Weekly Recap

Reform advocates in Arkansas, Nebraska and North Dakota have turned in signatures to place citizens’-initiated cannabis measures on the 2024 ballot.

Arkansas voters will decide whether to expand medical access, Nebraska activists have submitted signatures for a pair of MMJ measures and North Dakota advocates turned in enough signatures to support an adult-use legalization measure.

They’ll join South Dakata and Florida as the five states in play this Fall.

A bipartisan bill in the U.S. House seeks to create an expungement mechanism for low-level, non-felony violations of federal cannabis laws. The Marijuana Misdemeanor Expungement Act, sponsored by Reps. Troy A. Carter (D-LA) and Kelly Armstrong (R-ND), would create an expedited process to clear non-felony federal cannabis offenses.

“No one should be in jail just for using or possessing marijuana. This bipartisan bill will restore justice to millions of Americans who’ve suffered excessive consequences associated with cannabis-related misdemeanors.” Rep. Troy Carter (D-LA)

Gulf Stream

Two recent polls show that Amendment 3, the ballot measure to legalize adult-use cannabis in Florida, is likely to win enough votes to pass in the November election.

The surveys suggest an increase in voter support for the canna legalization initiative compared to earlier polls, which indicated results that were shy of the 60% support threshold that will be needed to pass.

Oh, Hi! Oh…

Ohio officials were predicting recreational cannabis sales would launch in June and despite scores of dispensaries being primed and ready, the month passed without a gram of adult-use flower being sold.

The 110 existing MMJ shops that were given provisional permits are still all waiting for their final certificates of operation from the same agency and while it’s not clear when they will receive such permission, advocates still have high hopes it’ll happen soon.

“We’re a matter of weeks away from Ohioans being able to purchase legal, regulated, taxed, tested, adult-use cannabis products in the Buckeye State.”

Stocks & Stuff

Cannabis stocks continue to be card-carrying members of the Pay-No-Mind club as uncertainties surrounding the timing and viability of federal reform, coupled with the continued custody restrictions, have investors chasing shiner, more liquid objects.

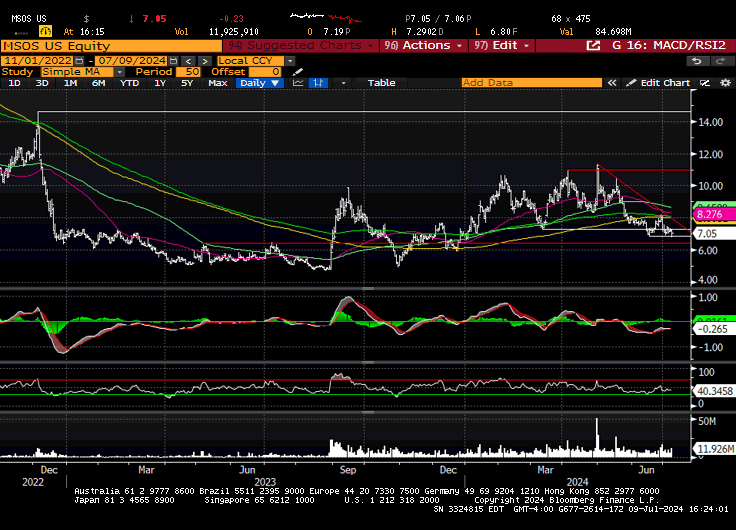

Today’s session got an afternoon jolt after a scary headline crossed the wires, hitting U.S. cannabis ETF MSOS for more than 6%. Upon further review, the headline, which screamed, “GOP Congressional Committee Approves Bill To Block Rescheduling, While Rejecting State Cannabis Protections Amendment,” is not only D.O.A on both sides of the Hill, but also a sign of desperation from the prohibitionists.

Still, in the absence of liquidity, people are so thirsty that they’ll drink the sand. Given how thin U.S. canna markets are sans custody—at 2:20 PM, $8M notional volume had traded in the underlying stocks—it doesn’t take much, either way. MSOS finished the day down 3%, and is now flat YTD.

Below, we’ll contextualize the state of play, weigh upcoming debt obligations, review the risks and rewards of the hemp market, check current multiples and the potential impact of the upcoming catalysts, and offer a handful of Random Thoughts.

