Daily Recap

Cannabis stocks rallied for the second straight session after a letter was reportedly leaked to Bloomberg on Wednesday that The U.S Department of Health and Human Services (HHS) recommended the Drug Enforcement Administration (DEA) reclassify cannabis from Schedule I to Schedule III under federal law. That was some leak.

If it was leaked, it would be the most bullish set-up possible given the holiday-thinned ranks into the last few days of August. There was zero warning for the abundance of bears caught short, pressing the most recent technical failure. No head’s up for any interested longs, most of whom were in wait-and-see mode heading into September.

"We believe that rescheduling to Schedule III will mark the most significant federal cannabis reform in modern history," said Ed Conklin of the U.S. Cannabis Council. "President Biden effectively declared an end to Nixon's failed war on cannabis and placed the nation on a trajectory to end prohibition."

“This is potentially the best-case scenario for advancing U.S. cannabis reform for the U.S. MSOs,” said Andrew Semple at Echelon. He reminded investors that his “current price targets don’t assume any federal cannabis reform,” and that “there’s ample room for further price appreciation.”

We would agree. U.S canna ETF MSOS traded $15 in December on the mere specter that SAFE Banking would pass. Schedule III, while not the ultimate destination that we want to see, is entirely more powerful than SAFE Banking could ever be. What’s more, they’re not mutually exclusive; in fact, this amps the pressure on Sen. Schumer.

In today’s column, we’ll take a trip around the world to gauge the insights, reactions and perspectives surrounding this historic move. 99.99% of the US population doesn’t understand the implications of this recommended rescheduling and they surely don’t know what IRC Sec. 280E is or why US Canna balance sheets + sentiment just inflected.

Lot’s more, too; just keep scrolling…

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑

PT Notional: $283M (15X recent average)

Top Stories

Biden Administration Calls on DEA to Move Marijuana to Schedule III

U.S. health agency advises easing federal marijuana restrictions in historic move

Stocks Rally Following Leaked Cannabis Rescheduling Letter

HHS Call To Reschedule Marijuana Is A Big Deal

Top US health officials recommend rescheduling cannabis

ABC News: HHS recommends easing restrictions on marijuana

Possible easing of marijuana restrictions could have major implications

Bipartisan Lawmakers Claim Credit For Biden Admin’s Marijuana Rescheduling Recommendation

Random Thoughts

While yesterday’s news wasn’t the endgame—cannabis will still be federally illegal + people will remain in jail—it may be as close to Goldilocks as currently possible for legacy operators: still not federally legal so the barriers to entry remain, but no longer as medieval so the playing field finally begins to level.

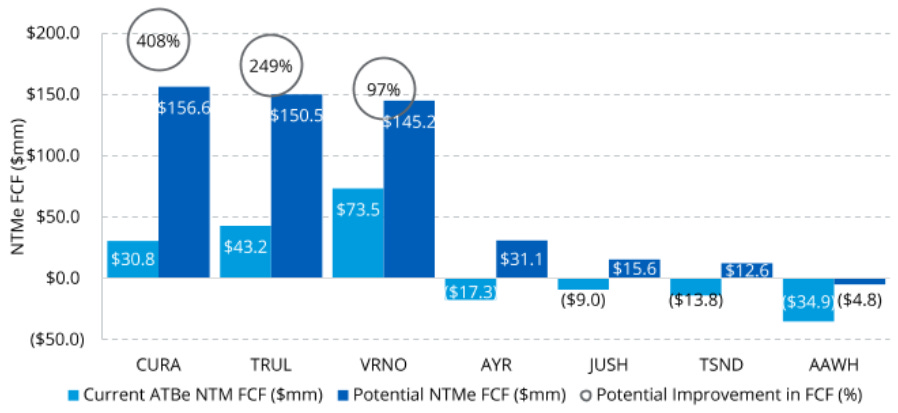

The ability to deduct normal operating expenses, in and of itself, changes the game. A recent article suggested that cannabis companies paid almost $2 billion in extra taxes because of the 280E tax code. That money—in some cases, up to $50M per quarter—will flow straight to the bottom line.

MSOS—the NYSE-listed ETF was once deemed to to be a Trojan Horse, of sorts—has been much maligned of late, with everyone seemingly wagging their fingers—and a few rather sharp tongues—at them…

…but we would remind folks that that sword swings both ways, as our friend Sammy J has so eloquently shared. There are structural issues and unintended arbitrages when an ETF lists on the NYSE and the underlying securities list on Canadian shit-boards.

That dynamic has been bastardized seven ways ‘til Sunday, as we screamed into the vortex to no avail, but it didn’t/ doesn’t matter. Until it does.

Back to lesson at hand: caveats certainly remain—it is possible the DEA chooses not to follow the recommendation of the HHS but we have a hard time seeing that happen with a Biden-appointed Attorney General in/to an election year.

It’s also possible the FDA will clamp down on adult-use but it seems far-fetched they would be more aggressive under SIII vs. SI, on top of the fact that they don’t have the funding to enforce anything comprehensive. We anticipate they’ll focus on labels and claims, marketing to children, that sorta stuff.

There are additional concerns that Schedule III would violate the Single Convention, which is an international treaty on drug trafficking, but given the state-led reality and pace of international adoption, it would seem we’re not the only country interpreting a softened stance on this magical plant.

What’s not yet clear, at least to us, are the implications for interstate commerce and/or the ability for big box CPG to enter the space and begin the M&A train. I don’t know that anyone knows those answers, at least not yet, but perhaps we’ll gain some clarity when the Garland Memo drops and yes, we expect that to hit the wires soon enough.

One more thing: cannabis price compression will re-emerge in time as capacity again comes online. We’ve said it before and we’ll say it again: the cost of canna will trend lower over time and that’s a good thing, both for the consumer and as it pertains to the ability to cannibalize the still-pernicious illicit market.

[btw nine out of ten illicit cannabis samples that were tested contained pesticides, in stark contrast to regulated products, per a study released today. The findings affirm what canna advocates said all along: regulating marijuana provides consumers with safer products]

Around the World

Andrew “it’s not that” Semple at Echelon makes it so:

Freddy “Miles” Gomes from ATB did the math on 280E…

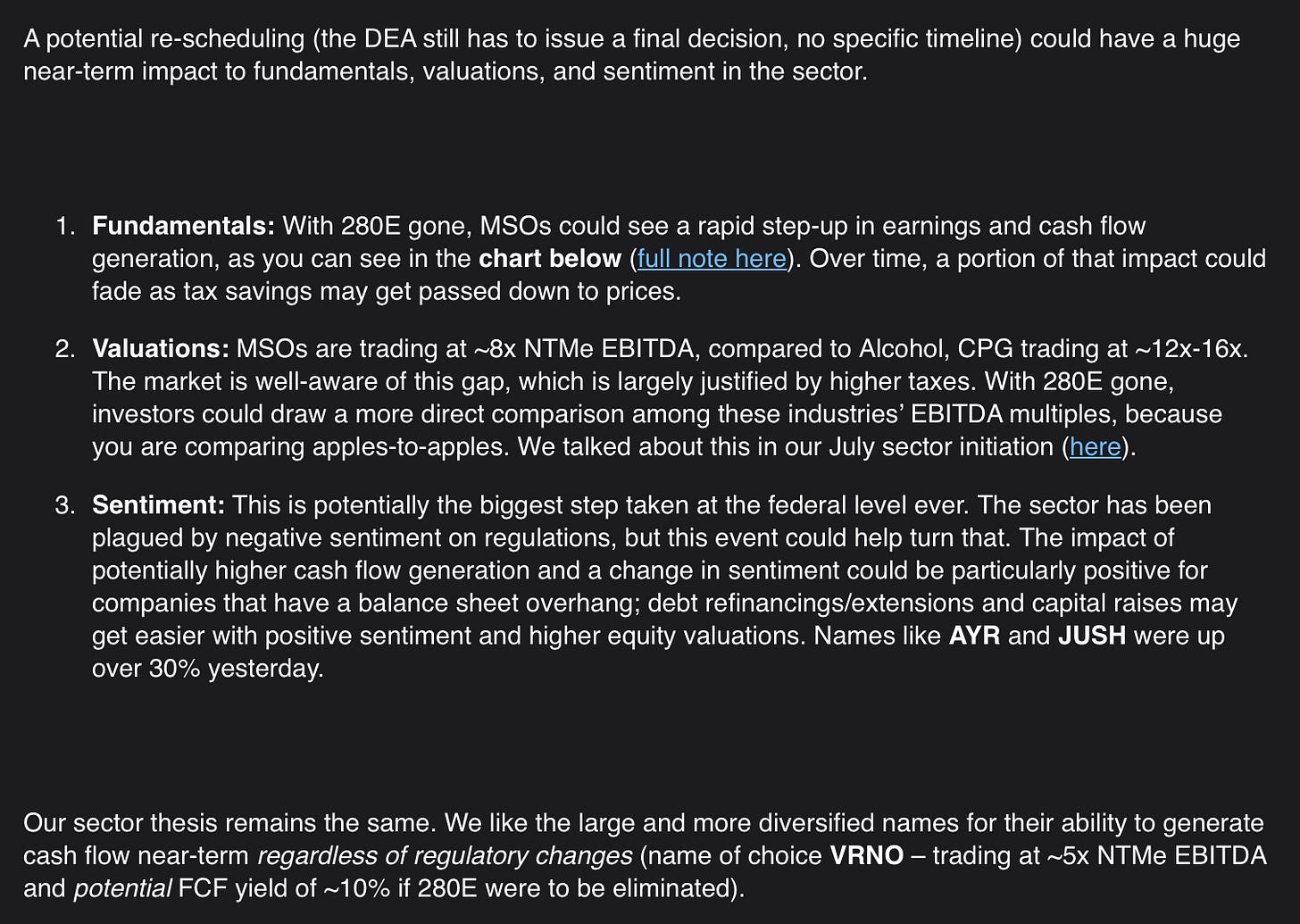

…then spelled it out: U.S canna stocks could double just to get to the average valuation multiples of alcohol and CPG.

O.B (he’s been so good to me) at Jefferies on the HHS news

VIII Capital weighed in:

Olympic Gold Medal winner Scott Fortune from Roth MKM offered his take:

And finally, Curaleaf Chairman Boris Jordan spoke on SAFE Banking + the massive short squeeze in play. Click the link above for a quick listen, it’s worth the time.

I’ll be out tomorrow for some downtime with my family. Cannabis Confidential will return on Tuesday, September 5th—right along side the U.S Senate, by the way—so enjoy the long weekend and please remember to consume responsibly.

/end

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.

Thanks for the excellent on-the-spot coverage, Todd. Enjoy your family time!