Daily Recap

It was supposed to be an uneventful session during the last week of the summer.

Skeletal crews were manning the trading desks, liquidity was thinner than usual and after Pavlov continued his nut-punch parade yesterday, the sense on the street was that if cannabis investors could just get through Labor Day, we might see a September surprise—that is, if the government manages to stay open.

In an attempt to front-load my day before seeing some friends after the close to enjoy the end-of-summer, I knocked out my workout first thing this morning, populated my twitter feed thereafter and even wrote this column before today’s trading began.

[title was Scent of the City: NYC canna in the dark, which played on the chasm b/w the sorry state of NY weed and the pungent smell at the US Open; even had Pacino teed]

True to form, the day moved smoothly. With most of my media stuff out of the way, I was able to chew through a few projects and work on some upcoming events. I even had a chance to catch-up with some old pals after what’s been a long, hard summer.

I was on the phone with Jonathan Sandelman, the Chairman of AYR Wellness, talking about how this journey has been longer than any of us thought it would be, as well as the specter of federal reform. Our discussion eventually turned to the recent chatter that the HHS was going to recommend moving cannabis to a schedule III.

“When we get that red headline,” I said, repeating a statement that has cost me a lot more money than it’s made, “If you’re not already on the cap table, have fun chasing.”

Then, it happened:

BN 12:11 *HHS RECOMMENDS MOVING MARIJUANA TO SCHEDULE III DESIGNATION

BN 12:11 *HHS MAKES RECOMMENDATION IN LETTER TO DEA

BN 12:11*HHS CALLS FOR MOVING MARIJUANA TO LOWER-RISK US DRUG CATEGORY

BN 13:40 *DEA CONFIRMS IT WILL REVIEW CLASSIFICATION OF MARIJUANA

This historic news has significant implications for researchers and importantly, would also remove cannabis from IRC Section 280E, which is the culprit behind the onerous 70% effective tax-rates that so many pioneers and entrepreneurs are forced to endure.

We’ll dig into what all this means in further detail below and JS if you’re reading this, my apologies for screaming OMG! OMG! OMG! in your ear and cutting our call short.

In other news:

New York state Judge Kevin Bryant abruptly reversed course in a new order that forestalls any exemptions to a retail licensing freeze in New York. He also blasted state regulators for ‘not having their ducks in a row,’ which is of little solace to all the medical and social justice operators who tried to follow their ever-changing rules.

The irony, of course, is that weed is everywhere in NYC and most residents assume their corner bodega is the regulated legal framework. The AP reported that a strong marijuana smell clouded the concentration of one of the world’s top players at the U.S. Open this week and suggested cannabis is now the unofficial scent of the city.

It didn’t have to be this way. In Connecticut, the state has made low-interest loans available for qualifying cannabis businesses in an effort to help them launch. The canna revolving loan fund is intended to help social equity applicants rehabilitate, renovate and develop properties for use as a cannabis establishment.

Ohio also recently extended the deadline for medical marijuana dispensaries to open, meaning those granted medical marijuana retail licenses that haven’t opened yet will not lose their permits as long as they open before year-end.

Meanwhile, the battle to legalize recreational marijuana in Ohio got a strong, vocal and credible champion as U.S. Rep. Dave Joyce threw his support behind the ballot measure in his home state. A majority of Buckeye voters, including most Republicans, support the upcoming adult-use initiative on the November ballot (Fallon):

Arkansas medical cannabis sales hit $23.2M in July, which brings the total over the first seven months of 2023 to 165M, or $7.3M more than last year at this point in the year. The Natural State has come a long way since Bubba didn’t inhale some 31 years ago although something tells me he might be fibbing on that one.

The California DOJ launched a new program to combat illegal cannabis operations as the California Attorney General called for lowering taxes on marijuana to help combat the illicit market. “The barriers to entry are too high, the costs to stay in operation are too high,” he said loud enough for other states to hear, “we should be lowering taxes..."

In other sector news, Colombian lawmakers approved a new MJ legalization bill in the first of eight debates after reform stalled in the last session; France is contemplating including the legalization of medical cannabis in their 2024 annual budget and ATB, AGP and Jeff Schultz Esq. dig into today’s news and the many implications.

All that, and more, just scroll down…

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ PT Notional: $235M (←)

Top Stories

‘Like Snoop Dogg’s living room': Smell of pot wafts over notorious U.S. Open court

Arkansas medical cannabis sales hit $23.2M in July

The battle to legalize recreational marijuana in Ohio gets a vocal credible champion

Connecticut makes low interest loans available for qualifying cannabis businesses

California DOJ launches new program to combat illegal cannabis operations

California AG Calls For Lowering Taxes On Marijuana To Combat Illicit Market

Will the Legalization of Medical Cannabis in France be Included in the Annual Budget for 2024?