All that and more, just scroll down, because there’s no paywall.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ ETF Notional: $85M

Top Stories

Advocates Turn in Signatures for Canna Ballot Measures in Three More States

Florida Marijuana Legalization Bid Headed To Victory, Polls Suggest

Ohio has over 100 dispensaries awaiting final approval to kickstart adult-use

Maryland's marijuana sales surpass $1.1 billion in first year of legal adult-use

Cannabis will soon be legally classified as medicine—but for what?

House Bill Seeks to Expunge Low-Level Federal Cannabis Charges

Will Labour Party Change Cannabis Policy In The U.K.?

Cannabis advocates in Thailand protest a proposal to ban against general use

German Officials Approve Country’s First Cannabis Social Club

Delta 8 THC Hemp Regs Moves Forward In NJ, Sparks Debate Between Alcohol And Cannabis Industry 👇

Pregame (written 8AM ET)

We fire up Turnaround Tuesday after one of the more unimpressive 2% rallies we’ve seen, as measured by MSOS. The ETF spent the better part of the Monday trying to reclaim the March lows ($7.30) but was unable to close above that level.

The price action since May’s DEA dookie dance leaves much to be desired, particularly when we factor in all-time highs across major averages and the risk, if not likelihood, of macro volatility ahead (←Chinese banks, U.S. political uncertainties, gravity).

All of that should be weighed against looming upside triggers, per Freddy at ATB:

"stocks remain undervalued on fundamentals, but stuck on regulations. MSOs are trading at a 2024e EV/EBITDA of 7.7x, compared to our sector base-case valuation of 11.8x, which does not include near-term rescheduling or Florida legalization."

With 13 days left in the comment period, sentiment in the gutter, arguably for good reason, and the Dems in panic mode, we expect that cannabis will elevate in the pre-election narrative once the comment phase completes (+ the Garland Memo looms).

A large contingent of investors remain convinced that any number of items, from DEA holdouts to partisan judges in select jurisdictions, will extend/ derail the rescheduling process, creating a wall of worry for this sector to climb on the back nine of 2024.

From here to there, it'll be bumpy and hot, so stay cool like Fonzi and remember why we started this journey even if at times, we wish we hadn't.

Housekeeping

I've flipped my perception of the Stripe substack saga and while they tell me that the situation is being looked into, I've decided to take July off from the daily recaps, enjoy additional time with my family and scribe when there's something to say.

As Stripe debates whether my Substack actually violates their services agreement as a “cannabis-related business” (scoffs), subscribers won’t be charged and I’ll revisit this decision at a later date, if it's even mine to make.

I will continue to focus on the day-to-day market stuff in real-time on X-subs.

Random Thoughts

Biden needs weed, in more ways than one.

The Green Thumb 200day remains symbolic yet important at $11.74.

The oldest axiom out there is ‘markets hate uncertainty,’ which is why investors wanna see where S3, hemp, Trump, ballots et al land before allocating capital.

Hard to put lipstick on this 'U.S. canna can't take out the March lows despite a historic market rally' pig.

Only higher prices / a false breakdown—on volume—would do that.

Our space should become increasingly active as the comment period concludes and elections draw near—and that's before the looming broader tape volatility.

Q1 was superb, Q2 a shit-show; if the alternating performances are to continue, it’ll likely require fresh headlines to shake this sector’s wake-and-bake.

Drip, drip, drip, drip, rip (on news) seems to be the script; just dk timing, degree, or point of origin.

It’s not like U.S cannabis companies didn’t know they would end up in court with the I.R.S over 280E. Super-curious to see how Chevron impact’s that case.

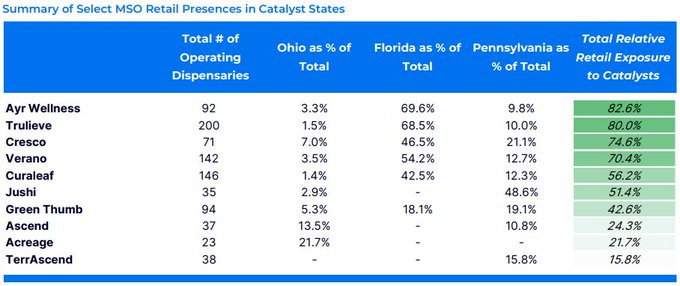

ATB on U.S. canna swing states

Ohio is expected to start adult-use sales imminently, Florida has a vote coming in November, and Pennsylvania could see legalization soon. We present the relative exposure that MSOs’ have to those states.

