The Everything* Rally

Cannabis stocks watch the fun from afar

Daily Recap

The beat continued for broader markets on Monday as the path of least resistance giggled higher, still. The NDX is +43% YTD, with the most recent push driven by a feverish unwind of negative bets. The performance anxiety is real, as the only thing portfolio managers hate more than losing money is underperforming their peers.

The strength of the markets and defiance of the yield curve has fooled it’s fair share, proof positive to stay humble or the market will do it for you. I share this from a place of knowing as it’s been 887 days since the cannabis markets topped. That wouldn’t be such a big deal if cannabis stocks actually participated in The Everything* Rally.

No such luck, at least not yet, as investors have been conditioned to believe in two things: 1. the sector will remain uninvestable until there is structural plumbing in place to facilitate real liquidity, which would seemingly require SAFE Banking…

…and 2. given how many false starts and empty promises we’ve endured—it’s been ten full years since SAFE Banking was first introduced in the U.S Congress—investors are tired or running full-speed and face-first into a brick wall. Ask me how I know.

[gonna leave out the part about the pernicious algorithms that dominate our illiquid little world. Besides, as Sammy J knows, they’ll be our besties when this switch flips]

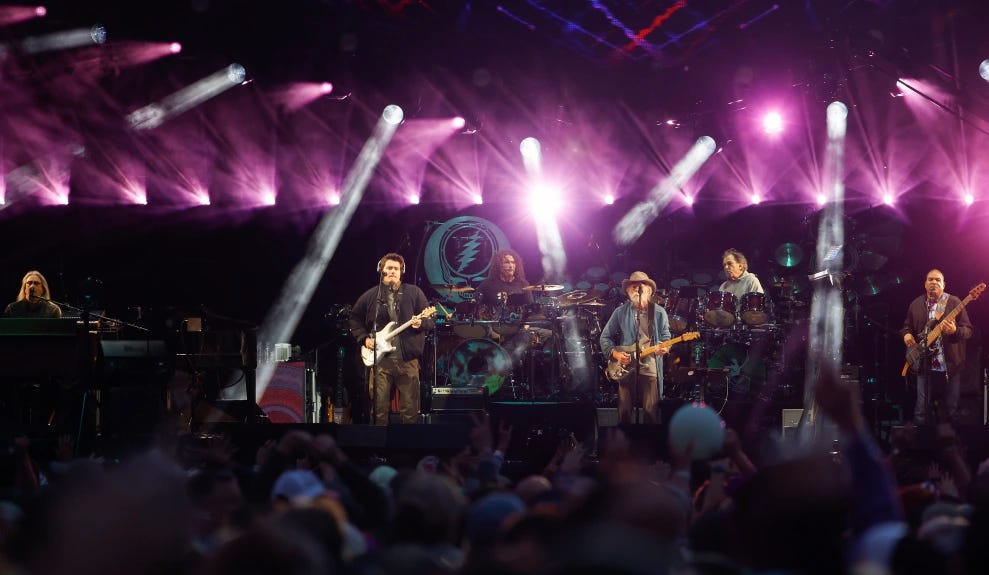

In other sector news, Missouri is selling $4 million of cannabis daily (a number they expect will grow), the Senate is trying to legalize cannabis for veterans in the NDAA (after the GOP-controlled House whiffed last week), Michigan sold $261 million of cannabis in June, gummies topped flower for the first time ever, in terms of consumer preference, and the Grateful Dead took their final bows, again, and until next time.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ PT notional: $29M

Top Stories