New York Judge Changes Course on Exemptions, Freezes All Licensing

Random Market Thoughts

I had a long conversation with someone who said investors felt duped by investing in U.S cannabis—they thought they were buying growth and it turned into value, maybe.

We used to refer to these stocks as “growth at value” but given the persistent missteps by federal +state officials, on top of industry-specific headwinds, inventory gluts and a still-thriving illicit market, growth gave way to, “we need to survive this thing first.”

To that end, these names aren’t trading on quarterly earnings—most of which showed improved metrics and margins—they’re trading on balance sheet optionality: will this company be able to pay off their debt with capital markets closed and rates rising?

Tell me what happens with the HHS (now we know), SAFE banking, Florida’s Supreme Court, the Ohio ballot initiative; tell me when Pennsylvania flips, or New York finally gets it’s shit together… so many variables that’ll shape future cash flows, none of which can or will be known without the benefit of time.

It is estimated that leading U.S plant-touching cannabis companies (Tier1 MSOs) pay $40-$50M per quarter in 280E tax so yeah, today was a massive development.

Plus, according to Vangst and their most recent jobs report, cannabis moving from schedule I to III would immediately create over 100,000 new jobs in the industry.

Add into the mix the timing—summer holiday week, zero warning—and we’re left to wonder how many shorts are trapped, how many longs are still at the beach and what the next shoe might be, as these things go.

[we’ve been looking for a Schedule III/ Garland Memo/SAFE Banking tri-fecta this fall and to that end, heard the HHS recco + Garland Memo would be released around the same time. Memo’s ain’t laws, we know, but DOJ clarification certainly wouldn’t hurt, especially if it has specific language aimed at the banks, as we’ve also heard]

And two random random thoughts:

1) I don’t think there’s any question anymore that TerrAscend made the right call in moving to the TSX in July. The volume, price action (although much is driven by their pristine execution, growth profile and balance sheet) and performance tells us all we need to know—and we expect others will follow.

2) GLASF raised their $15M D-Series after the lawsuit was filed against them, which tells us what investors thought regarding the merits of pending lawsuit.

Moving on…

Fab “Vibe” Freddy at ATB shared his pre-market thoughts on U.S canna catalysts and valuations, as well as their top pick.