Viridian on U.S. cannabis debt

Debt investors can look forward to a relatively stress-free 2025 in preparation for a tense 2026 with more sizeable and more challenging debt maturities. If S3 remains on track, we expect to see cannabis capital markets re-open to facilitate refinancings.

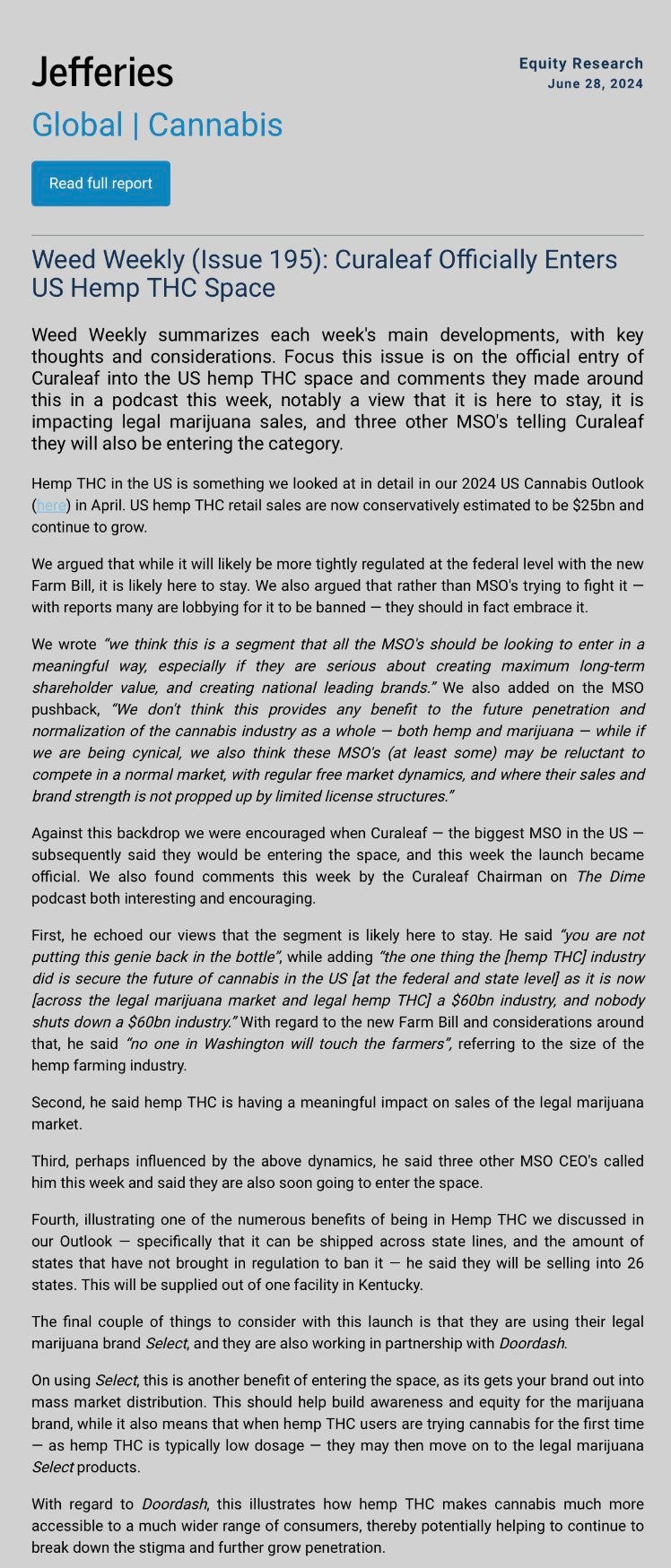

Jefferies on U.S. Hemp space

Stems & Seeds

Cannabis Linked To Diabetes Prevention And Better Blood Sugar Control

Have a safe night and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice