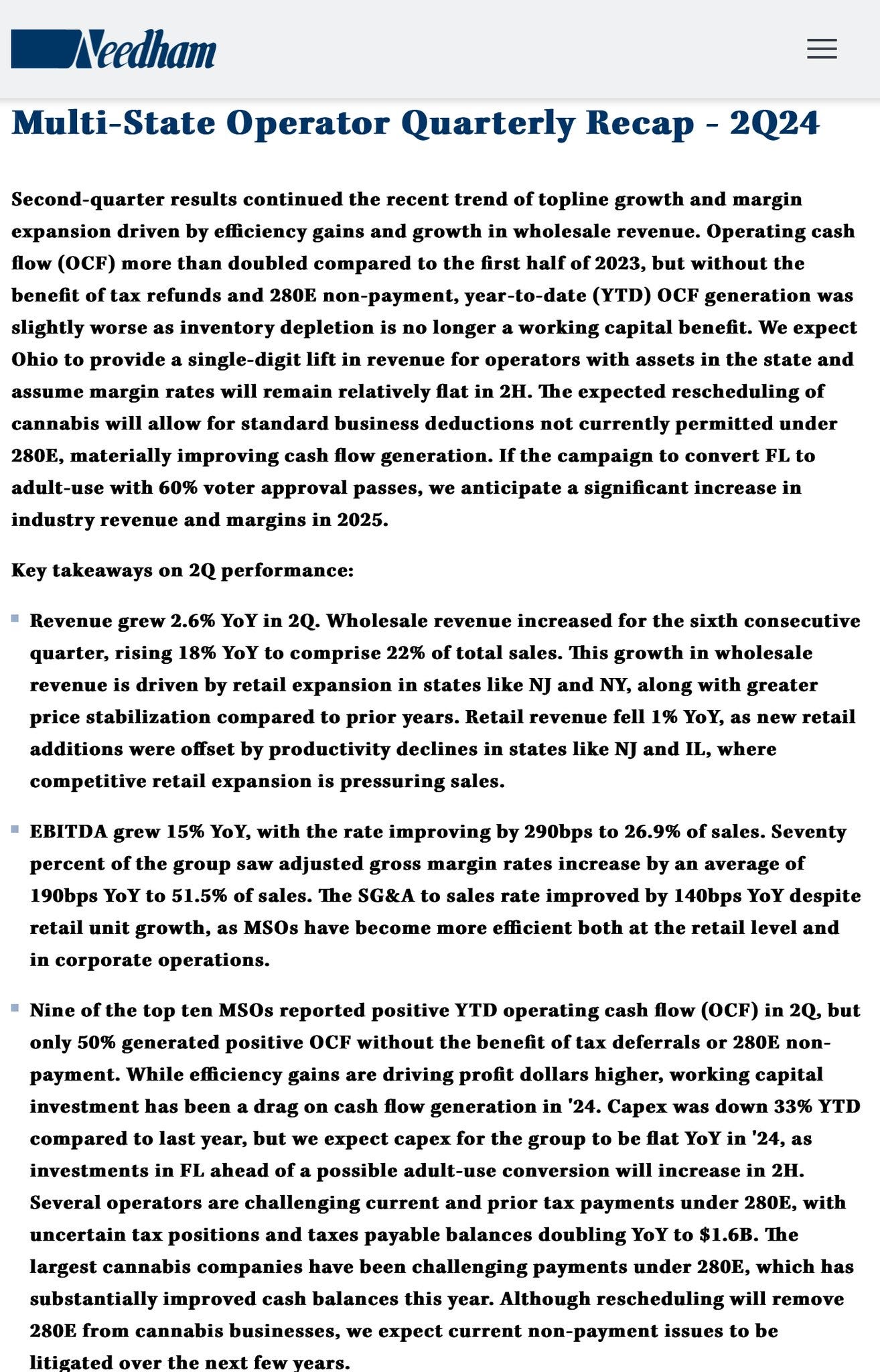

U.S. cannabis ETF MSOS is more-or-less flat on the year after sporting market-leading gains in Q1. It’s so thin out there, a sloppy quarterly rebalancing by a smaller ETF has dominated the flows and driven eye-popping three-day returns in select underlyings.

Below, we’ll top-line the recent price action and influences, recap the rest of earnings, kick the 280e tires, and get ready for some (political) football ahead of the elections.

All that and more, just scroll down.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑

Top Stories

Chevron’s End Can Help Cannabis Firms Use Tax Code Favorably

Ohio marijuana sales ‘exceeding expectations’, high sales from other states

Most People Who Use Canna Obtain It From Licensed Retailers

Delaware marijuana business license applications start on Monday

Germany's Medical Cannabis Imports Soar: Q2 Data Reveals 44% Spike

Rescheduling, Farm Bill trigger cannabis industry lobbying blitz 👇

Industry Headlines

AdvisorShares Ahrens on Cannabis Investing

Cannabis Stocks Rally on Trump's Cannabis Comments

Curio Wellness and Ascend Wellness Announce Manufacturing and Distribution Partnership

Glass House Earnings + Call Notes 👇

The Bay Street Butcher

In the land of the blind, the one-eyed man is King was the first thing I thought of when I saw a smaller U.S. cannabis ETF begin their rebalancing on Friday. Given the custody fuckery restrictions on underlying plant-touching U.S. cannabis stocks, its easy to see which names MJUS 0.00%↑ has been active in.

These rebalances typically last about a week, per our pal Boldux, and there is usually an opportunity to take the other side, for a trade or more.

Journey of a Lifetime

‘If you’re unhappy with your life, you are the only one who can change it' was another thought that recently passed behind my eyes. I recalled thinking that after SAFE failed in '21 and I dove deeper into Mission [Green] tryin’ be the change we need to see.

Three years later, the fight continues with conversations elevating on both sides of the electoral fence. While the progress has been frustratingly muted, the efforts and energies expended have never been more acute. We all know what's at stake.

Cannabis didn’t arise as an issue on Monday’s X Spaces with the former President and while we don't know when his presser will be—nor do we know if we'll hear about it at the DNC given it hasn't come up yet on the campaign trail—we remain confident that it will emerge as a political football into the November elections.

Clarus Sees It too

Chart Check

The bears have controlled the Con since the false breakout in late April. With 82 days until the ballots are cast, our space is in show-me mode and with several seismic catalysts inching closer, one observation seems all-too-real: the buyers are higher.

MSOS $7.30 and $8.20 remain resistance as the ETF tries to build upon a series of higher lows vs. last week when the Trump comments hit).

Bloomberg Intelligence on Schedule III:

"The possible DEA reclassification of marijuana to Schedule III might cut the tax liability among the five largest MSOs by around $500 million."

Matt “Shooter” McGinley on U.S. cannabis earnings:

Stems & Seeds

Can You Smoke Weed With Your Dog? You Sure Can

Cannabis Helps Depression, Pain And Anxiety While Reducing Prescription Drugs

Marijuana Use Shouldn’t Disqualify Athletes From The Olympics, Americans Say

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.