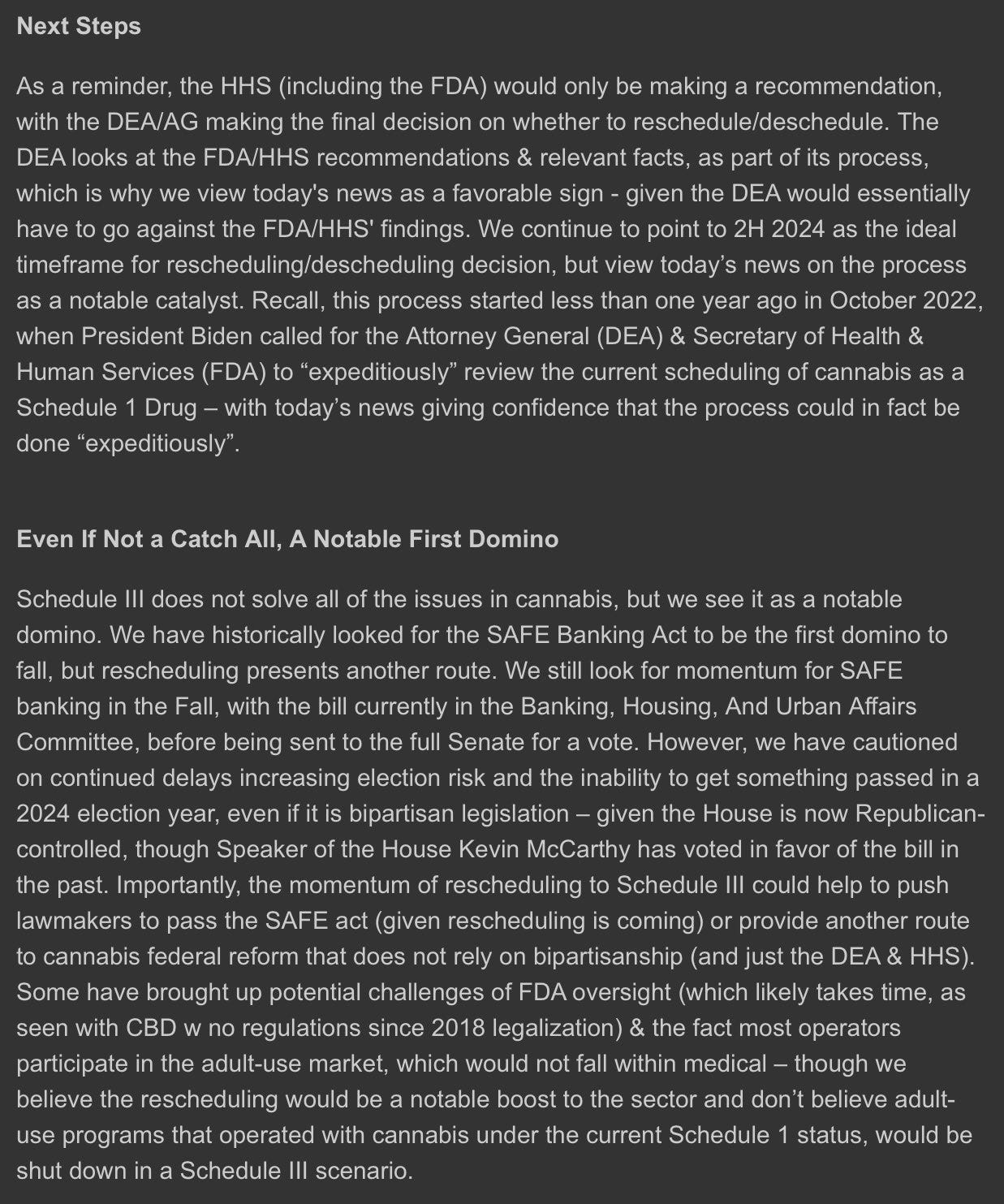

Aaron “a touch of” Grey from AGP talks next steps:

Bonus: Jeff Schultz Esq. of Foley Hoag fame shares his thoughts here, and I quote:

“The potential for a reclassification of cannabis under the Controlled Substances Act is monumental. Among other things, rescheduling would remove state-legal cannabis businesses from the crippling effect of Section 280 of the Internal Revenue Code, allowing them to deduct business expenses like any other business. Rescheduling may reinvigorate capital markets and could cause Nasdaq and NYSE to re-evaluate their position prohibiting the listing of plant-touching U.S. companies. It’s also likely we could see a refresh of the “Cole Memorandum” issued by Attorney General Garland in the coming weeks or months that could provide more concrete guidance on the legality of the state-level cannabis industry, banking and capital markets. The implications for drug development overseen by the FDA are many. If the news is true, this may be the first step – finally – toward cannabis normalization.”

Interestingly, after 931 days—and btw that motherfucker is not real anymore—most of the folks I spied on social media weren’t sufficiently impressed with today’s headline, opting instead to say, ‘we’ll see what the DEA does,’ or ‘there’s still a long road ahead.’

True enough and anyone who hasn’t learned to duck has the head wounds to prove it.

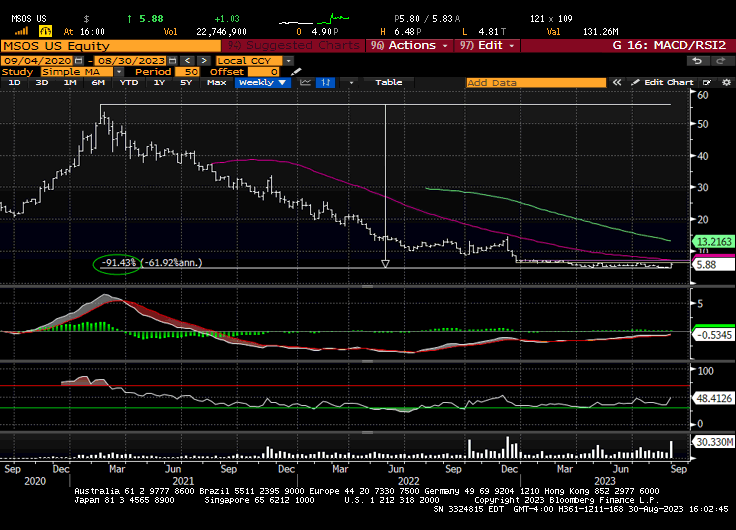

A little perspective goes a long way, however, so I’ll leave you with this: I understand that MSOS isn’t the industry, it is merely a reflection thereof, but it sorta sums up the journey since that fateful day so many moons ago. Good luck, and think positive.

/end

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.

Bojo was on right at the end if you'd like to hear it

and fwiw, on toby's spaces tonight, boris seconded your thoughts on SAFE out of committee to the floor during first couple of in session weeks in sept.